Summary:

- We remain sell-rated on Tesla, Inc. stock, as we believe the company is in troubled waters for 1H23.

- We see more downside ahead as inventory piles up and price cuts don’t meaningfully boost sales, with the exception of wholesales in China.

- We still expect margins will be pressured by the hyped-up price cuts earlier this year and expect the upcoming 1Q23 earnings to be disappointing.

- The stock is also not cheap, trading above the peer group on all metrics.

- We’re bullish on Tesla in the long run, but believe investors should look for exit points at current levels and revisit the stock once the downside has been factored in.

jetcityimage

We’re still sell-rated on Tesla, Inc. (NASDAQ:TSLA). We now revise our bearish sentiment in light of deliveries growing a quiet 4.3% over the final three months of December and the company’s upcoming 1Q23 earning results. We see more downside ahead for Tesla, as we expect the company’s price-cut strategy failed to boost sales enough to offset the lower price per vehicle.

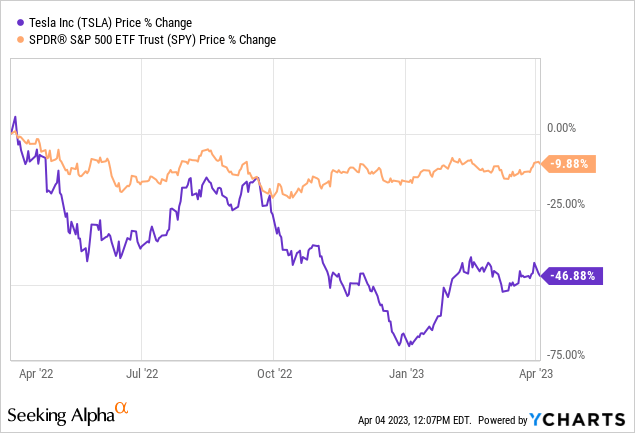

Tesla kick-started the year with aggressive price cuts and CEO Elon Musk forecasting sales to boost in response. Amid the hype of Tesla slashing prices, we maintained our sell-rating based on our belief that even if price cuts boost demand, they will meaningfully impact Tesla’s margins. Now, we’re skeptical whether the price cuts have boosted demand at all. The stock is down roughly 47% over the past year, underperforming the S&P 500 (SP500), down about 10% during the same period. We recommend investors begin looking for exit points at current levels and revisit the stock once the near-term headwinds have been factored in.

The following graph outlines Tesla stock against the S&P 500.

YCharts

Peek into 1Q23 production and deliveries

We’re revisiting our investment thesis on Tesla after the company released its 1Q23 vehicle production and delivery report. Our main concern for the company has been the imprint the price cuts, as high as 20% in some regions, will have on gross profit margins. Now, we believe the company is facing an inventory problem on top of the pressured margins in 1Q23. Hence, we’re updating our rating with a more pessimistic outlook on demand levels in 1Q23 as inventory piles up.

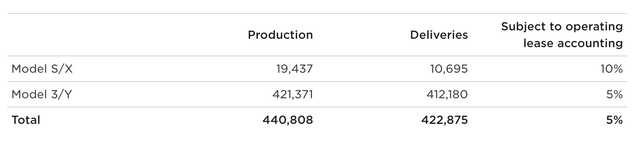

It’s been roughly three months since the company cut prices, and the question that begs itself is what has happened to demand since. We’re seeing Tesla struggle with excess supply, which became apparent after the company posted its 1Q23 vehicle production and delivery report; total deliveries were 422,875, while total production was higher at 440,808. Total deliveries are up 36% Y/Y. Sequentially, deliveries growth was low at 4% despite the price cuts earlier this year. The following table outlines the company’s vehicle production and deliveries for 1Q23.

Tesla Vehicle Production & Deliveries for 1Q23

Tesla produced more cars than it sold, although it slashed prices to make its vehicles more affordable. We believe Tesla’s swelling inventory levels highlight a deeper demand issue that price cuts have failed to resolve. We also believe the company is facing increased rivalry in the EV space even with its pricing power advantage, including competition from NIO Inc (NIO), XPeng Inc (XPEV), Ford (F), and General Motors (GM), among others. Consistent with our expectations, we believe Tesla is losing high-end customers, as the price cuts came at the expense of the company’s luxury electric vehicle (“EV”) maker status. Longtime Tesla bull, Ross Gerber, shares our concern, stating that “delivery numbers for X/S are a bit troubling.” The company’s production levels have exceeded deliveries for the past four quarters. We expect excess inventory levels to require strong growth in delivery for the company to grow meaningfully, and we don’t see this happening in the near term.

