Summary:

- After a rough slide in the stock price, the macro environment is finally taking its toll on Affirm’s financials.

- Growth slowed down greatly in the latest quarter with persistent weakness expected ahead.

- Management remains committed to delivering non-GAAP profitability this year.

- The stock is still too cheap at 2x sales.

Kevin Dietsch/Getty Images News

Affirm (NASDAQ:AFRM) has been a disappointing stock to own over the past year. First the stock price was hit by a reset in broader tech sector valuations. But for many quarters, the company had posted resilient fundamentals highlighted by strong growth rates. This most recent quarter finally saw the company show fundamental weakness with an uncharacteristic revenue miss and guide-down on full-year financials. While the company maintains a strong balance sheet and the valuation is undemanding, prospects for near term upside appear limited and heavily reliant on a Fed pivot.

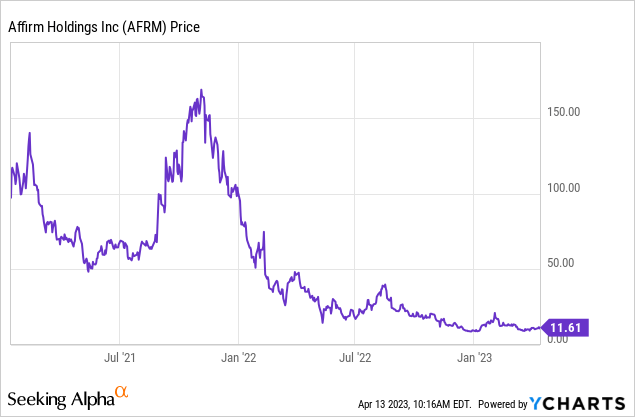

AFRM Stock Price

AFRM is down 90% from all-time highs, but the stock had previously traded at unreasonable levels.

I last covered AFRM in January where I continued to recommend buying the stock based on the resilient growth rates. With that thesis shattered, it is time for an update.

AFRM Stock Key Metrics

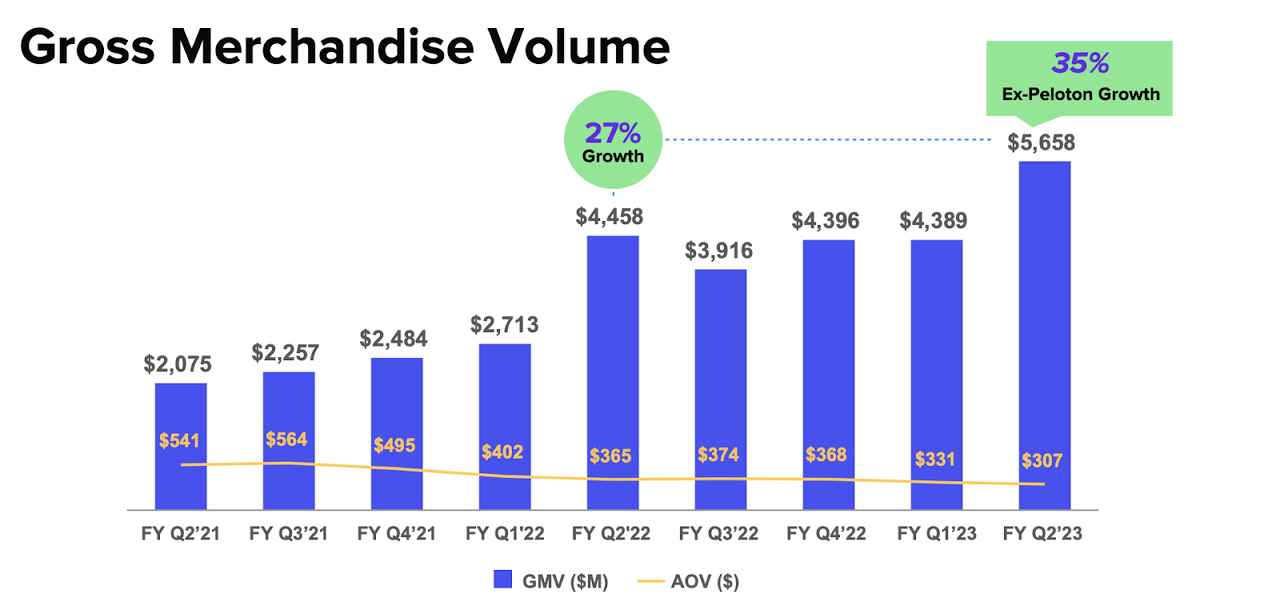

The most recent quarter still showed some bright spots, including 27% growth in gross merchandise volume (‘GMV’) or 35% excluding Peloton (PTON).

