Summary:

- OPEC days ago announced new output cuts.

- The announcement has driven up prices for crude oil, but Exxon Mobil also said yesterday that profits dropped QoQ.

- However, the OPEC deal is unlikely to have a lasting effect.

Bruce Bennett

Production cuts announced by the Organization of the Petroleum Exporting Countries have resulted in oil stocks popping this week. The valuation of Exxon Mobil Corporation (NYSE:XOM) also profited from the supply cut. In a weakening economy, I believe a return to 2022-like profitability is unattainable.

Exxon Mobil also warned of lower profits in their recent securities filing, implying that profits will be lower for the third quarter in a row.

The bank crisis added another layer of uncertainty, and I expect Exxon Mobil’s profit situation to deteriorate significantly in 2023.

OPEC Is Striking Back

The ongoing decline in crude oil prices prompted the Organization of Petroleum Exporting Countries (OPEC) to make an unexpected announcement on Sunday.

The organization stated in the announcement that it will reduce supply in an effort to support oil prices. The members of OPEC and Russia agreed to decrease cumulative production volume by 1.15 million barrels per day, which the market was not expecting.

Saudi Arabia is said to absorb the largest drop in production by reducing output by 500K barrels per day, with the output cuts, which come on top of an already agreed-upon 2 million barrels of oil per day supply cut, set to take effect in May 2023. The price of West Texas Intermediate crude rose 6% as a result of the news, helping the stock price of oil companies such as Exxon Mobil.

While the OPEC announcement is good news for oil companies in the short term, earnings in the sector are still expected to fall dramatically in 2023.

Exxon Mobil had a fantastic year in 2022, setting new records for both the company and the entire Western oil industry. Exxon Mobil earned $56 billion in profits in 2022, the most of any Western oil company ever. However, there are several indications that Exxon Mobil will not be able to replicate its extraordinary success of 2022 this year.

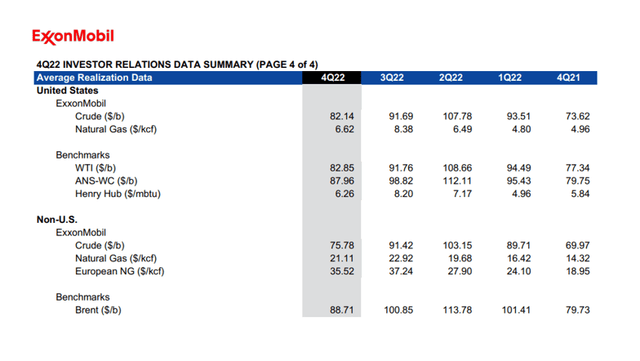

The most important factor is that crude oil prices have fallen significantly in the last year, resulting in lower realized world crude oil prices. The decline in crude oil prices began shortly after Russia’s invasion of Ukraine, and WTI prices have steadily declined over the last year, as have Exxon Mobil’s realized global world crude oil prices. Exxon Mobil’s realized market price in the United States fell 24% in the last two quarters, while it fell 27% internationally.

Crude Oil Prices (Exxon Mobil)

Furthermore, Exxon Mobil stated in a filing that it expects 1Q-23 earnings to be down at least $1 billion from the previous quarter, owing primarily to lower liquids and gas prices. In other words, Exxon Mobil is on track for its third consecutive quarter of falling price realizations, both domestically and globally.

How Is OPEC’s Decision Going To Affect Exxon Mobil?

