Summary:

- Intel Corporation has built on its competitiveness in laptop CPUs, with its performance benchmark scores overtaking AMD for the first time.

- We believe its strong performance improvement is responsible for Intel’s laptop market share gain for the first time in the past 5 years.

- For desktop CPUs, Intel has maintained superior value in terms of performance per pricing against AMD, as it has maintained its CPU prices consistently lower than AMD.

- For server CPUs, Intel is disadvantaged against AMD, which has superior value in terms of performance per pricing, as its performance is almost double of Intel.

- Despite weakness in the PC market expected to continue in 2023, we believe the company.

hapabapa

In our analysis of Intel Corporation (NASDAQ:INTC), we have assessed the company’s performance following the release of its full-year 2022 results. The company experienced a substantial 20.2% decline in revenue compared to the previous year, which was significantly worse than our anticipated decline of 6.8%. It also fell short of the analyst consensus estimate of a 1.3% decline in Q1 2022. As a result, we conducted a thorough examination of the company to identify the underlying factors behind this significant underperformance.

Our analysis focused on evaluating the growth of Intel’s various segments. Specifically, we scrutinized the shipments and ASP growth of the company’s CCG and DCAI segments, as well as its market share for CPUs across desktops, notebooks, and servers. Finally, we drew conclusions about Intel’s prospects for the year 2023 and beyond.

Data Center Segment Weakness Adds to Underperformance

|

Intel Revenue ($ bln) |

2019 |

2020 |

2021 |

2022 |

Our Forecast (2022) |

Average |

|

Client Computing Group |

37.938 |

40.535 |

41.067 |

31.708 |

34.25 |

|

|

Growth % |

6.8% |

1.3% |

-22.8% |

-16.6% |

-4.9% |

|

|

Datacenter and AI |

21.696 |

23.413 |

22.691 |

19.196 |

24.71 |

|

|

Growth % |

7.9% |

-3.1% |

-15.4% |

8.9% |

-3.5% |

|

|

Network & Edge |

6.829 |

7.132 |

7.976 |

8.873 |

10 |

|

|

Growth % |

4.4% |

11.8% |

11.2% |

25.4% |

9.2% |

|

|

AXG |

0.606 |

0.651 |

0.774 |

0.837 |

1.05 |

|

|

Growth % |

7.4% |

18.9% |

8.1% |

35.7% |

11.5% |

|

|

Mobileye |

0.879 |

0.967 |

1.386 |

1.869 |

1.7 |

|

|

Growth % |

10.0% |

43.3% |

34.8% |

22.7% |

29.4% |

|

|

IFS |

0.461 |

0.715 |

0.786 |

0.895 |

2.61 |

|

|

Growth % |

55.1% |

9.9% |

13.9% |

232.1% |

26.3% |

|

|

Others |

4.15 |

5.091 |

5.019 |

0.196 |

0 |

|

|

Growth % |

22.7% |

-1.4% |

-96.1% |

-100.0% |

-24.9% |

|

|

Intersegment Revenue |

-0.594 |

-0.637 |

-0.675 |

-0.520 |

-0.675 |

|

|

Total |

71.97 |

77.87 |

79.02 |

63.05 |

73.645 |

|

|

Growth % |

8.2% |

1.5% |

-20.2% |

-6.8% |

-3.5% |

Source: Intel, Khaveen Investments.

From the table, Intel’s largest segment (50% of total revenue), CCG, declined by 22.8%, a large drop compared to the growth rates in previous years as management highlighted in its latest earnings briefing that “PC TAM deteriorated faster than expected due to macroeconomic headwinds” but was supported by CPU ASPs that grew 11% YoY.

Moreover, its DCAI segment, which is the second largest segment (30.3% of total revenue), also saw a steep decline of 15.4% and was a larger decline compared to past years. Management indicated that this fall was “driven by TAM contraction and competitive pressure.”

For the NEX segment, which is the third largest (14% of total revenue), revenues grew in line with the previous year at 11.2% “driven by higher Ethernet ASPs and increased demand for 5G products, partially offset by lower demand for Network Xeon.”

Besides that, for the rest of its smaller segments, the AXG segment, which accounts for 1.3% of total revenue grew 8.1% YoY which is lower than the previous year’s growth rate of 18.9%. Additionally, Mobileye and IFS segments accounted for 3% and 1.4% of total revenue respectively. Mobileye grew at 34.8% YoY whereas IFS had 13.9% annual growth.

