Summary:

- While Apple may be expensive, I believe future prospects justify the current prices.

- With the Federal Reserve expected to finish raising rates in the next FOMC, Apple could benefit from the weakening of the US dollar.

- As the industry recovers and Apple releases new products with N3 fabrication in 2023, demand could quickly return.

Nikada/iStock Unreleased via Getty Images

Introduction

In recent weeks, some investors have pointed out weaknesses and risks surrounding Apple (NASDAQ:AAPL). The major factor contributing to this argument was the relatively high valuation in times of weak consumer discretionary markets. Companies like Samsung (OTCPK:SSNLF) showed weak earnings leading to the conclusion Apple’s relatively high valuation is unsustainable in the near term. However, I would like to argue otherwise. While I also agree that Apple’s current valuation is pricey, I think this is the case because investors are looking into the future making the bearish argument less appealing. It is true that consumer discretionary goods’ demand is at record lows today, but much pieces of evidence from semiconductor producers and consumer discretionary companies have been pointing to a return to sequential growth toward the second half of 2023. Further, as I have mentioned in my previous article, I continue to believe that forex headwinds will turn into tailwinds as the Federal Reserve finishes its interest rate hikes. Finally, combining the demand returning potential and the forex headwinds easing, Apple’s new products expected to release later in 2023 with new fabrication details are expected to create a synergy in the company’s portfolio; therefore, I am maintaining my buy rating on Apple.

Bearish Argument

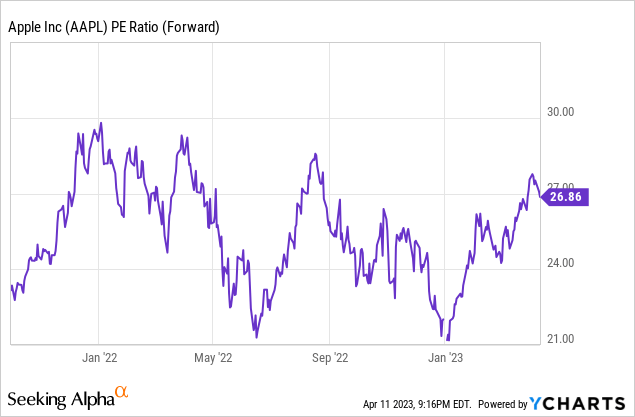

Apple has a pricey valuation today. As the chart below shows, the forward price-to-earnings ratio indicates that the company’s valuation multiples are near pandemic highs when stocks were in a bull market supported by strong monetary and fiscal policies.

Valuation is relative. What is too expensive for some may be reasonably priced or even cheap for others. In the case of Apple, some investors with bearish views argue that the valuation is expensive because of the current volatile macroeconomic conditions that have led to continued weakness in the consumers’ demand for electronics such as phones, laptops, tablets, and more. These views are backed by multiple pieces of evidence. For example. recently, IDC reported that Apple’s Mac sales decreased by 40% year-over-year as the global PC market contracted by 29% year-over-year. Beyond the PC market, the memory chip market and consumer electronics market weakness has been showcased by Samsung. Samsung is not only expecting to report an operating profit of only 0.5-0.7 trillion Korean won compared to 4.31 trillion won in the previous quarter, but the company has also announced a production cut for its memory chips, which came as a surprise since the company, in the previous quarter, said that there will be no cuts.

Compiling this evidence and more, I believe the argument for Apple being expensive due to the worsening market weakness to be reasonable. It seems as if the consumer demand for electronics is continuing to weaken without a rebound; however, I have different interpretations of the current situation.

My Views

The consumer electronics industry has been seeing declining demand for about a year now, yet Apple, since early 2023, has been seeing an increasing stock price. Everybody knew that the market was weak and consumer demand for electronics was declining; I believe this phenomenon happened due to positive future expectations. In recent months, there has been rising evidence of the consumer electronic market recovery that has led to optimism.

First, looking at the same data from Samsung, I interpreted the company’s decision to cut memory chip output slightly differently. Instead of viewing it as a response from Samsung to a continually weakening demand, I saw it as Samsung using it as a tool to pull memory chip demand forward. To better understand the potential reasoning behind Samsung’s decision, we have to look at Micron’s (MU) future expectations. Micron, as demand recovers, is expecting a “sequential revenue growth in [the] quarterly results” in the coming quarters. Thus, Samsung’s actions could be interpreted as a method to pull demand forward since Samsung is the last company to call supply constraints in the memory chip market. OEMs using the memory chip market now expect demand to recover, but Samsung limiting the supply, may motivate these OEMs to order memory chips earlier than their expected time schedule. My article on Micron explains this matter in more detail. Thus, I had a positive view of the consumer electronics market.

