Summary:

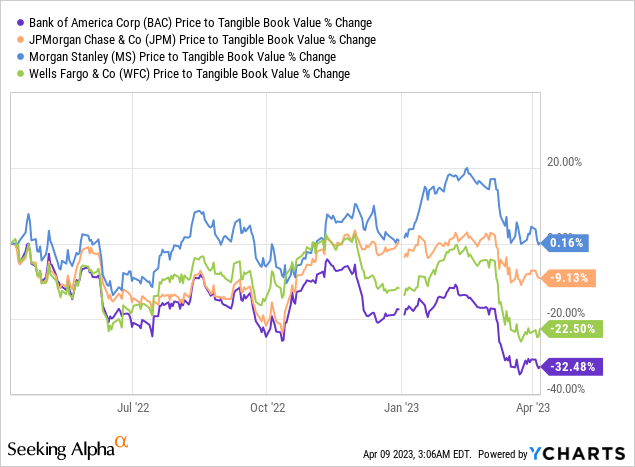

- BAC share price has underperformed so far in 2023 in spite of the higher rates environment.

- Mr. Market is concerned about deposits outflows and repricing as well as lower rates near term.

- BAC is trading (unjustifiably so) as a bond proxy.

- It has a diversified and resilient business model that should perform throughout the cycle.

- It is now approaching my buy zone once again and I may pick up shares in the next week or so.

tupungato

Most investors know Bank of America (NYSE:BAC) as the bank to own when interest rates go higher. BAC is the most interest-rates sensitive large U.S. bank given its monster-like deposits franchise across a number of its business lines.

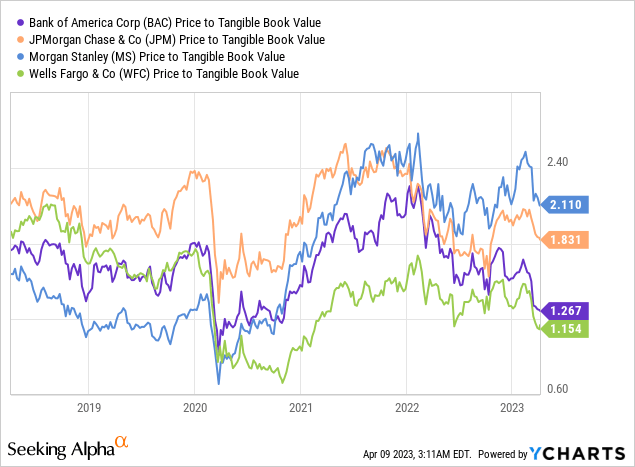

The stock valuation on the basis of price to tangible book value is lower than many of its peers currently:

The one-year percentage drop in its price to tangible book value is a stark ~32% and the worse performance out of its immediate U.S. peers.

The culprit for the decline in the share price has been mostly related to interest rates. The rapid rise in interest rates during 2022 is a double-edged sword for BAC. It clearly hugely benefited the NII line in 2022 but as rates have moved from 3% to nearly 5%, customers have increasingly moved their funds to higher-yielding non-checking accounts, money markets funds, saving accounts, and CDs. This is beginning to exert pressure on its Net Interest Margin (“NIM”).

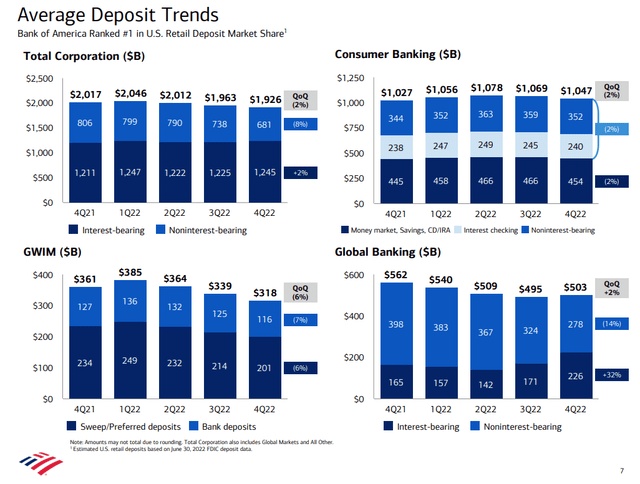

The deposits trajectory is shown in the below chart from the FY2022 earnings presentation:

On a year-on-year basis, average deposits are down ~5% to $1.93 Trillion.

In Q4 alone, however, noninterest-bearing deposits are down 8% reflecting an acceleration of deposits repricing. The mix shift is especially pronounced in the global banking business (“GB”) where corporate treasurers who manage $500 billion of deposits with BAC are quick to adjust to a higher rates environment. Whilst more and more affluent customers in wealth management (“GWIM”) also place funds into higher-yielding deposits available in the market.

