Summary:

- Coca-Cola’s commitment to innovation, diversification, and market expansion, particularly in Latin America and Asia-Pacific, offers significant growth opportunities.

- KO’s strong relationships with bottlers and distributors bolster innovation, product rollout, marketing, and go-to-market strategies.

- With its extensive global manufacturing and distribution network, KO achieves scale efficiency, providing a competitive edge over smaller peers.

- Consistent Shareholder Returns: KO rewards shareholders with regular cash dividends and share buybacks, offering a current dividend yield of 2.8%.

- I value the shares at $65.

Scott Olson/Getty Images News

The Coca-Cola Company (NYSE:KO) has shown resilience and adaptability through its diversified portfolio, strong brand recognition, and innovative strategies. In this article, I will explore KO’s growth prospects, particularly in the Latin America and Asia-Pacific regions, its competitive advantages, and the potential risks it faces. The shares seem fairly priced.

Strong Brand Portfolio

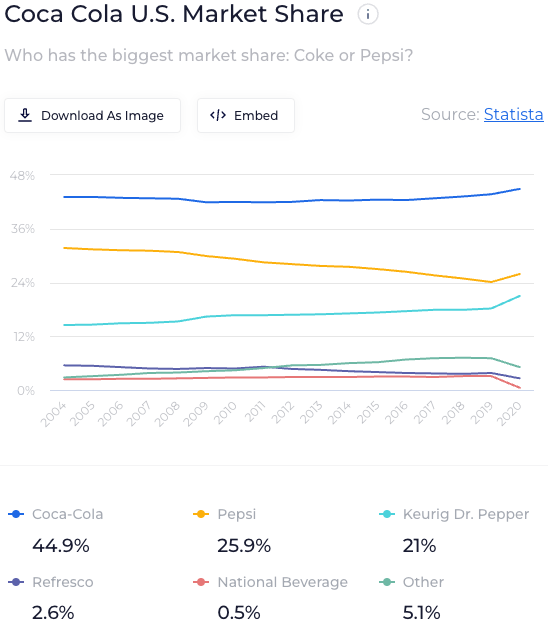

KO possesses a strong collection of renowned brands that connect with consumers. In 2022, KO’s brand was worth $98 billion. KO has fostered a unique bond with multiple generations of consumers, enabling it to excel in the CSD category. In 2022, KO secured a 44.9% market share in the US market, considerably outpacing its primary rival, PepsiCo (PEP), which held a 25.9% market share. If you’re interested in reading my perspective on PEP, you can find it here.

wallstreetzen.com

KO’s brand appeal results in a steady price premium over lesser-known brands, and consumers are willing to pay for it. KO enjoys considerable pricing power and flexibility to pass on cost inflation.

Strategic Bottler Relationships

KO has attracted bottlers and distribution partners in key regions such as the US and Latin America. KO maintains a distinctive relationship with its bottlers. KO produces and supplies syrup to authorized bottlers, who subsequently mix water and carbonation to create and market finished KO products. This segment is known as KO’s concentrate operations. KO functions through numerous local channels. The primary route for their products to enter the market begins with KO, which produces and sells concentrates, beverage bases, and syrups to bottling operations. KO also owns the brands and handles consumer brand marketing initiatives. Their bottling partners take care of manufacturing, packaging, merchandising, and distributing the final branded beverages to their customers and vending partners, who ultimately sell the products to consumers. KO’s strong influence over innovation, product rollout, marketing, and go-to-market strategies.

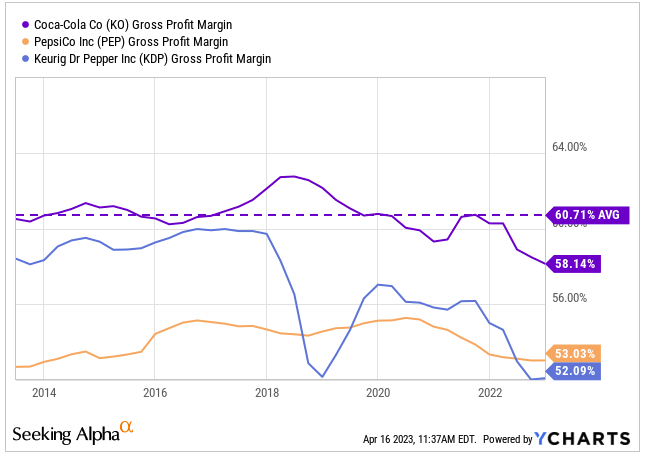

Cost Advantage and Operational Efficiency

KO’s competitive advantage is also supported by a significant cost advantage arising from its scale. With an expansive global manufacturing and distribution footprint, KO can achieve scale efficiency across its entire supply chain. This results in lower production and distribution costs that are hard to match by smaller peers, giving KO an upper hand in pricing for both established and new products.

