Summary:

- Airbnb got hammered into the close yesterday, as The Bear Cave issued a short report.

- The short report highlighted the competitive threats from professional hosts building their platform and undercutting Airbnb.

- ABNB investors must assess whether it could impact the company’s near- and medium-term profitability.

- The valuation gap with arch-rival Booking Holdings stock has closed as BKNG surged toward its 2022 highs. However, investors’ sentiments toward ABNB remain uncertain.

- With ABNB down nearly 25% from its February highs, we move to the sidelines from here after our Sell rating in February.

Carl Court

The Bear Cave’s Edwin Dorsey initiated a bearish report on Airbnb, Inc. (NASDAQ:ABNB) yesterday (April 6), which sent ABNB tumbling nearly 5% to close yesterday’s session.

Dorsey is a well-followed investigative writer who digs deep into significant problems that could plague the underlying thesis of companies in his report. He also wrote a bearish report against Roblox (RBLX) in early 2022, impacting investors’ sentiments.

However, his decision to target CEO Brian Chesky & team yesterday was likely a surprise.

Airbnb is an emerging leader in the short-term vacation rental market, as it competes with traditional OTAs such as Booking Holdings (BKNG) and Expedia (EXPE). Moreover, it’s no longer a new upstart that’s still struggling for traction and achieved its first full year of GAAP EPS profitability in FY22.

Airbnb is also free cash flow or FCF profitable and expected to remain so over the next three years. Therefore, it was a surprise revelation as Dorsey attempted to uncover cracks in Airbnb’s business model.

The Bear Cave highlighted that Airbnb faces competition from its “top professional hosts.” These hosts are developing “their own booking platforms and offering cheaper deals to cut out Airbnb.”

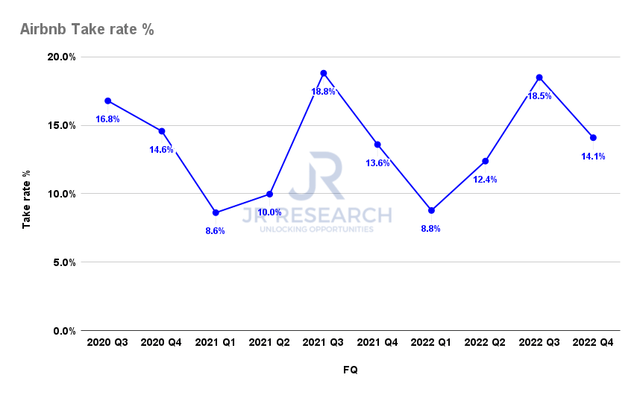

Airbnb take rate % (Company filings)

As such, the thesis is that they can undercut Airbnb’s lucrative take rates, leaving less for the company moving ahead and impacting its underlying profitability growth.

Notably, The Bear Cave highlighted that “professional hosts represent 1% of all vacation rental hosts.” However, these pros “manage 23% of available listings, which generate 35% of total revenue.” In other words, professional hosts could be disruptive for Airbnb if they can undercut Airbnb successfully, taking share away from the emerging leader and eroding its ability to maintain its moat.

However, management sees the move toward developing a closer relationship with property managers as quite different from what Dorsey presented.

Chesky highlighted at Airbnb’s FQ4’22 earnings call that the company is building more momentum with these professional hosts because Airbnb “started getting a lot of inbound from real estate developers.”

Accordingly, management articulated that these property managers see a strong value proposition in Airbnb’s customer segment, as Chesky highlighted:

And [the property managers] started saying if we made our buildings Airbnb friendly, would it make the building more appealing, especially to young people that are moving to markets in certain cities? And so we did a partnership. We started with working with Greystar, Equity Residential, and over 10 other companies, and we’ve launched. (Airbnb FQ4’22 earnings call)

However, Dorsey’s thesis has a valid point. These managers have a bigger scale, wherewithal, and know-how that individual hosts don’t possess. As such, it makes sense that if they can build and scale a platform successfully, they could take share in the process.

Hence, investors will need to assess whether Airbnb’s scale and supply listings which took the company more than 15 years to build, could fall prey to heightened competition.

We think it’s premature to suggest that Airbnb is doomed. The company has over 4M hosts on the platform, accumulating “1.4B arrivals through 2022.” As such, it has inherent “network advantages” that help it to defend its moat against these professional upstarts.

It’s important to remember that Airbnb is not new to tough competition. It competes against the traditional OTAs while also fending off competition against Google (GOOGL) (GOOG) and Amazon (AMZN) as they encroach into the OTA market.

Hence, the importance of continuing to innovate new tools to enhance the value proposition for its hosts and guests will likely help to keep Airbnb ahead. Chesky also highlighted in a recent conference that Airbnb will continue to make hosting more attractive, “[giving] away more value than they’re charging and to make it feel cheaper to be a host every year.”

Hence, the company remains committed to its “huge opportunity for a suite of services that [Airbnb] will give away for free to get the moat deeper.”

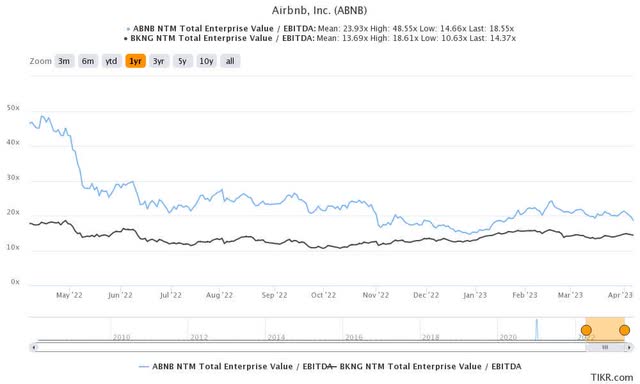

ABNB Vs. BKNG NTM EBITDA multiple valuation trend (TIKR)

ABNB’s valuation has fallen markedly since our Sell rating in February as we urged investors to avoid buying the surge. Accordingly, ABNB fell nearly 25% from its post-earnings February highs, as astute sellers took profit against the late buyers chasing momentum.

The valuation gap between ABNB and BKNG has also closed, as BKNG has recovered remarkably, closing in against its 2022 highs.

Hence, we believe it’s appropriate for us to move to the sidelines from here, as our Sell thesis has played out accordingly.

Investors waiting to add exposure should remain patient, as we have yet to glean a lower-risk entry point, and its valuation is still too expensive.

Rating: Hold (Revised from Sell).

Important note: Investors are reminded to do their own due diligence and not rely on the information provided as financial advice. The rating is also not intended to time a specific entry/exit at the point of writing unless otherwise specified.

We Want To Hear From You

Have you spotted a critical gap in our thesis? Saw something important that we didn’t? Agree or disagree? Comment below and let us know why, and help everyone to learn better!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AMZN, GOOGL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA’s bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!