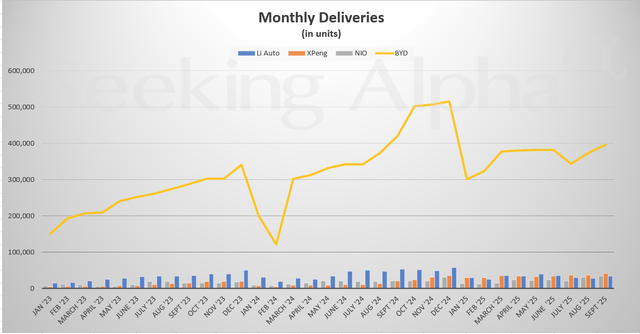

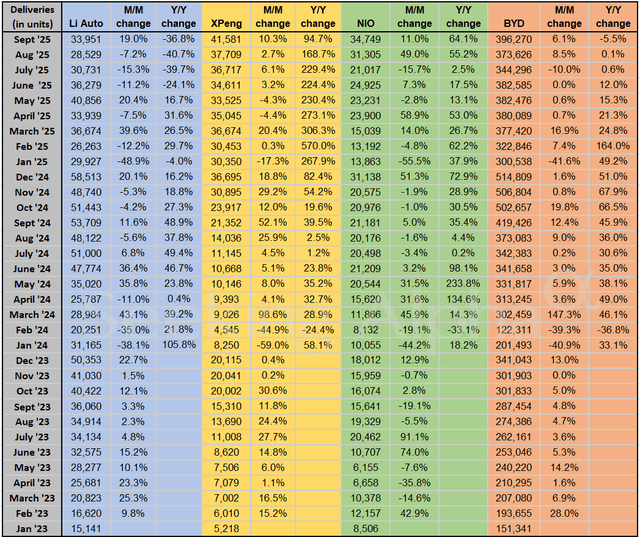

China’s EV market showed fresh signs of momentum in September 2025, with NIO and XPeng delivering their strongest monthly results to date. Li Auto staged a rebound from August’s weakness, while BYD maintained its lead in absolute volumes, though Y/Y growth softened.

China’s EV market showed fresh signs of momentum in September 2025, with NIO and XPeng delivering their strongest monthly results to date. Li Auto staged a rebound from August’s weakness, while BYD maintained its lead in absolute volumes, though Y/Y growth softened.

Overall, September marked a turning point where emerging players gained significant traction, signaling intensifying rivalry in the world’s largest EV market.

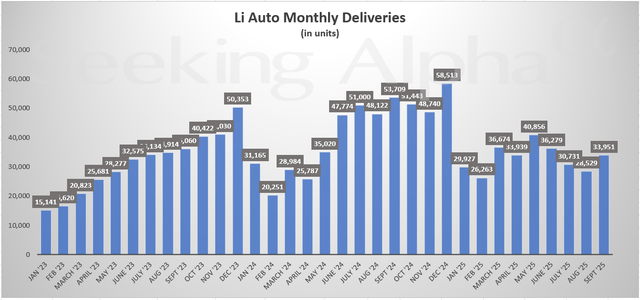

Li Auto (NASDAQ:LI)

- September Deliveries: 33,951

- M/M Change: +19.0%

- Y/Y Change: -36.8%

Li Auto saw a sharp rebound in September, with deliveries rising 19% from August’s slump. Still, volumes remain under pressure compared to last year, plunging nearly 37% Y/Y. The recovery signals near-term stabilization, but the broader downtrend shows demand headwinds are far from resolved.

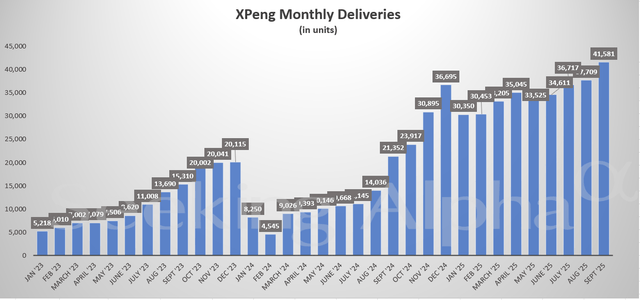

XPeng (NYSE:XPEV)

- September Deliveries: 41,581

- M/M Change: +10.3%

- Y/Y Change: +94.7%

XPeng extended its strong momentum with 41.6K units in September, a 10% sequential rise and nearly doubling Y/Y. While growth slowed slightly from earlier triple-digit surges, XPeng remains the standout among startups, consolidating market share with consistent gains across 2025.

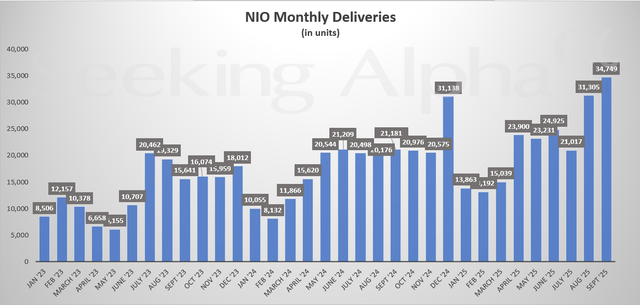

NIO (NYSE:NIO)

- September Deliveries: 34,749

- M/M Change: +11.0%

- Y/Y Change: +64.1%

NIO continued its recovery path, posting 34.7K deliveries, up 11% M/M. The 64% Y/Y surge underscores its turnaround momentum after a volatile first half of the year. Sustained double-digit sequential growth suggests its latest models are resonating strongly with buyers.

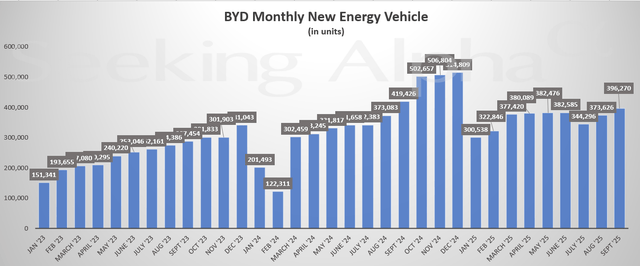

BYD (NYSE:BYD)

- September Deliveries: 396,270

- M/M Change: +6.1%

- Y/Y Change: -5.5%

BYD remained the undisputed volume leader with nearly 400K units, though the 6% monthly uptick couldn’t offset a rare 6% Y/Y decline. With a high base effect and intensifying competition, BYD’s growth engine shows signs of cooling despite its dominant scale.