Summary:

- AI-powered search is changing the business fundamentals for Alphabet.

- Shifted focus to profitability as revenue growth slows and cost of capital increases.

- Our DCF model signals limited upside from the current stock price level.

400tmax

The purpose of this article is to evaluate the value of Alphabet (NASDAQ:GOOG, NASDAQ:GOOGL) by estimating its future cash flows and determining a fair market value for the company.

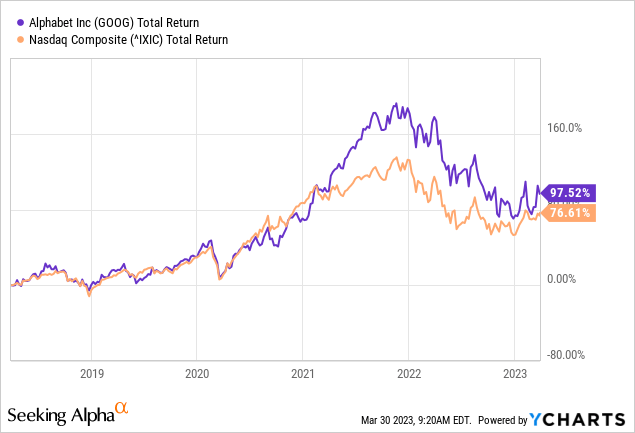

Currently, Alphabet’s stock is trading at $106.90, which represents a -21% decline over the past year. Several factors have contributed to this decline. Interest rate hikes, decreasing P/E multiples for tech companies, increased competition in Alphabet’s business segments, and most recently, Microsoft’s announcement of AI-powered search from Bing, which poses a potential risk to Alphabet’s core business.

While it is unclear who will emerge as the winner in the AI search business, we do know that the search business is undergoing significant changes. This leads us to the question of what Alphabet’s fair market value would be if its growth prospects were to slow down.

Key Drivers for Valuation

- Revenue growth – Maintain an outsized market share in the core business segment to drive revenue growth

- EBIT margin – Ability to funnel an increasing share of revenues into FCF

Historical Results – Base for projection

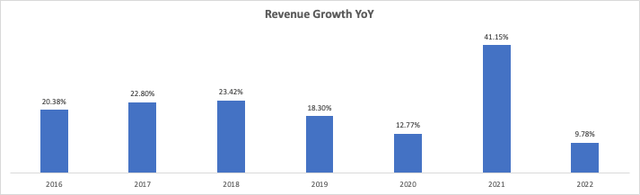

Looking at the historical revenue growth rates for Alphabet, we can see a clear trend of slowing growth since ’19. COVID-related restrictions gave Alphabet a temporary advantage in ’21, driving the stock price and revenue upwards. As COVID-related restrictions are no longer a factor, the business is again moving into a slower growth phase.

FORM 10-K: ’22, ’20, ’18, ’16

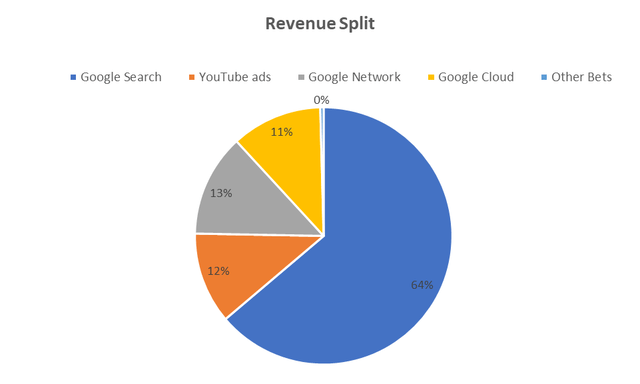

In ‘22, revenues increased by +9.8%, and +9.1% excluding non-recurring items. The growth was driven by its core business, Google Search, generating +$13.5 billion more than the previous year.

| Business Segment | 2021 | 2022 | Abs. | % |

| Google Search | 148,951 | 162,450 | 13,499 | 9.1% |

| YouTube ads | 28,845 | 29,243 | 398 | 1.4% |

| Google Other | 28,032 | 29,055 | 1,023 | 3.6% |

| Google Network | 31,701 | 32,780 | 1,079 | 3.4% |

| Google Cloud | 19,206 | 26,280 | 7,074 | 36.8% |

| Other Bets | 753 | 1,068 | 315 | 41.8% |

| Recurring Revenue | 257,488 | 280,876 | 23,388 | 9.1% |

Google Cloud is also experiencing substantial growth, but it is associated with higher costs. The other major business segments are growing more modestly.

