Summary:

- Tim Cook with the ghost of Steve Jobs – Innovation and creativity at every level.

- Apple’s annual revenue and earnings trends remain impressive – Realistic expectations for Q1.

- A significant comeback since January 23, 2023 – An over 30% gain.

- Cash is king for three reasons – Interest rates, opportunity, and flexibility.

- AAPL shares are closer to the record high than January 2023 low.

Shahid Jamil

In a December 29, 2022, Seeking Alpha article on Apple (NASDAQ:AAPL), I wrote:

It’s impossible to pick bottoms in any market that is in a bearish trend, and they often fall to levels that defy logic, reason, and rational analysis. However, AAPL has been the cream of the crop in technology for decades, which is likely to remain the same in the coming years. I will buy AAPL shares for my granddaughters, and if the shares continue to decline, I will add to their long positions. When the girls are ready to attend college and begin their adult lives, the shares will likely be much higher as the company will remain the gold standard in the technology sector.

On that day, AAPL shares were at the $129.67 level. On January 3, the stock reached a $124.17 low, which was a significant bottom. With AAPL shares at the $165 level on April 17, my only regret is it did not fall lower to continue adding shares to my granddaughters’ portfolios.

Tim Cook with the ghost of Steve Jobs

Steve Jobs was an innovator and a leader who said, “Innovation distinguishes between a leader and a follower.” At Apple, Jobs created an environment that fostered innovation with the organization’s culture. Before his untimely death in October 2011, Jobs handpicked Tim Cook as his successor. Steve Jobs once said Tim Cook was “not a product guy.” However, he chose Cook because of his operational skills and mastery of Apple’s supply and manufacturing chain, primarily in China. Meanwhile, Jobs saw something in Cook, who he had worked alongside for years. Tim Cook was eager to “try something different” and willing to take responsibility when it went awry.

After running Apple for a dozen years, the ghost of Steve Jobs remains, but Tim Cook has steered the company to become the most valuable firm.

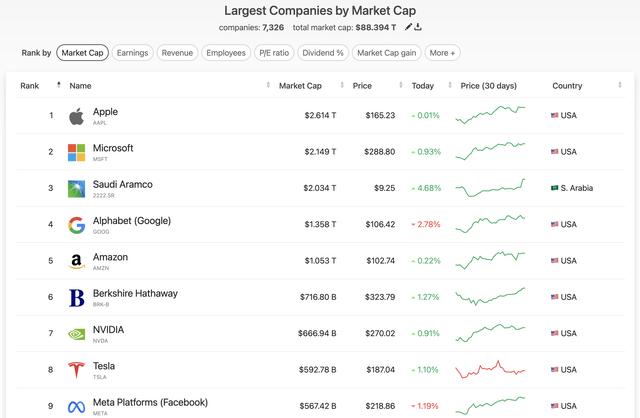

Leading Companies by Market Cap (companiesmarketcap.com)

At the $165 per share level, AAPL’s $2.614 trillion market cap leads the world.

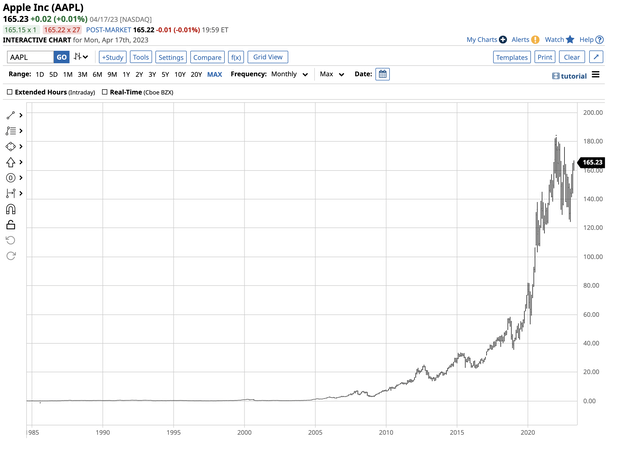

Long-Term AAPL Chart (Barchart)

The chart shows when Steve Jobs passed in October 2011, the shares reached a $15.24 high during that month, which was a record peak. While many analysts doubted Tim Cook’s ability to fill Job’s shoes, the stock continued to rally, reaching a record $182.94 high in January 2022. After a decline to $124.17 in January 2023, the stock rallied back to the $165 level in April 2023, as Tim Cook oversaw a rise of over ten times the share price over the past twelve years. Steve Jobs, ever the cynic and critic, would likely find issues with some of Cook’s decisions, but he would be proud of his choice, given the stock performance and rise of his company to lead the world.