When comparing our forecasted numbers, we can see that there is a noticeable difference between the actual values to the forecasted values for all business segments. The most striking difference is the one in the DCAI segment. The two values trends in the opposite direction with the forecasted growth rate being an 8.9% increase whereas the achieved growth rate was a decline of 15.4%. The CCG segment showed a slightly larger decline of 16.6% compared to the forecasted values, whereas the growth rate of the NEX segment fell short by more than half of our forecast.

Furthermore, the AXG segment showed much lower growth than anticipated at 8.1% compared to the predicted 35.7% based on Intel’s target of $1 bln in revenue for the AXG segment. Mobileye was the only segment that achieved a higher growth rate than forecasted at 34.8% compared to the forecasted growth rate of 22.7%. The IFS segment was another segment whose achieved values fell far short of the forecasted values, achieving a 13.9% growth rate versus the forecasted growth rate of 232.1% as we previously expected the acquisition of Tower Semiconductor to close in 2022 as announced by Intel in Feb 2022 that it expected the deal to close within 1 year but had been faced with regulatory setbacks from Chinese regulators.

Overall, while its CCG segment revenues were slightly under our projections, it was almost in line. However, its DCAI segment had majorly underperformed compared to our estimates with a decline of 15.4% in 2022.

Resilient PC CPU Share Despite Market Weakness

|

Company |

Share (Actual) |

Share (Our Forecast) |

|

Intel (Desktop) |

56.8% |

54.1% |

|

AMD (Desktop) |

43.5% |

45.9% |

|

Intel (Laptop) |

77.1% |

75.5% |

|

AMD (Laptop) |

22.8% |

24.5% |

|

Intel (Server) |

92.4% |

92.4% |

|

AMD (Server) |

7.6% |

7.6% |

Source: PassMark, Khaveen Investments.

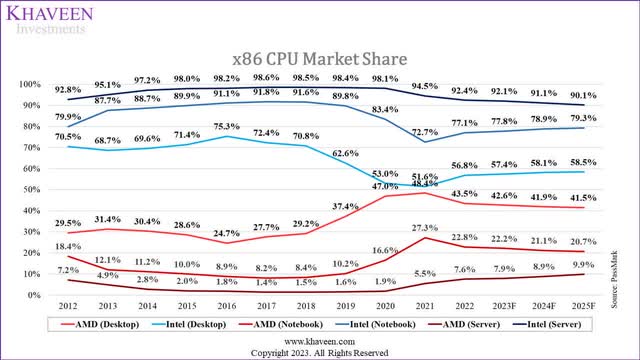

The chart above shows the CPU market share across three segments which are Desktop, Notebook and Server. In 2022, Intel lost 2.1% (94.5% to 92.4%) of the server market to Advanced Micro Devices, Inc. (AMD), but managed to show significant gain in market share for both the desktop (51.6% to 56.8%) and notebook (72.7% to 77.1%) segments. Compared to our previous analysis, our share projections for Intel’s desktop and laptop CPUs were lower than its actual market share in 2022. Though, our share projections for server CPUs were in line with the company’s actual share.

In the following section, we compiled Intel’s desktop, laptop and server CPU revenues as well as volume and ASP growth for each segment in 2022 and compared it with our previous forecasts.

Desktop CPU

|

Intel Desktop CPU (2022) |

Actual |

Our Previous Forecast |

|

Desktop CPU Revenue ($ mln) |

10,661 |

11,168 |

|

Desktop CPU Revenue Growth % |

-14.3% |

-10.2% |

|

PC Market Shipment Growth % |

-16.5% |

-8.2% |

|

Desktop Volume Growth % |

-19.0% |

-12.3% |

|

Desktop ASP Growth % |

5.0% |

2.4% |

Source: IDC, Intel, Khaveen Investments.

For the Desktop market, the company’s revenue generated from desktop CPU sales is very close to the forecasted level ($10,661 mln compared to a forecast of $11,168 mln). This is attributable to a decline in desktop unit sales (-19% compared to our forecast of –12.3% as the total PC market declined by 16.5% which is larger than the market forecast of 8.2% by IDC which we used as our assumption in our previous analysis), which has been offset by a rise in ASP (5% to our forecast of 2.4%).

