Summary:

- Merck is facing the LOE on Keytruda before the end of the decade, which makes up more than 35% of the company’s revenue.

- The company has an impressive portfolio of assets, but its pipeline is sparse and its valuation is higher.

- The company’s Prometheus acquisition is incredibly promising and the premium the company is willing to pay highlights the strength of the asset.

- We expect the company to continue its growth and future shareholder returns.

JasonDoiy

Merck (NYSE:MRK) is an American multinational pharmaceutical company worth just a hair under $300 billion. The company has a dividend yield of just over 2.5% and a higher valuation with an incredibly well distributed portfolio of assets. As we’ll see throughout this article, the company’s impressive assets and Prometheus acquisition will enable strong shareholder returns.

Prometheus Biosciences Acquisition

The company has announced a $11 billion acquisition of Prometheus Biosciences. That’s a roughly 75% premium to the company’s prior share price.

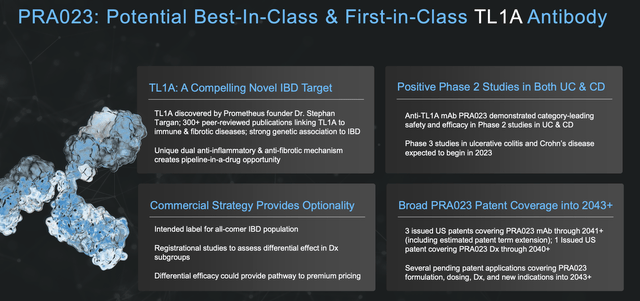

However, there are some major benefits to the acquisition. The most impressive is Prometheus Biosciences’ candidate PRA023. The drug is expected to be able to potentially help dramatically with IBD and recently moved into Phase 3 studies on the success of its Phase 2 performance. There’s still a non-zero chance the candidate fails.

PRA023 – Prometheus Biosciences Investor Presentation

The drug’s most recent Phase 2 trial was for UC (Ulcerative Colitis) which is one example of IBD. The company is looking for new indications. The drug has broad patent protection into 2043 and we can see strong sales by the end of the decade. The company sees a strong opportunity to continue its growth and is planning to announce a fourth indication this year.

It’s worth noting Merck is paying a substantial premium here over the market’s valuation. Last year, before the Phase 2 results announcement, the company had a $2 billion market capitalization. Now it’s $5.5 billion. Merck clearly needs the drug to pan out, and if it doesn’t, shareholders can kiss the 5% of their equity that was spent goodbye.

Still, the potential is huge. Forecasts are for $4.3 billion in peak sales for the drug, versus the company’s Keytruda currently earning $22 billion. With Keytruda loss of exclusivity in 2028, this is a drug that could replace Keytruda should it succeed. In that case, it will very much be worth the investment for Merck.

Given the performance in Phase 2 trials, we think it’s a strong investment, but with a hefty premium.

Merck 2022 Performance

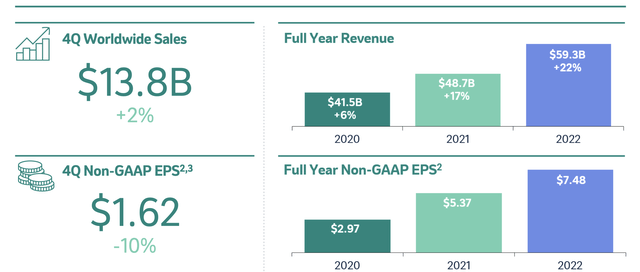

Merck has achieved strong 2022 performance, which we think highlights the company’s strength.

Merck 2022 Performance – Merck Investor Presentation

The company achieved just under $14 billion in FY 2022 revenue, along with just under $60 billion in FY revenue, a massive 22% YoY increase. The company’s FY Non-GAAP EPS was just under $7.5, a non-GAAP P/E of 15. Human health drove roughly 90% of the company’s revenue while animal health drove the other 10%.

That’s incredibly strong performance for the company and helps to highlight the strength of its assets.