FY23 Q2 Presentation

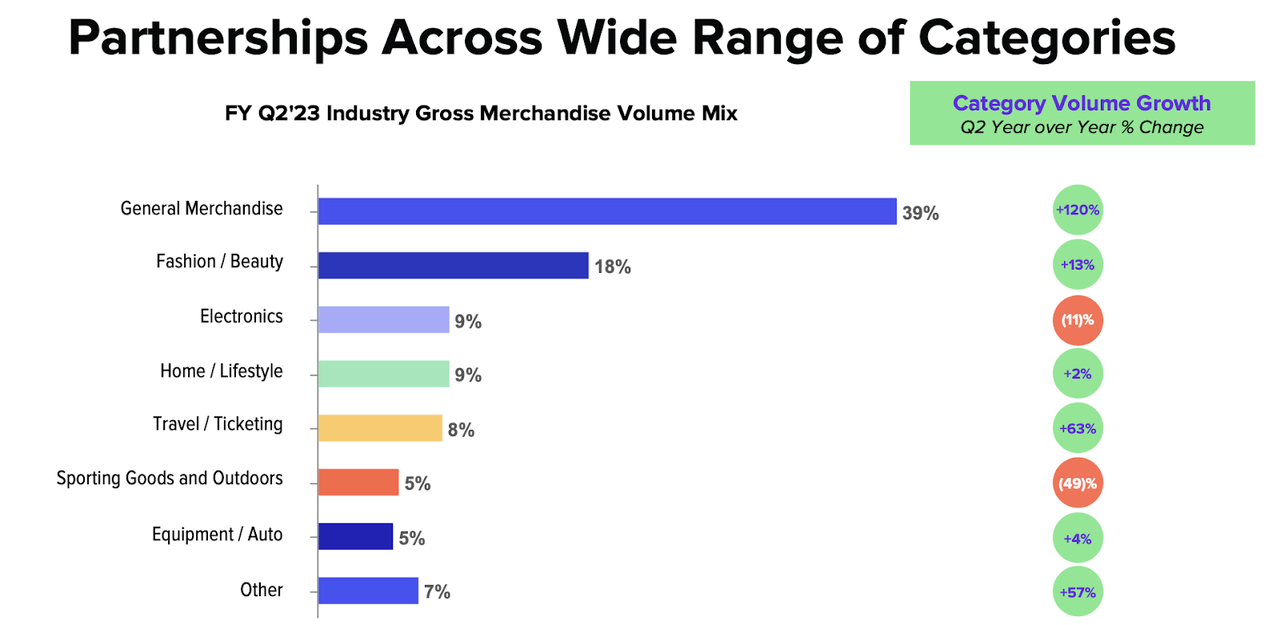

AFRM has benefited from the category diversification of its buy now, pay later services. Whereas many other e-commerce companies have faced steep decelerating growth post-pandemic, AFRM continued to post solid growth as it had exposure to high growing categories like general merchandise. That helped to offset weaker categories such as sporting goods, which had been a beneficiary of the pandemic.