Laptop CPU

|

Laptop Comparison (2022) |

Actual |

Our Previous Forecast |

|

Laptop CPU Revenue ($ mln) |

18,783 |

20,155 |

|

Laptop CPU Revenue Growth % |

-26.2% |

-20.9% |

|

PC Market Shipment Growth % |

-16.5% |

-8.2% |

|

Laptop Volume Growth % |

-36.0% |

-22.7% |

|

Laptop ASP Growth % |

15.0% |

2.4% |

Source: IDC, Intel, Khaveen Investments.

For the Laptop market, revenue generated is slightly lower than predicted ($19,196 mln compared to the forecasted $24,714 mln). This is mainly due to a drop in Intel laptop unit sales (-36% compared to our forecast of –22.7% as the total PC market declined by 16.5% which is larger than the market forecast of 8.2% by IDC which we used as our assumption in our previous analysis), partially offset by a significant rise in ASP (15% to 2.4%).

Server CPU

|

Intel Server CPU (2022) |

Actual |

Our Previous Forecast |

|

Server CPU Revenue ($ mln) |

19,196 |

24,714 |

|

Server CPU Revenue Growth % |

-15.4% |

8.9% |

|

Market Shipment Growth % |

4.3% |

5.1% |

|

Server Volume Growth % |

-16.0% |

3.6% |

|

Server ASP Growth % |

-5.0% |

5.1% |

Source: DigiTimes, Intel, Khaveen Investments.

Lastly, for the Server segment, there is a significant difference in actual and our estimated revenue generated from the sale of server CPUs ($19,196 mln compared to the forecasted $24,714 mln). This is mainly due to the opposite trends shown by the market shipment, server unit sales and ASP growth rates. All of them exhibited a downward trend compared to the forecasted positive trends. The biggest difference can be seen in server unit sales which fell 16% year-on-year compared to the forecasted increase of 3.6%. Market server shipments growth showed a lower growth of 4.3% compared to the forecasted value of 5.1% based on Trendforce and Intel’s server ASP growth showed a decline of 5% compared to the forecasted value of a 5.1% gain.

Performance

Company Data, PassMark, Khaveen Investments

In 2022, Intel launched its next-gen Raptor Lake PC CPU whereas AMD released its Zen 3+ for Laptops and Zen 4 for Desktops. We updated our analysis of its CPU comparison based on a total of 344 CPUs for AMD and Intel in terms of benchmark scores, pricing and performance per pricing.

|

CPU Benchmarks |

Gen 2 |

Gen 3 |

Gen 4 |

Gen 5 |

Gen 6 |

Average |

|

Intel Desktop Growth % |

15.6% |

26.7% |

35.0% |

21.7% |

59.6% |

31.7% |

|

AMD Desktop Growth % |

– |

20.1% |

41.1% |

43.8% |

25.2% |

32.5% |

|

Intel Laptop Growth % |

90.8% |

-2.4% |

30.2% |

90.4% |

68.8% |

55.5% |

|

AMD Laptop Growth % |

– |

4.6% |

142.1% |

20.8% |

3.5% |

42.8% |

|

Intel Server Growth % |

60.9% |

-8.2% |

19.1% |

78.5% |

– |

37.6% |

|

AMD Server Growth % |

– |

– |

68.4% |

55.3% |

– |

61.8% |

Source: Company Data, PassMark, Khaveen Investments.

Based on the table, the average score for Intel’s Gen 6 (Raptor Lake) showed an impressive improvement for its desktop CPUs at 59.6% growth compared to its historical average of 31.7%. On the other hand, AMD’s desktop CPUs showed a growth of 25.2% which is below its historical average of 32%. Notwithstanding, AMD’s average score is still higher than Intel which indicates its superior performance advantage though Intel is catching up.

For laptop CPUs, Intel’s average score had increased by a massive 68% gain compared to an average of 55.5% with Raptor Lake and had overtaken AMD which had only a 3.5% growth. Most notably, Intel had overtaken AMD in laptop CPUs in terms of average benchmark scores for the first time.

In server, AMD’s average score is over twice higher as Intel highlighting its advantage over the company and posing a threat to Intel in the server market.

Company Data, PassMark, Khaveen Investments Company Data, PassMark, Khaveen Investments

Moreover, we compared the average pricing of Intel and AMD’s desktop and server CPUs. Intel’s desktop CPUs had an average increase of 8.2% based on its past 5 generations. Though, its average score per pricing is higher than AMD’s desktop CPUs indicating superior value. For server CPUs, AMD’s average score per pricing is higher than Intel’s CPUs. Overall, we believe Intel’s superior value in terms of performance per pricing for desktop CPUs and superior performance for laptop CPUs supported Intel’s market share gain in 2022. Though, we believe Intel continues to face a performance and value disadvantage to AMD.