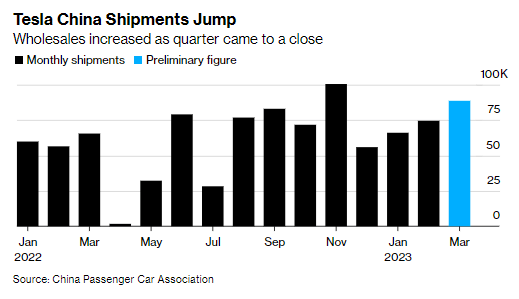

Tesla’s seen demand recover in the Chinese EV market; the company shipped 88,869 vehicles from its factory in March alone, according to preliminary data from China’s Passenger Car Association. The boost in demand was driven by wholesales, which refers to dealerships and delivery centers rather than direct retail consumers, with wholesales up 19% last month and 35% Y/Y. We expect to see weaker retail consumer demand in 1H23, even in the Chinese market, which is the fastest-growing EV market at the moment. Still, Tesla is staying active; the company launched a portable home charger called “Cybervault” for the Chinese EV market. However, we don’t expect the increased sales in China to offset potentially weaker global demand. The following outlines Tesla’s China shipments as of March.

Bloomberg

Tesla is largely judged as a growth stock, and our bearish sentiment is driven by our belief that the company won’t grow meaningfully towards 2H23. Tom Zhu, the company’s executive responsible for global production and sales, stated, “As long as you offer a product with value at an affordable price, you don’t have to worry about demand.” We’re worried that Tesla doesn’t have the delivery numbers to back up this sentiment of demand growth.

Valuation

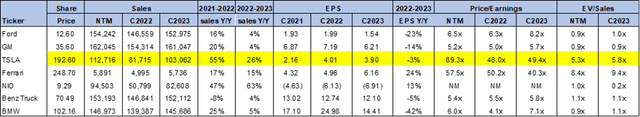

Tesla is relatively expensive – we’ve highlighted Tesla’s high valuation issue in our previous notes on the company. On a P/E basis, the stock is trading at 49.4x C2023 EPS $3.90 compared to the peer group average of 19.4x. The stock is trading at 5.8x EV/C2023 Sales versus the peer group average of 2.7x. We recommend investors wait for the stock’s valuation to get compressed and reflect the company’s actual earnings rather than factoring in future growth that has yet to be delivered.

The following table outlines Tesla’s valuation.

Word on Wall Street

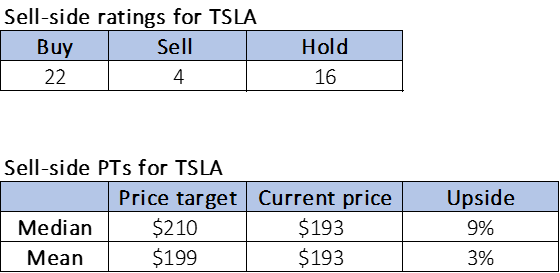

Wall Street is bullish on the stock. Of the 42 analysts covering the stock, 22 are buy-rated, 16 are hold-rated, and the remaining are sell-rated. We very often diverge from Wall Street’s sentiment on the stock; while we believe Wall Street’s bullish sentiment is the result of Tesla’s leading position in the EV market, we don’t believe the Tesla bulls are factoring in the near-term headwinds that’ll likely pressure the company’s margins and demand levels.

The following table outlines Tesla’s sell-side ratings.

TechStockPros

What to do with the stock

We continue to be sell-rated on Tesla, Inc. Our previous note focused on our concern about Tesla’s margins per vehicle being pressured by the price cuts. Now, we add high inventory levels to our bearish sentiment on the stock. So far, we’ve only seen the price cuts yield gradual growth in sales. We believe delivery growth would have to increase significantly for Tesla to successfully meet Musk’s target of increasing annual sales by 20M vehicles a year until 2030. We see more downside ahead as worrying signs of excess inventory surface before the 1Q23 results scheduled for April 19th.

We expect Tesla, Inc. 1Q23 earning results (expected after the close on April 19) to be lackluster and will continue to monitor the stock closely to see how the price-cut strategy pans out. We see favorable exit points at current levels and recommend investors sell their Tesla, Inc. shares and revisit once the downside has been factored in.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.