FY23 Q2 Presentation

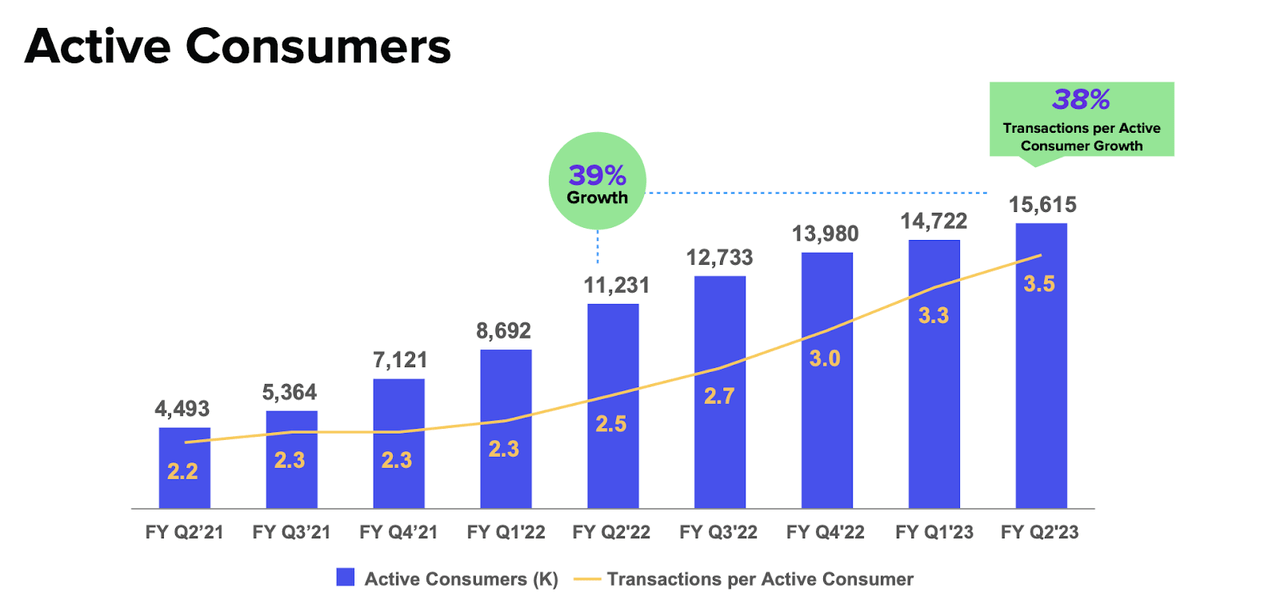

AFRM also continued to grow its active consumer base, which grew by 39% YOY.

FY23 Q2 Presentation

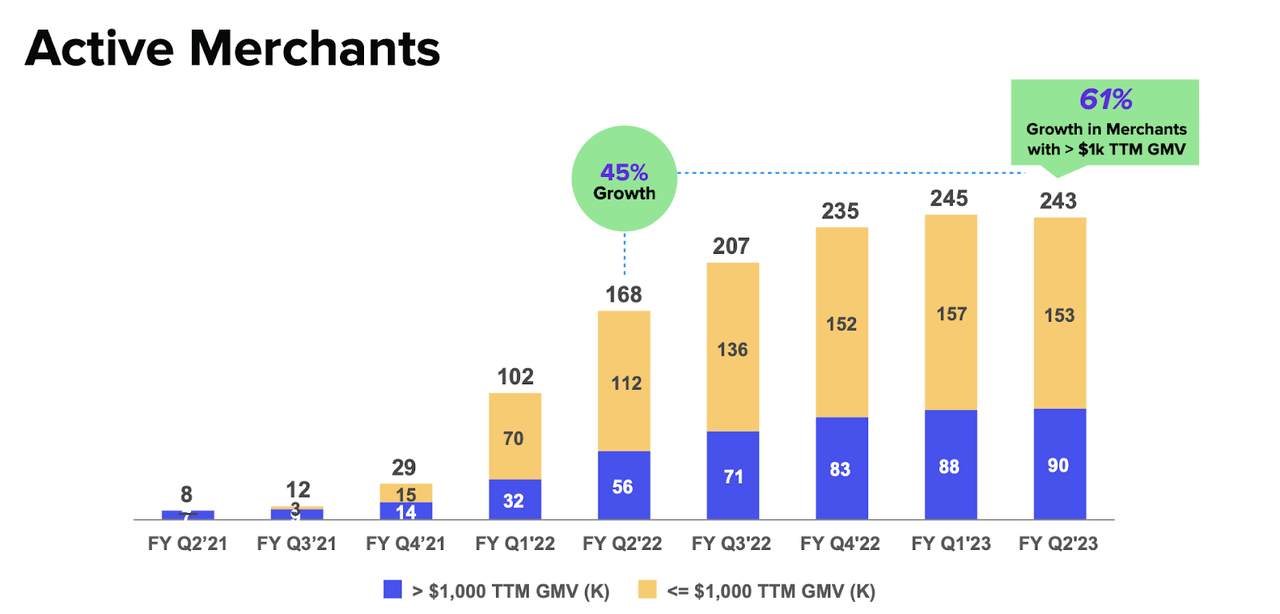

Active merchants declined sequentially but on the conference call, management stated that this was mainly due to fluctuations at smaller merchants and that GMV was the better metric to track.

