Summary:

- Amazon’s recent moves towards efficiency is more than welcome.

- Amazon’s is the only member of the “Big 5” to increase its share count over the last 5 years.

- A dollar saved is worth more than a dollar earned.

HJBC

While Meta Platforms, Inc. (META) has vocally announced its “year of efficiency”, Amazon.com, Inc. (NASDAQ:AMZN) is slowly but surely moving towards years of efficiency. The company has made many welcome moves in the last few months with an eye towards shareholder returns. Let’s recap a few significant ones.

- First round of layoffs affecting about 18,000 between November 2022 and January 2023.

- Second round of layoffs impacting 9,000 more, bringing the total to nearly 30,000.

- Third round of layoffs impacting about 100 in Video games division.

- Stalling the progress on its second headquarters in Virginia.

- Or, more to the point of this article, the report that the company is looking at reducing its stock awards to employees as reported by Seeking Alpha here.

Before we give the company way too much credit, let’s remember that the company is merely undoing some of its recent self-inflicted and collateral damages.

- Amazon doubled its headcount more than doubled to 1.6 Million (Yes, a vast majority is due to retail expansion spurred by COVID).

- The company’s move to double its maximum base pay at what may have been the worst possible time from investors perspective, in hindsight. Granted, Amazon has always had a notoriously (comparative) low base pay among the tech giants as its stock more than made up for that since early 2000s. But still a move that effectively increased the upper limit by 100% was a head scratcher.

Back to the subject of this article, the rumored move to reduce stock grants to employees is a welcome sign for investors. Startup and Technology companies have used Stock Options (“Options”) and Restricted Stock Units (“RSUs”) to lure employees for a very long-time. Options are typically used by start-ups and smaller companies while maturing/mature companies like Amazon typically use RSUs. In addition to potentially being lucrative, they also offer a real sense of ownership as employees benefit as the company grows. The trouble for investors is that this dilutes the existing shareholders one way or the other.

With options, the dilution typically happens when the employee exercises the underlying grants favorably and converts the option to stock ownership. In many cases, employees walked away with nothing (meaning no dilution for investors) as their Options strike price was above the market price (worthless option) at the time of their departure from the company for various reasons (termination, quitting, or expiration of the grant).

While proponents of RSUs argue that dilution is delayed till vesting, it is dilution nonetheless and an almost guaranteed event. This guaranteed event typically happens 3 to 4 times for each RSU grant, meaning the vesting is divided over a few years. Amazon’s RSU vesting policy (public information) is below:

- 5% vesting at the end of year 1 (Cumulative Total: 5%)

- 15% vesting at the end of year 2 (Cumulative Total: 20%)

- 20% vesting every 6 months till end of year 4 (Cumulative Total: 100%).

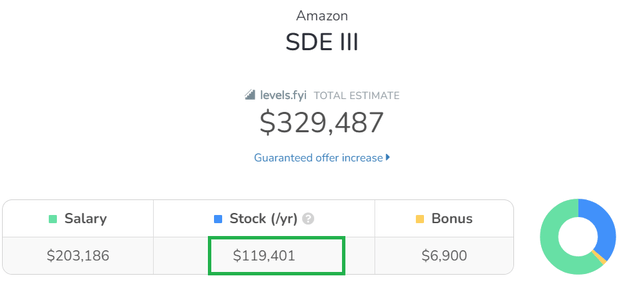

Proliferation of websites like Levels.Fyi has provided the general public and investors with a reasonably reliable insight into the pay packages of companies they are interested in or invested in. The chart shown below says the typical Senior Software Development Engineer (“Level 6”) gets about $120,000/yr in stock grants. That is about 1,200 shares based on the current market price. Obviously, retail employees do not get paid as much as most corporate employees and I am not saying the average employee gets 1,200 shares a year. But the flip-side is that as we move up the ladder from L6 to L10, the compensation is more heavily skewed towards RSUs (Remember, Amazon’s base cap is still capped, although at a higher ceiling since Feb 2022).

Amazon Typical RSU Senior (www.levels.fyi/)

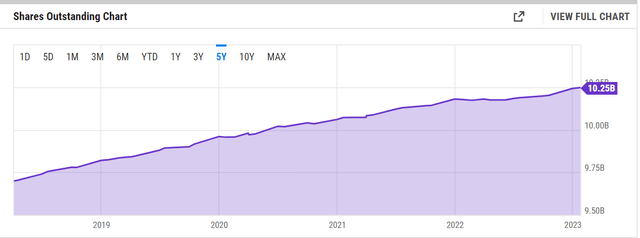

It is impossible to say how much has this dilution cost the shareholders but then, without the right talent, Amazon will not be where it is today. So, all is fair when the investors benefit too. But with the stock stalling over the last few years, it is fair that employees get a smaller percentage of the reduced pie. To the company’s credit, shares outstanding has grown only about 6% in the last five years. I don’t have the data points with me but I’d bet on the side that this is much lesser dilution than the average Silicon Valley company. But the problem for Amazon and its investors is that Amazon is not that “average” company anymore and does not have the potential to 50X like it did over the past two decades.

AMZN Shares Outstanding (YCharts.com)

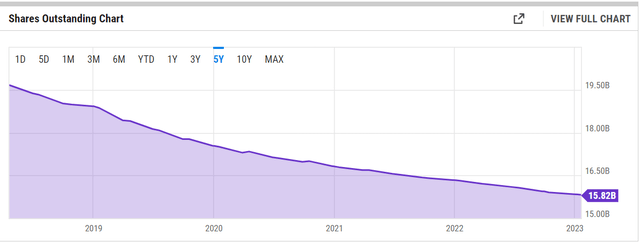

The more reasonable comparison is with its fellow mega-cap technology stocks, or the “Big 5”.

- Apple Inc. (AAPL) has reduced its shares outstanding by nearly 20% in the same five year period, thanks to its buyback programs.

- Microsoft Corporation (MSFT) has held steady over the last five years with a tiny 0.40% reduction.

- Alphabet Inc. (GOOG) has reduced its count by nearly 8%.

- Even Meta Platforms, often seen as the poster child for overpaying, has reduced its shares outstanding by more than 10%.

AAPL Shares outstanding (YCharts.com)

In short, while I’d love an effective buyback program, the report that the company is looking at reducing its stock based compensation is a welcome news. Perhaps, this was always part of Amazon’s plan, especially when it announced the bump in base pay in 2022. RSUs were always given as the excuse for the base pay being low in comparison and with the base cap increasing significantly, Amazon does have the room to reduce its stock compensation.

Conclusion

Usually, when tech companies slash their pay or announce layoffs, they risk mass exodus to their competitors. But this time is different, as the job market in general has remained strong but the high-paying technology companies are trimming their fat all around. While super-talented employees will always find their way, it is undeniable that even the average employee was fed way too much over the last few years. Amazon first reduced the number of mouths to feed and is now reducing how much it feeds the remaining mouths. And both are welcome news for investors.

In a world focused on making and consuming more, it is easy to forget that a dollar saved is worth more than a dollar earned. Thanks to Uncle Sam.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AMZN, AAPL, GOOG, MSFT, META either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.