Summary:

- Management is attacking costs by selling unwanted assets and investing in new low cost and value added proposals.

- The combination of sales and investments is lowering the corporate breakeven.

- A gift like the high commodity prices in 2022 gives the company more cash to speed up the process.

- Despite the sales, upstream production actually grew a little in 2022.

- Management appears to be raising the goals for 2027 thanks to the unusually good year of fiscal year 2022.

imaginima

A billion here and a billion there properly spent is going to make a cost difference for the corporate breakeven. Then there is a billion here (on low-cost assets) followed by a billion there of sales of noncore assets. Exxon Mobil (NYSE:XOM) management is working on the cost structure of the company to reduce the corporate breakeven over time. That will offset any perceived future negative pricing action. When this cost reduction effort is combined with slow growth, the company will not need help from commodity prices to produce higher earnings.

First, The Sales

Exxon Mobil announced the sale of a refinery in the Washington State area. That refinery had been around since 1949. It no longer was considered a core asset. At the time of the sale, it was mentioned that the company wants to invest where it can make more value-added products.

Management also announced the sale of some chemical assets. The idea here was to use the proceeds to focus on areas where the company had a competitive advantage. This billion-dollar sale was a significant step in that direction.

Back in 2020, Exxon Mobil wrote down natural gas assets because there was a belief at the time that those assets could not compete for capital. No one saw the natural gas pricing recovery that saw prices rise to unexpected levels in fiscal year 2022. But management waited until 2021 to begin to sell the noncore properties. The sale of some Barnett Shale properties was announced in 2022 for $750 million.

Management is selling noncore properties and higher cost properties in an effort to refocus the company where it has competitive advantages and can add value to what is produced. In the process, high cost (and low profitable) assets are being eliminated. That cash raised will be redirected to more profitable uses. Management has a goal in each division to straighten things out.

Next, The Investments

In the fourth quarter, management announced that Permian and Guyana production increased more than 30%. Management noted that Permian production was now 560,000 BOED. Permian production is noted for being low cost and if production increased as management stated, then there is a lot of new low-cost production in the Permian.

Not only that but production grew about 100,000 barrels in excess of the sales and divestments (even the loss of production in Russia). Now 100,000 BOED may not sound like much, but when the company has a goal to dump far larger amounts of unwanted production and still grow, that number look more impressive by the minute.

Then there is Guyana:

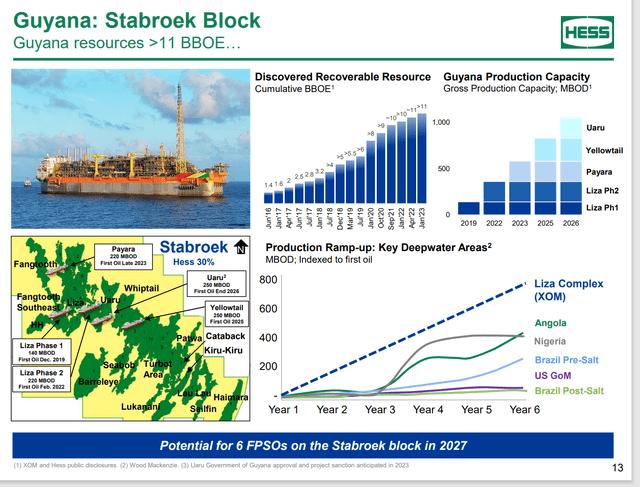

Hess Presentation Of Guyana Partnership Guidance (Hess Corporate Presentation March 2023)

In the fourth quarter of 2022, Exxon Mobil management announced two more discoveries to add to the long string of discoveries shown above. The smallest partner in the partnership, Hess (HES), is a little more optimistic about the production levels by 2027 than is Exxon Mobil. Still the results shown above demonstrate that this low-cost project will soon become very significant for a company the size of Exxon Mobil.

The partners have noted that a new FPSO will have first oil production before the end of the current fiscal year. That will add about 250,000 BOED to the partnership production when it is fully up and running probably in 2024. By the time 2027 arrives the partnership will expect to achieve 6 producing FPSO’s. The total production capacity at that point is expected to exceed 1.2 million BOED. The Exxon Mobil share of that production would be 45%.

This is only one block in Guyana. Exxon Mobil has interests in other blocks in Guyana and Suriname and has begun exploring on some of those blocks. Any commercial discoveries are likely to add to the potential end-of-the-decade production guidance.

Management also announced the startup of a significant amount of new refining capacity. In answer to President Biden’s comments, this new refining capacity is the equivalent of a midsized refinery. Management is highly unlikely to stop there either.

The Strategy

Basically, management is selling high-cost, low-profit production and replacing it with lower cost production. The sales and the production replacements are in the low hundreds of thousands of barrels of production each. But the potential overall effect can total as much as 500,000 barrels in any given year (for example sell 200,000 barrels while bringing on 300,000 barrels of low-cost production). For a company the size of Exxon Mobil, this is an overall giant project that is designed to show results. Over time, the effort to sell high-cost production while developing low-cost production will significantly increase profitability.

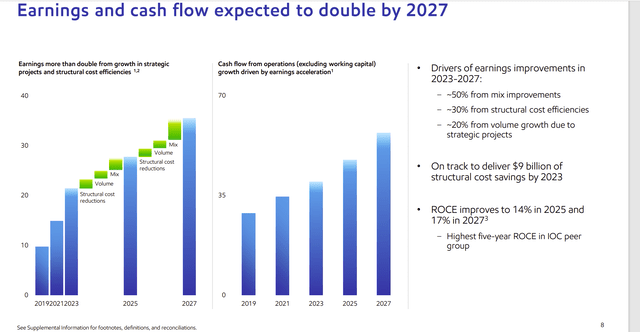

Exxon Mobil Updated Corporate Plan (Exxon Mobil December 2022, Corporate Plan Update)

What management did with the earnings on the left side chart is raise the guidance because fiscal year 2022 was an unexpectedly good year. More cash was generated than was expected, so management made a little more progress than expected. Notice the key words there “more than double”.