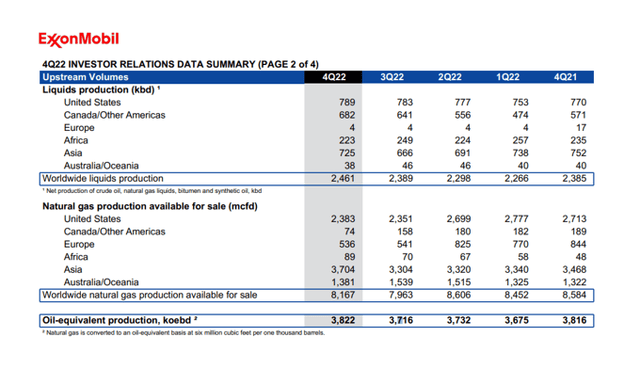

The decision by OPEC to reduce output is likely to have little, if any, impact on Exxon Mobil. Despite the outbreak of a major war in Ukraine, the company’s production volumes have remained stable in the last year.

Exxon Mobil’s liquids and natural gas production has either flatlined or increased in the last four quarters, so I don’t expect a significant increase in production from Exxon Mobil.

Exxon Mobil may see higher price realizations in the short term as a result of OPEC’s decision to cut prices. In the long run, however, I believe the general gist of this article is correct and that energy prices will fall.

4Q22 Investor Relations Data Summary (Exxon Mobil)

Factors That Could Drive Exxon Mobil To Perform Better

If OPEC is successful in raising crude oil prices, Exxon Mobil will benefit from higher price realizations in the short term, which will boost the company’s profits.

If the United States’ economy avoids a recession, Exxon Mobil’s profit situation will most likely improve. Avoiding a U.S. recession would almost certainly result in a rebound in energy demand (crude and natural gas), which could help Exxon Mobil achieve a higher market valuation based on its profit potential. However, this is true for all energy companies that deal with crude oil products.

I believe the chances of higher crude oil prices for a longer period of time are slim at best, as economic growth in advanced economies is slowing, according to an IMF report. This has a negative impact on crude oil price realizations and energy demand, two of the most important factors determining Exxon Mobil’s profitability.

Profit Estimates Are Falling And Exxon Mobil’s P/E-Ratio Is Set To Correct

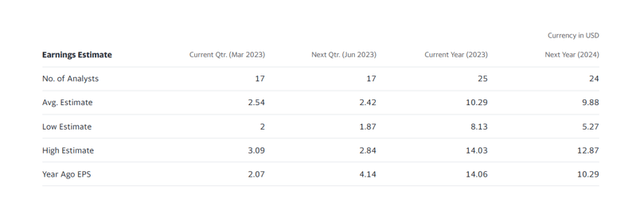

The market expects this downward trend in price realizations to continue in 2023 and 2024. Profit estimates have dropped significantly, and the market expects profits to fall year after year.

Exxon Mobil is expected to earn $9.88 per share in 2024, translating into an earnings multiple of 11.6x at the current stock price of $115.02. Because profit estimates are still likely to be cyclically inflated, I do not believe Exxon Mobil’s profit multiple is a compelling reason to buy the stock.

In fact, I believe that XOM will continue to face downward valuation pressure in the coming months as investors digest the fact that the company’s profits most likely peaked in 2Q-22.

Earnings Estimate (Yahoo Finance)

Investment Risks with Exxon Mobil

Strong job growth, lower inflation, and a global economic recovery are three distinct factors that could lead to increased demand for energy, higher crude oil prices, and a higher valuation multiple for Exxon Mobil.

However, investors should be aware that energy prices have been steadily declining over the last fifteen months.

Furthermore, the U.S. bank crisis has created new uncertainty for investors.

My Conclusion

On Sunday, the Organization of Petroleum Exporting Countries responded to falling crude oil prices by announcing that it will reduce output by more than 1 million barrels per day, causing market prices for WTI and Brent crude to rise.

However, I believe that the energy market is facing significant headwinds, making it unlikely that Exxon Mobil will return to a 2022-like profitability level, especially if the bank crisis worsens or the U.S. economy enters a recession in 2023. The OPEC announcement may temporarily boost crude oil prices.

I believe Exxon Mobil’s cyclical profit peaked last year, and the company’s recent filing shows that it expects lower profits in 1Q-23 as well.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.