Summary:

- Stock-based compensation at Amazon materially increased in 2022. This, coupled with deteriorating fundamentals resulted in investors voicing concerns about the sustainability of stock awards.

- My aim with the current article is to demystify SBC at the company by quantifying possible future shareholder dilution resulting from already issued and planned to be issued stock awards.

- In addition, I discuss the efforts of management in efficiently managing shareholder dilution.

- Based on my deep-dive analysis I believe SBC shouldn’t be a reason why investors would miss out on an otherwise great investment opportunity.

Tas3/iStock via Getty Images

Introduction and Investment thesis

The faith of Amazon (NASDAQ:AMZN) has been shaped by several external and internal factors in the preceding years sending shares on a roller coaster that seems to be never-ending. As I see things currently, there is a consensus view among analysts that margins will improve in the upcoming quarters/years, which should help the share price recover. I’ve also done my share on this topic, and I agree with this thesis (Amazon: My ‘Margin-Call’; The Amazon Yin-Yang). Looking at large investment houses like Goldman Sachs or Morgan Stanley everyone has Amazon on its Top Picks list.

In the wake of bullish analyst calls some buying power seemed to emerge in the $80-100 trading range this year, which could be a good sign for a possible turnaround. However, I believe that after a series of mixed quarterly results Amazon became a show-me story. Investors don’t settle for promises anymore the company has to deliver on several fronts.

First and foremost, the frequently voiced turnaround in margins should become visible in Q1 earnings. I believe this should serve as the number one catalyst. Based on my previous analysis on the company I believe there is a good chance for this.

Second, management should confirm that growth slowdown in AWS is close to a bottom after reaching mid-teens yoy growth in January. Based on rather encouraging management commentaries from SaaS companies I used to cover on SA, I believe there is a realistic chance for this as well.

Other important drivers include the continuation of strong growth in advertising sales or how the general macro slowdown will impact the retail business. For all these questions we’ll get answers on the day of the highly expected earnings release, on 27th of April.

My personal opinion is that it’s better from a risk/reward perspective to buy the rumors, because in the case of a possible “inflection” in earnings/margins valuation could reset suddenly to a greater extent. Furthermore, I believe downside risk at these valuation levels is more limited and expectations going into Q1 earnings are not that high.

Until we are biting our nails waiting for Q1 earnings I brought a special topic to Readers, which is stock-based compensation (SBC) at the company and the way Amazon manages the resulting shareholder dilution. Recent rumors that the company plans to increase cash benefits at the expense of stock awards brought renewed focus on the topic leaving several questions hanging in the air. In the following I’ll provide a summary on how Amazon uses SBC as a tool for compensation and how this effects investors and company fundamentals at the end.

My goal is to show that SBC at Amazon is not utilized to such an extent that should deter investors from investing in the shares of an otherwise transformative company trading at a reasonable valuation.

SBC at Amazon in general

Amazon utilizes SBC in the form of awarding restricted stock units (RSUs) to its employees. One RSU usually represents one share of the company, which will be “unlocked” by the recipient after working a pre-specified time for the company starting from the grant date. This period is the so-called vesting period, which usually lasts 4 years (like in the case of Amazon) and is broken down into smaller time frames.

RSUs provide a more predictable income stream than stock options as the employee receives the shares of the company regardless of the actual share price. Furthermore, RSUs do not require a cash outlay. RSUs are not only more predictable for employees and the company, but also for analysts. Among others these were those features, which made RSUs more popular among tech companies in recent years, especially after the Covid induced stock market meltdown, which frightened the holders of stock options to a great extent.

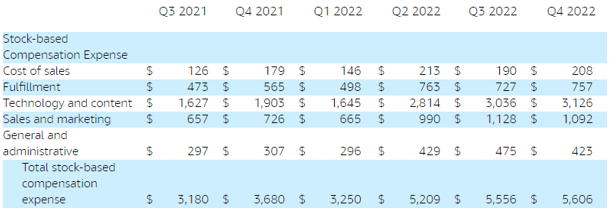

Amazon records SBC expense as part of its normal operating expenses. Although many tech companies provide non-GAAP earnings figures, which strip out SBC expense, Amazon doesn’t do it this way. So, if investors look at operating margins in the earnings release these include the effect of SBC expense as well. Most of SBC is related to the AWS unit that can be seen in the following breakdown:

Amazon Q4 2022 earnings release

Technology and content make up more than 50% of total SBC expense, which category overwhelmingly represents the AWS unit.

