Summary:

- In this article, we will present a comparative analysis of these two companies, one of which is becoming more and more attractive to long-term investors.

- However, excluding COVID-19 products from the calculations, AstraZeneca’s revenue was $10,388 million in Q4 2022, up only $243 million from Q4 2021.

- In our estimation, Calquence and Enhertu are AstraZeneca’s gems in the multi-billion-dollar oncology drugs market.

- Moreover, we are increasing the minimum price range noted in the previous article, “What To Expect From Pfizer In The Post-COVID-19 Era,” to $37 per share, at which we will start buying shares in the company.

- Pfizer’s dividend yield is 3.98%, well above AstraZeneca’s dividend yield of 2.01%.

VioletaStoimenova/E+ via Getty Images

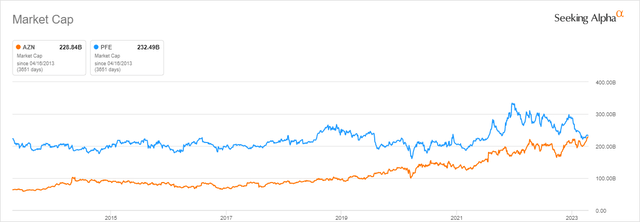

It has been almost nine years since Pfizer (NYSE:PFE) lost a bitter takeover battle to take over AstraZeneca (NASDAQ:AZN), a British-Swedish pharmaceutical company and one of the leaders in the fight against cancer. In those days, Pascal Soriot, in his second year as CEO, was able to keep AstraZeneca from falling off a cliff thanks to innovative R&D and M&A strategies that were able to limit the damage from the loss of exclusivity of some of the blockbusters. What’s more, AstraZeneca’s management has been able to replace obsolete mass-market pills with a new generation of drugs to treat cancer, cardiovascular disease, and rare diseases. As a result, after the unsuccessful attempt to carry out the takeover of AstraZeneca for $118 billion, the targeted company’s capitalization is almost as high as the capitalization of Pfizer now.

Source: Seeking Alpha

In this article, we will present a comparative analysis of these two companies, one of which is becoming more and more attractive to long-term investors.

Financial position of Pfizer vs. AstraZeneca

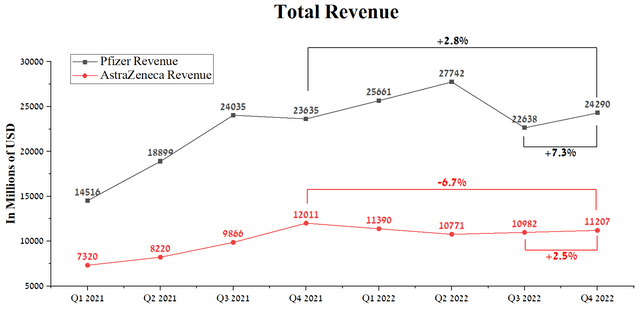

Pfizer’s revenue was $24,290 million in Q4 2022, up 7.3% QoQ but a more modest 2.8% YoY growth. At the same time, AstraZeneca showed a worse trend, which earned $11,207 million in the fourth quarter, showing a decrease of 6.7% compared to the 4th quarter of 2021.

Source: Author’s elaboration, based on Seeking Alpha

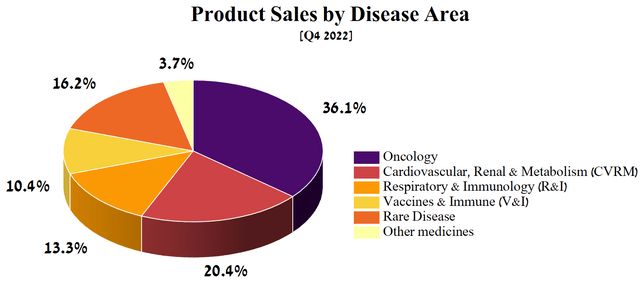

Pfizer and AstraZeneca have large, well-diversified portfolios of medicines and vaccines, but not all of them are critical to the future development of their business and increasing the share of their products in the highly competitive pharmaceutical industry. Medicines targeted at oncology, cardiovascular, renal, and metabolic (CVRM) diseases accounted for more than half of the Anglo-Swedish drugmaker’s total revenue in Q4 2022.

