Summary:

- Exxon Mobil is once again on the prowl to add to its vast E&P assets. Spoiler alert, it may not be Pioneer Natural Resources.

- The Texas Oil Titan is flush with cash and in need of a place to put it, as evidenced by the exorbitant buyback announcement.

- I lay out my top three potential acquisition targets and which one I believe Exxon will buy.

Brandon Bell

A few months back I took profits on my Exxon Mobil (NYSE:XOM) position after an over 200% gain. My father, who retired from a career as a US Air Force Intelligence officer and then became a stockbroker, had a saying that has always resonated with me. He would say “you have to take profits to make profits.” By the way, he passed away at the age of 83 in 2013 with a multimillion dollar retirement portfolio intact. I learned a lot from my dad over the years. As well as from my experience managing my own portfolio for nearly 30 years since 1994.

I received a plethora of negative comments when I stated I took profits on my Exxon position. The one thing I feel I may have not made clear was what I meant by the “party was over” for Exxon Mobil. Let me clear up the confusion. I wasn’t saying the oil and gas sector was about to tank. I was saying Exxon Mobil’s stock had risen so high since the 2020 low, over 200%, that all the good news already was priced in to the stock.

Exxon Mobil Long-term Chart

What makes a good investment is finding a solid stock that’s currently out of favor. This was the case for Exxon Mobil when it was selling for $35 back in 2020. Yet, after a 230% run off the bottom, the stock has been stalled out for the past five months.

Exxon Mobil Current Chart

Exxon’s stock has had a hard time breaking above this level for a long time now. What this tells me is we’re getting to point where everyone is already in. I still see new comments from members stating the same bullish narrative for Exxon. The supply/demand equation is favorable, China is coming back online, and the current administration is causing oil and gas companies to return capital to shareholders rather than increasing production.

I agree with all these statements, yet the issue is… who hasn’t heard this already? I hate to break it to you, but it’s all already priced in to the stock. Finding great investments is about finding a solid stock that’s out of favor, not one that has been hot for two years and you are the last one to jump on the bandwagon. As Warren Buffett so eloquently stated “be fearful when others are greedy and greedy when others are fearful.” I have to say, there aren’t many fearful Exxon investors out there at present. Getting back to the issue at hand, the recent news Exxon Mobil is looking to make an acquisition is more proof the Texas Oil Titan has hit a top. Let me explain.

Exxon needs an accretive acquisition

When I heard that Exxon Mobil announced a major multi-billion dollar buyback plan rather than increasing the dividend, that was a major red flag to me that management had realized the stock has reached stall speed. They would need to decrease the share count to increase EPS and hopefully create additional upside. Now, with the failure of the major Brazilian campaign, Exxon management has turned their attention to making an accretive acquisition to enhance the value of its shares. I applaud this effort. Hopefully, they will retract their share buyback plans and use the cash to purchase an oil and gas producer. Recently, news broke that Exxon is considering buying Pioneer Natural Resources (PXD). I hate to break it to those that bought into Pioneer, I don’t see it happening. Now let’s turn our attention to my top two candidates.

My Top two candidates

My top two candidates for an oil major acquisition are Diamondback Energy (FANG) and Devon Energy (DVN).

FANG current chart

DVN current chart

Just FYI, I own all three of the names put forth in this article – Pioneer, Diamondback, and Devon. I used half the profits from my 200%-plus gain in Exxon to purchase shares in these names. They all have much higher dividend yields and upside potential than Exxon presently. It’s nice to have Exxon Mobil management corroborate my decision by considering doing the same thing. Diamondback is an excellent operator and has recently stated they have a very positive outlook going forward.