FORM 10-K ’22

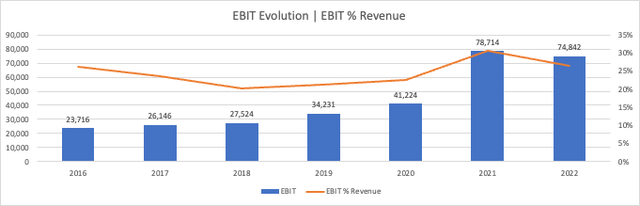

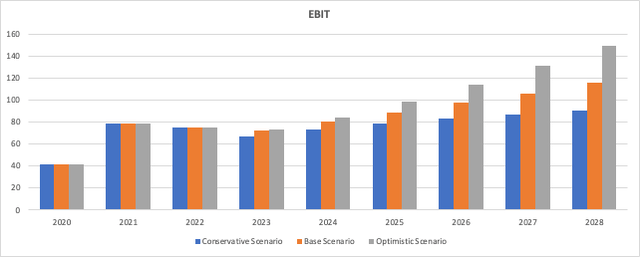

As revenue growth slows, investors will turn their attention to profitability to find support for Alphabet’s current valuation. Fortunately, Alphabet’s EBIT is in a clear upward trend.

FORM 10-K: ’22, ’20, ’18, ’16

DCF model

DCF Inputs

Company Guidance

The Q4 ’22 report included management comments that provided guidance on major items that will impact the ’23 result.

- Reduction of the workforce by approx. 12,000 roles. Severance packages & related charges of 1.9-2.3 billion

- Optimization of global office space. Immediate exit costs of 0.5 billion, potentially incurring more charges in H2 ’23

- Completion of assessment of the useful life of servers and network equipment, resulting in an extension of the useful life of the equipment by six years. This will result in a reduction of depreciation of 3.4 billion

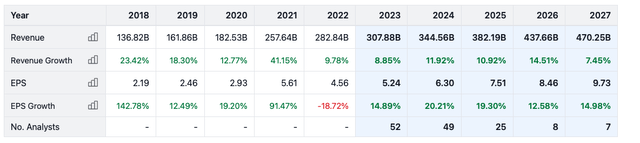

Analyst Guidance

The consensus among analysts covering Alphabet is that the growth rate will decline in ’23 and that there will be low double-digit growth over the next five years.

Revenue Consensus

This information and projections are taken into account when developing our scenarios for the DCF analysis.

DCF Scenarios

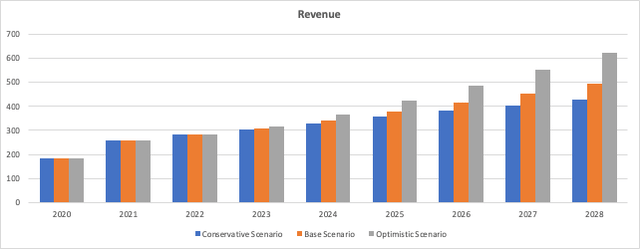

Three scenarios have been created to reflect potential future outcomes, all of which predict a slowdown in growth rate in ’23, followed by a recovery in ’24 after the restructuring, and a gradual decline in growth until ’31. Terminal growth rate (TGR) is indicated for each scenario after the 10-year period.

| Label | Conservative | Base | Optimistic |

| Revenue Growth – ’23 | 7.2% | 8.9% | 12% |

| Revenue Growth – ’24 | 8.8% | 11.0% | 16.0% |

| Revenue Growth – ’31 | 2.0% | 7.0% | 10.0% |

| EBIT Margin | 20.0% | 22.0% | 23.0% |

| WACC | 9.0% | 8.0% | 8.0% |

| TGR | 2.0% | 2.5% | 3.0% |

Revenue projection per scenario

Internal Estimates (FORM 10-K)

We are expecting the restructuring costs to bring down the EBIT initially and then trend in line with the revenue growth.

