Summary:

- Apple Inc. is expected to report a 40% drop in PC sales in Q2 year-over-year.

- This softness in the PC market is not limited to Apple, but rather the PC market as a whole.

- We believe that counting Apple out is a risky proposition.

Scott Olson

Straight From The Headlines

When you’re the biggest company in the world, everything you do naturally makes waves. So, when it was announced that Apple Inc. (NASDAQ:AAPL) personal computing [PC] business shipments are likely to have dropped by 40% year-over-year in the first quarter of 2023, investors can’t help but take notice. What made the drop worse is the fact that the expected drop outpaces declines at other PC makers, like HP Inc. (HPQ) and Dell Technologies Inc. (DELL).

Sentiment around Apple seems to feel, well, a bit jittery among investors. The stock has been such a stalwart for so long, and its performance and valuations have held up so well (relatively speaking) even through the 2022 “tech-wreck,” however, that perhaps it is natural for investors to wonder if (or when) the other shoe will drop.

So, let’s dive in and see what the recent news means for Apple.

A Troubled Industry

The PC market faces considerable macro headwinds. Research firm Gartner recently published a piece on the global state of the industry, and the picture it painted was grim indeed.

The PC market, it seems, is the latest market to be caught in the jaws of multiple negative forces–consumers overbought PCs at the height of the pandemic when they were locked inside with nothing to do, thus pulling sales into the future. Further, as recession fears grow, consumers and enterprise customers are scaling back the pace at which they are replacing older machines. Extending the life of computing hardware is a great way to avoid large cash outlays for companies.

Thus, the industry seems caught in a bit of a perfect storm: people that would have bought today bought yesterday, and people who need to buy today are delaying purchases until tomorrow.

Against this backdrop, let’s consider Apple’s positioning within the market. Gartner estimates that in the fourth quarter of 2022, Apple controlled a respectable 17% of the U.S. market, giving it the third place behind HP and Dell, which held 23% and 26% of the market, respectively.

Next, consider Apple’s spot as the premium-price provider in the space. A mid-range Mac will cost you a little more than $1,000, while a comparable PC is likely to cost around $600 (and yes, we know that the rabbit hole on “comparable” PCs can get quite deep–we are assuming an average user with average needs and very little required in the way of specialization in this scenario).

Lastly, it’s fairly well-known that Apple’s PC products have a longer life expectancy than machines from other manufacturers (another potential rabbit hole here, but again we are considering an average amount of use).

Considering all of this, it’s not surprising that Apple’s expected PC sales should fall a bit more dramatically than its peers. In tough times, consumers cut costs, and it makes all the sense in the world to prefer a $600 option over a $1,000 option if that is what can truly be afforded.

In this scenario, Apple’s longevity also acts as a double-edged sword, in that one of the products greatest benefits (its lifespan) is creating a drag on sales.

So, then, we must ask ourselves–is this the proverbial shoe that jittery investors have been waiting on to drop?

Revenue Segmentation

In short, we don’t think so.

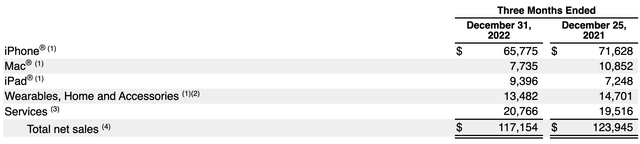

Here’s a look at Apple’s revenue mix for the quarter ending December 31, 2022 (figures in millions).

By revenue segment, Mac’s brought up the rear with only (only!) $7.7 billion in sales, down from $10.8 billion the year prior. Mac sales, then, represented slightly less than 7% of overall sales for Apple during the holiday season.

Let’s also consider the nature of the headlines, namely that Apple is expected to have lower PC sales year-over-year by 40%. So, for an apples-to-apples (no pun intended) comparison, let’s consider Apple’s Q2 2022 sales.

In the quarter ending March 2022, Apple sold $10.4 billion in its Mac segment. A 40% drop from that level implies Mac segment revenue of $6.24 billion for the quarter ending march 2023.

Levers to Pull

Apple, of course, is like any other company–it doesn’t want to see a loss of market share in any category, and investors should not expect that management will go quietly into the night without fighting back.

To this end, DigitalTrends reported that Apple had begun discounting prices on a handful of its Mac products. This is most likely an effort to juice demand of these products and, secondly, to avoid any painful build-up of idle inventory.

Discounts, of course, are only one option. Another is for the company to expand the terms it already offers Mac purchasers who want to pay over time for their Macs. Apple currently offers payments in 12 monthly installments for its Mac products, and a simple way to drop the payments for price-sensitive buyers would be to extend payments by a few months until demand normalizes.

The Bottom Line

To be sure, any expectation of a 40% drop in segment sales is alarming. However, we feel that Apple Inc. is uniquely positioned to withstand PC market softness compared with its more pure-play PC peers, given that its PC segment accounts for less than 10% of overall sales.

We also wrote in early March about what we consider to be Apple’s exceptionalism among its peers (you can read that article here), and we believe that that thesis remains intact today.

We also remind investors to consider their time horizon, especially in troubling times like these. Investors with a shorter-term focus may indeed analyze Apple Inc. and find it to be a tad too expensive. We, however, have a long-term focus and are of the opinion that dips in Apple Inc. stock today are good buying opportunities that will yield dividends in the future.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Disclaimer The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Factual errors may exist and will be corrected if identified. Before buying or selling any stock, you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal, and readers should not utilize anything in our research as a sole decision point for transacting in any security for any reason.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.