There are more than a few managements out there that take a gift like fiscal year 2022 and report to shareholders “we achieved our goal so we are done”. Evidently that is not going to be the case with this management.

For example, back in fiscal year 2021, there was a lot of news about the sixth drill ship to arrive in Guyana.

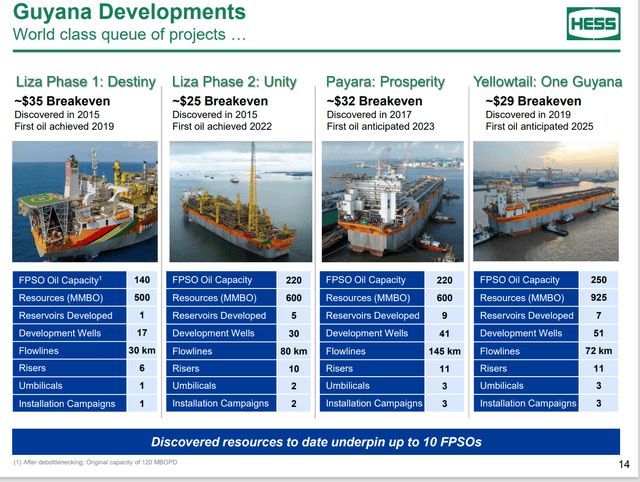

Hess Presentation Of Guyana Partnership With Exxon Mobil Approved And Operating FPSO Projects (Hess Corporate Presentation March 2023)

After that came the news that the Payara FPSO was accelerated from the beginning of 2024 to the end of 2023 that is now shown above. There was also the news of a fourth FPSO (also shown above). So, when times are good, this management gets going. Every little bit helps when it comes to lowering costs and increasing earnings.

The Future

Exxon Mobil also now has a discovery in Suriname as well. Any successful new discovery generally takes five to seven years to get to production offshore. So this new discovery will take time to evaluate for commercial significance and then get to production.

Exxon Mobil has plenty of these other projects around the world that investors can read about on the company website and elsewhere. This management is not sitting still or depending upon better commodity prices to report superior results.

Instead, management is embarking on a cost reduction (and where they can more value-added production) to increase company profitability regardless of what happens to commodity prices in the future.

Investors can expect management to go about this in two ways. The noncore assets will be sold during times of favorable selling conditions. In the meantime, new value-added projects will be developed and emphasized while more profitable upstream operations will be invested in.

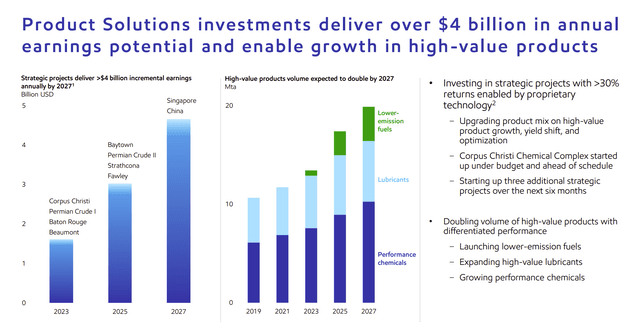

Exxon Mobil Plan To Increase Corporate Profitability Summary (Exxon Mobil Corporate Plan Update December 2022)

Management will likely add more refining capacity (probably several times more than the recent announcement of capacity addition). But there are several more attractive possibilities on the list above. Undoubtedly there will be more additions in the future.

This is not going to be a repeat of the Exxon Mobil that “sat there” for about a decade or so. Management clearly has plans to transition the company to a growth and income situation from a strictly dividend strategy that seemed to prevail for a long time. As a result, investors can expect a steady announcement of more profitability improving project and more growth projects in the future.

This company appears to be on track to improve the profit outlook in spite of rather than because of the commodity price outlook.

One Final Thought

I follow a lot of oil and gas companies. The quarterly conference calls largely mention that many managements consider the industry cheap. As such they do not think this is the time to sell. Instead, they believe it is the time to buy.

Whenever in the past I listened to great investors like Peter Lynch, or John Templeton, for example, they often stated to wait until it’s a sellers’ market to sell.

A current example would be the automobile market where all those car companies went public. Clearly a lot of insiders believed they were getting good value for their backers by going public.

This oil and gas industry is nothing close to what we saw with automobiles. Valuations and price-earnings ratios appear to be largely below historical levels (not above). Therefore, you will not see insiders doing a lot of selling or a lot of companies going public until conditions are more favorable. That is probably a clue to hang on to good companies like this one until insiders change their minds in large numbers.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of XOM HES either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Disclaimer: I am not an investment advisor and this is not a recommendation to buy or sell a security. Investors are recommended to read all of the company's filings and press releases as well as do their own research to determine if the company fits their own investment objectives and risk portfolios.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

I analyze oil and gas companies like Exxon Mobil and related companies in my service, Oil & Gas Value Research, where I look for undervalued names in the oil and gas space. I break down everything you need to know about these companies — the balance sheet, competitive position and development prospects. This article is an example of what I do. But for Oil & Gas Value Research members, they get it first and they get analysis on some companies that is not published on the free site. Interested? Sign up here for a free two-week trial.