Internal Estimates (FORM 10-K)

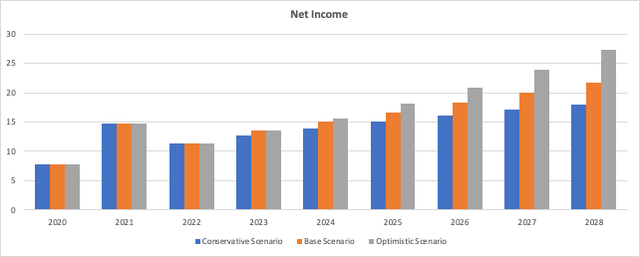

Alphabet’s tax rate has been stable year over year and we project a similar tax level in the future as the historical averages. The Conservative scenario has a tax rate of 19% whilst the most optimistic scenario is 18.5%, i.e., small differences between scenarios to calculate the net income.

Internal Estimates (FORM 10-K)

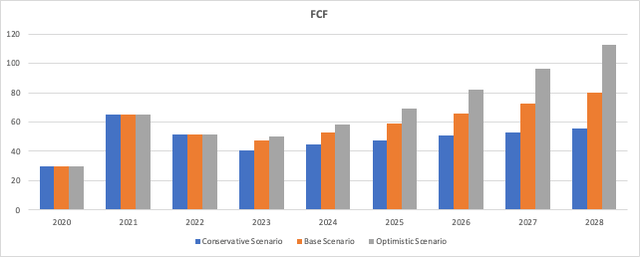

To calculate FCF, Net income needs to be adjusted for D&A, CAPEX, and changes in NWC. In Alphabet’s case, these ratios as a % of revenue have been stable and predictable in the past, and management has some flexibility to maintain them. Therefore, we have projected these items to remain in line with historical averages for the projected years.

Internal Estimates (FORM 10-K)

To determine the fair value of the enterprise, we discount the business’s future cash flow for each scenario, add the available cash balance sheet, and deduct the debt. Based on these scenarios, we have generated the following stock price targets:

| Label | Conservative | Base | Optimistic |

| Price Target | $63.5 | $112.7 | $157.2 |

The base case scenario suggests a modest 5.4% upside from the current stock price.

It’s all about growth

As we can observe in the three scenarios, it is all about the ability to accelerate the revenue growth rate for Alphabet. It is the catalyst that enables us to discount back higher expected FCT to support a more optimistic valuation. We are currently not seeing this acceleration.

Digital ad spending worldwide is projected to grow 10.5% in ’23 and 11% the year thereafter. Alphabet needs to showcase at least the same growth rate as the industry to support a higher valuation than our base scenario long-term.

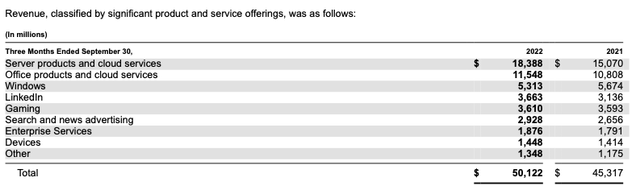

Microsoft coming quarterly reports will also help us to monitor the competitive pressure from the new Bing search engine. In the latest report, Microsoft showcased a growth rate of 10.2%. A continued slowdown in growth for Alphabet and vice versa for Microsoft will push Alphabet’s stock price closer to our conservative scenario.

FORM 10-Q ’22 – Microsoft

We will monitor this development closely and share our insights in upcoming articles.

Recommendation

Our target price for Alphabet is $112.7 per share and we recommend holding GOOG stock for now. However, investors who are worried about the impact of AI search on Alphabet’s competitiveness in the market may consider taking a position in the Nasdaq composite index instead. This approach allows investors to wait and see until we have more clarity about who emerges as the winner with the new AI search capabilities.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.