Summary:

- JPMorgan Chase & Co. just delivered a blowout quarter.

- JPMorgan Chase beat in the current quarter and raised the guidance for the full year.

- Share price is up strongly in pre-market.

- Hold and never sell JPMorgan Chase & Co.

- JPMorgan Chase & Co. is a strong buy.

winhorse

JPMorgan Chase & Co. (NYSE:JPM) just delivered exceptionally strong earnings on practically all metrics in Q1 2023. Q1 GAAP EPS of $4.10 beats by 64 cents even though it has taken reserves of $1.1 billion for the uncertain macro environment. Revenue has also been beaten by a massive $2.3 billion.

Unsurprisingly the share price reacted strongly, with the shares up ~6% in pre-market earnings as I write this article.

However, the most remarkable number is the RoTCE of 23%, which is well above its targeted ratio throughout the cycle of 17%. Simply put, JPM is minting money even in this environment, and Fortress Dimon is as resilient as ever.

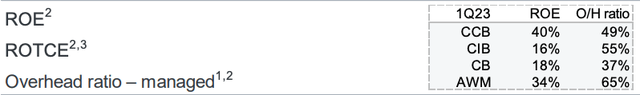

Breakdown of RoTCE By Division

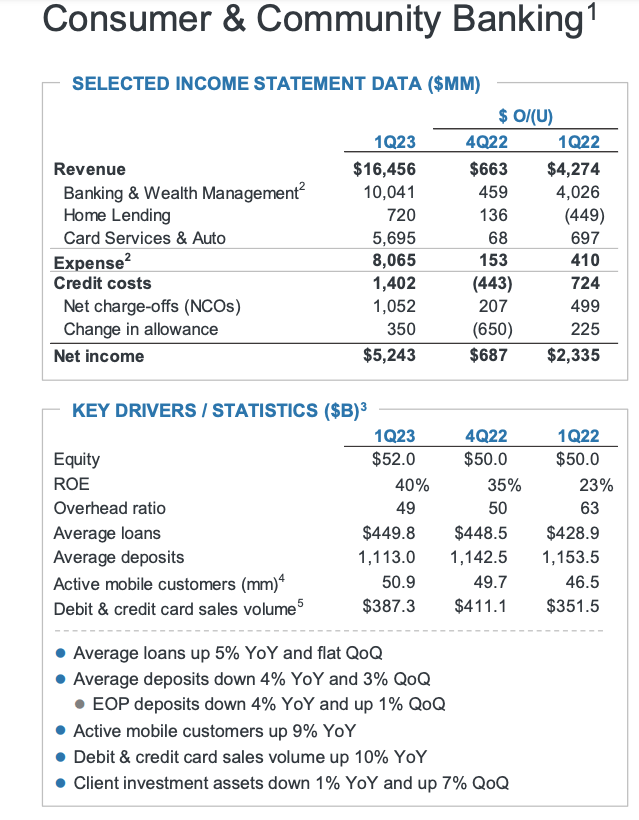

The overall RoTCE of 23% was driven by all divisions, but especially the Consumer and Community Banking (“CCB”) business that is benefiting from the higher interest rates:

The benefit of net-interest-margin (“NIM”) expansion year-on-year is clearly evident in the CCB business, and a return on capital of 40% is simply astounding, especially given that it already incorporates $1.1 of additional lifetime expected loan losses under the CECL method.

JPM Investor Relations

JPM seems to have benefited from the recent crisis, as deposit outflows were much lower than expected (given quantitative tightening) and were actually up (on an end-of-period basis) by 1% quarter-on-quarter.

