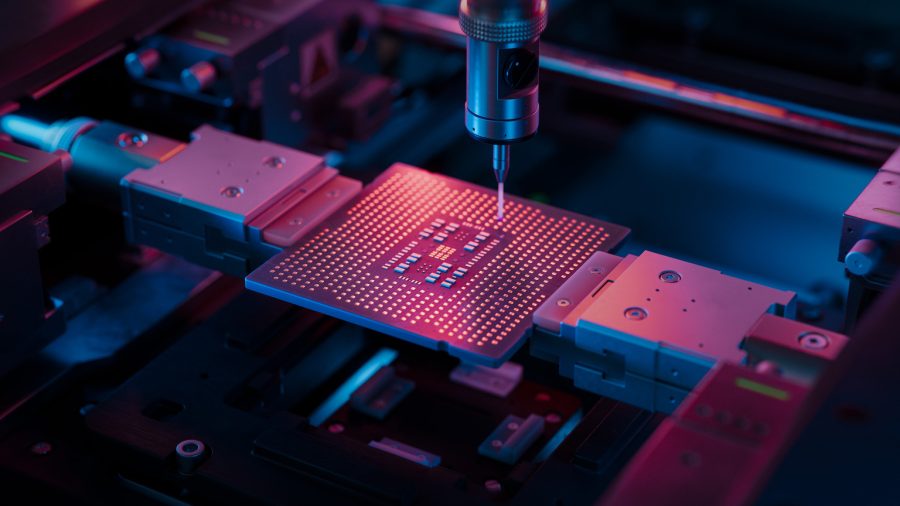

Shares of some U.S. semiconductor companies, including Intel (NASDAQ:INTC) and GlobalFoundries (NASDAQ:GFS), gained ground on Friday following reports the Trump Administration is planning a new policy that would require companies to manufacture the same number of chips in the U.S. as their customers import from overseas producers.

This rule would create a 1:1 domestic-to-imported chips ratio.

Intel was up 4.3% during pre-market trading and GlobalFoundries had jumped 7.6%. Intel, Micron Technology (MU), GlobalFoundries (NASDAQ:GFS), TSMC (TSM) and Samsung Electronics (OTCPK:SSNLF) are all building multibillion-dollar U.S. facilities. Micron edged up 1%.

Under the proposed system, if a company commits to producing one million chips in the U.S., its customers can continue importing that quantity without tariffs until the factory is operational.

Dear readers: We recognize that politics often intersects with the financial news of the day, so we invite you to click here to join the separate political discussion.