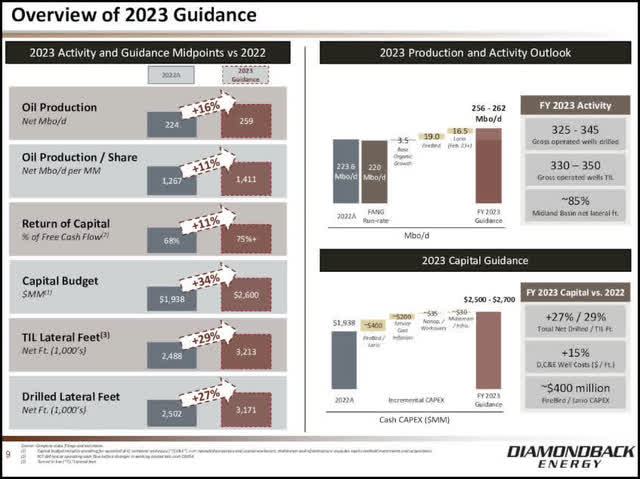

FANG 2023 Outlook

Diamondback and Devon currently reside in my Income Investing Group’s SWAN Income portfolio.

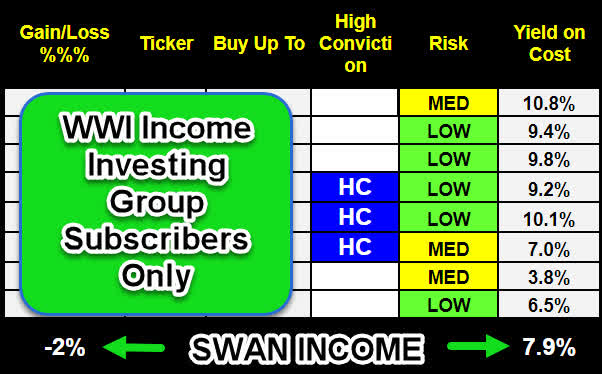

WWI Income Investing Group SWAN Income Portfolio

WWI Income Investing Group

The portfolio currently yields 7.9% with only a 2% capital loss at present. The objective is to provide stable solid income with an eye on principal preservation. Out of the three prospects, Pioneer, Diamondback. and Devon, I see Devon as the one Exxon Mobil will finally zero in on. Here’s why.

Devon Energy Bull Case

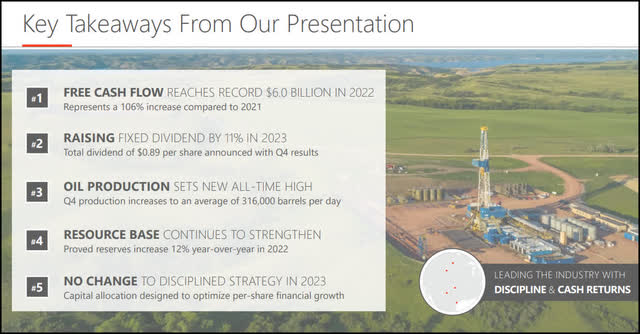

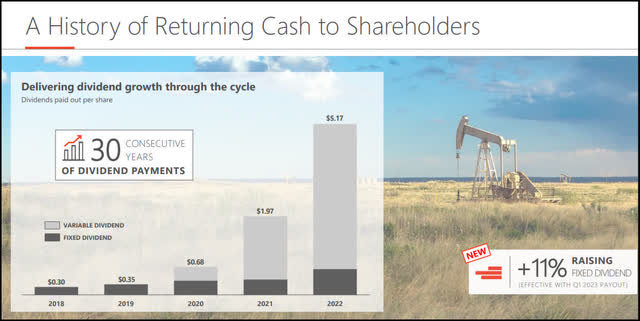

Based on last quarter’s earnings, the company is projecting production to snap back during the balance of 2023. Guidance remains strong and they just raised the fixed dividend by 11%. Below is a key quote from the CEO regarding 2023 guidance followed by some key slides from the latest quarter’s earnings call presentation.