Negative Outlook Remains in 2023

CCG

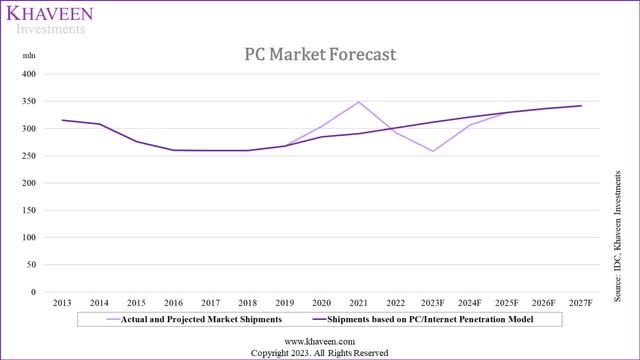

The PC market shipments declined by 16.5% in 2022 due to weak demand based on IDC. According to Intel, the company guided revenue to decline by 40% YoY in Q1 2023. Based on its earnings briefing, the company expects the PC market to continue underperforming in 2023 at around 270 mln shipments in 2023 with continued market uncertainty.

In Q3, we provided an estimate for the calendar year 2023 PC consumption TAM of 270 million to 295 million units. Given continued uncertainty and demand signals we see in Q1, we expect the lower end of that range is a more likely outcome. – Pat Gelsinger, Chief Executive Officer.

|

PC Market (2022) |

Growth % |

|

Actual Growth % |

-16.1% |

|

IDC Forecast |

-2.4% |

|

Gartner Forecast |

1.9% |

|

Top PC Makers Forecast |

3.8% |

|

Analyst Revenue Consensus |

1.5% |

Source: Company Data, IDC, Gartner, Khaveen Investments.

In our previous analysis on AMD, the IDC highlighted that “the PC market has passed peak pandemic demand with a slowdown in certain segments such as education markets due to high saturation.” Furthermore, AMD’s management guided that the company could face growth headwinds due to PC market weakness in 2022. We based our forecast of the company’s CPU shipments and factored in our market share projection on the PC market forecast by the IDC which we believed was the most appropriate with its growth forecast of -2.4% in 2022. This is in contrast to the positive growth forecast of Gartner’s device growth forecast of 1.9% and the average guidance of the top PC makers of 3.8% including Lenovo, Dell, HP and Asus. Additionally, the average revenue consensus by analysts for the top PC makers was positive at 1.5% at that point in time. However, all of the projections were well below the actual market growth rate of -16.1%. Therefore, we seek to obtain more accurate forecasts by attempting to build our forecast model to project the PC market sales. We do this by back-testing various results based on only 2021 data assuming we had projected these figures last year.

Back Test Model

We first obtained the actual PC market shipments from IDC until 2021. Then, we derived the PC market shipments based on our PC/Internet Penetration model excluding 2022 data to obtain our growth forecast for the PC market for 2020 through 2022 based on PC/Internet penetration.

Statista, Statistics Times, Khaveen Investments

*d = b x c, f = [(1 + a) * (1 + e)] – 1

Source: Statista, Statistics Times, Khaveen Investments.

We then calculated the excess shipments between the actual PC market shipments and our derived PC market shipments forecast based on our PC/Internet Penetration model. We assumed these shipments are brought forward and to normalize the following year’s figures, we subtracted the excess shipment from 2021 actual market shipments multiplied by a factor of 0.5 as we assume these shipments to be normalized in 2 years.

|

Yearly PC Shipments (‘mln’) |

2019 |

2020 |

2021 |

2022F |

|

Actual Market Shipments (‘a’) |

267.7 |

303.9 |

348.7 |

292.4 |

|

Growth % |

3.1% |

13.5% |

14.8% |

-16.1% |

|

Khaveen Investments Back Test Model Forecast (‘b’) |

310.1 |

|||

|

Growth % |

-11.1% |

|||

|

Projected Market Shipments |

267.7 |

284.7 |

290.8 |

301.4 |

|

Cumulative Excess Shipments (Difference between Actual and Projected Market Shipments) (‘c’) |

19.2 |

77.1 |

68.2 |

*b = a – (c * 0.5)

Source: IDC, Khaveen Investments.