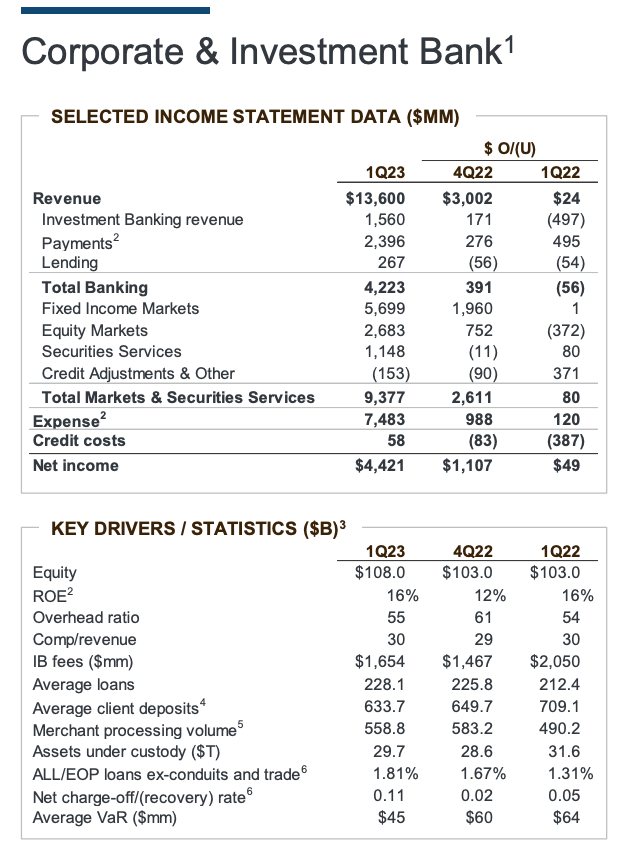

The Corporate and Investment Bank (“CIB”) has also outpaced expectations, especially in FICC trading (surprisingly strong) and investment banking fees:

JPM Investor Relations

FICC trading was expected to be down ~10% but came in slightly up year-on-year. It also appears that investment banking fees were down much less than expected at only 19%. Deposits did drop by ~$76 billion, which was expected as corporate treasurers are much more interest-rate sensitive than retail customers. All in all, JPM managed to deliver 16% RoE, which was the same as last year but in a much tougher environment.

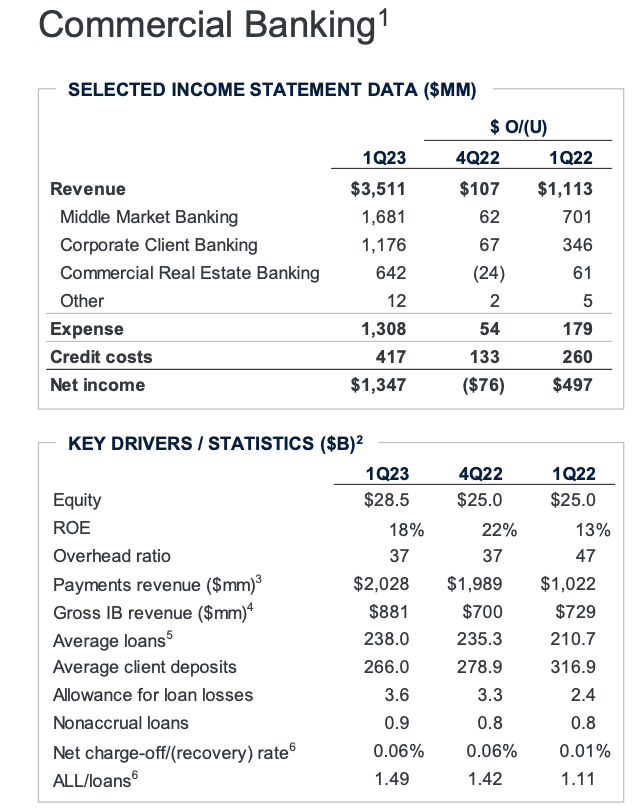

The Commercial Banking (“CB”) division also delivered a strong performance year-on-year, driven by higher rates and middle market clients, in spite of deposits outflows to the tune of $50 billion.

