Summary:

- Don’t get me wrong. Apple Inc. has been one of my favorite stocks over the years.

- However, owning Apple stock has become a habit, and there is little to be excited about these days.

- Moreover, Apple’s valuation remains incredibly rich for a company in its limited growth position.

- Apple remains overvalued, offering little upside potential, likely making the stock dead money from here.

Shahid Jamil

Do you ever sense that something isn’t right? That’s what I feel when I look at Apple Inc. (NASDAQ:AAPL) stock and its remarkably high valuation. Also, I am no Apple hater. I exclusively use Apple products, and its stock was a top-performing All-Weather portfolio “AWP” holding for years. However, what has Apple’s stock done lately? I wrote about Apple’s stock being dead money back in November 2021, and its share price has mostly stayed the same since. The best thing about Apple’s stock is that it held up relatively well during the recent downturn.

Nevertheless, Apple’s stock is costly and likely has limited upside potential. Therefore, the company’s stock could remain rangebound or move lower in the coming months. Moreover, Apple’s stock will not likely make new highs soon, and investors should look for better opportunities to invest capital in the technology sector.

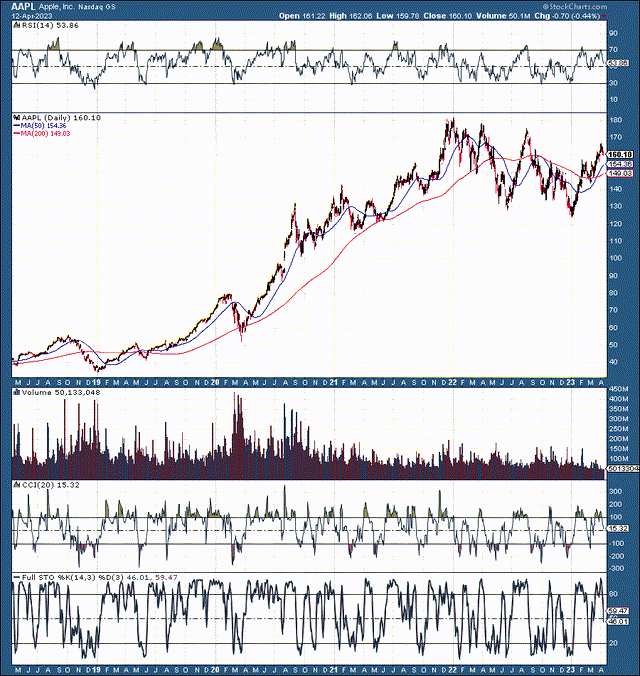

Technically Speaking – Apple Does Not Look Good

Apple had an incredible run-up after its stagnant time in 2018 and 2019. Apple’s peak-to-trough increase has been around 500% since the company’s low level in early 2019. However, Apple has been quite volatile since topping in early 2022. We continue seeing lower lows and lower highs, a highly negative intermediate technical image. Moreover, Apple’s stock recently hit another lower high around the $160-170 resistance level. The next down leg could bring Apple’s stock to a lower low, around the $120-110 range. I’ll consider Apple a strong buy if it moves into my buy-in range, and if the stock ever goes below $100, it’s a gift. Nevertheless, for now, Apple’s valuation remains high.

Apple Valuation – Sky High for a Value Company

Several years ago, Apple was a strong buy with considerable momentum and earnings growth potential. Apple’s stock also occupied a significant portion of my All-Weather portfolio holdings, and I continuously called Apple the ultimate value/growth stock in the 2017-2019 period.

However, let’s put things in perspective. Apple’s stock was trading in the $30-50 range then (split adjusted) and typically carried a forward P/E ratio of just 12-15. The company had its new, highly profitable, freshly redesigned iPhone lineup on deck. Moreover, Apple’s services and other business segments were firing on all cylinders, and it was obvious that Apple’s earnings growth should lead to multiple expansion and a higher stock price.

Several years have passed, Apple’s earnings have increased, the company’s P/E ratio has skyrocketed, and its stock is around $160 now. Nevertheless, why does Apple deserve to trade at a forward P/E ratio of around 27 here? Yes, the company has steady earnings due to the hardware nature of its business. Still, the short answer regarding its wild P/E ratio is that the company only deserves such a lofty valuation if it can produce significant growth.

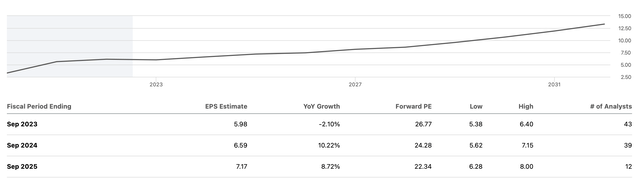

EPS Estimates – Limited Growth and High Multiple

EPS estimates (StockCharts.com )

Consensus estimates imply that Apple should see about a 2% YoY drop in EPS this year, delivering around $6. However, Apple missed its revenue and EPS estimates last quarter. The company provided $1.88 in EPS (a cent miss), which missed its revenue estimate by $4.5 billion. This negative earnings trend may continue due to the challenging macroeconomic environment, leading to more margin pressure, decreased growth, and lower profitability. Therefore, we may see Apple’s P/E multiple contract to around 20 in the coming years and quarters. If Apple should earn around $5.50-6 in EPS in 2023, a more reasonable stock price would be around the $120 level. This point would equate to around a 20 P/E multiple, enabling the stock to become a strong buy again.

iPhone 15 – Why I’m Yawning Here

The iPhone 15 is coming out, and my wife says I should upgrade. However, my iPhone 12 Pro Max works perfectly fine; I’ve had it for fewer than two years. Moreover, I plan to upgrade once I utilize my iPhone for three years, which seems reasonable considering its relatively high cost. Moreover, what am I upgrading for? The iPhone 15 Pro Max has very few noticeable differences (if any) from my iPhone 12 Pro Max model.