Comparing our backtest growth rate of our excess adjusted shipments forecast in 2022 of 310.1 mln (-11.1% growth) with the actual market shipments growth rate of -16.1%, our forecast is still off the mark. However, the forecast from IDC, Gartner, top PC makers and analyst revenue consensus is even further off the mark. This leads us to believe the 2022 actual shipments were a huge anomaly and unexpected. Seeing as how our model is still the most accurate than all the other external forecast options, we believe our model is the most reasonable out of all the options to use to forecast the PC shipments until the excess shipments normalize into the market.

Khaveen Investments PC Projections

To forecast the PC market in 2023, we updated the model with the actual market shipments of 292.4 mln in 2022. We also updated our PC/Internet Penetration model to derive the growth forecast for 2023 through 2027. We then derived our 2023 excess adjusted shipments of 258.3 mln by subtracting the 2022 actual market shipments of 292.4 mln by the cumulative excess shipments of 68.2 mln in 2022, multiplied by a factor of 0.5 based on a 2-year assumption, which is a growth rate of -11.7%. In 2024, we revert our shipment projections based on our PC/Internet Penetration model with a growth rate of 18.7% and shipments of 306.6 mln.

| Yearly PC Shipments (‘mln’) | 2019 | 2020 | 2021 | 2022 | 2023F | 2024F | 2025F | 2026F | 2027F |

| Actual Market Shipments (‘a’) | 267.7 | 303.9 | 348.7 | 292.4 | |||||

| Growth % | 3.10% | 13.50% | 14.80% | -16.10% | |||||

| Shipments based on PC/Internet Penetration Model | 267.7 | 284.7 | 290.8 | 301.4 | 311.9 | 321.2 | 329.4 | 336.1 | 341.4 |

| Growth % | 3.10% | 6.40% | 2.10% | 3.60% | 3.50% | 3.00% | 2.50% | 2.10% | 1.60% |

| Cumulative Excess Shipments (‘c’) | 19.2 | 77.1 | 68.2 | ||||||

| Our Excess Adjusted Shipments Forecast (‘b’) | 310.1 | 258.3 | 306.6 | 329.4 | 336.1 | 341.4 | |||

| Growth % | -11.10% | -11.70% | 18.70% | 7.40% | 2.10% | 1.60% |

*b = a – (c * 0.5)Source: IDC, Khaveen Investments.

DCAI

Furthermore, in data centers, Intel’s management provided a negative outlook in the first half of 2023 in its latest earnings briefing.

We expect Q1 server consumption TAM to decline both sequentially and year-over-year at an accelerated rate with first half 2023 server consumption TAM down year-on-year before returning to growth in the second half. While all segments have weakened, enterprise and rest of world, especially China, continues to be weaker than hyperscale. However, we’d highlight that the correction in enterprise and rest of the world, where we have stronger positions are further along than hyperscale. – Pat Gelsinger, Chief Executive Officer.

According to Trendforce, server shipments are projected to grow by only 1.3% YoY in 2023.

Synergy Research Group, Company Data, Khaveen Investments

*a = b × c

We believe the slowdown in the server market could be attributable to the slowed down cloud market growth of 27.5% in 2022 due to “a stronger US dollar, constrained Chinese market and macroeconomic headwinds” in our previous analysis on Amazon. In that analysis, we projected to cloud market to recover beyond 2023 at an average of 37.3% through 2026.

We based the 2024 cloud infrastructure revenue/data volume growth factor on the 5-year average of 1.22x and prorated the factor in 2022 to conservatively increase to its 5-year average with the headwinds in the cloud market – Khaveen Investments.

We forecasted Intel’s CPU market share in desktops and laptops to increase based on our analysis of its average score per pricing for its desktop CPUs and superior performance for laptop CPUs. However, we expect AMD to continue gaining a share in the server market due to AMD’s strong performance advantage and value with a higher score per pricing than Intel.