Source: Author’s elaboration, based on quarterly securities reports

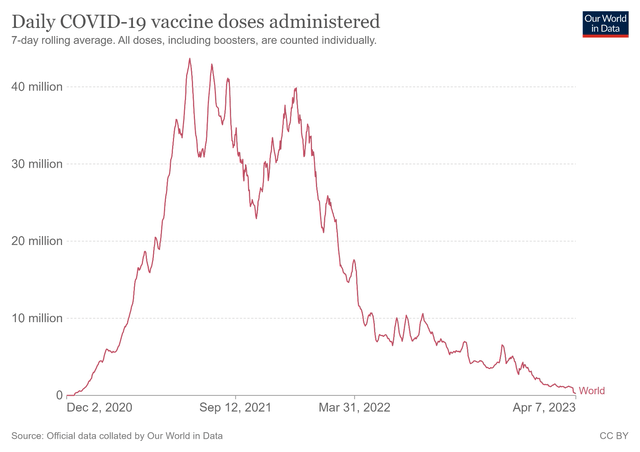

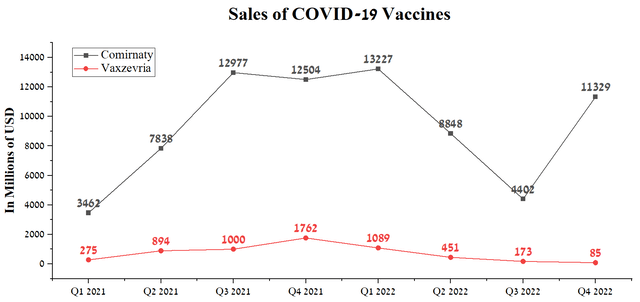

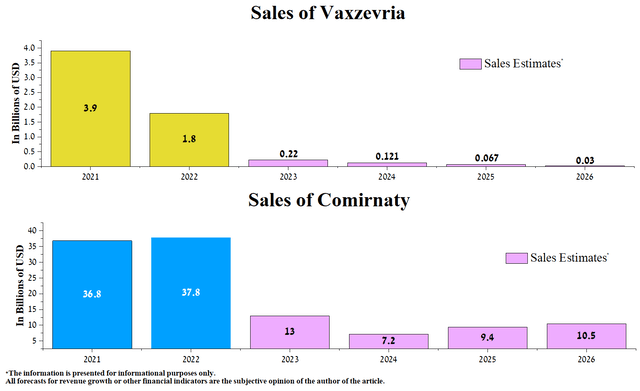

But despite revenue growth in these two therapy areas, AstraZeneca’s year-over-year decline in overall revenue was mainly due to a sharp drop in demand for Vaxzevria, a viral vector vaccine against COVID-19 developed in collaboration with the University of Oxford. Vaxzevria sales were $85 million in Q4 2022, down 95.2% from the previous year. We believe total revenue from the COVID-19 vaccine will continue to decrease substantially due to the completion of many of the contracts signed during the pandemic and the sharp decline in people’s desire to be vaccinated following the cancellation of the COVID-19 vaccine mandate.

Source: Official data collated by Our World in Data

In addition, the drop in Vaxzevria sales was caused by increased competition from mRNA vaccines produced by Moderna and Pfizer in partnership with BioNTech (BNTX). mRNA-based vaccines against COVID-19 have competitive advantages in terms of efficiency and significantly less time spent on developing boosters against new variants relative to AstraZeneca’s product. Pfizer’s Comirnaty sales were $11,329 million in Q4 2022, just slightly short of the figures seen in 2H 2021, a time of peak fear and tight restrictions imposed to combat the coronavirus. The main reasons for continued high sales are multi-billion-dollar contracts with the US government and the European Union’s approval of an Omicron BA.4/BA.5-adapted bivalent vaccine for children aged 5-11 years.

