Summary:

- AT&T’s shares are in an up-trend.

- Although the firm still has broadband momentum and covers its dividend with free cash flow, I am selling my shares to lock in profits.

- AT&T’s yield has compressed to just 5.8%. The stock is now oversold and has traded up to my fair value range.

Brandon Bell

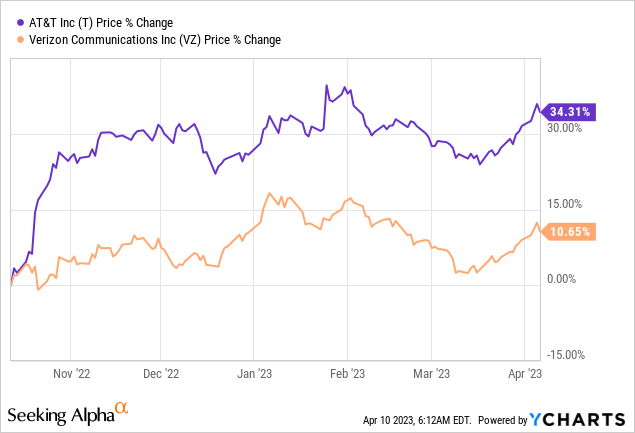

I am selling shares of telecommunications company AT&T (NYSE:T) because of the strong increase in price and the compressed dividend yield. I still like AT&T due to variety of factors including a strong dividend that is supported by free cash flow, momentum in the core broadband business, and a reasonable P/E valuation. While AT&T is still an attractive dividend investment, I believe a 25% increase in price since my October recommendation — AT&T: General Buying Opportunity — can and should not be ignored. As much as I like AT&T, the stock has hit my longer term price target and I believe the strengthening momentum over the last few weeks gives investors an attractive exit opportunity. However, I will be looking forward to rebuying AT&T for income at a later stage when the valuation becomes more attractive again!

AT&T: possibly fairly valued now around $20

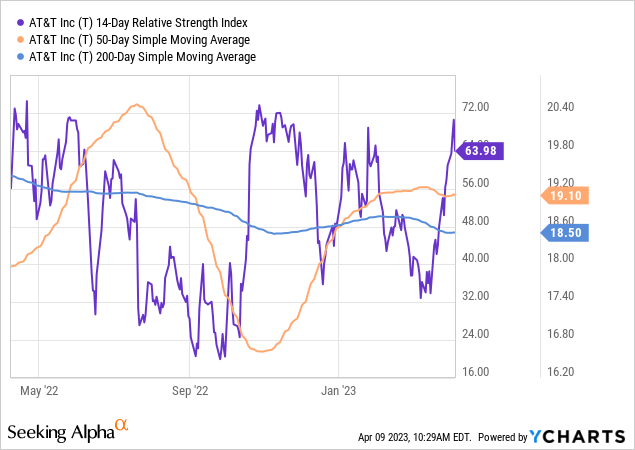

I am not selling AT&T because I see problems with the firm’s business, dividend coverage or debt situation, but rather because the stock has reached my longer term price target of about $20. Compared to October 2022, AT&T’s valuation has increased by approximately 25% and AT&T became overbought last week based off of RSI… which is when I sold my shares. AT&T’s shares have risen approximately 36% since reaching a 1-year low at $14.46 in October of last year (the return does not factor in the payment of dividends).

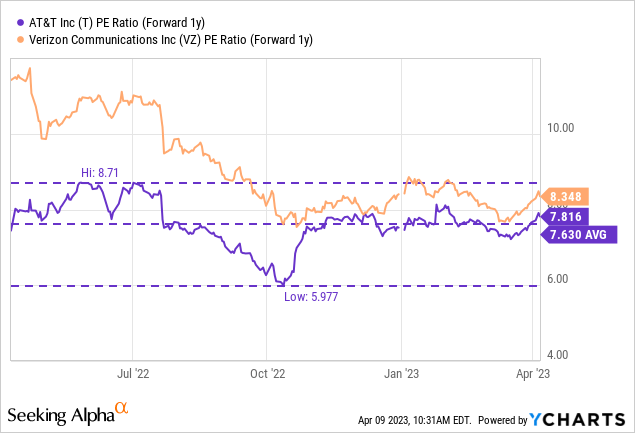

AT&T’s valuation has received a significant re-rating in recent weeks, due in part to relief about easing banking fears. AT&T shares have re-rated from an earnings multiplier of 6.0 X in October 2022 to 7.8 X last week. AT&T’s P/E ratio has also once again surpassed its average 1-year P/E ratio of 7.6 X, which may indicate limited upside potential going forward.

