Summary:

- Johnson & Johnson announced its 61st consecutive dividend increase.

- JNJ raised its 2023 outlook along with beating top and bottom line estimates.

- The Consumer Health business spin-off remains on track.

yuelan

“Beat and Raise” is an often used phrase in the world of investing, especially around earnings season. Johnson & Johnson (NYSE:JNJ) has just done that with its Q1 earnings as Seeking Alpha has reported here. In addition, the company also raised its annual dividend by more than 5%, making it the company’s 61st consecutive annual dividend. That’s a few decades older than me, so excuse me if this article comes across all too reverent.

I was surprised that I haven’t covered JNJ’s dividend exclusively since 2016. But this has its advantage too as it allows for comparison across a wider time span. To keep things easier for comparison, I am using the same structure as in the 2016 article. Let us get into the details.

Payout Ratio:

- The new annual dividend of $4.76 gives the stock a payout ratio of 46%, based on trailing twelve months’ EPS of $10.19. This number has gone down from 50% to 46% in the last 7 years despite an increase each year.

- Based on forward EPS of $10.51, the payout ratio works out to 45%, which once again beats the 48% forward payout ratio at the time of the 2016 article.

- The fact that the payout ratio still looks very comfortable after 61 years of increases tells us quite a bit about the earnings prowess and operational discipline.

Free Cash Flow: Now that we’ve established that the dividend seems safe from earnings/share perspective, let us take a look at the free cash flow [FCF] strength.

- The minimum quarterly FCF over the past 5 years stands at $2.733 billion.

- The maximum FCF was $7.646 billion and the average FCF is at $4.87 billion.

- Total outstanding shares currently stand at 2.60 billion.

- So the company’s quarterly dividend commitment to shareholders is $3.094 billion (2.60 billion shares times $1.19 dividend/share).

- In a nutshell, free cash flow looks as strong as ever with the average free cash flow being almost 60% higher than the company’s dividend commitment.

- As a comparison to 2016, all these numbers are in the right direction with share count reducing from $2.75 Billion while the average quarterly FCF has gone up nearly 40%.

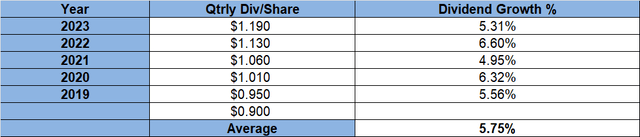

Dividend Growth Rate:

The table below shows the dividend growth rate for Johnson & Johnson over the past 5 years. The average stands at a respectable 5.75%. While this is as consistent as ever, the dividend growth rate has gone down a hair compared to the 7% 5-year average at the time of the 2016 article. This is not yet a cause of concern but one to just be monitored over time.

JNJ DG (Table compiled by author with data from Seeking Alpha.)

Extrapolation:

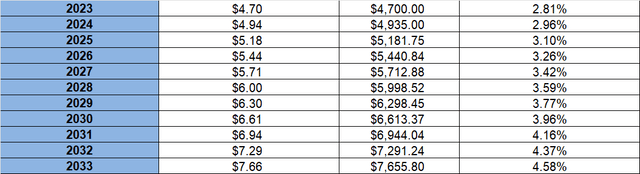

Given the room in payout ratio based on both EPS and FCF, I expect Johnson & Johnson to reward investors with better increases than my assumption. But the table below assumes a safe 5% dividend increase/yr for the next 10 years and the yield on cost grows to a very respectable level once you bear in mind that price of stocks like JNJ tend to catch up with increasing dividends over time.

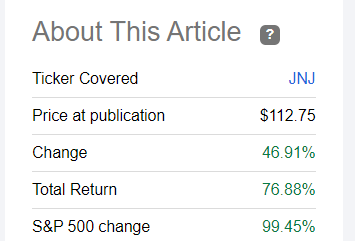

In addition, the impact of the dividends is easy to see in the image below where JNJ has returned about 77% since my 2016 article. Granted, it is lower than the market return but in hindsight, it is undeniable that the last decade was not the most favorable for stocks like JNJ with the Federal Reserve’s monetary policies favoring riskier assets. I’d think the current environment is likely to favor names like JNJ.

JNJ Extrapolation (Author) JNJ Returns (Seekingalpha.com)

Forward thoughts and Conclusion:

- As the recent earnings report proved, the business is still going strong with many divisions showing enough strength to offset the odd weakness or two. Pharmaceutical sales grew 4%, primarily driven by Darzalex and the COVID-19 Vaccine. Darzalex has been on an upward trend since 2019 and is still on track to continue dominating what is expected to be a $60 Billion playing field. Consumer health showed tremendous strength (11% revenue growth) primarily driven by over-the-counter sales.

- JNJ’s upcoming spin-off of Consumer-Health division Kenvue is still on track for later this year. As written in the article linked, the spin-off may help JNJ’s businesses get better overall valuation like Procter & Gamble (PG) and Colgate-Palmolive (CL) especially after the lawsuit clouds clear.

- With the company guiding for up to $10.70 in EPS for 2023, the stock is trading at a forward multiple of 15.6, which is an extremely reasonable valuation for a stalwart like JNJ.

- If you believe in a particular yield level, the 3% yield mark is $158.66 after this dividend increase. As a confirmation that stock price tends to catch up with increasing dividends, the 3% yield was $106 during my 2016 review. That’s the definition of slow and steady.

- Once again, Dividend growth has two magical effects – an increasing income stream and slow (but sure) capital growth as the market is used to a particular yield level and this offers the stock a solid base level.

- Finally, heading into at least a soft-landing if not worse, a stock like JNJ warrants your attention. Trading at a reasonable multiple of 15 with a nearly 3% yield after a 7% sell-off YTD, JNJ is a buy here.

What are your thoughts on JNJ here and about its future? Please leave your comments below.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of JNJ either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.