The average short interest in the S&P 500 Healthcare sector (NYSEARCA:XLV) decreased slightly in August, indicating a minor softening of negative sentiment among investors. The average short interest for the sector was 1.89%, down from 1.95% the previous month. Despite this overall trend, Moderna (NASDAQ:MRNA) remains the most heavily shorted stock in the sector.

Despite its 12.12% weighting in the S&P 500, the healthcare sector has underperformed the broader market this year. The Health Care Select Sector SPDR Fund ETF (NYSEARCA:XLV) has seen a modest rise of 0.39% year-to-date, a notable contrast to the S&P 500’s 11.95% gain over the same period.

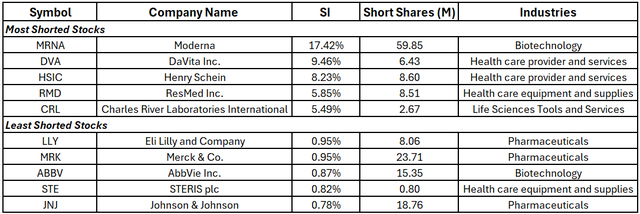

Stocks with the largest and least short positions

Ranked by short interest as a percentage of shares float

Seeking Alpha (Seeking Alpha)

Moderna (NASDAQ:MRNA) remained the most heavily shorted stock in the sector, with short interest at 17.42% of its float, a decrease from 18.29% the previous month. Despite the high short position, Seeking Alpha’s Quant Rating gives the stock a “Hold” with a score of 2.74 out of 5.

“Moderna (NASDAQ:MRNA) reported a sharp decline in revenue for Q2 2025, earning only $0.1 billion and experiencing a net loss of $0.8 billion. The stock has dropped over 70% in the past year due to investor concerns regarding ongoing losses and reduced demand for COVID vaccines. Despite recent product approval, the company anticipates significant losses in 2025. However, with a strong cash position of $7.5 billion, a revenue recovery is possible through opportunities in vaccines and oncology,” a Seeking Alpha analyst wrote.

The second-most shorted stock in August was DaVita (NYSE:DVA) at 9.46%, while Henry Schein (NASDAQ:HSIC) was third at 8.23%.

On the other hand, several major companies had very low short interest, including Johnson & Johnson (NYSE:JNJ) at 0.78%, STERIS plc (NYSE:STE) at 0.82%, and AbbVie (NYSE:ABBV) at 0.87%.

Industry Analysis

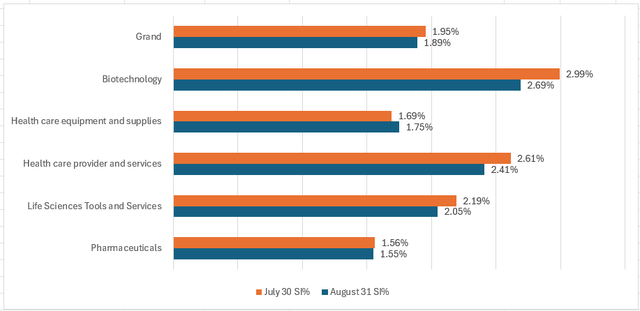

Average short interest as a percentage of floating shares

Seeking Alpha (Seeking Alpha)

For the 17th month in a row, the biotechnology industry was the most shorted in the healthcare sector, despite short interest ticking down to 2.69% from 2.99% in July. The healthcare provider and services sectors also saw a notable increase in short interest, rising to the second-highest level at 2.41%.

In contrast, the pharmaceuticals’ industry had the lowest short interest, which fell to 1.55% for the month.

Related ETFs: Health Care Select Sector SPDR Fund (NYSEARCA:XLV), SPDR S&P Pharmaceuticals ETF (NYSEARCA:XPH), VanEck Pharmaceutical ETF (NASDAQ:PPH), iShares Nasdaq Biotechnology ETF (NASDAQ:IBB), iShares U.S. Pharmaceuticals ETF (NYSEARCA:IHE), and Invesco Nasdaq Biotechnology ETF (NASDAQ:IBBQ).