Summary:

- JPMorgan has just released its shareholder letter.

- The company will report earnings results soon.

- The outlook for JPM stock is compelling.

Drew Angerer

Article Thesis

JPMorgan Chase & Co. (NYSE:JPM) CEO Jamie Dimon has recently sent out the JPM shareholder letter. On top of that, JPMorgan will soon report its first-quarter earnings results. In this article, we’ll look at both of these themes and at the outlook for JPMorgan stock.

What Happened?

JPMorgan CEO Jamie Dimon recently sent out the company’s shareholder letter. On top of that, the mega-bank will report its next earnings results nine days from now.

Before that, JPMorgan had been selling down in recent weeks, due to bank troubles. The problems at Silicon Valley Bank (OTC:SIVBQ), Credit Suisse (CS), and so on have made investors wary of financial corporations, which is why even large banks such as JPM have seen their shares decline. This is somewhat perplexing, as there is no indication that JPM or one of its large peers is in trouble. In fact, it looks like the biggest banks are even benefitting from problems at regional and community banks, as the largest banks are seen as less risky, which is why they have seen deposits grow, as customers moved funds from smaller banks to huge banks such as JPMorgan.

Jamie Dimon’s Shareholder Letter

Jamie Dimon has been vocal in the past about his views not only when it comes to JPM’s prospects, but also when it comes to the overall economic environment and themes such as interest rates, inflation, the potential for a recession, and so on.

In the most recent shareholder letter, which is available here, JPM’s CEO notes the following [emphasis by author]:

While we don’t run the company worrying about the stock price in the short run, in the long run we consider our stock price a measure of our progress over time. This progress is a function of continual investments in our people, systems and products, in good and bad times, to build our capabilities. These important investments will also drive our company’s future prospects and position it to grow and prosper for decades. Measured by stock performance, our progress is exceptional. For example, whether looking back 10 years or even farther to 2004, when the JPMorgan Chase/Bank One merger took place, we have significantly outperformed the Standard & Poor’s 500 Index and the Standard & Poor’s Financials Index.

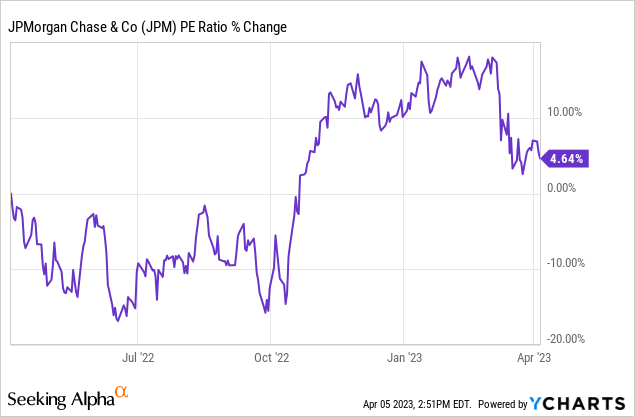

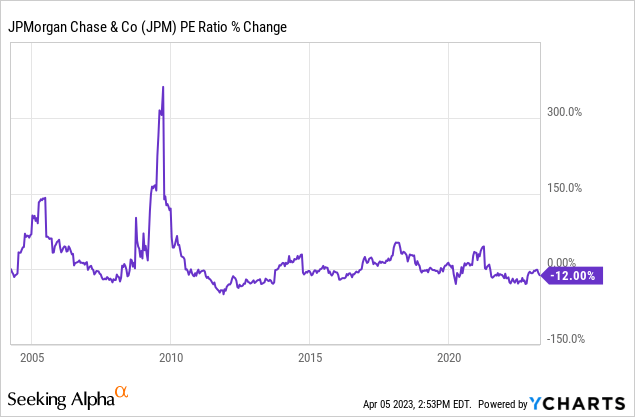

While past returns do not necessarily translate into future returns of a similar size, it’s still a good sign when a company has done well over long periods of time. This can be an indication of a strong brand, competitive advantages, a shareholder-friendly culture, strong company-wide risk management, and so on. Of course, companies can also outperform over periods of time due to multiple expansion, even if their underlying business is not doing too well. In that case, future returns at a similar level are less likely, as valuations can’t expand forever. But that is most likely not the case at JPMorgan, as the company has not really become more expensive over the last decade:

Today, JPM’s earnings multiple is less than 5% higher relative to a decade ago, meaning the valuation has more or less been the same. JPM’s strong total returns have thus been mostly driven by underlying business growth, dividends, and profit increases, whereas changes in its valuation have not had an outsized impact.

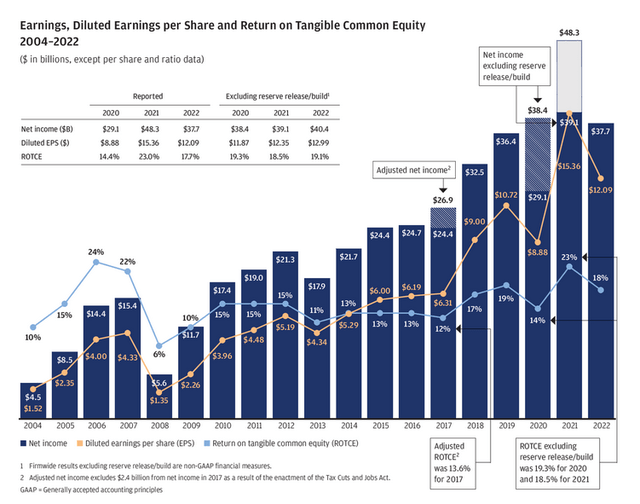

As we can see in the above chart, JPM’s valuation has actually declined over the last 18 years, i.e. since 2004, when JPM merged with Bank One (Jamie Dimon had been the CEO of Bank One prior to this merger). The fact that JPM has still outperformed the broad market in that time frame, despite JPM’s valuation declining, is a very positive sign, I believe. JPM’s strong brand and market position in both the investment banking field and in consumer and commercial banking is one of the reasons. Another reason for the strong past performance is a fact that Jamie Dimon notes in the quote above — the company isn’t focused on chasing short-term share price gains, but is focused on creating lasting shareholder value over time.

