Summary:

- This is a technical analysis article. Nvidia has our proprietary Buy Signal, but it is overvalued and overbought, riding the AI emotional wave.

- We have two Timing signals that tell us when to buy on weakness. We will wait for these signals to be triggered.

- The end of the best six months in the market as well as the seasonal “go away in May” encourage us to wait for a market pullback.

- Also, the Fed is going to keep interest rates high and you can see the cracks developing in the economy, banking, commercial real estate and housing.

- The last lagging indicator to turn south will be the jobs data. We believe the market, as a leading indicator, will head back down before the jobs data weakens.

Shutthiphong Chandaeng

Artificial Intelligence emotion is spiking technology stocks higher and helping Nvidia Corporation (NASDAQ:NVDA) become more overvalued and overbought. It has our proprietary Buy Signal, but we like to buy on weakness, during a pullback in the market or the stock price.

We have two Timing signals that will be triggered when that happens. We like stocks that have both our Buy Signal and a pullback in price. We currently have about 40 stocks in the Index that have our proprietary Stocks In Demand, SID Buy Signal which uses both fundamentals and technicals. (We will be happy to send you that list.)

We like to use Seeking Alpha’s Quant system to do our due diligence on stocks picked by our SID computer system. We want to confirm what we are seeing on the technical analysis chart shown below. Seeking Alpha gives NVDA high grades except for Valuation, and if you hit that tab on the screen, up pops all the negative metrics for Valuation. We don’t mind overvalued stocks as long as the Growth is good. SA gives high grades for Growth, Profitability, Momentum and Revisions.

We just don’t like to buy stocks that are both overvalued and overbought. The technical analysis overbought factor is eliminated when price pulls back. We expect a market pullback is coming with the end of the best six months in the stock market and the seasonal trend of buyers “going away in May” to the Hamptons or some other vacation attractions. We expect the Fed’s continued high interest rates for the rest of the year will hurt technology stocks and help defensive stocks.

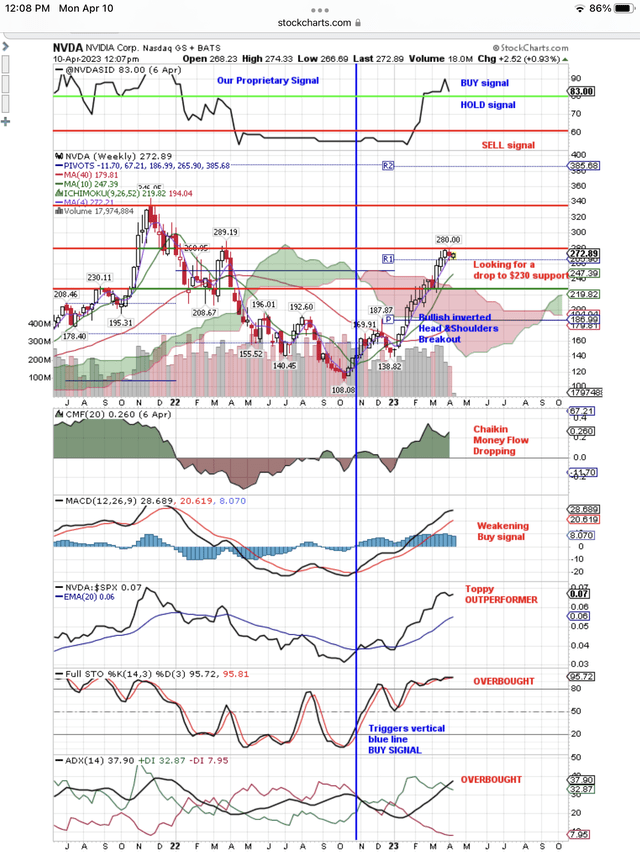

Here is our weekly, NVDA chart that shows our proprietary Buy Signal at the top of the chart. This signal uses both fundamentals and technicals. The other signals on the chart are purely technical.

Buy Signals early signs of weakening (StockCharts.com)

As you can see on the above chart NVDA has had a fantastic run-up in price from $108 to $280, but now it is hitting resistance, as the market is looking for a pullback. NVDA could still reach for $340 in April and May, but it is long overdue for a pullback to test support.