Source: Author’s elaboration, based on quarterly securities reports

We expect the average annual drop in Vaxzevria sales from 2024 to 2025 will be 45%, and starting from 2026, the revenue from this product will likely be in the mid-double-digit million range. At the same time, sales of Pfizer’s vaccine will decline at a high rate between 2023 and 2024 due to the completion of government contracts and an oversupply of vaccine doses in warehouses caused by low interest from the public to be vaccinated. One of the factors that may slow down the negative trends in the company’s COVID-19 vaccine sales is the transition of Comirnaty sales from government contracts to traditional commercial market sales, which we estimate will lead to an increase in the cost of a single dose of the vaccine from $30.50 per dose to $115 and start commercialization of combined influenza/COVID-19 vaccine candidate from 2025.

Source: Created by author

However, excluding COVID-19 products from the calculations, AstraZeneca’s revenue was $10,388 million in Q4 2022, up only $243 million from Q4 2021. The low growth rates of this financial indicator were caused by the ambiguous dynamics of sales of anti-cancer drugs and products aimed at combating chronic respiratory and immune diseases. However, we believe the situation will continue to improve with new launches and increased patient access to Enhertu, Tagrisso, Imfinzi, Farxiga, and Calquence.

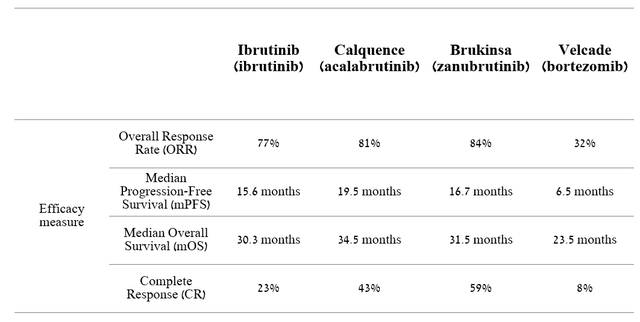

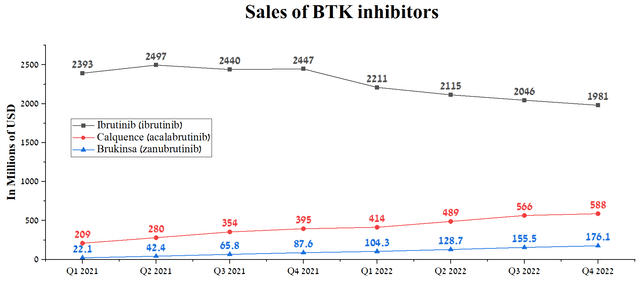

In our estimation, Calquence and Enhertu are AstraZeneca’s gems in the multi-billion-dollar oncology drugs market. Calquence (acalabrutinib) is a medicine used to treat certain types of blood cancer, such as chronic lymphocytic leukemia (CLL), small lymphocytic lymphoma (SLL), mantle cell lymphoma (MCL), and whose mechanism is based on the inhibition of Bruton’s tyrosine kinase (BTK) activity, which plays an essential role in B cell receptor (BCR) signaling pathways. Several small molecule BTK inhibitors are approved, including AstraZeneca’s Calquence, AbbVie/Johnson & Johnson’s Imbruvica, BeiGene’s Brukinsa, Eli Lilly’s Jaypirca, InnoCare Pharma Limited/Biogen’s orelabrutinib. But at the same time, AstraZeneca’s medicine shows excellent safety profile data and outperforms competitors in such vital indicators as overall survival and progression-free survival in patients with relapsed or refractory mantle cell lymphoma (R/R MCL).

Source: Author’s elaboration, based on quarterly securities reports

Ultimately, these benefits translate into an increase in the proportion of new patients who choose Calquence as a treatment for blood cancer. So, for example, AstraZeneca’s product sales amounted to $588 million in the 4th quarter of 2022, showing an increase of 48.9% compared to the previous year. That said, we believe that Calquence’s revenue growth rate will continue in the coming quarters due to its approval in China at the end of March 2023 and increased demand in Europe and the US.