Quote from CEO

On the latest earnings conference call President and CEO Rick Muncrief stated:

As we shift our focus to 2023, I want to be clear that there’s no change to our disciplined strategy. At Devon, we are driven by per share value creation, not the pursuit of produced volumes. For the upcoming year, we have designed a consistent capital program to sustain production, deliver high returns on capital employed and generate significant free cash flow that can be harvested for shareholders.

Now let’s run through some of the highlights of our 2023 outlook. Beginning with production, we expect volumes to build throughout 2023, to reach an average of 643,000 to 663,000 BOE per day for the full year, of which approximately half is oil. Combined with the tailwinds from share repurchases and our two well-timed acquisitions, our volumes on a per share basis are on track to deliver an attractive high single-digit growth rate once again in 2023.

The capital investment required to deliver this production profile is expected to range from $3.6 billion to $3.8 billion with these capital requirements being self-funded at pricing levels as low as a $40 WTI oil price. This low breakeven funding level showcases the durability of our business model and positions us with an attractive free cash flow yield in 2023 that screens as much as 2x higher than other key indices in the market.

With this strong free cash flow, we will continue to prioritize the funding of our dividend, which includes an 11% hike to our fixed dividend payout beginning in March.

We will also have plenty of excess cash after the dividend to evaluate opportunistic share buybacks or take steps to further improve our balance sheet.”

The company is firing on all cylinders and focused on returning capital to shareholders. The following are key slides from the latest earnings presentation.

Overview

The company recorded record free cash flow of $6 billion and an all-time high production increase to an average of 316,000 BPD. They increased the fixed dividend by 11%. Devon plans on sticking to their current strategy of allocating capital to maximize shareholder value. Let’s take a closer look at the strategy.

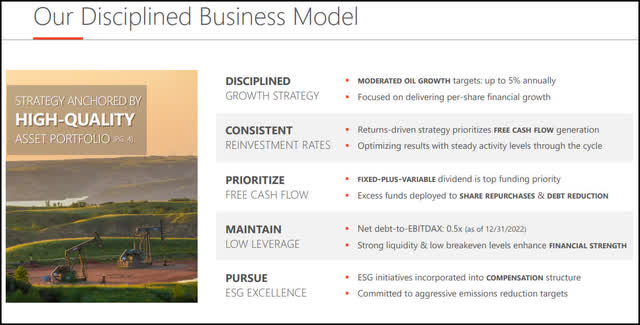

Disciplined Business Model

The company moderated their production growth targets to 5% focusing on delivering per-share financial strength. They’re closely monitoring reinvestment rates in order to optimize free cash flow generation. Devon has very low leverage with a net debt to EBITDA of 0.5x. Return of capital to shareholders is the company’s top priority.

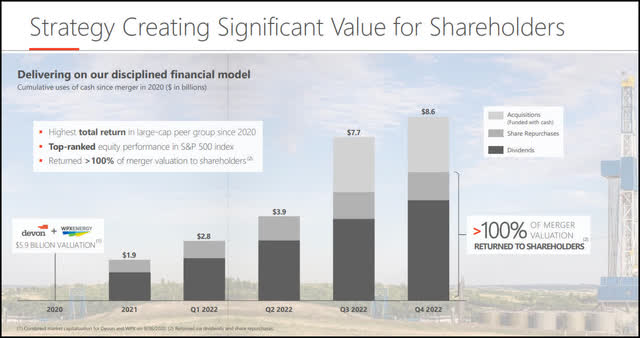

Focused on return of capital to shareholders

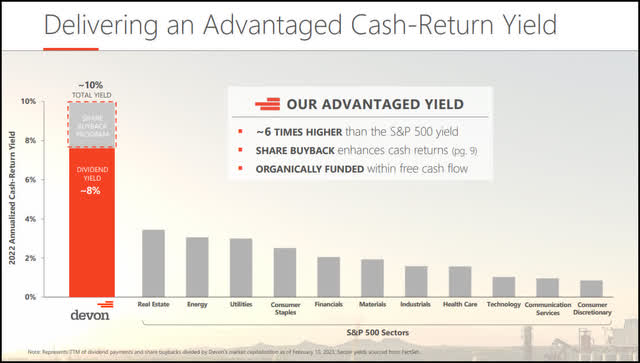

The fixed + variable rate dividend payout of nearly 10% coupled with the stock’s performance makes Devon one of the highest total return plays when compared to their peers.