When will Apple do something notably different with the iPhone? Why not add a “hologram” or another futuristic feature? Furthermore, as the trend for bigger screens grows, Apple can get away with increasing the size of its Pro Max line, up from its current 6.7-inch to a larger 7.1-inch size.

It sounds big, but Apple could make the iPhone thinner, improving the overall design and staying ahead of the curve in the smartphone industry. The bottom line is that Apple needs to innovate, and changing the iPhone’s colors once a year will not cut it anymore. The iPhone needs a significant refresh, as it remains the company’s primary cash cow.

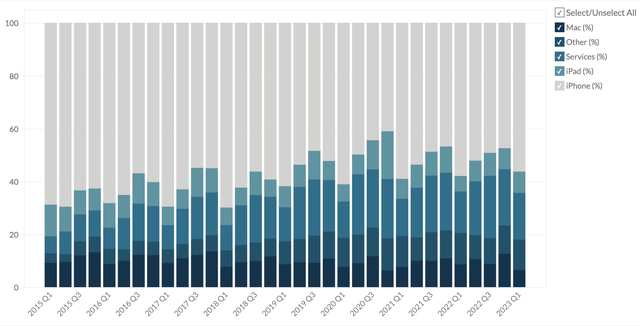

Apple’s Revenues by Segment %

iPhone sales accounted for approximately 56% of total sales last quarter, and the all-important segment continuously accounts for a significant (50% or more) portion of the company’s revenues. Apple’s second most significant segment services accounted for approximately 18% of all revenues last quarter.

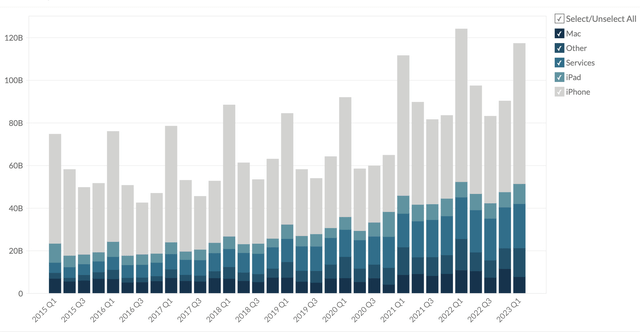

Apple’s Revenues

Revenues $ (Businessquant.com)

iPhone segment revenues came in at $65.78 billion last quarter. While this figure is mind-bending, it represents an 8.2% decline YoY. Therefore, we see the iPhone segment struggling to maintain revenues around previous highs. Moreover, we may see future price cuts pressuring revenues further. Furthermore, worsening margins due to high inflation and increasing labor costs should lead to lower profitability as Apple advances in the coming quarters.

Apple – Cannabalizing Sales

What happened to increased efficiency? We see Apple’s units cannibalizing sales recently. First, the regular iPhone Max model should go. Apple’s more prominent, cheaper iPhone deters potential Pro Max sales. If consumers shop for a cheaper iPhone, the “regular” version is fine. However, I suggest increasing the screen size from its current 6.1 inches to about a 6.4-6.5 inch screen size, going with the general trend for larger screens as the iPhone industry evolves moving forward.

Also, I’m concerned with the new MacBook Airs taking sales from higher-end products. The company’s Air MacBooks are packed with performance that rivals some higher-end MacBook Pros. Of course, MacBook Pros are more expensive than their Air counterparts. My concern is that some consumers may lean toward the company’s cheaper Air products instead of dishing out the more expensive MacBook Pro side. Consumers may pay around $1,350 for a solid MacBook Air version rather than nearly twice as much for a 14-inch MacBook Pro with similar specs.

The Bottom Line: Apple is Still Dead Money Here

Apple Inc. is a fantastic company making excellent products. Unfortunately, Apple’s stock has become very expensive in recent years. Also, the company lacks clear catalysts to propel its stock price higher. At 27 times forward-EPS estimates, Apple should be growing double-digit sales, but the company’s most significant segment sales are in decline. Furthermore, Apple missed its recent earnings report and could continue disappointing estimates due to worsening margins, higher costs, and lower-than-anticipated profitability. Therefore, we could see Apple’s P/E ratio contract in the coming quarters, leading to a buying opportunity in the $110-120 range. Moreover, if Apple Inc. ever gets back to $100 or lower, the stock’s a gift, and I’m backing up the truck.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I am long a diversified portfolio with hedges.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Are You Getting The Returns You Want?

- Invest alongside the Financial Prophet’s All-Weather Portfolio (2022 17% return), and achieve optimal results in any market.

- Our Daily Prophet Report provides crucial information before the opening bell rings each morning.

- Implement our Covered Call Dividend Plan and earn an extra 40-60% on some of your investments.

All-Weather Portfolio vs. The S&P 500

Don’t Wait! Unlock Your Own Financial Prophet!

Take advantage of the 2-week free trial and receive this limited-time 20% discount with your subscription. Sign up now, and start beating the market for less than $1 a day!