FY23 Q2 Presentation

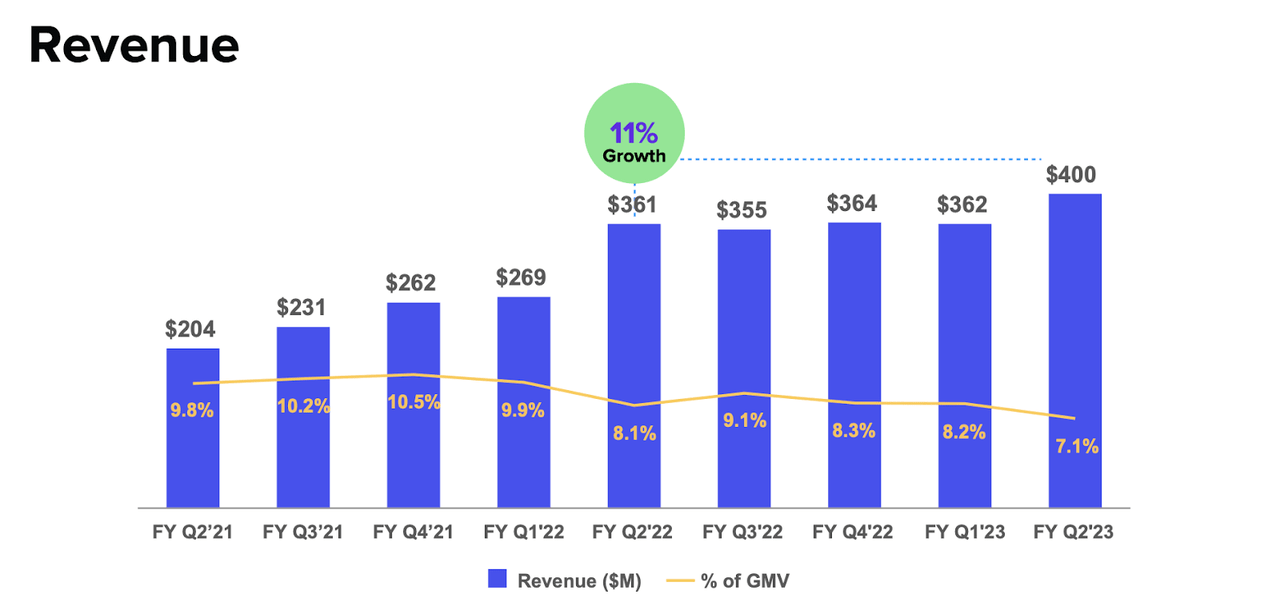

Revenue grew slower than GMV at 11% YOY. AFRM had previously guided to revenue of between $400 million and $420 million. The company typically beats guidance by a wide margin, making the $400 million result a clear disappointment. The discrepancy in growth rates as compared with GMV is due to the partnerships with Amazon (AMZN) and Shopify (SHOP) carrying lower take rates.