While Verizon’s (VZ) shares are still slightly more expensive based off earnings, but the telecom’s recovery was not nearly as strong as AT&T’s: the telecom has widely outperformed Verizon and produced a 3X higher price return since October 12, 2023 which is when the stock market went into a new up-leg.

There is one reason to stay invested… and that’s the dividend

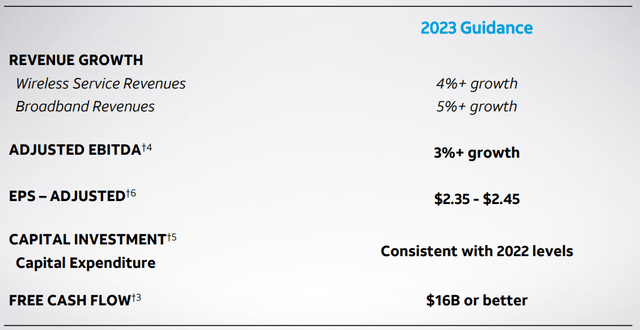

I get that not many investors would want to sell a dividend-paying stock as long as it pays a nice dividend once a quarter. AT&T’s dividend remained covered by free cash flow in FY 2022 and the telecom’s outlook for FY 2023 calls for $16B in free cash flow. AT&T pays approximately $2B/quarter in dividends which calculates to a dividend payout ratio of about 50%. With this payout percentage, AT&T still retains enough cash to invest in the continual roll-out of its fiber broadband network and pay down its debt. Since I have achieved a return of more than 30% on my investment in AT&T, however, I have decided to sell my shares in AT&T and use the proceeds to raise my portfolio cash level.

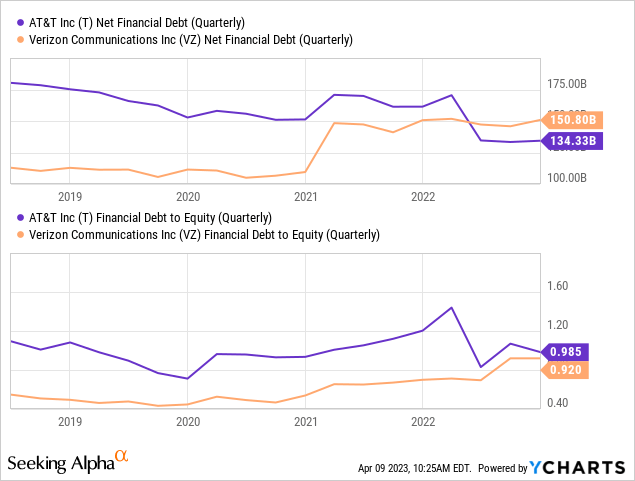

AT&T still carries a lot of debt on its balance sheet which is the result of years’ worth of expensive acquisitions. AT&T had about $134.3B in net financial debt on its balance sheet as of the end of FY 2022 which is about $16B less than Verizon has to service. Both telecoms have debt-to-equity ratios of approximately 1.0 X which I would consider high. Going forward, AT&T will have to reduce its debt and I believe the telecom could put $8B annually towards its debt (the amount remaining after it fulfilled its dividend obligations). After a period of prioritized debt repayments, I believe AT&T could be using more free cash flow to either increase its dividend or buy back shares.

Risks with AT&T

There is a risk when selling a stock into trading strength simply because I could be missing out on incremental valuation gains and surely on future dividend income… and by doing this I am creating opportunity costs that I have to earn elsewhere. However, with a total return of ~34% in about six months, I believe not realizing the accrued gains is a bigger risk than missing out on additional upside. While I don’t see AT&T as overvalued, I believe the technical sentiment speaks against an engagement at this level.

Final thoughts

I am finally taking profits in AT&T, simply because the valuation multiplier has increased significantly since October 2022 and shares of AT&T are now overbought based on the RSI indicator. I still like AT&T (and the telecom’s broadband momentum) and I don’t rule out a reinvestment in the telecom at a later point when the valuation becomes more attractive again. Considering that the stock has soared 36% since its 1-year low, I believe selling is not a bad option right now, even if it means losing out on AT&T’s attractive, FCF-covered dividend income!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of VZ either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.