Source: Author’s elaboration, based on quarterly securities reports

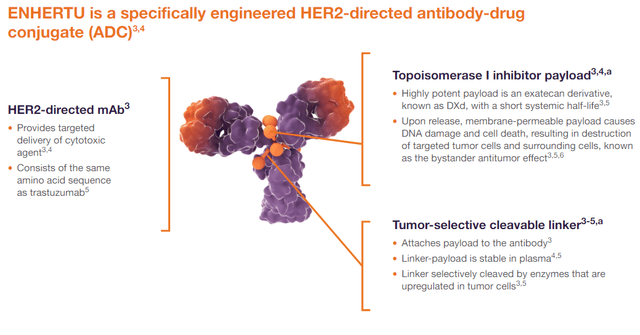

The second medicine to tie with blockbusters like Pfizer’s Ibrance and Roche Holding’s Avastin in terms of sales is Enhertu (trastuzumab deruxtecan), developed in partnership with Daiichi Sankyo (OTCPK:DSNKY). Enhertu is an antibody-drug conjugate (ADC) targeted therapy approved for treating certain breast and stomach cancers. ADCs consist of an antibody targeting a specific cancer cell protein and a chemotherapy drug linked to the antibody. Enhertu’s antibody targeted at HER2 is trastuzumab, while the chemotherapy drug is a derivative of exatecan, which is a topoisomerase I inhibitor. Inhibition of this enzyme contributes to interrupting DNA replication in cancer cells, with their subsequent death.

Source: Official website of Enhertu

On July 8, 2008, Seagen (SGEN) and Daiichi Sankyo entered into an agreement to develop antibody-drug conjugates that target an antigen found in several types of solid tumors. After its completion in 2015, the Japanese company continued to develop its ADCs.

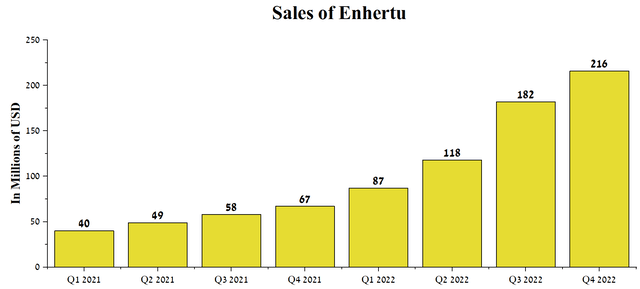

In 2020, Seagen filed a lawsuit in the U.S. District Court for the Eastern District of Texas against Daiichi Sankyo, alleging that Enhertu infringed on patent No. 10,808,039. Although the jury found that the patent had been infringed, the award was modest, amounting to only $41.82 million. Moreover, Seagen’s claim to pay royalties on future Enhertu sales until 2024, when the patent expires, was denied. We estimate that the decision of the Texas Federal Jury is a win for Daiichi Sankyo and AstraZeneca, as Enhertu sales are growing at a substantial rate QoQ to $216 million in Q4 2022. That said, we expect peak sales of this drug to be $7.2 billion by 2028, driven by increased indications and share for breast cancer therapy.

Source: Author’s elaboration, based on quarterly securities reports

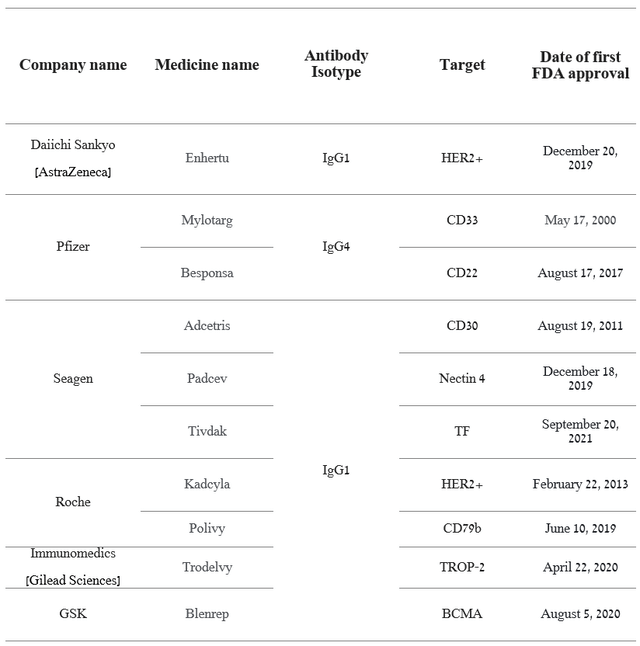

Overall, Pfizer and Seagen are pioneers in ADC technology, and Mylotarg (gemtuzumab ozogamicin) is the first in this class of biopharmaceutical medicines to be approved by the FDA for treating patients with CD33-positive AML. Currently, several drugs from this class are approved by the FDA, such as Gilead Sciences’ Trodelvy, GSK’s Blenrep, Roche Holding’s Polivy, and more.