FY23 Q2 Presentation

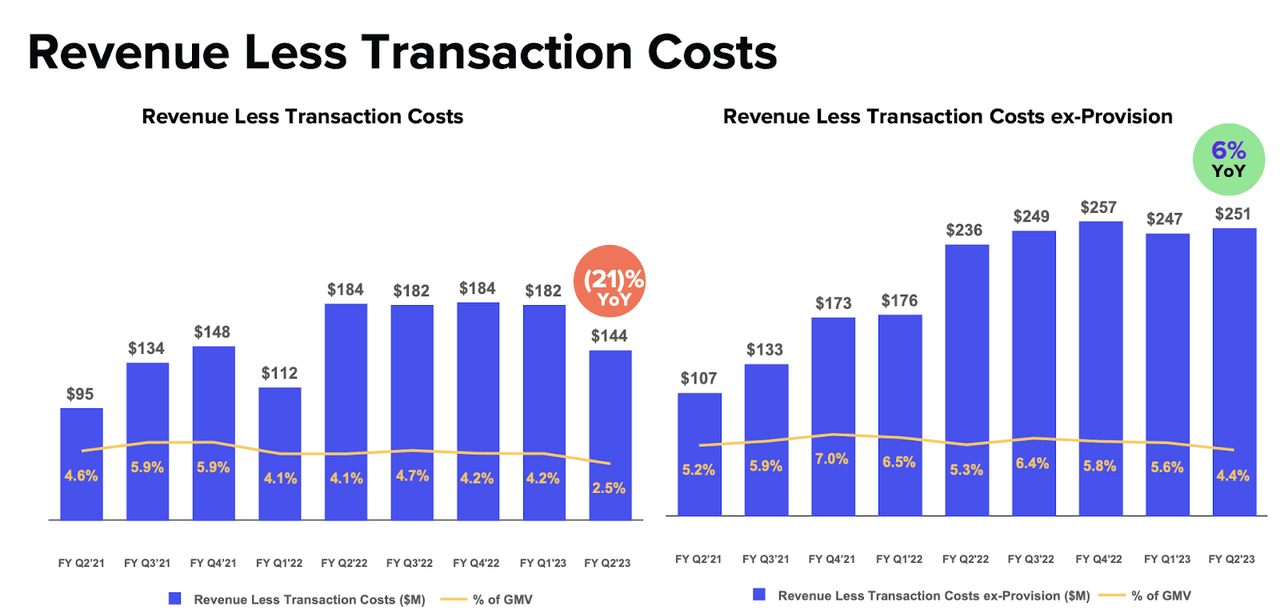

Revenue less transaction costs was weak in the quarter mainly due to the company taking on more loan investments onto its balance sheet. Management expects RLTC as a percentage of GMV to normalize throughout the year.

FY23 Q2 Presentation

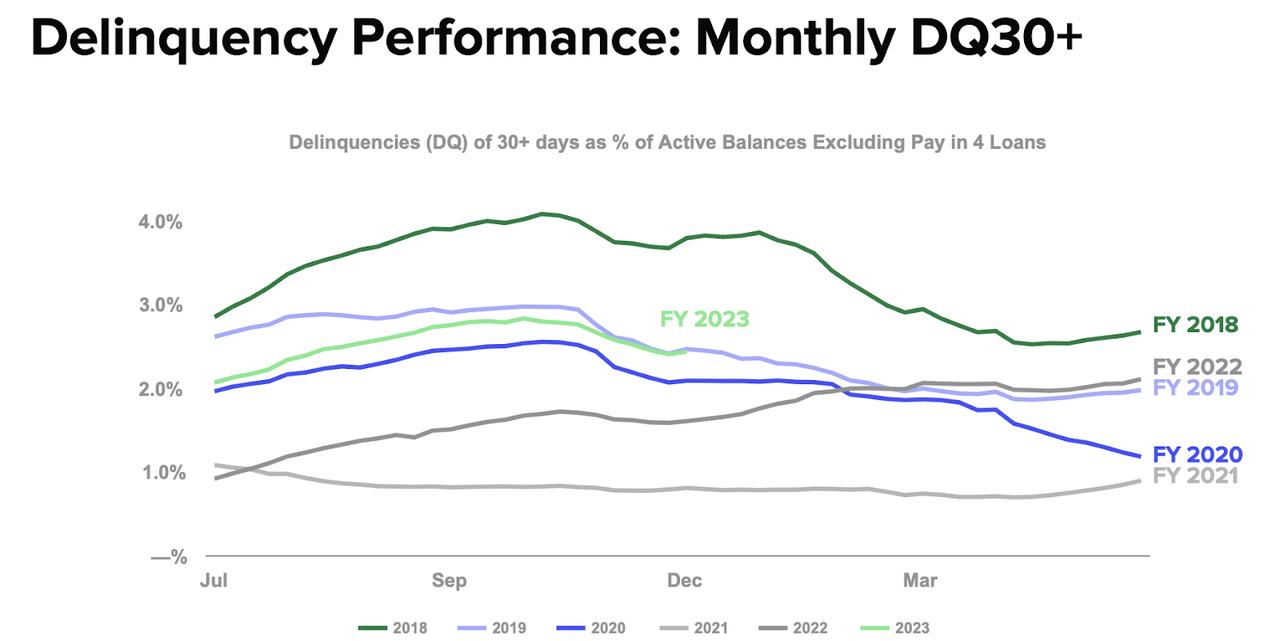

Meanwhile, while credit performance is not as strong as pandemic times, it remains comparable with pre-pandemic levels as measured by delinquencies of 30 days or greater.

