Summary:

- Nvidia Corporation’s share price has been going up recently, as the rise of generative AI should have a positive impact on its growth prospects for the short term and long term.

- I see Nvidia’s shares rising above $300, considering that Nvidia is well-positioned to leverage on generative AI growth opportunities, and the implied 1.5 times PEG ratio is reasonable.

- My Buy rating for Nvidia remains unchanged; Nvidia still offers a decent upside at its current price, and the stock is a long-term play on AI.

Justin Sullivan

Elevator Pitch

I continue to rate Nvidia Corporation (NASDAQ:NVDA) stock as a Buy.

NVDA’s shares have surged by +63% (source: Seeking Alpha price data), since I raised my investment rating for Nvidia Corporation to a Buy in my July 26, 2022 write-up outlining its 10-year outlook.

With my latest update, I highlight that NVDA is still a worthy investment candidate. Taking into account its new AI inference offerings and the stock’s price/earnings to growth or PEG valuations, Nvidia Corporation has the potential to rise by a further +12% to $300 or higher in the current year. Looking into the future, generative AI holds significant growth potential, and NVDA is a beneficiary of the potential shift in AI inference workloads from CPUs to GPUs. As such, I have kept my Buy rating for Nvidia Corporation intact.

Why Has Nvidia’s Stock Price Been Going Up?

Nvidia Corporation’s share price went up by +13%, +88%, and +104% in the last one month, 2023 year-to-date, and the past six months, respectively.

NVDA’s stock price has been rising because the company is a key beneficiary of the rise of generative AI. Mckinsey defines generative AI as “algorithms (such as ChatGPT) that can be used to create new content.”

In the short term, NVDA disclosed at its shareholder/analyst conference on March 23, 2023, that it is “seeing stronger demand from our hyperscale customers for all of our data center platforms as they focus on generative AI,” particularly in the past one month. Earlier, Nvidia Corporation guided for positive QoQ and YoY revenue growth for its data center segment in Q1 FY 2024 (YE January) as per its management comments at the late-February FY 2023 earnings call. Notably, NVDA’s new H100 data center GPU (Graphics Processing Unit) which delivers better AI inference performance than its predecessor (A100) has been well-received by clients. As such, the near-term outlook for Nvidia Corporation’s data center business is favorable.

For the long run, AI inference is expected to be a major growth driver for Nvidia Corporation. As per a March 16, 2023 report (not publicly available) titled “Large Language Model Enthusiasm Is Transforming Cloud Capex,” Morgan Stanley (MS) estimated that NVDA’s annual AI inference revenue could potentially increase 10-fold to $5 billion in the next five years. MS’ forecasts are aligned with NVDA’s comments at the recent March 23 shareholder/analyst conference on March 23 noting that generative AI will drive a “step function increase in the amount of inference workloads.”

Is The Chip Shortage A Problem For Nvidia?

The lack of semiconductor chips shouldn’t be an issue that holds back Nvidia in the near term.

At its shareholder/analyst call in late March, Nvidia Corporation assured investors that “we feel confident that we will be able to serve this (data center) market as we continue to build the supply,” when it addressed a question on potential data center chip shortage.

NVDA’s recent management remarks are consistent with third-party research. Based on a March 23, 2023 research report published by Bain, “delivery times” for semiconductor chips on average were approximately nine weeks shorter in early 2023 as compared to what they were last year.

In other words, I don’t expect chip supply to be a constraining factor for Nvidia Corporation this time around.

What Are Analysts Saying About Nvidia?

Wall Street is saying good things about Nvidia Corporation in relation to the generative AI growth driver.

Earlier, Seeking Alpha News published an article on March 22, 2023, citing comments from a couple of sell-side analysts with regards to their views on NVDA. Barclays (BCS) referred to Nvidia Corporation as the “king of generative AI” which it described as “the biggest secular tailwind in Tech.” Separately, the analyst from Bank of America (BAC) highlighted the company’s “dominance in the nascent generative AI/large language model market.” More importantly, Bernstein’s sell-side analyst stressed that “the massive [total addressable market] numbers” for NVDA “are looking a little less outlandish every day” with the rise of generative AI.

In a nutshell, the Wall Street analysts’ comments support my view that generative AI’s rise will extend Nvidia Corporation’s growth runway, as I have discussed above.