Quality High Yield

The combination of share buybacks and dividend payout are organically funded with free cash flow from operations. The yield is vastly outperforming all other S&P 500 sectors. Finally, Devon has an excellent history of dividend payments.

Solid Dividend history

Devon has 30 years of consecutive dividend payments. This helps me to sleep very well at night. Management is laser focused on returning capital to shareholders as well. These are the reasons I currently own the stock. The fact that Devon could very well be a primary target for an acquisition by Exxon Mobil is just icing on the cake. According to a recent Seeking Alpha News report, Devon and Diamondback are both on the Permian Basin’s “hottest target” list. The report states:

Truist analyst Neal Dingmann said the Permian Basin will be the hottest target for deal activity, as many existing companies want to beef up their positions in the region, and he sees Exxon (XOM) and rival Chevron (CVX) will be on the hunt, with Diamondback (FANG), Devon (DVN), Coterra Energy (CTRA), APA Corp. (APA) and Permian Resources (PR) as firms that “could remain active in the M&A market.”

It could be Chevron that steps in and snaps up one of these prime candidates as well. Nevertheless, one prodigious lesson learned from my 30 years in the market is, never buy a stock based solely on the fact it’s a rumored acquisition target, that is a sure way to lose money. I own these names due to the fact they are solid income producing securities with upside potential. Now let me wrap this up.

The Wrap Up

The energy sector has been on fire for the last two years. It’s reached a point where merger and acquisition activity usually occur. This is due to the fact oil majors like Exxon Mobil and Chevron have made a bundle and are flush with cash. They’re on the prowl to make accretive acquisitions in order to grow production with less risk rather than strike out, as Exxon did, with its recent Brazilian blunder. Out of the three, I see Devon as presenting the best opportunity. Nevertheless, I will be happily collecting the dividend income while I watch the fireworks show. Those are my thoughts on the matter, I look forward to reading yours. Please use this article as a starting point for your own due diligence.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of DVN, PXD, FANG either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

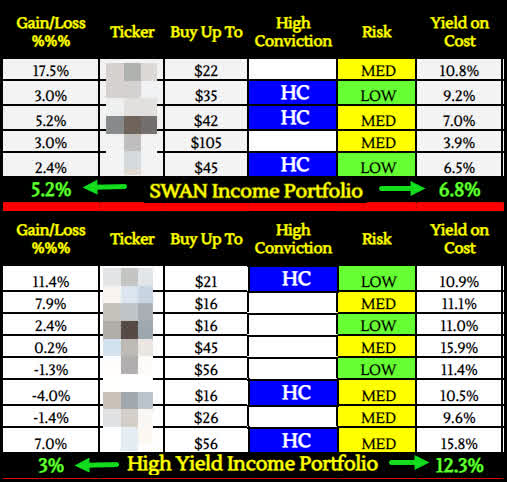

Join the #1 fastest growing new Income Investing Group! Our SWAN and High Yield Income Portfolios are substantially outperforming the market!

We have opened up an addition 50 Charter memberships at the legacy rate! Memberships are going fast with 30 new members already signed up! We have 17 FIVE STAR reviews in the first few months!

~ Quality High Yield Income – Current Yield – 12.3%

~ SWAN Quality Income – Current Yield – 6.8%

~ High Quality Growth

~ Ultra-High Growth

Join now for top income buys, timely macro insights, and a lively chat room! A portion of the proceeds is donated to the DAV (Disabled American Veterans).