FY23 Q2 Presentation

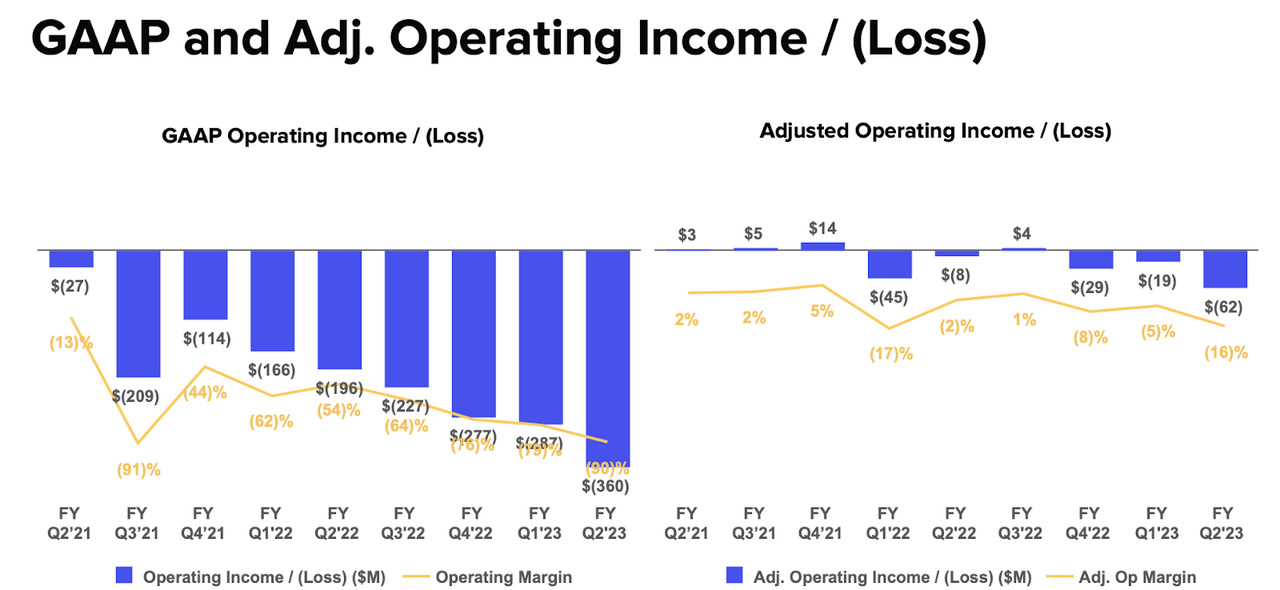

The disappointing growth led non-GAAP operating margin to deteriorate to negative 16%. It goes without saying that the company is also not profitable on a GAAP basis.

FY23 Q2 Presentation

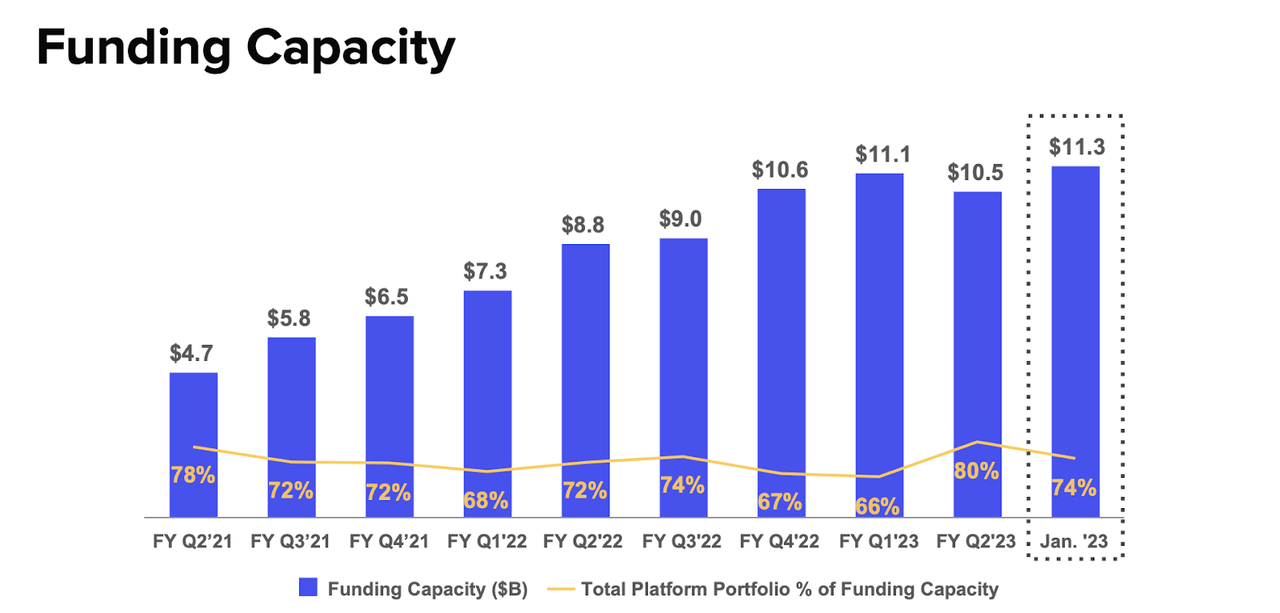

Perhaps the main bright spot for the company is its continued access to funding, with funding capacity increasing to $11.3 billion in the quarter. In this rising interest rate environment, funding access can be a detriment for many fintech operators, including investor favorite Upstart (UPST) – but not for AFRM.

