Summary:

- Revenue should benefit from price increases, good demand, digital expansion, and new restaurant developments.

- Margin should benefit from sales leverage and price increases, however, inflationary pressure on company-owned restaurant margins and costs to support franchise expansion should be a headwind.

- Valuation is in line with historical averages.

jetcityimage/iStock Editorial via Getty Images

Investment Thesis

McDonald’s Corporation (NYSE:MCD) is expected to see revenue growth as a result of price increases and the resilience of consumer demand for takeaways and quick-service restaurants even during a recessionary environment, as people prefer less expensive and more convenient dining options. Additionally, MCD’s digital expansion, core menu advertising, and acceleration of new restaurant development should attract further demand and contribute to revenue growth in the coming years.

On the margin front, MCD’s franchise business model is relatively resilient. However, inflationary pressure on company-owned restaurant margins and incremental costs associated with supporting franchise growth may put pressure on margins. This pressure should be offset by sales leverage and pricing increases, resulting in flattish margin performance.

While the company’s revenue growth prospects are good, the stock is trading in line with its historical averages and at a premium to its peers, which makes me want to stay on the sidelines. Therefore, I would rate the stock as neutral for now.

Revenue Analysis and Outlook

McDonald’s sales growth recovered quickly post-pandemic due to an increase in off-premise business, especially through delivery and drive-thru orders. As COVID-related restrictions eased, pent-up demand for dine-in, along with off-premise momentum, helped MCD’s sales growth.

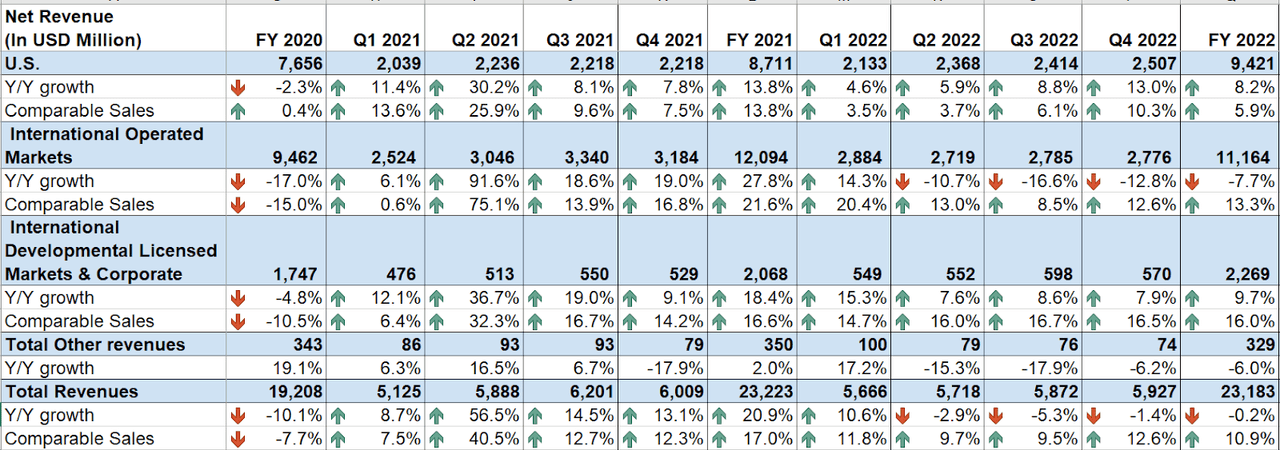

In the fourth quarter of 2022, the growth momentum from off-premise and good demand continued across all geographies. In addition, price increases and a positive guest count also benefited the company’s sales growth. However, foreign exchange (FX) headwinds more than offset these tailwinds. This resulted in a 1.4% year-over-year (Y/Y) decline in reported sales to $5.927 billion, while on a constant currency basis, sales increased by 5% Y/Y. On a same-store-sales basis, global comparable sales increased by 12.6% Y/Y, reflecting double-digit comparable sales growth across all operating segments.

