Summary:

- Great company but has low growth going forward.

- Strong market share in the US, but likely at its peak globally in a more cost-conscious market.

- The iPhone is the most successful consumer product ever created in the entire universe. A successful encore is nearly impossible.

- Valued like a double-digit grower, 4-6% growth is much more plausible.

Nikada/iStock Unreleased via Getty Images

Investment Thesis

Apple (NASDAQ:AAPL) is a tech giant, and the highest market capitalization stock traded on the stock market. The iPhone is the most successful consumer product ever created in the entire universe. A successful encore is nearly impossible. As the innovator of the smartphone, Apple has had unrivaled success and is a global powerhouse and dominant position the United States, especially with teenagers and young adults.

Globally, around 1 billion people have an iPhone. Since the launch of the iPhone sales is estimated to have totaled $2 trillion. Apple is the most valuable company of all time, with a market cap of $2.6 Trillion.

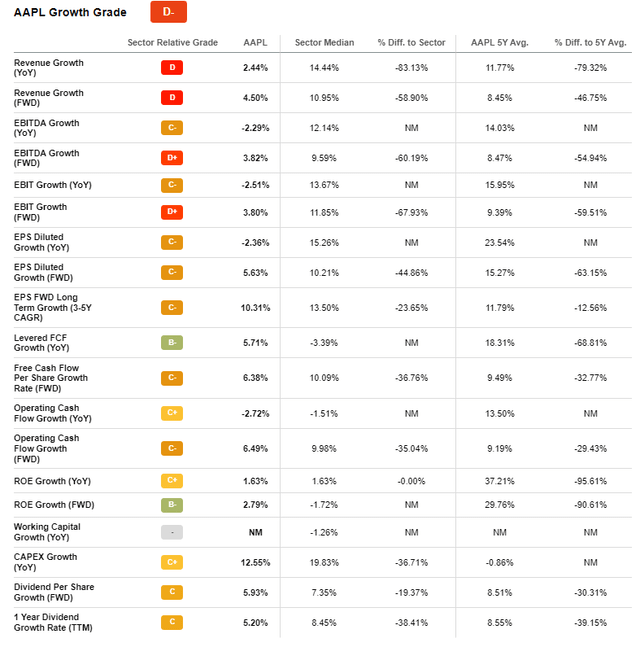

However, revenue and earnings growth has slowed to the 4-6% range. This slow growth is primarily a victim of “The Law of Large Numbers” and Apple’s on success. Additionally, Apple has not been immune to COVID-19 supply chain chokepoints and a saturated smartphone market. Most of the developed world has a smartphone so business there is replacement only and few new features warrant an upgrade. In the developing world, fewer customers can afford the luxury of purchasing the status symbol of buying an iPhone.

Nonetheless, Apple is still priced as a growth stock with a 27.8 PE (Price to Earnings ratio). Given that AAPL had a 12 PE in 2013 when its 8.6% 10-year CAGR revenue was still in front of them, we would not be surprised to see the PE fall to this level which would be more appropriate given its low forward expected growth. Apple has been one of the greatest investments of all time. I hope you own it and are in a position to sell or trim. I believe the stock will underperform over the next 5-10 years and do not own any shares.

Outlook

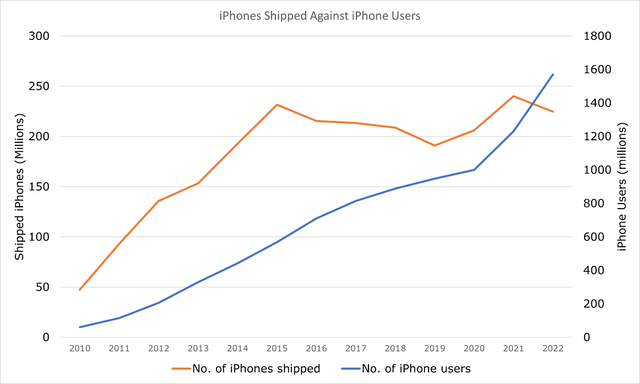

Consumer spending is expected to weaken in FY23. Apple’s financial performance is heavily reliant on the success of their consumer products like the iPhone. Around 52% of revenue in FY22 came from iPhone sales, trailed by services which made up 20%. Additionally, iPhone sales have been flat in recent years, stagnating or declining since FY15. No other device Apple has produced has had the growth rate or sales of the iPhone. It is not even close as the iPhone is the most successful consumer product ever created in the entire universe.