FY23 Q2 Presentation

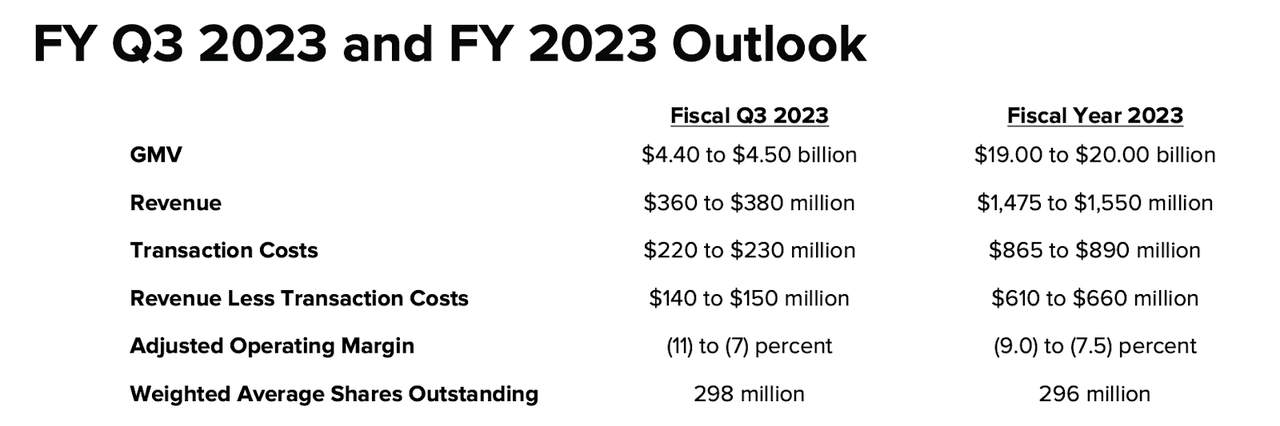

Looking ahead, AFRM guided for just $380 million in third quarter revenue, implying just 7.1% YOY growth. AFRM also lowered full year revenue guidance to just $1.55 billion, implying just 19.2% YOY growth. Perhaps more troubling is the implied $408 million in fourth quarter revenues, which would equate to just 12% YOY growth for that quarter.

FY23 Q2 Presentation

On the conference call, management noted that part of the weakness is due to an execution error in which they “began increasing prices for our merchants and consumers later in the year than we should have as this process has taken us longer than we anticipated.” This had a negative impact on growth rates because AFRM is very strict on only approving loans within an expected loss rate, thus in the absence of better financing terms it could not approve loans that otherwise may have been approved. Management reiterated their commitment to achieving non-GAAP profitability as the company exits fiscal 2023. The company laid off 19% of its workforce on the same day as its earnings release and management noted that they had also shifted their hiring focus to Poland where they have “been able to attract exceptional talent at significantly lower cost than Silicon Valley.” Unlike many other tech stocks, however, the commitment to profitability did not have the same positive effect in offsetting the slowdown in growth rates.

Is AFRM Stock A Buy, Sell, Or Hold?

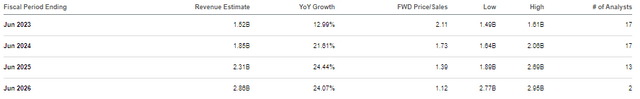

At recent prices, AFRM was trading at 2x sales. Growth is expected to accelerate over the coming years.