Source: Author’s elaboration, based on quarterly securities reports

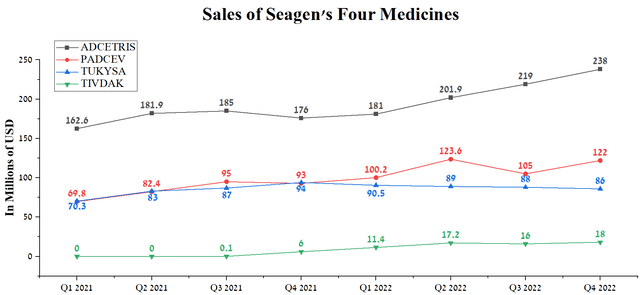

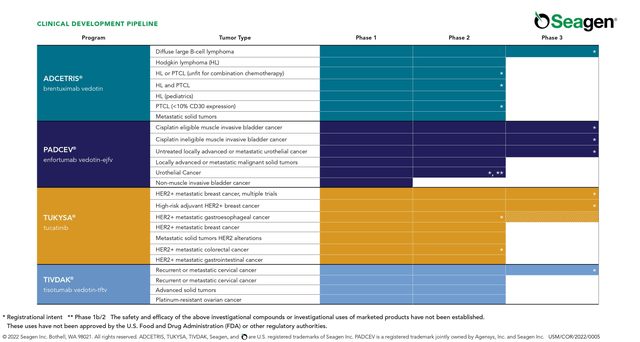

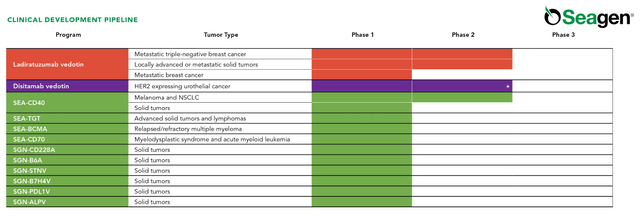

On March 13, 2023, Pfizer announced the acquisition of Seagen for $43 billion, increasing its portfolio by three regulatory-approved drugs using ADC technology and Tukysa (tucatinib), a tyrosine kinase inhibitor.

Source: Author’s elaboration, based on quarterly securities reports

In general, sales of these medicines have not yet shown outstanding dynamics and, in our estimation, the situation will start to improve dramatically from the second half of 2024, thanks to the label expansion for Padcev (enfortumab vedotin), increased patient access to the company’s drugs after recent approvals, and Pfizer’s innovative marketing strategies.

Source: Seagen Pipeline

In addition, Pfizer is acquiring several product candidates targeting metastatic urothelial cancer, metastatic triple-negative breast cancer, R/R metastatic solid tumors, and more.

Source: Seagen Pipeline

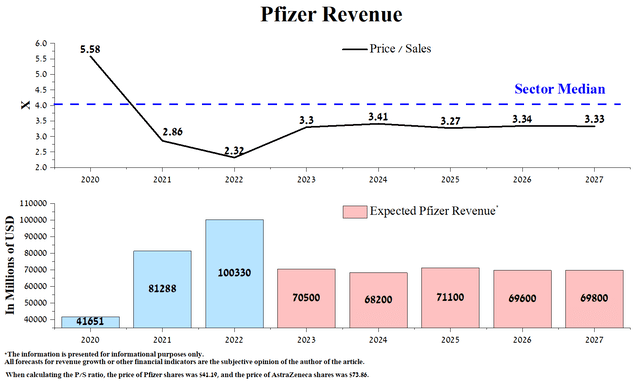

According to our model, the acquisition of Seagen will not close until early 2024, and as a result, we expect Pfizer’s revenue to drop significantly in 2023 to $70.5 billion, down 32.7% from 2022 due to a sharp decline in demand on COVID-19 products. At the end of 2022, the company’s P/S ratio reached a record high of 2.32x, which is 41.9% below the average over the past five years and significantly below the healthcare sector. Overall, we believe that from 2024 to 2027, the company’s revenue will be stable due to the launch of new products that will offset the decline in sales of blockbusters due to the loss of their exclusivity.