MCD’s Historical Revenue (Company Data, GS Analytics Research)

Looking ahead, I believe McDonald’s will continue to deliver same-store sales growth in the coming years. The company’s revenue should benefit from price increases, the resiliency of consumer demand for quick-service restaurants, digital expansion, a focus on core items, and new unit growth.

To protect itself from inflationary costs, McDonald’s has increased menu prices globally over the last year, as have other players in the industry. This has helped the company increase average guest checks and support sales growth. The carryover impact from last year’s price increases, along with further price increases, should help the company deliver sales growth moving forward.

I also expect demand for quick-service restaurants to remain somewhat resilient in a recessionary environment as consumers become value-conscious and look for affordable and convenient dine-in options. Additionally, the company is continually investing in its digital platforms to increase consumer engagement, primarily through its McDonald’s app. The focus of this expansion is on the loyalty program, which provides various offers and loyalty points that can be redeemed in future transactions. This program enhances the consumer experience by enabling more customization in offering products, items, and discounts based on individual customer preferences, which should increase visit frequency. Furthermore, these digital investments help the company better access consumer insights and leverage data to drive the top line. According to management, the loyalty program is available through the McDonald’s app in over 50 markets, with more than 50 million active loyalty consumers in its top six markets, who comprised 35% of system-wide sales in those markets. The company aims to further expand the program and attract more loyalty members in other markets.

Moreover, McDonald’s is focused on advertising its core menu items, such as the Big Mac, Chicken McNuggets, or McChicken Sandwich. Consumers are more attracted to familiar items they know will provide value during an inflationary environment and advertising them is a good way to offset some impact of a macroeconomic slowdown.

I expect this digital expansion and core menu advertising to help the company increase demand even if there is a potential recession in 2023.

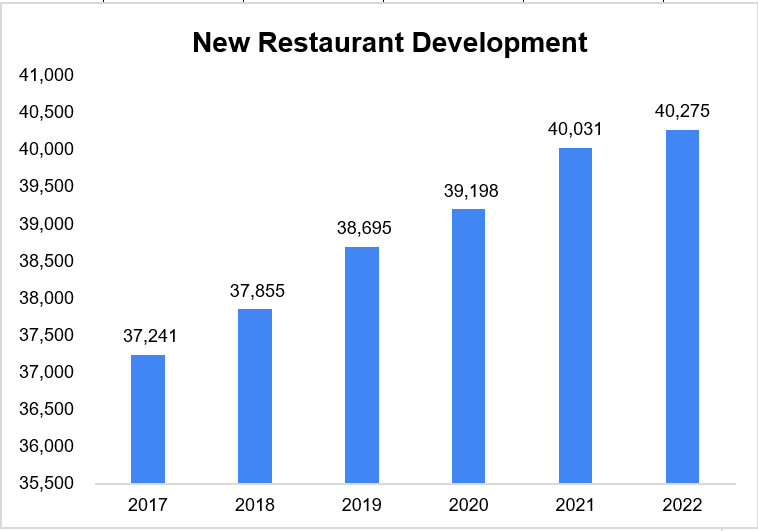

Finally, new restaurant development has also helped the company increase its global footprint and boost top-line growth. Since 2017, McDonald’s has increased its restaurant units by about 8% to 40,275. The company is accelerating new restaurant development for 2023 and is planning to open about 1,900 gross restaurants in the current year (~1,500 net openings due to anticipated restaurant closings). Of these openings, more than 400 will be in the U.S. and IOM segments, and the remaining 1,500 will be in the IDL segment, including about 900 in China.

MCD’s Historical Restaurant Unit Development (Company Data, GS Analytics Research)

Additionally, with the reopening of the Chinese economy, it is expected to be a significant growth driver for the IDL segment along with the new restaurant openings. Management anticipates that the new openings in 2023 and the restaurants opened in 2022 should contribute approximately 1.5% to system-wide sales growth in the current year. In the medium to longer term, new restaurant development is likely to continue supporting MCD’s sales growth. Thus, I am optimistic about the company’s sales growth prospects in the coming years.