As SBC is not a cash expense the effect of it is mitigated in the cash flow calculation just like depreciation and amortization expense. So, if one looks at the cash flow margins of the company these don’t include the effect of SBC. I believe the best way to include both the cash generation ability of a company and the dilution resulting from SBC into a valuation framework is to look at FCF on a per share basis.

In the case of most smaller tech companies, it’s not an easy process to collect all the data related to SBC, but in the case of Amazon it is a more straightforward process. The company includes detailed data on SBC in its earnings release and earnings presentation, which transparency in itself indicates that they keep an eye on this topic.

Before going into the details, I want to highlight, that share count data has been modified in retrospect in Amazon’s financial statements to reflect the 20:1 stock split in March 2022. This makes pre- and post-stock split data comparable.

Significantly increasing SBC in 2022

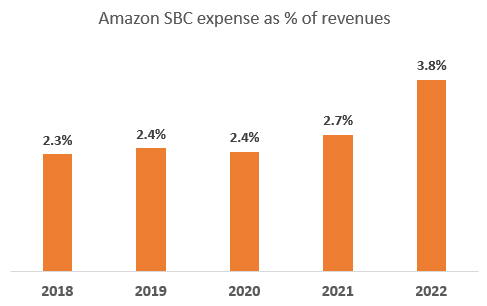

When it comes to quantifying SBC there are several points of reference that it can be measured against. One typical way that companies used to highlight is to measure SBC expense as a percentage of revenues. Just like in the case of Amazon the fair value of an RSU-based stock award is determined by the number of shares granted and the company’s stock price on the date of the grant. Multiplying these two for each stock award granted and summing it all up gives us SBC expense for the measurement period. When employees leave the company during this period their RSUs got forfeited, for which effect must be adjusted accordingly. Looking at Amazon SBC expense as % of revenues over the past 5 years looks as follows:

Created by author based on company filings

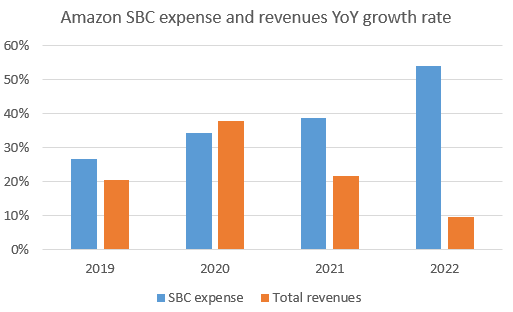

First, as a side note it’s worth to analyze SBC expense for entire financial years, because it usually includes some seasonality within the year. Looking at the chart above we can see that Amazon SBC expense totaled 2.3-2.7% of total revenues from 2018-2021 but jumped to 3.8% in 2022. The reasons for this jump have been twofold, which can be seen in the following chart:

Created by author based on company filings

On the one hand, total revenues only grew 9% yoy in 2022 (global macro slowdown impacting retail and AWS business), while on the other hand, SBC expense grew 54%, the highest yoy growth in the past few years. The latter could have been the result of ongoing hiring and increasing wages in the AWS business, where SBC is more widespread than in other parts of the business.

The cumulative effect of these has been the significant jump of SBC expense as % of revenues to 3.8% in 2022 from 2.7% in 2021. Considering that operating margin has been 2.4% in 2022 this 3.8% seems significant.

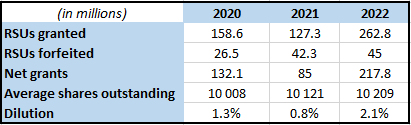

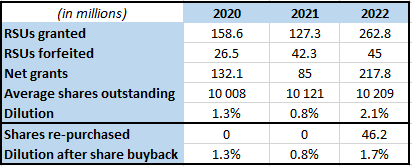

However, at the end what really matters is the resulting dilution of shareholders from these stock awards as this is the real price investors must pay. The growth in SBC expense of 54% yoy coupled with a significantly lower average share price during 2022 vs 2021 suggests that Amazon should have granted far more stock awards during 2022 than during 2021 resulting in increasing future dilution for shareholders. If we look at the company’s most recent 10-K filing, we can see a confirmation for this:

Created by author based on Amazon 10-K filing

From the table above we can see that Amazon utilized stock awards as the form of employee compensation in a much greater extent during 2022. The company granted almost 263 million RSUs to its employees in 2022 more than double the grants in 2021. After accounting for forfeitures and comparing this to the average share count of the company this was equal to a shareholder dilution of 2.1%. I believe ~2% dilution in one year is not insignificant, especially in the current environment when topline growth at the company cooled off meaningfully.