JPM Investor Relations

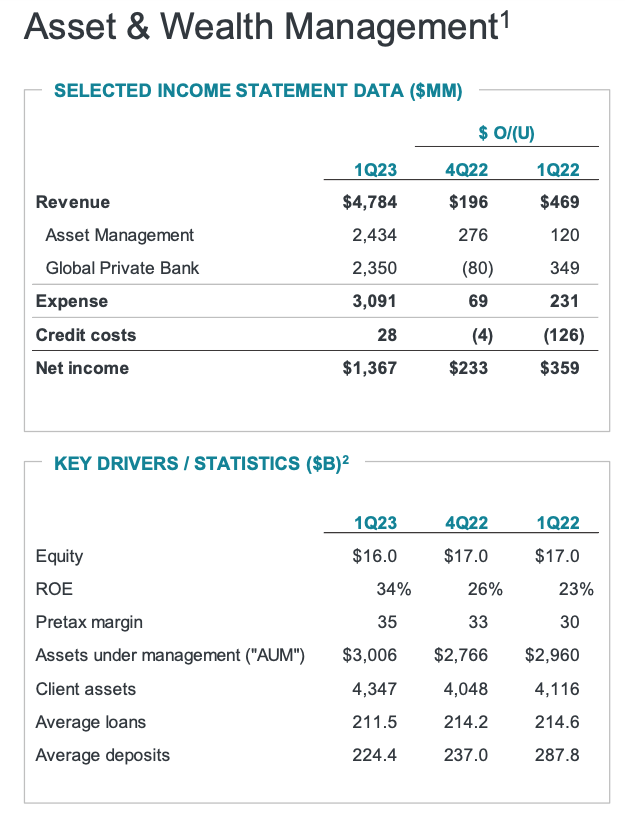

Finally, the Asset and Wealth Management (“AWM”) division printed strong returns on equity of 34%, and net income was up $1.4 billion. This is in spite of average deposits of $224B down 22% year-on-year.

JPM Investor Relations

For the quarter, assets under management (“AUM”) had long-term net inflows of $47B and liquidity net inflows of $93B.

Fortress Balance Sheet

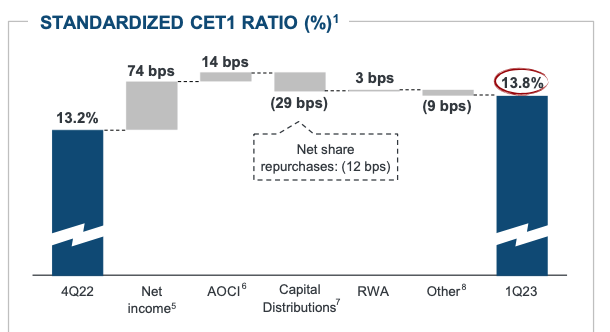

JPM also printed a very strong CET1 ratio that increased by 60 basis points over the quarter, driven by net earnings and reversal of Accumulated Other Comprehensive Income (“ACOI”) but somewhat offset by distributions to shareholders.

JP Morgan Investor Relations

This places JPM in a very strong position to buy back shares and/or increase the dividend.

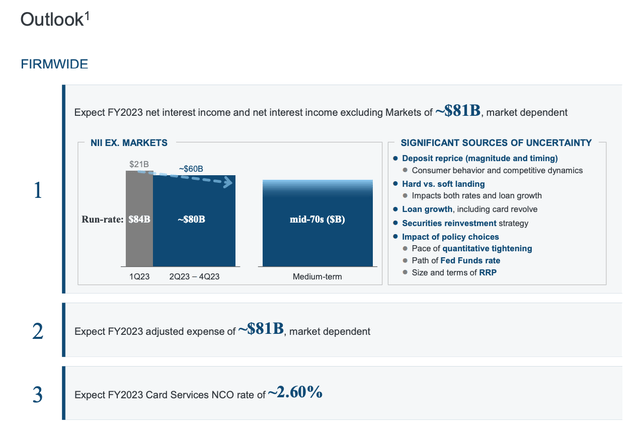

A Beat And A Raise

Many market participants were concerned about the guidance and especially expected a slowdown or drop in the net interest income line. The guidance did not disappoint. JPM beat the current quarter by a mile and also raised the guidance for the full year.

The market was expecting net-interest income to land somewhere in the low to mid-70s. JPM is now guiding to ~$81 billion.

The Only Thing That Can Stop The Jamie Dimon Train Is The Fed

The only thing that can stop the JPM train is the Fed. By that, I mean materially increasing the capital requirements for the large U.S. banks.

It is, of course, impossible to predict whether and to what extent the capital requirements will increase for the large banks. JPM CEO Jamie Dimon has been very vocal in articulating his view that large banks are holding huge amounts of capital, and that any increase in capital requirements would be ultimately borne by the American economy as well as reduce the competitiveness of the U.S. banking industry.

Final Thoughts

One should not trade JPMorgan Chase & Co. It is the best-of-breed bank and investors should hold it for decades. I have been a shareholder for more than a decade and never contemplated selling or trading it.

JPMorgan Chase & Co. should be delivering high-teens ROE rain or shine and through various macroeconomic conditions. I am intending to buy more JPMorgan Chase & Co. shares now given the strong results.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of JPM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.