UBS named its top stock picks out of the consumer sector. The firm highlighted 7 stocks where it said it has a differentiated view based on interesting or proprietary data sources.

PepsiCo (NASDAQ:PEP): “We believe PEP represents a compelling rate-of-change story over the next 12-18 months and is one of the few large-cap Staples names with a defensible case for multiple expansion. With potential for a return to on-algo growth in 2H26 along with +HSD EPS growth for ’26, we think the risk/reward for PEP is among the most attractive in the entire group.”

J.M. Smucker Company (SJM): “Our analysis suggests that favorable underlying category growth dynamics coupled with the company’s ability to take price in the coffee segment will drive +MSD organic growth and more than offset continued pressures from Hostess, with our organic growth estimate of +5.6% ahead of consensus (+5.5%). From a bottom line perspective, we believe cost savings, potential pricing, and favorable below-the-line dynamics pave a path to solid long-term EPS growth that could result in upside to current estimates.”

Albertsons (ACI): “We believe ACI’s pullback has been overdone, & doesn’t reflect its opportunity for upside. It’s now past the distraction from its merger attempt with Kroger. It’s seen 15 straight quarters of double-digit pharmacy growth. These shoppers tend to have some of Albertsons strongest lifetime customer values. It’s also making price investments, that should help to spur grocery SSS growth.”

Dutch Bros (NYSE:BROS): “We believe BROS shares remain positioned for further upside given industry leading store growth and ongoing sales and traffic momentum likely sustainable through 2H25 and ’26 supported by a compelling catalyst path. We expect BROS should maintain market share gains in a high-growth category (~10% category sales CAGR ’21-’24) enabling 20%+ revenue growth, supported by strong customer brand affinity and drivers to sustain momentum, including compelling new products, marketing effectiveness, mobile order, operational enhancements, and a ’26 food launch.”

Ulta Beauty (ULTA): “ULTA is demonstrating strong execution under its new CEO, with improved internal operations and a favorable competitive backdrop, as evidenced by 2Q comp acceleration. Manageable comp comparisons in 2H and a robust pipeline of product newness support sustained momentum and potential outperformance. For FY24, margin expansion presents a key opportunity, with SG&A investments expected to moderate, driving positive earnings revisions.”

On Holding (ONON): “We think On’s continued focus on innovation, performance, athletes, sports, direct-to-consumer selling, and maintaining a premium, full-price brand image will lead to industry leading sales growth and margin beats. Plus, we think ONON is poised to navigate tariffs better than most Softlines companies.”

Peloton Interactive (NASDAQ:PTON): “We have a Buy rating on PTON with a PT of $11, supported by: 1) upside to ’26E EBITDA driven by revenue growth and cost efficiencies; 2) positive trends in key underlying metrics; and 3) favorable risk/reward, with the stock trading at ~6-7x EBITDA as cash flows inflect. Subscriber growth inflection is critical for multiple expansion, requiring improvement in subs trajectory despite potential churn from price increases during seasonally important months.”

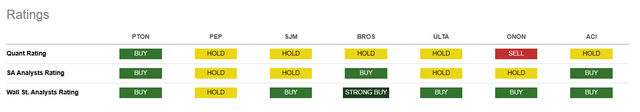

Digging into UBS’ list of top consumer stocks, Peloton (NASDAQ:PTON) is the only one with a clean sweep of buy ratings from Seeking Alpha analysts, Wall Street analysts, and the Seeking Alpha Quant Rating system.

Seeking Alpha