And this focus on value creation has indeed worked well in the past:

The company has not only grown its net profit and earnings per share at an attractive pace in the past, but its return on tangible equity has also improved. At a constant ROTCE, profit would grow as tangible common equity grows, but a rising ROTCE causes net income to grow faster than common equity. On top of that, since JPMorgan is buying back shares, its earnings per share growth benefits from an additional boost. That is why JPMorgan has managed to grow its earnings per share by a little more than 130% over the last decade, even though company-wide net income grew by 77% only (which is still far from bad, of course). Since the same principles should remain in place going forward, it is likely that earnings per share growth will continue to lead JPM’s company-wide net income growth, I believe.

JPM’s Q1 Earnings

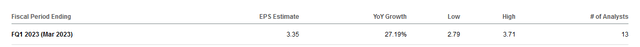

JPMorgan will report its first-quarter earnings results on April 14, before the market opens. Results are forecasted to be strong both on an absolute basis and on a relative basis, i.e. when we compare the analyst consensus to the results JPM reported during the previous year’s first quarter:

$3.35 in earnings per share would be up by close to 30% versus the previous year’s quarter, although it should be noted that the comparison is made easy by the fact that Q1 2022 was the weakest quarter last year. Still, $3.35 per quarter would pencil out to $13.40 in per-share profits for the whole year, which would be a strong feat for the company and which would be well above the total from last year.

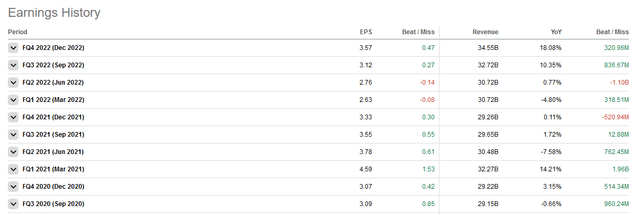

While it is possible that current analyst estimates are too optimistic, history suggests that this will not be the case. In fact, JPM has generally been underestimated in the past, as the company has beaten profit estimates in 8 out of the last 10 quarters:

The average earnings per share beat was $0.47 — if JPM were to beat Q1 estimates by a similar amount, its earnings per share would come in north of $3.80 for the quarter, which would be a great result.

Even if JPM does not beat estimates, investors could be quite happy with the results, as the estimated profit level for the first quarter still pencils out to a very undemanding single-digit earnings multiple at current prices.

Of course, not only JPM’s profit will be an important metric to watch. Investors should also look for clues when it comes to a couple of other themes:

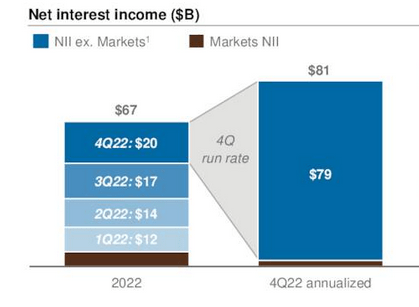

– Did JPMorgan’s net interest margin expand? In a rising rates environment, banks oftentimes are able to grow their net interest margins, as the rates they demand for loans rise faster than the rates they offer for deposits. The company’s net interest income performance in recent quarters suggests that more growth could be seen in 2023, although that is, of course, not guaranteed:

JPM results presentation

Q4 2022 was the strongest quarter during the year when it comes to the net interest income that JPM generated, by far.

– How much did JPM’s deposits grow? The bank runs seen in regional and community banks suggest that JPM and other major banks, those deemed as “too big to fail” have benefitted from deposit growth, but we don’t know the exact numbers yet.

– How high is JPM’s common equity tier 1 ratio? Over the last year, it grew slightly, to 13.2% as of the end of the fourth quarter. If the ratio continued to climb during the first quarter, that positions JPMorgan well for even higher shareholder returns in the future. Since the dividend does not require a large portion of JPM’s profits — the payout ratio is less than one-third based on current forecasts — the capital position will primarily decide how much JPMorgan will spend on buybacks in the foreseeable future. Actual buyback announcement will likely happen in summer, following CCAR results, but the higher JPMorgan’s CET1 ratio climbs, the higher the potential for accretive buybacks in the second half of 2023 and beyond.

Is JPMorgan A Good Investment?

Banking is not a high-growth industry, but JPMorgan still could be a good investment. Between some business growth and JPM’s buybacks, earnings per share growth could be very solid. On top of that, there’s a 3.1%-yielding dividend, which adds nicely to JPMorgan’s total return potential. Last but not least, JPMorgan could also benefit from multiple expansion: Today, shares trade at just 10x forward net profits, while the median earnings multiple over the last decade is 12. If JPM’s earnings multiple expands to the historically normal level of 12 over the next five years, that alone would add 4% per year to JPM’s total returns. Even if JPM were to grow its earnings per share by just 5% per year going forward, which would be below the long-term trend, total annual returns could then be north of 10%.

Since JPM looks like one of the least risky banks, thanks to its strong brand, massive capital reserves, and the fact that it attracts new deposits, the compelling total return outlook makes it look favorable from a risk-reward perspective, I believe.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Is This an Income Stream Which Induces Fear?

The primary goal of the Cash Flow Kingdom Income Portfolio is to produce an overall yield in the 7% – 10% range. We accomplish this by combining several different income streams to form an attractive, steady portfolio payout. The portfolio’s price can fluctuate, but the income stream remains consistent. Start your free two-week trial today!