Nvidia Stock Key Metrics

There are certain metrics which indicate that analyst sentiment for Nvidia has become much more favorable in recent months.

The market’s consensus Q1 FY 2024 normalized EPS estimate for Nvidia Corporation has been increased by +4.1% in the past three months. During this same time period, twice as many analysts (18) lifted their first quarter bottom line forecasts for NVDA as compared to those (9) who cut their Q1 EPS projections.

Also, the average sell-side analyst rating for NVDA rose from 4.16 as of February 27, 2023 to 4.27 as of April 5, 2023. With ratings of 4 and 5 representing Buy and Strong Buy recommendations, respectively, it is apparent that analysts in general are increasingly bullish on Nvidia Corporation’s appeal as a potential investment candidate.

What Is The Current NVDA Price Target?

The mean Wall Street analyst target price for Nvidia Corporation’s stock has increased substantially by +37% from $202.45 at the end of last year to $276.53 as of April 5 this year. The current mean sell-side price target for NVDA is still above the company’s last traded share price of $268.81 at the end of the April 5, 2023, trading day.

But it will be more meaningful to refer to the median analyst target price for NVDA, as the mean metric is easily influenced by outliers. Nvidia Corporation’s current median sell-side price target is higher (as compared to mean) at $290.50 (source: S&P Capital IQ), which translates into an +8% upside.

I expect NVDA’s actual share price performance for 2023 to be better than what the analysts are expecting, as detailed in the next section.

Can Nvidia Stock Reach $300 In 2023?

My opinion is that NVDA’s shares can go up to $300 or higher in 2023, and this will be equivalent to a minimum double-digit percentage (or 12% to be exact) capital appreciation potential as compared to its current price level. Nvidia Corporation’s valuations will be still quite reasonable at a stock price of $300, and the company’s recent new platform introductions suggest that it is well-positioned to capitalize on AI inference growth opportunities.

As per S&P Capital IQ data, a $300 price target for NVDA will translate into a consensus forward FY 2024 normalized P/E of 50.0 times, while its consensus FY 2024-2027 normalized EPS CAGR is +32.8%. This works out to be a PEG multiple of 1.5 times for Nvidia Corporation, which isn’t unwarranted for a high-growth stock like NVDA.

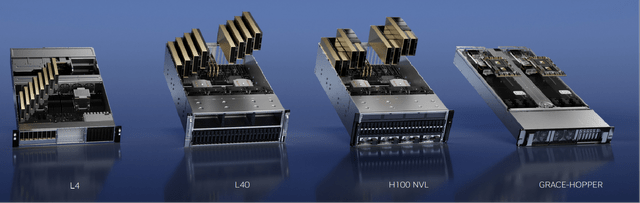

Nvidia Corporation’s New AI Inference Platforms Introduced At GTC 2023

At the recent GPU Technology Conference or GTC 2023 in late-March, NVDA introduced four AI inference platforms. The L4 and L40 are targeted at video computing and image generation, respectively. The H100 NVL is focused on LLM or Large Language Models, while the Grace Hopper will be suited for recommendation models.

Nvidia Corporation had emphasized at its March 23, 2023 analyst/shareholder conference that the rise of generative AI means “it is no longer possible, using general-purpose computing CPUs” to “sustain increased workloads.” As workloads eventually shift from CPUs to GPUs, it is very likely that NVDA’s AI inference offerings, which the company has indicated to be cost- and energy-efficient, should gain substantial share.

Bottom Line

Nvidia Corporation shares are still a Buy despite the recent outperformance. In the near term, Nvidia Corporation stock still has a decent upside of at least +12%, as I expect its share price to go above $300 this year. For the intermediate to long term, Nvidia Corporation is a key proxy for the generative AI investment theme.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Asia Value & Moat Stocks is a research service for value investors seeking Asia-listed stocks with a huge gap between price and intrinsic value, leaning towards deep value balance sheet bargains (i.e., buying assets at a discount, e.g., net cash stocks, net-nets, low P/B stocks, sum-of-the-parts discounts) and wide moat stocks (i.e., buying earnings power at a discount in great companies like "Magic Formula" stocks, high-quality businesses, hidden champions and wide moat compounders). Sign up here to get started today!