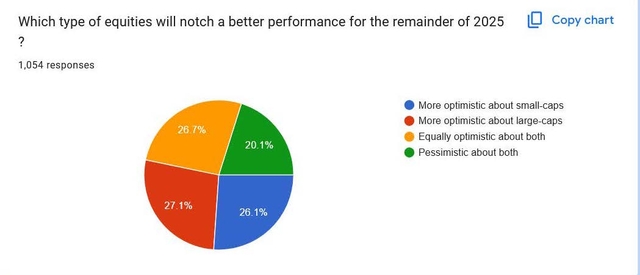

We recently asked Seeking Alpha readers whether they thought large cap stocks would outperform small caps during the remainder of the year, or vice versa.

Out of the 1,054 readers who responded to the survey, 27.1% said they thought large caps would be the winners, 26.1% picked small caps, 26.7% were optimistic about small and large caps, while 20.1% said they were pessimistic about both.

SA readers poll on Q4 equities performance expectations (Seeking Alpha)

We asked Seeking Alpha analysts Rick Orford, Agar Capital and Daniel Jones which stocks they thought would perform better in the year’s last quarter.

Rick Orford: I see the markets as being the most valued they’ve ever been – all this while economic and geopolitical issues are at their highest in generations. One only needs to look at Europe to see a place that was once unquestionably protected by its NATO peers now questioning whether that security will actually be provided if needed. Add to that looming interest rate cuts from the Fed on the back of weak employment and inflation data, and now we suddenly have reason to pause.

One might argue that lower rates will help small cap stocks. Possibly. But right now, I see far more risks than rewards.

For me, I’m holding. I’m bullish on the megacap companies with a long history of weathering storms and increasing their bottom line. Companies like Amazon (NASDAQ:AMZN), Microsoft (NASDAQ:MSFT), and Alphabet (NASDAQ:GOOGL) should continue to perform well regardless of what might happen. The defensive stocks should also do well, like Procter & Gamble (NYSE:PG), Coca-Cola (NYSE:KO), and even names like Clorox (NYSE:CLX). Companies like these offer investors a good mix of what both the consumers and the government need.

Agar Capital: I remain constructive on large caps, but careful selection and choosing quality stocks is essential. The way I see it is that the Federal Reserve’s rate reductions will have a ripple effect on the stock market, and consequently the shares from industrial and materials sectors, including technology, will also “join the party.”

There are a lot of analysts drawing parallels to the 2000 dot-com bubble, but the growth of the stock market was quite different back then, as it was largely supported by debt and “creative finance”; companies were borrowing and using vendor financing to boost sales and inflate multiples. Today, the money circulating is real and put on the table by companies that are grinding out huge profits and by governments that are investing for strategic reasons. Valuations are high, but I wouldn’t call it an AI bubble. Nevertheless, fuel is running out, and new catalysts are needed to push prices even higher, such as the quarterly reports that will start coming out in mid-October.

Although I am not a fan of small caps, I am positive about this historic market phase. After the Fed’s pivot, the Russell 2000 broke through its highs, even though investor positioning remains cautious. The Fed’s rate cuts are very helpful to small caps, because they have a lot of short-term debt (average maturity 3 to 4 years) and each 25 bps rate cut translates into earnings relief of about 2 points.

If the only focus was on companies with profits, stocks of small cap companies would be evaluated at their lower valuations by nearly 30% compared to large cap stocks, and this gap is significant since it provides the possibility of a return. Profit estimates are getting better, and the sentiment towards this area is not yet very positive, so there is potential for the move to go further. My advice would be to stay away from microcaps, as they are highly speculative.

Daniel Jones: I fully expect the gains that we have seen in recent months to not continue through the rest of this year. There was some optimism after it became clear that the Federal Reserve had finally started cutting interest rates again. In the long run, that will prove to be bullish. But in the short run, I expect the market to be guided more by legitimate economic uncertainties.

The primary issue here is tariffs and the harmful impact they have had on the economic climate. Jobs data has been awful. Consumer confidence is near all-time lows. And a slew of other data suggests that we are heading toward a recession. And likely, it won’t be just any recession. It will be one defined by stagflation.

I’m not sure if we will hit a recession this year. But since we are moving in that direction, I expect the market to start incorporating that data more and more. At best, this should mean that markets remain more or less flat. But there is a real chance that we could see a decline as we head into the new year. A low tide affects all boats, so I fully anticipate that large cap stocks and small cap stocks will experience pain.

If I am correct about the direction things are heading, I expect large cap stocks to outperform small cap stocks. Over the long run, the opposite should be true. But there are two reasons for this mindset that I have. First and foremost, larger companies have a tendency, on average, to be more financially stable than smaller firms. They likely have less leverage and more levers at their disposal to deal with tough times. I view them as sort of a safe haven compared to smaller cap stocks.

Of course, once things bottom out, small cap stocks are where the real opportunities lie. That needs to be taken into consideration, but I digress.

The second reason for my way of thinking here, however, is that there are certain trends that are playing in favor of larger companies. Specifically, I’m talking about investments in AI and data centers. I don’t expect, for instance, for firms like Facebook parent Meta Platforms (NASDAQ:META) and Google parent Alphabet (NASDAQ:GOOG) (NASDAQ:GOOGL) to be fundamentally impacted to a severe extent. There might be some weakness, such as around advertising spending. But beyond that, not much.

Amazon (NASDAQ:AMZN), which is another big player in this market, could see some pain on its ecommerce side. But with a lot of its value today driven by AWS and shares of the company not looking particularly expensive, it should help buoy the performance of large cap stocks as a group.