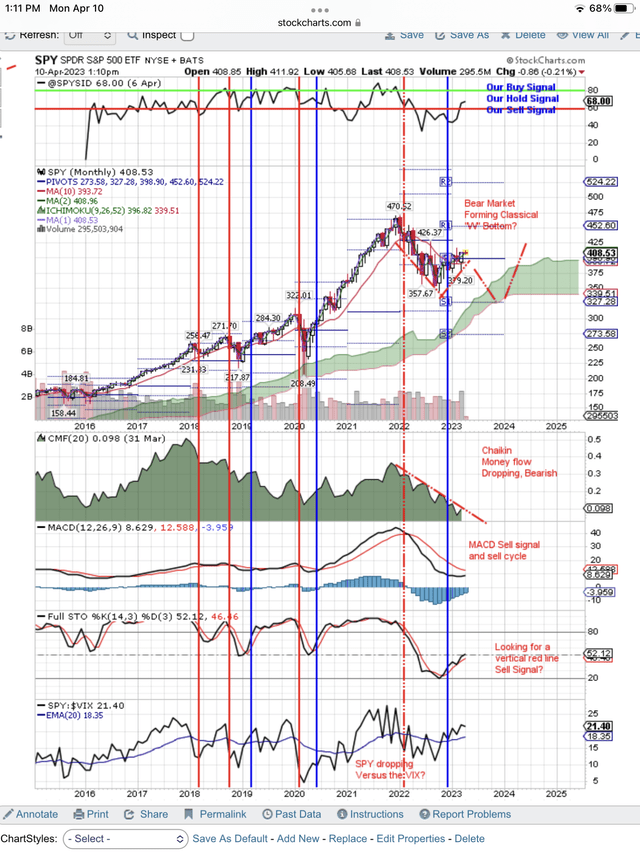

Here is our monthly market (SPY) chart where we outline our thesis for a pullback and a retest of the bottom because of high interest rates and a slowing economy in 2023.

SPY at peak of “W” bottom (StockCharts.com)

Because of the Fed and the cracks in the economy caused by high interest rates for 2023, we expect the market to bottom between now and October, forming the classical double bottom we have outlined in red on the prices shown on the chart above.

The signals are still positive including the blue vertical, buy signal line. However notice the big drop in Chaikin Money Flow. We think the buyers are almost exhausted except for safe harbor stocks like Apple (AAPL), Microsoft (MSFT) and Alphabet (GOOGL) and winners like NVDA. But the market will take even these lower when it drops. A bear market takes all stocks down, just like a low tide takes all boats down.

It is possible that the market could keep moving higher, but we don’t think that is probable with the analysts downgrading earnings, the economy tanking, the banking crisis and companies announcing big layoffs. We think the market and technology stocks, in particular, will go down with these high interest rates to retest the bottom. Even Nvidia Corporation will be hit. The pros always buy on weakness.

Analyst’s Disclosure: I/we have a beneficial short position in the shares of SPY either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Disclaimer: We are not investment advisers and we never recommend stocks or securities. Nothing on this website, in our reports and emails or in our meetings is a recommendation to buy or sell any security. Options are especially risky and most options expire worthless. You need to do your own due diligence and consult with a professional financial advisor before acting on any information provided on this website or at our meetings. Our meetings and website are for educational purposes only. Any content sent to you is sent out as any newspaper or newsletter, is for educational purposes and never should be taken as a recommendation to buy or sell any security. The use of terms buy, sell or hold are not recommendations to buy sell or hold any security. They are used here strictly for educational purposes. Analysts price targets are educated guesses and can be wrong. Computer systems like ours, using analyst targets therefore can be wrong. Chart buy and sell signals can be wrong and are used by our system which can then be wrong. Therefore you must always do your own due diligence before buying or selling any stock discussed here. Past results may never be repeated again and are no indication of how well our SID score Buy signal will do in the future. We assume no liability for erroneous data or opinions you hear at our meetings and see on this website or its emails and reports. You use this website and our meetings at your own risk.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Use our free, 30 day training program to become a successful trader or investor. Join us on Zoom to discuss your questions.