However, there is one thing a company can do to mitigate the effect of shareholder dilution resulting from SBC, which is buying back its own shares. Amazon refrained from this activity during the past, however, in 2022 management decided to buy back 46.2 million shares worth $6 billion. This modifies 2022 dilution to the following extent:

Created by author based on Amazon 10-K filing

Although 1.7% is still not negligible, it’s an encouraging sign in my opinion that management pays attention to dilution and tries to manage it efficiently. At the same time, it’s interesting that Amazon only re-purchased shares in the Q1 and Q2 quarters during 2022, while it didn’t re-purchase any stock in Q4, when shares traded significantly lower. I believe some other considerations regarding cash flows could have influenced this decision. It will be interesting to see in the next 10-Q filing, whether management decided to buy back shares again at ~$100 levels.

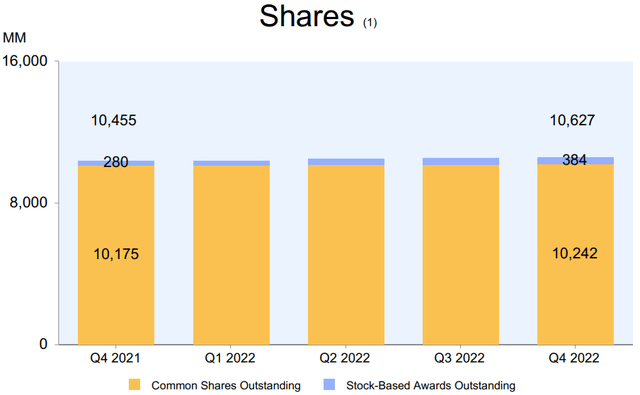

Another aspect for gauging how effectively a company manages shareholder dilution is to look at common shares and stock-based awards outstanding combined, which shows the theoretical share count of the company in the case every stock grant would have been exercised. Amazon updates investors on this topic in its investor presentation regularly, the Q4 2022 chart looks as follows:

Amazon Q4 2022 earnings presentation

This chart shows that total diluted shares outstanding increased from ~10.45 billion from Q4 2021 to ~10.63 billion in Q4 2022. This equals a 1.6% increase yoy, which is not far from the 1.7% actual dilution I have described above. These two don’t have to go hand in hand on the short run as employee turnover or the different vesting schedules can have an influence on diluted shares outstanding to a greater extent, but on the long-term there should be a strong correlation.

Both data points confirm that shareholder dilution trended around 1.6-1.7% in 2022 at Amazon, which is a material increase compared to previous years. The question arises at this point: Should investors worry about that?

The impact of dilution is manageable at current levels

For the first sight, the combination of deteriorating fundamentals (9% yoy sales growth rate in 2022 and 1.8% operating margin in Q4 2022, which both marked lows for the past several years) and materially increasing shareholder dilution doesn’t seem encouraging.

To illustrate how 1.6-1.7% annual dilution could impact the valuation of shares in the upcoming years I brought the following example: Let’s assume that Amazon reaches an operating margin of 10% for 2027, which coupled with current average revenue estimate of analysts would lead to an operating income of $87.2 billion for that year. With current enterprise value of ~$1.1 trillion this would manifest in an EV/EBIT ratio of 12.6 with 2027 operating income. If we assume that dilution stays constant at 1.6-1.7% until 2027 this would result in a cumulated dilution of ~6.8% for the beginning of 2027. Including this effect into the valuation of shares would increase the forward EV/EBIT ratio from 12.6 to 13.5. Although this increase is not immaterial, I believe it doesn’t really move the needle whether an investor decides to buy the shares or not. So, based on this example 1.6-1.7% annual dilution for the upcoming few years wouldn’t be catastrophic.