Source: Created by author

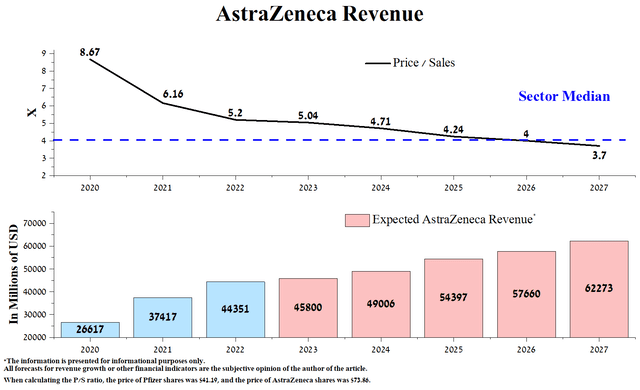

For AstraZeneca, we expect higher revenue growth from 2024. In 2023, the increase in this financial indicator will be only 3.3% due to a decrease in sales of the COVID-19 vaccine and almost no revenue from Evusheld, a drug used to prevent COVID-19 due to its withdrawal from sales in the United States. However, after a transitional period, AstraZeneca’s revenue will again grow in double-digit percentages due to introducing its products into medical practice and becoming the ‘gold standard’ for many of them, thanks to the incredible efficiency data. AstraZeneca’s current P/S ratio of 5.2x is above the healthcare sector average, and we expect it to fall below 4x only by 2027.

Source: Created by author

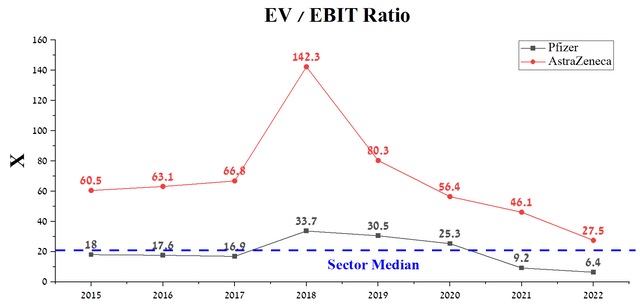

Pfizer’s EV/EBIT ratio is 6.4x, significantly lower than the healthcare sector average, but more importantly, this financial ratio is 76.7% lower than AstraZeneca’s. One of the main reasons for this difference is Wall Street’s understanding that Pfizer’s EBIT will continue to decline in at least the coming quarters due to falling sales of the COVID-19 vaccine, Xeljanz, Ibrance, and Seagen’s negative EBIT, which will have a temporary negative effect on the company’s financial position. While AstraZeneca’s EBIT margin, combined with revenue, is growing, and we estimate that this rate will increase due to new launches and increased patient access to drugs aimed at treating cancer and rare diseases, which will ultimately lead to a decrease in the company’s EV/EBIT ratio from current 27.5x to 9.1x by 2026.

Source: Author’s elaboration, based on Seeking Alpha

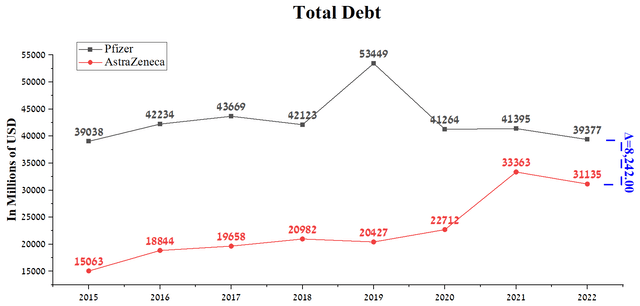

AstraZeneca’s total debt was $31,135 million at the end of 2022, down $2,228 million year-over-year thanks to stable cash flow and the successful integration of Alexion. In comparison, the total debt of Pfizer is $8,242 million more than the British-Swedish company. Despite this, Pfizer has reduced its total debt by about $2 billion despite several significant acquisitions that have strengthened its position in the fast-growing rare disease and neuroscience treatment markets. However, investors should consider Pfizer’s acquisition of Seagen, which will be financed with $31 billion in long-term debt, which could be a negative factor for Pfizer’s financial position. Generally, we believe debt servicing risks will be minimal due to the company’s extensive drug portfolio, high EBITDA margins, and modest CapEx requirements.

