Summary:

- Microsoft Corporation has enjoyed a 20% gain YTD, mainly due to the excitement in AI and the investments in ChatGPT.

- As of yet, Bing has not taken any market share from the dominant search engine leader Google, and the question is when will they.

- Microsoft is valued as extremely expensive at 36x price to free cash flow, while 73% of free cash flow is spent on share buybacks and dividends.

- Expectations are high, and any misses could result in a massive decline in Microsoft’s stock price.

jewhyte

Microsoft Corporation (NASDAQ:MSFT) has seen a great run upward after the news that the company invested immensely in OpenAI, better known as the maker of ChatGPT. Microsoft has integrated the AI bot in their search engine Bing and is planning to do the same for Office 365. On the other hand, the probability of the acquisition of Activision Blizzard, Inc. (ATVI) is increasing as Japan’s watchdog said the deal is of no harm toward competition. Yet, all of this does not confirm Microsoft is a great investment, let me explain.

Fight For Share In Search

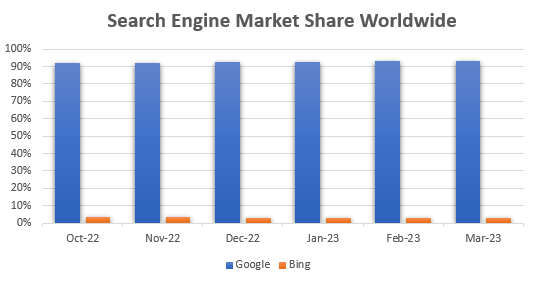

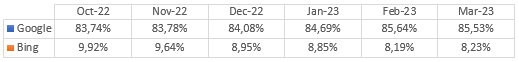

The largest driver for the recent stock appreciation in Microsoft is the expectation that Bing will take market share in the search engine space from Alphabet Inc. (GOOG, “Google”). In 2021, the global search engine market had the size of almost $170 billion, so any shift in market share can earn or cost a lot of money. Thus far, the needle hasn’t moved in favor of Bing at all.

In March, Bing increased its global search engine market share slightly. But this came after losing market share for 5 consecutive months.

Statcounter (made by author) Statcounter (made by author)

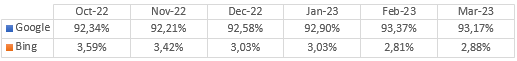

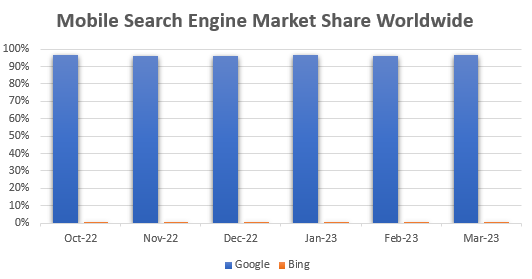

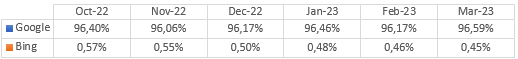

Zooming in on the desktop search engine market, where Bing holds a higher market share than in other segments, we can see a similar decline in market share over the past months. Compared to the previous drops, the increase in March is relatively low. The desktop market share should be the largest beneficiary of the ChatGPT implementation; still, there is not much movement to detect.

Statcounter (made by author) Statcounter (made by author)

The mobile search engine market is highly dominated by Google, and this has been stable for a very long time. Even in March, Bing kept losing market share from Google and other providers.

Statcounter (made by author) Statcounter (made by author)

If you have ever used Bing, you will understand why Bing is not taking any market share. Whenever you search something, you simply don’t get the best results. And that is a huge problem… In addition, ChatGPT is still available through Google, so that also does not give an incentive to move over to Bing. The user interface and the search performance will probably need an improvement first, before Googlers will take their bags and move.

Valuation Vs Growth

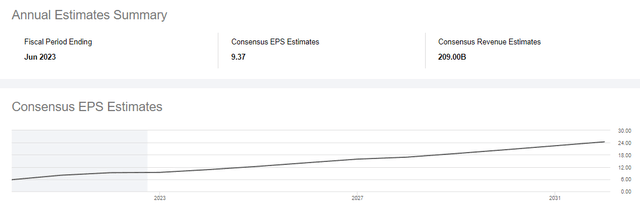

While Wall Street remains extremely bullish, it is important to remain highly realistic and to not get caught up in the hype train. In the latest quarter, Microsoft reported revenue growth of 2% and a net income decrease of 8%, showcasing that the company is not unscathed either from a changing environment.

Currently, Microsoft is trading at a 32x price to earnings valuation. Compared to Apple Inc. (AAPL), Meta Platforms (META), and Alphabet, MSFT stock is trading at quite a premium. This means investors are betting on the future growth of the company. Any misses in the estimated growth number can cause some serious re-evaluation.

Further, in terms of price to free cash flow, the stock is priced at an even higher valuation. We are nearing the peak excitement of 2021 and this is not what you want to start off your investment. That aside, the percentage in dividends and buybacks will be significantly lower, as they are free cash flow dependent. In the trailing twelve months, the company bought back only 1% of shares outstanding, not because of a low amount of buybacks, but because of the high price Microsoft is buying back their own shares. Including the $7.5 billion spent on stock-based compensation (“SBC”) in 2022 would lower the percentage in buybacks even more. The company spent $24.8 billion on share buybacks (TTM), which is 41% of their free cash flow. Next to that, the current dividend yield is below 1% ($19.2 billion) and eats up another 32% of free cash flow (“FCF”). If not for their massive balance sheet, this would not be able to keep on going for long.

Takeaway

Microsoft Corporation is by far not a risky or bad business, however, the stock is a risky investment at these valuations. If Bing does not manage to take any market share away and Microsoft keeps up its slow-paced growth of the latest quarter, then a pullback will be imminent. The higher the price, that much harder it is to outperform the others. The opposite is also true, as we have seen with Apple in 2019 at a P/E of 11 and Meta in 2022 at a P/E of 8. Right now, it would be safer to sit at the sidelines. Therefore, I rate the stock a Sell. A better entry would be at a price to free cash flow of 20-25, which at least results into a price of $215 per share and a minimum decline of 30% from the current price.

Alphabet was for me personally a smarter buy below $100, but since it has moved higher, I have not increased my position.

As for my investment in Meta, investors enjoyed an almost double in stock price since my article was published in November. I am looking to close out my position soon after a previous trim of 50% in February.

Thank you for reading and let me know in the comments what you think!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of GOOG, META either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I am not a financial advisor. Investing is your own responsibility. I am not accountable for any of your losses.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.