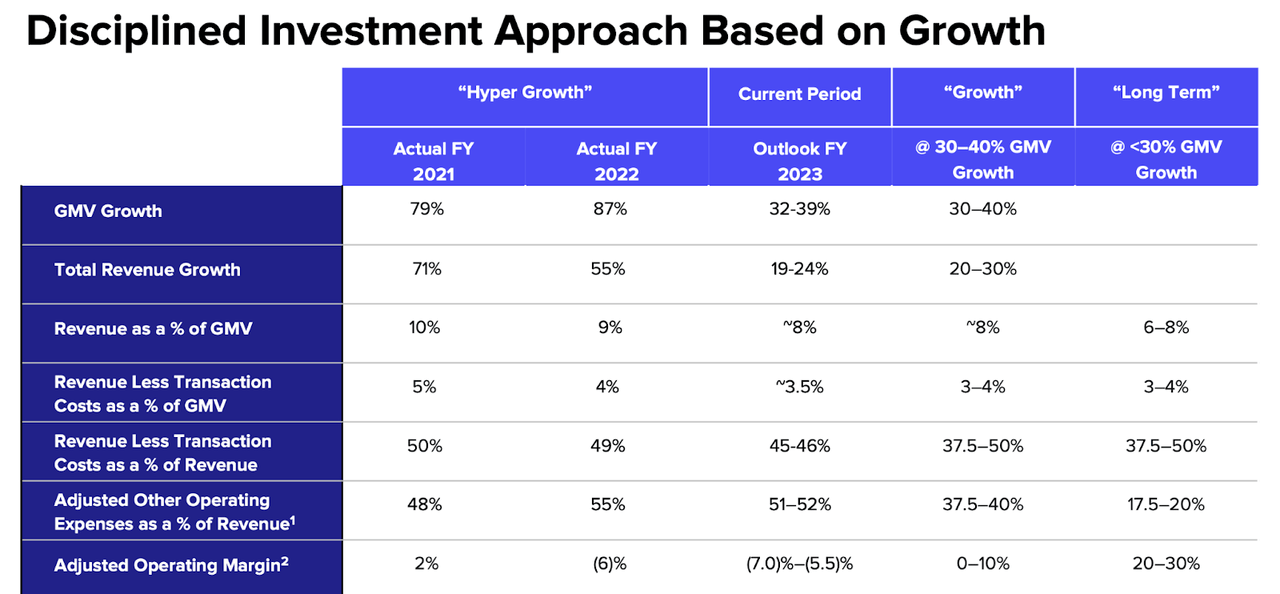

Management had previously given the following long term guidance regarding the puts and takes on profitability versus growth.

FY23 Q1 Presentation

However, management stated the following on the call:

I think that we would probably say we’re in the midst of one of the biggest kind of moments of volatility from a macro sense. So, not sure that we would hold ourselves to the framework that we outlined a year and a half ago in this very moment.

This quarter was a rude awakening as management seemed to lose the confidence that they previously exuded in prior calls. I am reducing my forward growth estimate to 15%. Using the low end of management’s profitability assumption at 20% and a 1.5x price to earnings growth ratio (‘PEG ratio’), I could see AFRM trading at 4.5x sales, representing a stock price of $27 per share over the next 12 months. I may increase that target as the company makes greater progress towards sustainable profitability and accelerates growth rates, but this may prove unlikely in the current macro environment.

What are the key risks? In spite of partnerships with AMZN and SHOP, growth rates have decelerated rapidly in this rising interest rate environment. BNPL is a newer financing concept and it is unclear how consumers will react with interest rates higher. While I continue to believe in the long term growth story of BNPL, this story is reliant on increasing awareness of its differences in relation to traditional credit and volatile interest rate environments may only slow down such a transition. Further, it is possible that AFRM’s credit models are not properly calibrated for the current environment and loss rates may prove larger than expected. There is also great competition within the BNPL space, including notable BNPL operators Klarna and Afterpay (owned by Block (SQ)), as well as newer entrants in PayPal (PYPL) and Apple (AAPL). With AFRM having now lost its exclusive operating agreement with AMZN, it is possible that newer competitors are able to take market share. At the same time though, AFRM still has not yet released its Debit+ product, and management notes that “every class of transactions in Debit+ is profitable.” CEO Levchin expects Debit+ to be released “soon” though that has been the consistent message for many quarters. Investors can be hopeful that Debit+ can help accelerate growth even in a tough macro environment. While risks are as high as ever, AFRM remains highly buyable on account of the undemanding valuation and $600 million in net cash ($1 billion inclusive of restricted cash). I continue to view a basket of undervalued tech stocks as being an optimal way to position ahead of a recovery in tech stocks. AFRM fits right in with such a basket despite the lack of near term catalysts.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AFRM, SQ, SHOP, AAPL, PYPL, UPST, AMZN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I am long all positions in the Best of Breed Growth Stocks Portfolio.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Sign Up For My Premium Service “Best of Breed Growth Stocks”

After a historic valuation reset, the growth investing landscape has changed. Get my best research at your fingertips today.

Get access to Best of Breed Growth Stocks:

- My portfolio of the highest quality growth stocks.

- My best 6-8 investment reports monthly.

- My top picks in the beaten down tech sector.

- My investing strategy for the current market.

- and much more

Subscribe to Best of Breed Growth Stocks Today!