|

Intel Revenue Projections ($ bln) |

2022 |

2023F |

2024F |

2025F |

|

Client Computing Group |

31.708 |

23.47 |

29.99 |

33.61 |

|

Growth % |

-22.8% |

-26.0% |

27.8% |

12.1% |

|

Datacenter and AI |

19.196 |

16.77 |

18.53 |

20.10 |

|

Growth % |

-15.4% |

-12.6% |

10.5% |

8.5% |

|

Network & Edge |

8.873 |

10.79 |

12.88 |

15.08 |

|

Growth % |

11.2% |

21.6% |

19.4% |

17.1% |

|

AXG |

0.837 |

0.97 |

1.11 |

1.26 |

|

Growth % |

8.1% |

15.7% |

14.6% |

13.6% |

|

Mobileye |

1.869 |

2.45 |

3.20 |

4.13 |

|

Growth % |

34.8% |

31.3% |

30.3% |

29.3% |

|

IFS (Including Tower Semiconductor) |

0.895 |

3.14 |

3.69 |

4.26 |

|

Growth % |

13.9% |

250.8% |

17.5% |

15.4% |

|

Others |

0.196 |

0.196 |

0.196 |

0.196 |

|

Growth % |

-96.1% |

0.0% |

0.0% |

0.0% |

|

Intersegment Revenue |

-0.520 |

-0.52 |

-0.52 |

-0.52 |

|

Total |

63.05 |

57.27 |

69.08 |

78.12 |

|

Growth % |

-20.2% |

-9.2% |

20.6% |

13.1% |

Source: Khaveen Investments.

We updated our revenue forecast for Intel with its full-year 2022 results and based on our updated projections for its CCG and DCAI segments. Furthermore, we factored in a conservative ASP assumption of -20% for Intel’s CCG and DCAI segments as Intel was reported to cut prices in 2023 by as much as 20%. In total, we see Intel’s revenue declining by 9.2% for the full year 2023 with large declines for its CCG and DCAI segments but recovering in 2024 and beyond.

Risk: Intense Competition from AMD in Server CPU

We believe the biggest risk to Intel would be the competition with AMD in the server segment. From the market share chart, AMD had rapidly gained market share from 1.9% in 2020 to 7.8% in 2022 and we forecast this number to keep growing. In our CPU performance comparison chart, we can see that AMD has had better performance in the server CPU segment across all generations and the growth in performance is also greater than that of Intel, with AMD’s latest-gen performance growth at 100.7% and Intel’s at 78.5%.

Furthermore, Intel had just released their latest 4th Gen Sapphire Rapids Xeon Scalable processors on January 10, 2023. According to Yole Development, the new Intel server CPU gen has higher cores and performance improvement over its previous gen by 53%.

Intel’s Sapphire Rapids chips bring the company up to a maximum of 60 cores, a 50% improvement over its previous peak of 40 cores with the third-gen Ice Lake Xeons. Intel claims this will lead to a 53% improvement in general compute over its prior-gen chips. – Yole Development.

On the other hand, AMD released their Zen 4 Genoa on 10 November 2022 which succeeded the Zen 3 Milan in 2021. According to SemiAnalysis, “AMD’s Genoa is ~2x the performance of Milan, with only a modest power consumption increase.” On top of this, the Zen 4 Genoa processors have 96 cores, which is far greater than that of Intel’s Sapphire Rapids at only 60 cores.

Valuation

We updated our valuation of Intel based on discounted cash flow (“DCF”) from our previous analysis with our latest revenue projections for the company. Based on a discount rate of 7%, our model shows an upside of 41% for its shares.

Our valuation for Intel, with a new target price of $46.37, is lower than our previous target of $63.39. The revised target price is based on a lower terminal value of 6.5x compared to 6.9x previously, based on Intel’s 5-year average.

Verdict

In summary, Intel’s performance in 2022 fell short of our expectations due to weaker revenues from its CCG and DCAI segments. Nonetheless, Intel managed to increase its market share in desktop and laptop CPUs against its competitor AMD. Despite the decline in the overall PC market, we attribute Intel’s share gain to its superior value in terms of performance per pricing for desktop CPUs and superior performance for laptop CPUs. Our analysis forecasts an increase in Intel’s CPU market share for desktops and laptops based on its average score per pricing for desktop CPUs and superior laptop CPU performance. However, we expect AMD to continue gaining market share in the server market, driven by its strong performance advantage and value with a higher score per pricing than Intel.

Despite cutting our price target, our target price still represents a significant 45% upside potential for Intel Corporation shares, showing that Intel stock is oversold. We maintain our Strong Buy rating for Intel Corporation.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of INTC, AMD either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

No information in this publication is intended as investment, tax, accounting, or legal advice, or as an offer/solicitation to sell or buy. Material provided in this publication is for educational purposes only, and was prepared from sources and data believed to be reliable, but we do not guarantee its accuracy or completeness.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.