Ycharts

Growth Prospects in Latin America and Asia-Pacific

KO has a significant presence in Asia-Pacific and Latin America, covering 37 markets with 3.3 billion consumers and an industry retail value of around $308 billion in Asia-Pacific. In Latin America, KO is present in 39 markets with about 520 million consumers and an industry retail value of nearly $72 billion. The expanding middle class and growing demand for non-alcoholic beverages in these regions offer promising prospects for KO.

In Latin America, urbanization levels have risen considerably since 1950, reaching around 80%. The burgeoning middle class presents opportunities for consumer-focused businesses like KO, as it drives growth across all consumption categories. KO has been proactive in developing innovative products and marketing strategies tailored to local cultural preferences and consumption patterns. By collaborating with local bottlers such as FEMSA (KOF), KO is well-prepared to capitalize on this growth potential.

Asia-Pacific, with its vast and diverse consumer base, also holds growth opportunities. The region’s increasing disposable income, rapid urbanization, and young demographic profile make it an ideal target for expansion. More than 2.2 billion people, or 54% of the global urban population, live in Asia, and this number is expected to grow by 50% by 2050.

KO’s focus on product innovation caters to the varied tastes of consumers in the Asia-Pacific market. These innovations include introducing new flavors, healthier alternatives, and locally relevant beverages. KO’s strategic partnerships and acquisitions in the region, involving local bottlers and beverage companies, provide a base for expanding its presence and improving distribution networks. One notable acquisition is Coca-Cola Amatil, with Coca-Cola European Partners agreeing to acquire the business in 2021. Coca-Cola Amatil is among the largest bottlers and distributors of non-alcoholic and alcoholic ready-to-drink beverages in the Asia-Pacific region. This acquisition and other strategic moves help position KO for continued growth in these promising markets.

Shareholder Distribution Practices

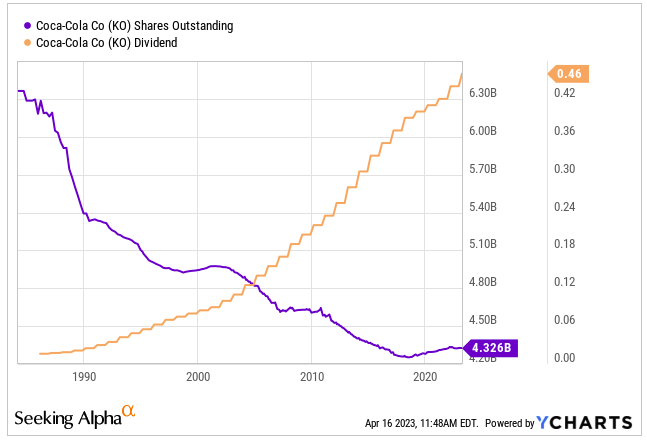

KO has consistently returned cash to its shareholders with cash dividends and share buybacks. Since 1990, KO has increased its quarterly dividend from 2 cents to 46 cents per share. In addition, share buybacks have decreased the total number of outstanding shares from over 6.3 billion in the 1980s to 4.3 billion today.