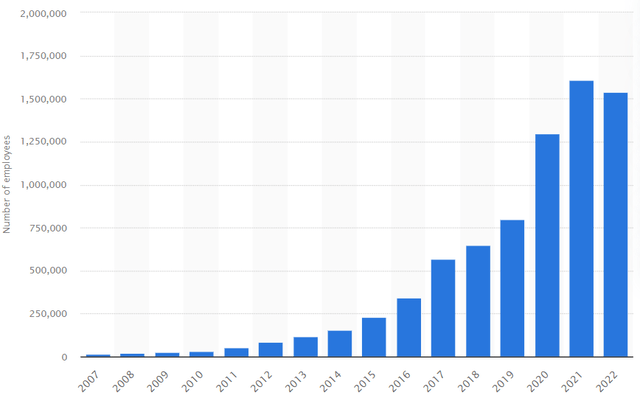

The reason I didn’t assume further growth in dilution from current levels is that headcount growth at Amazon seemed to have cooled off in 2022:

Based on recently announced layoffs, which also impact AWS workers this trend should continue into 2023. Fewer employees mean fewer stock awards, so this should create a natural barrier for increasing dilution.

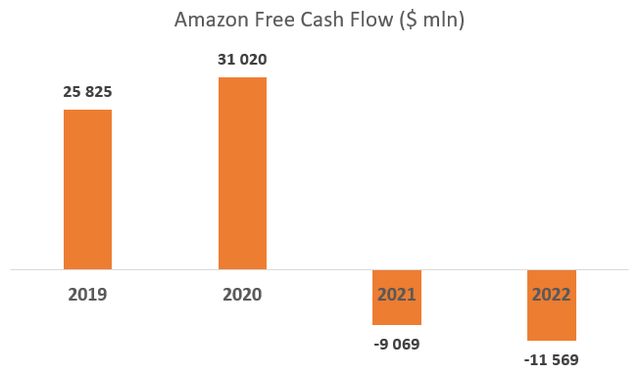

Another interesting aspect of shareholder dilution in 2023 will be whether Amazon decides to counterbalance the effect by buying back shares just like they did in H1 2022. I believe this won’t happen until the company manages to restore its FCF generating ability, which continued to suffer in 2022 after a weak 2021:

Created by author based on company filings

Even if Amazon has $54 billion in cash and cash equivalents on its balance sheet it wouldn’t be sustainable to spend billions on buybacks and burning cash at the same time. To entirely mitigate the effect of possible shareholder dilution in 2023 (assuming 1.65% dilution) Amazon would have to buy back 169 million shares, which at a $100 share price would cost $16.9 billion. This shows that currently Amazon has enough cash to counterbalance shareholder dilution for 3 years, which is not much. This confirms to me that until the cash generation ability of the company isn’t restored investors shouldn’t expect meaningful buybacks. Based on my previous analysis on the company I believe there could be a material change in this, possibly already in 2023. If the company begins to generate positive FCF again I believe they will resume buybacks to lower dilution from current levels.

Besides buying back shares it could be also a possibility for decreasing shareholder dilution to simply introduce a pay mix shift for employees by decreasing stock awards and increasing cash compensation. Recent rumors suggest that Amazon is thinking over this possibility indeed as the company confirmed that they plan to decrease RSU grants in 2025 to a slight extent. Although this is just a small first step it could materially affect company fundamentals if Amazon continues down this road.

To compensate employees for decreasing stock awards Amazon has to offer less cash in total than the fair value of RSUs previously offered because cash is the least risky type of compensation. I believe a 2:1 is ratio is not far from reality, so for every 2 dollars of lost RSUs employees could get 1 dollar in cash. If Amazon decides to make a larger pay mix shift its total compensation expense would decrease, which would aid operating income and margin. On the other hand, FCF would decrease as the company would shift from a non-cash compensation expense to cash compensation. However, if this reduces the need for stock buybacks this effect could be mitigated to some extent.

To sum it up, there are some efficient ways to manage shareholder dilution and based on recent experience Amazon is keeping a close eye on the topic. This in itself should be welcome news for investors in my opinion.

Conclusion

Amazon SBC expense growth and the resulting dilution of shareholders picked up significantly during 2022. However, the current level of annual shareholder dilution of 1.6-1.7% is still acceptable in my opinion. Slowing/reversing headcount growth and a seemingly conscious strategy of management to manage dilution make me conclude that investors shouldn’t worry that this could get out of hands. I believe we are close to peak dilution, and it should reverse as the company’s bottom line improves throughout the year.

I believe Amazon shares provide a good long-term investment opportunity at current levels and increasing SBC expense and shareholder dilution in 2022 shouldn’t scare off investors to invest in the company’s shares.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AMZN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.