Margin Analysis and Outlook

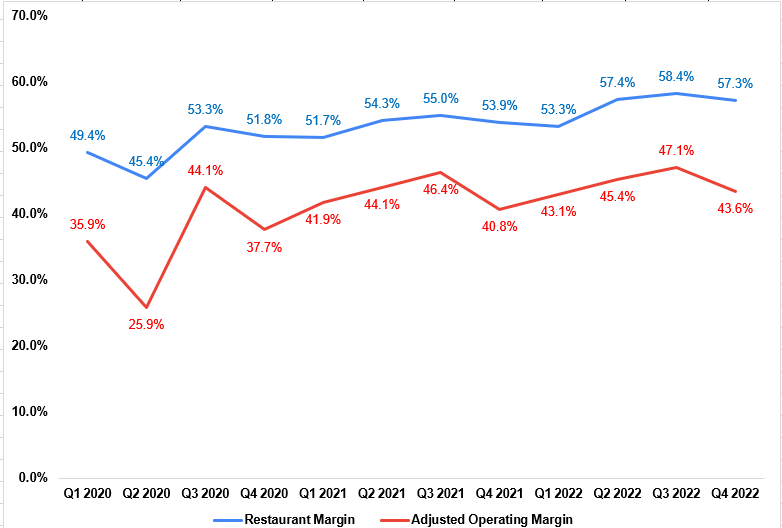

In an inflationary environment over the past couple of years, MCD’s franchise business model along with price increases, helped it sustain its margins. During the fourth quarter of 2022, despite inflationary pressures, the company was able to increase its adjusted operating margin Y/Y due to sales leverage and price increases. As a result, the adjusted operating margin increased by 280 bps Y/Y to 43.6%.

MCD’s Historical Restaurant Margin and Adjusted Operating Margin (Company Data, GS Analytics Research)

Looking ahead, I believe that MCD will be able to maintain its margins thanks to its highly efficient franchise model. In 2022, the franchise contributed approximately 90% of the operating income, with the remainder generated from company-owned margins. Volume leverage through sales growth and price increases should also benefit margins as the year progresses. However, these gains will be partially offset by inflationary pressure from commodities and labor wages on company-owned margins. Additionally, the company is expected to incur an additional $100-$150 million in costs in 2023 to support franchise development in the current inflationary environment. This should also somewhat impact margin growth. Overall, I expect the company’s adjusted operating margin to remain flattish around the mid-40s level in 2023. Beyond 2023, we may see some margin expansion as the inflationary headwinds ease.

Valuation and Conclusion

MCD is currently trading at a forward P/E multiple of 26.87x FY23 consensus EPS estimate of $10.59, which is consistent with its historical 5-year average of 26.44x. Furthermore, when compared to its peers, the company is trading at a premium based on forward EV/EBITDA and forward P/E ratios.

|

Peers |

FY23 FWD EV/EBITDA |

FY23 FWD P/E |

FY23 P/S |

FY23 EPS growth |

FY23 sales growth |

|

The Wendy’s Company (WEN) |

15.28x |

22.40x |

2.10x |

13.89% |

5.56% |

|

Restaurant Brands Inc (QSR) |

14.49x |

22.06x |

3.02x |

-3.33% |

5.63% |

|

Yum! Brands Inc (YUM) |

19.20x |

25.50x |

5.07x |

14.42% |

6.34% |

|

McDonald’s Corporation (MCD) |

18.48x |

26.87x |

8.54x |

4.80% |

5.16% |

Although I like MCD’s growth prospects, its resiliency even in a recessionary environment, and its market-leading position, these positives seem to be already factored into its current valuation. I would prefer to wait for a more attractive entry point for this QSR giant and I’ll rate MCD as neutral for the time being.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This article is written by Saloni V.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.