Merck Pipeline Improvements

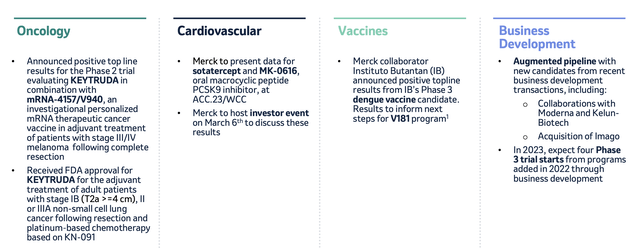

The company has a strong pipeline worth of assets, although its portfolio is concentrated to Keytruda.

Merck Pipeline – Merck Investor Presentation

The company’s cancer business is its core with Keytruda which makes up roughly 35% of the company’s revenue given its size. The company has recently announced positive results from a number of trials. The company is working in other segments such as cardiovascular and vaccines, where the company’s Gardasil continues to be a leader.

The company recently made another $1.4 billion acquisition of Imago. In 2023, the company expects 4 Phase 3 trial starts and has a number of exciting other candidates and pipelines that will enable continued performance. PRA-023 is a massive candidate here that’ll enable the company to substantially bolster its pipeline.

Fortunately, it still has half a decade before Keytruda expires but it needs to continue to work on its pipeline.

Merck 2023 Guidance

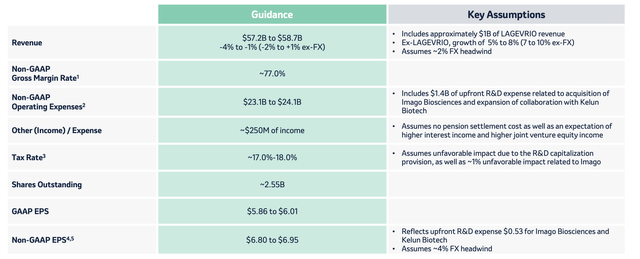

Merck’s guidance shows the strength of its portfolio, which should support continued shareholder returns.

Merck 2023 Guidance – Merck Investor Presentation

The company’s 2023 guidance shows its potential for continued success. The company is aiming for $58 billion in revenue, with $1 billion in Lagevrio revenue, a COVID-19 treatment that’s seeing revenue decrease substantially. The company’s growth is much stronger (5%-8%) when ignoring the decrease in Lagevrio revenue, which is a one-time event.

The company expects $24 billion in non-GAAP operating expenditures, influenced by recent acquisitions. At the end, it expects roughly $6.9 in non-GAAP EPS and $5.95 in GAAP EPS, a P/E of just under 20%. That’s a fairly lofty valuation, but highlights the company’s long history of growth and ability for that growth to continue.

Thesis Risk

The largest risk to our thesis is the success of PRA-023. We expect that the drug, based on its Phase 2 trials, will be able to generate strong revenue and make up for the loss of Keytruda. However, there’s no guarantee that it pans out, and if it doesn’t the company will still have LOE risk but be worth 5% less. In the pharmaceutical industry, that’s a very likely result.

Conclusion

Merck has an exciting and impressive portfolio of assets. The company paid a lofty premium for its acquisition of Prometheus, however, with the potential for success, the company has one of the few potential drugs that could replace Keytruda. Keytruda currently makes up more than $20 billion of the company’s revenue on an annualized basis.

Going forward, we expect Merck to continue driving substantial shareholder returns. In the short-intermediate term, Keytruda will continue to be a blockbuster drug for the company driving substantial revenue and profits. In the long-term acquisitions and continued trials can help the company to drive long-term returns. Let us know your thoughts in the comments below.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MRK either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

You Only Get 1 Chance To Retire, Join The #1 Retirement Service

The Retirement Forum provides actionable ideals, a high-yield safe retirement portfolio, and macroeconomic outlooks, all to help you maximize your capital and your income. We search the entire market to help you maximize returns.

Recommendations from a top 0.2% TipRanks author!

Retirement is complicated and you only get one chance to do it right. Don’t miss out because you didn’t know what was out there.

We provide:

- Model portfolios to generate high retirement cash flow.

- Deep-dive actionable research.

- Recommendation spreadsheets and option strategies.