On the positive side, 56% of the $1.05 trillion in Consumer deposits remain in low and/or no-interest checking accounts. And because of all that, the overall rate paid in this sub-segment remains low at only 6 basis points.

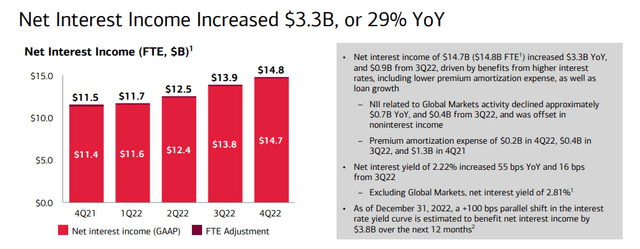

However, the trend with deposits is clear and the company is guiding in 2023 for additional deposit outflows and repricing of deposits. Clearly, this is very challenging to forecast accurately and it is a very dynamic environment. Naturally, the asset side of the balance sheet also goes up when rates go up and thus BAC delivered close to 30% year-on-year growth in Net Interest Income (“NII”) in Q4’2022 driven by NIM expansion as well as robust loan growth.

However, the 2023 guidance in the FY2022 earnings call was disappointing calling for a decline in Q1’2023 to $14.4 billion and stable thereof.

How Does The Above Impact BAC Valuation

The market is seeing deposits outflows and repricing higher as key risks. Also NII guidance for 2023 disappointed the market given the rates-related headwinds even when factoring in moderate loan growth.

Mr. Market is forward-looking and is also contemplating the ramifications of a potential upcoming recession that could manifest in higher unemployment, outsized credit losses as well lower rates (perhaps as early as 2H’2023) or 2024.

The combined impact is potentially negative for BAC on a number of fronts including heightened Credit losses, lower yields on assets, and lower loan growth. In such a scenario, the non-interest transactional deposits (which are currently elevated post-pandemic) may also begin to deplete rapidly. Putting it simply, BAC’s business model is subject to a number of downside scenarios depending on how the economy and rates environment develops.

These are the key reasons why BAC is trading at 1.2x tangible book value compared with a trading range of 1.5x to 2x in recent history.

Global Markets Division Is Destroying Capital

BAC has some leading banking franchises that are delivering exceptional returns.

The Consumer Banking (“CB”) division with an allocated capital of $40 billion is delivering ~30% RoTCE consistently. It is the crown jewel of BAC and is powered by its monstrous deposits franchise that is holding over $1 Trillion of low-cost sticky deposits.

Global Wealth & Investment Management (“GWIM) which comprises the strong brand of Merrill Wealth Management as well as the Bank of America Private Bank, is also delivering RoTCE in the high 20%s, on $17.5 billion of allocated capital, in spite of the 2022 bear market.

Global Banking (“GB”), which includes Global Corporate Banking, Global Commercial Banking, Business Banking, and Global Investment Banking is also delivering strong returns of 18% RoTCE in 2022, on ~$45 billion of allocated capital. This is a very resilient performance driven by commercial banking and mid-market clients’ activities.

The problem child remains the Global Markets (“GM”) division ($42.5 billion of allocated capital) which is destroying capital with a RoTCE of less than 10%. It did, like its peers suffered from a steep reduction in Investment Banking fees (~50% year-on-year reduction), but even with strong FICC trading tailwinds, it only managed to eke out RoTCE close to 10%. Mr. Market would value this division at very low multiples and well below its allocated capital of $42.5 billion given the inherent volatility of this business and normalizing for FICC trading review.

Final Thoughts

BAC is trading as a proxy for interest rates. The deeply inverted curve suggesting an upcoming recession and lower interest rates in the near term is perceived as a strong negative for BAC. Mr. Market is fearing NIM compression as rates decrease, deposits betas increase in the earnest near term, and potential losses from the manifestation of credit risks in the Cards and Commercial Real Estate portfolios. Continued deposit outflows are likely as customers flushed with liquidity post-pandemic are more likely to draw down on these savings in tougher times.

Having said that, I believe that the valuation at 1.2x tangible book value is already more than factoring in these risks. BAC is usually trading in the 1.5x to 2x. tangible book, so the current valuation is certainly discounted given its strong and diversified business model. BAC has delivered 15.8% RoTCE in 2022, so Mr. Market is certainly factoring in a substantial drop in earnings in the medium term.

I believe this is far too pessimistic given its diversified business model and a number of exceptionally strong returning businesses such as the CB and GWIM. There are also certain offsets that should come into play in 2023, for example, wealth management should perform better than under the conditions prevailing in the 2022 bear market, BAC also built substantial reserves in 2022 given the uncertain macro environment and Investment Banking fees should come back (at least partially so) in 2023 from a very depressed level in 2022.

Taking all of the above together, I rate BAC stock as a Buy and I may initiate a position in the next week or so.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in BAC over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.