Capital markets activity among publicly traded media and telecommunications companies in North America dropped year over year and sequentially in August, with the sector raising $4.70 billion.

This compares to the $11.42 billion the sector raised in July and $14.32 billion in August 2024, according to S&P Global Market Intelligence data.

Verizon Communications’ (NYSE:VZ) $2.25 billion offering in March remains the largest offering by gross amount so far this year, S&P Global stated.

Debt offerings comprised the largest share of the capital raise, while common equity offerings brought in just $200,000.

Charter Communications’ (CHTR) issuance of $1.25 billion in 5.850% senior secured notes due 2035 was the media and telecom sector’s largest offering in August. The company also offered $750.0 million in 6.700% senior secured notes due 2055.

Match Group Holdings II LLC’s (MTCH) offering of $700.0 million of 6.125% senior notes due 2033 ranked third by offering size in August, while Snapchat owner Snap’s (SNAP) $550.0 million senior notes offering due 2034 ranked fourth.

BCE (BCE) unit Bell Canada, meanwhile, raised the second-highest amount overall in August at C$2.00 billion, or just over US$1.45 billion, through four separate offerings. The gross amount of these offerings ranged from C$400.0 million to C$600.0 million.

(S&P Global Market Intelligence)

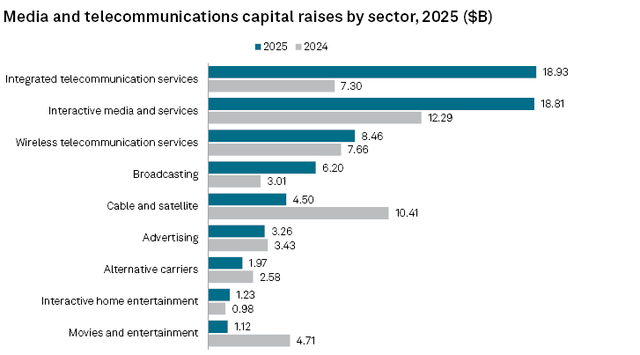

Turning to the media and telecom subsectors, integrated telecom services companies raised the highest amount of capital year-to-date at $18.93 billion. Interactive media and services companies ranked second with $18.81 billion, while wireless telecom operators ranked third with $8.46 billion.