Ycharts

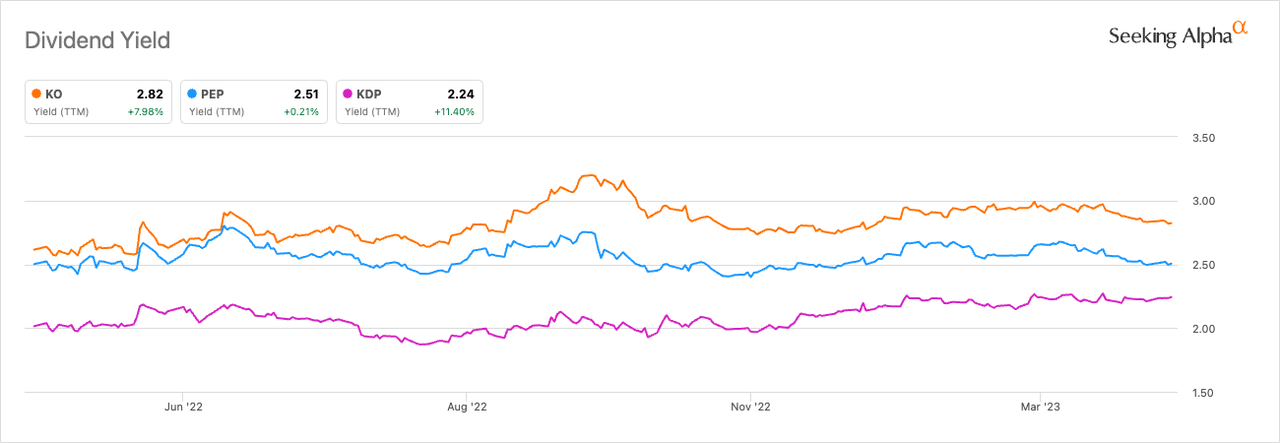

Currently, KO’s dividend yield stands at 2.8%, providing a premium compared to its competitors PEP and Keurig (KDP) by 30 and 50 basis points, respectively.

Valuation

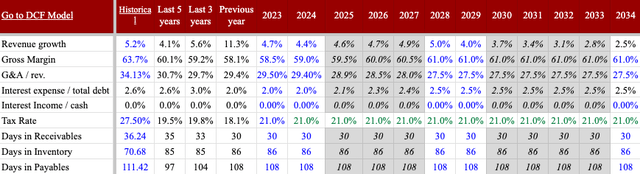

I value KO shares at $65, based on a DCF valuation using a 6.9% cost of capital, derived from an unlevered beta of 1.2 for the soft beverage industry. I anticipate revenues to grow at 4.6% per year until 2029, driven by expansion in Latin America and Asia-Pacific. Furthermore, I expect margins to improve by nearly 400bps by 2029, supported by proven pricing power, efficiencies in channel and packaging mix, and operational leverage. The main assumptions are as follows:

Author estimates & company filings

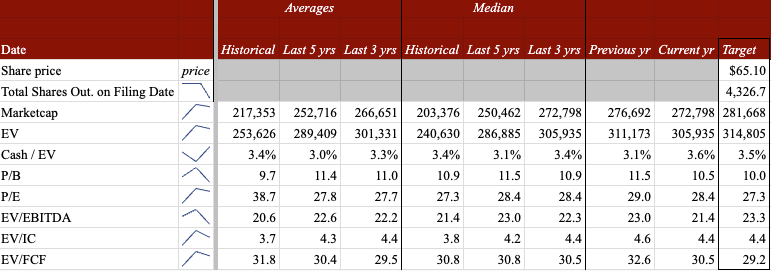

At $65 per share, the shares would be trading within historical ranges:

Seeking Alpha & company filings

Risk and uncertainty

While non-alcoholic beverage demand generally demonstrates resilience throughout economic cycles, KO’s significant exposure to international markets brings an element of uncertainty to its operations. Factors such as changing macroeconomic and regulatory environments, currency fluctuations, and geopolitical risks contribute to this volatility.

Another risk facing KO is the growing health consciousness among consumers. KO must balance the need to reduce the health impact of its beverages without sacrificing the unique taste that underpins brand loyalty. Although reformulations and updated recipes have mitigated the departure of customers from its sparkling drinks, secular headwinds persist as a risk that KO must address in the years ahead.

Conclusion

KO displays robust potential for expansion and remains an attractive choice due to its strategic focus on innovation, diversification, and penetrating new markets. As KO tackles risks and uncertainties, its flexibility in adapting to shifting consumer preferences and leveraging its global brand presence will be vital for lasting success. Since the shares currently appear fairly valued, I recommend maintaining a watchful eye on the stock and waiting for any opportunities that Mr. Market might provide.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.