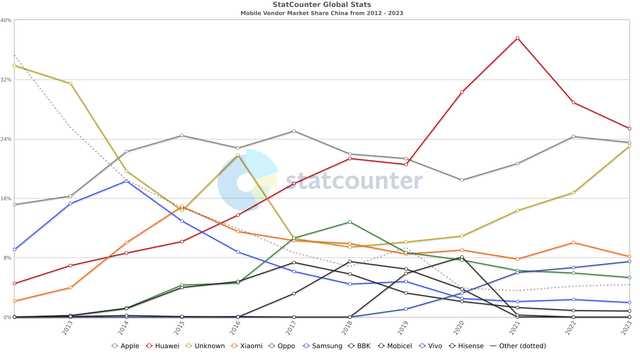

Apple’s market share in the smartphone market ballooned to record highs in FY20, reaching 61% in the US. While investors had been hopeful of a similar trend in China with its emerging middle class, Apple has not been able to breach the 25% mark in market share since the iPhone launched in China in 2009. Additionally, despite iPhone sales stagnating, iPhone users have steadily grown. While this will increase the company’s service revenue, it is clear that people are not as eager to buy brand-new iPhones every year as they have been in the past.

BuildingBenjamins, Apple, BusinessOfApps Chinese Market Share (Statcounter)

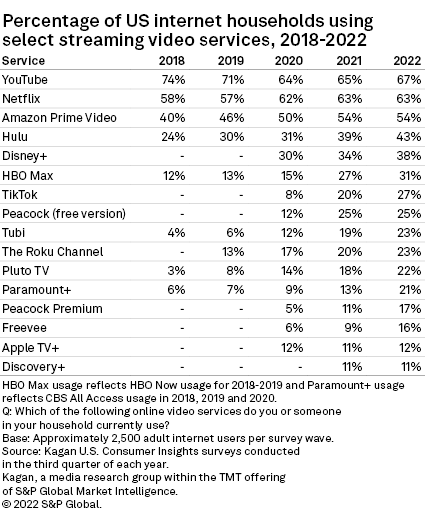

There is room to grow in the service area, with AppleTV launching its subscription service. But the market is already saturated with everyone rolling out streaming services. Apple has only been able to breach just over 10% market share in this area.

S&P Global Market Intelligence

Apple has made no friends in the advertising space, with its strict rules around advertising and user tracking making it an unattractive platform to advertise on. While this has been applauded as pro-privacy and pro-consumer, it dulled their own ability to carve out a revenue stream.

Apple is under scrutiny in the United States and Europe for competitive iPhone and MacOS ecosystem practices. Since 2019 Apple has been under investigation in the US on whether or not it suppresses third party apps in favor of its own. In Europe meanwhile, the entire MacOS ecosystem has been declared as a “threat to competition [utilizes] practices [that] effectively prevent them”. Not only this, but the most downloaded app on iPhones today is TikTok, which has come under equally harsh scrutiny.

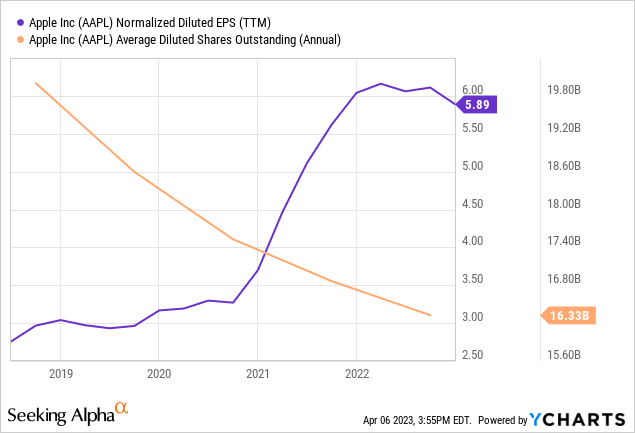

It is not as though AAPL is not a financially healthy company, it has fantastic margins on every level and eyewatering levels of free cash flow yearly – nearly $100 billion. In 1Q23 AAPL repurchased $20 billion in stock but has been stingy on the dividend with only a 0.56% forward yield. We struggle to see why management would prioritize further repurchases instead of dividend expansion at these stock valuations. Our guess is the board is concerned a reasonable dividend would be like an announcement that Apple’s growth days are behind it. Consistently spending $80 billion per year on repurchases and reducing outstanding share count by roughly 4% is not a sign of a company that believes that it has lots of opportunities to invest capital in areas that will match their existing business. That gets back to the core of the problem; no business is going to have the size and margins of Apple’s hugely successful iPhone.

While the financial robustness of Apple is hard to deny, we have growing concerns about the stagnation in earnings per share and revenue – especially in segments that used to be powerhouses. The company’s market share has also not budged, and efforts to expand into streaming with AppleTV and Apple Music have faced steep competition. We no longer believe there is a likely long-term case for Apple from a growth investor’s perspective and have removed it from our portfolio.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.