Source: Author’s elaboration, based on Seeking Alpha

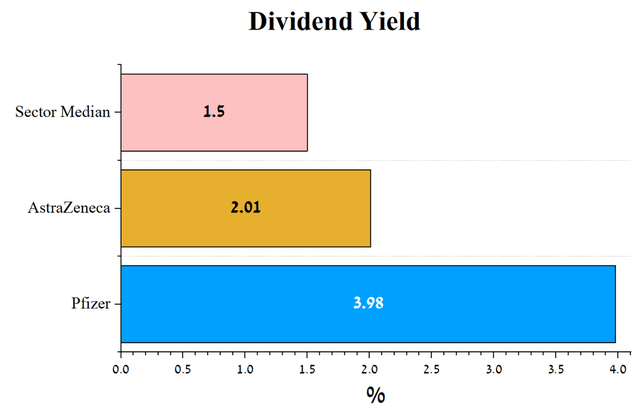

Pfizer’s dividend yield is 3.98%, well above AstraZeneca’s dividend yield of 2.01%. Pfizer’s dividend yield is well above the average for the healthcare sector and other industry mastodons such as Apple (AAPL), Exxon Mobil (XOM), and JPMorgan (JPM). In addition to the prospects for developing the company’s product candidates already discussed in this article, this is another key factor that makes Pfizer an attractive asset for investors interested in long-term investments.

Source: Author’s elaboration, based on Seeking Alpha

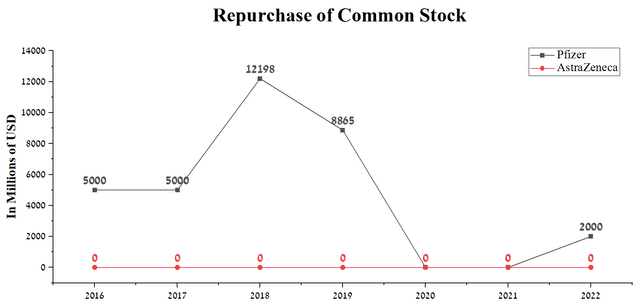

But unlike AstraZeneca’s management, Albert Bourla, as CEO of Pfizer, resorts to using the company’s share buyback policy. In 2022, Pfizer repurchased $2 billion of shares thanks to stable cash flow and still has $3.3 billion of reserves set aside for this purpose. On the other hand, AstraZeneca has yet to spend a cent on share buybacks since Q4 2012, making it less investment-attractive relative to Pfizer in this metric.

Source: Author’s elaboration, based on Seeking Alpha

Conclusion

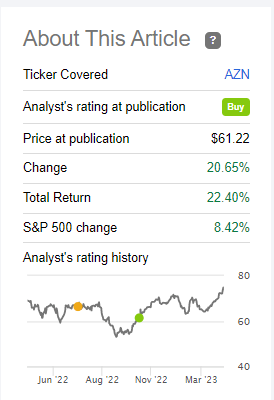

Since the publication of our last article on AstraZeneca, the company’s share price has risen by more than 20%, outperforming many of the leaders in the pharmaceutical industry and the S&P 500 (SPY).

Source: Nathan Aisenstadt – Seeking Alpha

However, we believe that the shares of the British-Swedish company are starting to look overheated, and therefore the potential for further growth is still limited relative to Pfizer. At the same time, although they slightly increased the risks associated with servicing Pfizer’s debt after the acquisition of Seagen, the company received promising drugs and product candidates that can not only offset the damage from the imminent loss of exclusivity of some of the blockbusters but also improve the margins of its business. Moreover, we are increasing the minimum price range noted in the previous article, “What To Expect From Pfizer In The Post-COVID-19 Era,” to $37 per share, at which we will start buying shares in the company.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This article may not take into account all the risks and catalysts for the stocks described in it. Any part of this analytical article is provided for informational purposes only, does not constitute an individual investment recommendation, investment idea, advice, offer to buy or sell securities, or other financial instruments. The completeness and accuracy of the information in the analytical article are not guaranteed. If any fundamental criteria or events change in the future, I do not assume any obligation to update this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.