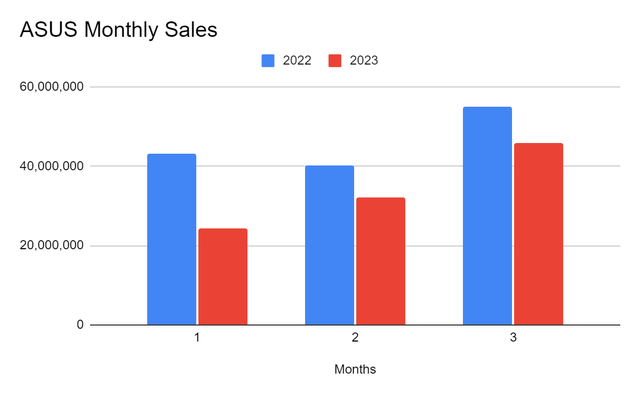

Further, consumer electronics companies such as MSI and ASUS has been reporting strong sequential growth in 2023 showing that demand has been returning.

[Source]

Starting with ASUS, a company known for laptops and computer component sales, all three months in 2023 have been seeing sequential growth with year-over-year numbers getting better from -39% in January to -13% in February and -10% in March.

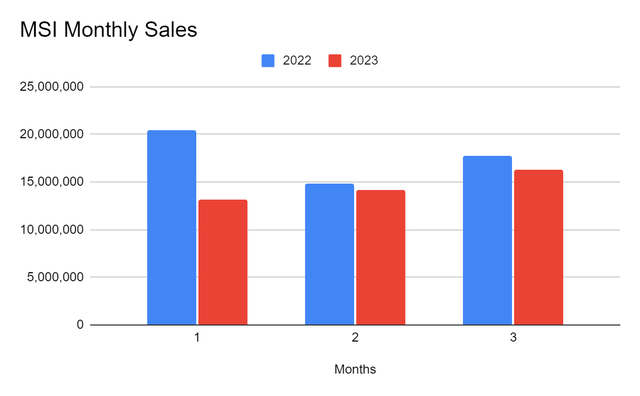

MSI, known for consumer electronics and computer components, reported data that showed a similar trend happening. As the chart below shows, all three months in 2023 saw sequential growth with year-over-year declines moderating from -35.67%, -22.66%, and -17.79% in January, February, and March, respectively.

[Source – From Investor Relations Page]

As such, considering that consumer electronics and computer component sellers are seeing a recovery along with Micron and potentially Samsung expecting a future recovery, I believe it is reasonable to argue that while the industry may be seeing a slow demand today, the consumer electronics market is expecting optimism in the latter half of 2023 supporting Apple’s high valuation. Each iPhone, MacBook, and iPad all have a memory chip called RAM, so memory chip makers’ view of improving sequential growth could be a precursor to Apple products’ demand. The stock market tends to look at future prospects; thus, the brighter future prospects should be viewed over grim past and present conditions.

Currency and Apple

Beyond seeing a recovery in the consumer electronics industry, I believe overall market sentiment and the foreign exchange market to positively benefit Apple in the coming two to three months.

According to the median forecast released by the Fed, just one more rate hike of 0.25% is expected before the FED calls an end to rate hikes and accessing the impact of the hikes. This comes as inflation, in the past few months, showed signs of easing. Thus, the currently predicted move by the FED could finally put an end to a strong dollar market making a favorable currency market for Apple. Apple has already raised prices in key markets last year in reaction to the strength of the dollar; thus, if the strength of the dollar eases, Apple could benefit from either instantiating more demand through lowering prices or benefiting from a tailwind created by the currency weakness compared to the previous year.

N3 and Apple

Apple’s new products produced with TSMC’s (TSM) newest 3nm, or N3, fabrication will likely drive demand for a vast array of products in the second half of 2023 as the demand recovers.

Multiple rumors including Macworld, CNET, MacRumors, and more are suggesting Apple release new MacBook and iPad line-ups as well as the annual iPhone and Apple Watch release. These releases could be more enticing for consumers than 2022 as Apple secured a deal with TSMC for its 3nm fabrication. This is significant as both Apple’s M1 and M2 chips used the same 5nm fabrication, a meaningful boost in performance was not seen, which was also the case for A15 and A16 bionic chips. Thus, considering that the N3 process will “offer up to 70% logic density gain, up to 15% speed improvement at the same power and up to 30% power reduction at the same speed as compared with N5 technology” according to TSMC, it may be likely that newest Apple products in 2023 will do a better job at enticing its loyal customers to switch to the newest products.

Valuations

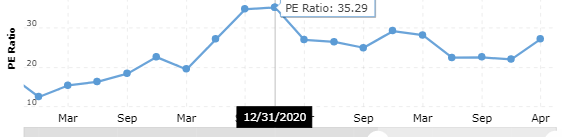

Finally, Apple’s valuation is not expensive in historical terms. The company currently has a forward valuation multiple of about 26.7. This number is far below the company’s historically high PE ratio during the pandemic times when the market sentiment surrounding consumer electronics and Apple products was positive. Thus, considering that the market is showing signs of sequential growth and moving toward a more positive sentiment, I believe it is reasonable for Apple to receive a premium.

Macrotrends

[Source]

Summary

Apple’s valuation could be seen as expensive when looking at the past and current state of the consumer electronics market, but looking at the recovery progress and future expectations laid out by memory chip manufacturers along with Apple’s product progress and changing market dynamics, I believe it to be more reasonable to argue that Apple’s current pricey valuation is justified. Therefore, I continue to maintain a buy rating on Apple stock.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AAPL,MU either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.