The annual revenue and earnings trends remain impressive

Over the past years, AAPL’s revenues and gross profits have been spectacular.

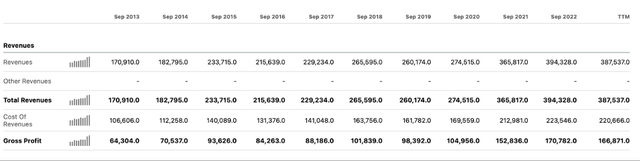

AAPL- Revenues and Gross Profits (Seeking Alpha)

The chart shows that the revenue and profit trajectory has consistently increased.

AAPL Quarterly EPS Since 2018 (Seeking Alpha)

The chart highlights constant profitability as the company has grown. As of the end of 2022, AAPL had $51.355 billion in cash on hand on its balance sheet. While the cash declined by 19.65% on a year-over-year basis, the rise in short-term interest rates to the 5% level means the cash balance naturally rises by around $2.5 billion annually.

A significant comeback since January 3, 2023

The decline in AAPL shares to $124.17 on January 3, 2023, came from an overall decline in the stock market caused by the U.S. Fed’s aggressive monetary policy addressing the highest inflation in decades.

On December 29, the tech-heavy NASDAQ found a bottom at 10,207.47.

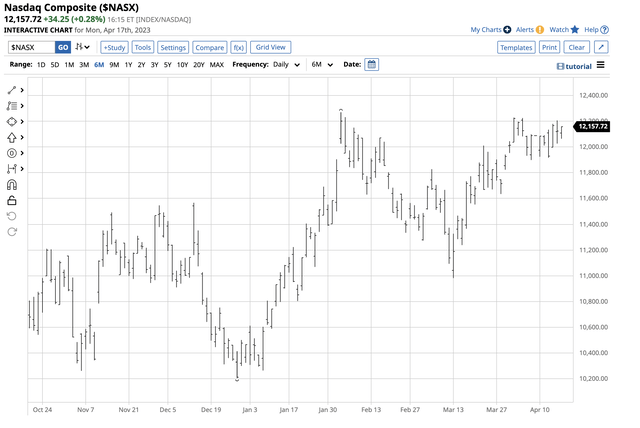

Chart of the NASDAQ since the late-December 2022 low (Barchart)

The chart highlights the NASDAQ composite’s rise to 12,157.72 on April 18, an 19.11% increase from the low.

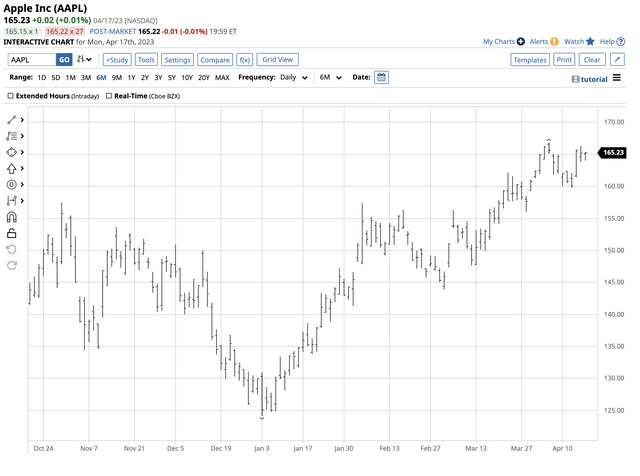

Chart of AAPL shares since the early January 2023 low (Barchart)

At $165.23 on April 17, AAPL shares were 33.07% above the January 3 low as AAPL outperformed the technology benchmark index. Meanwhile, at $165.23, AAPL shares were 27.4% higher than $129.67, the day of my last Seeking Alpha piece on the company, when I declared AAPL is the stock of choice for my grandchildren.

Cash is king for three reasons

AAPL is a cash-rich company with over $50 billion on its balance sheet at the end of 2022. Cash is king in the current environment for at least three reasons:

- Interest rates: Inflation has caused the U.S. central bank to tighten credit at an accelerated pace. The short-term Fed Funds Rate stands at a midpoint of 4.875%, with the latest CPI and PPI running higher. The Fed’s 5.13% target means at least one more 25 basis point increase in 2023. At 5%, AAPL’s cash will earn around $2.5 billion.

- Opportunity: The recent bank failures in the U.S. and UBS’s takeover of troubled Credit Suisse tightened credit and lending standards. Moreover, Silicon Valley Bank, which shut down in March 2023, was a leading technology start-up lender. Many emerging technology companies looking for financing must turn to other funding sources. AAPL’s cash balance positions the company for accretive acquisitions for the cream-of-the-crop emerging technology firms with limited options. A tightening credit environment is an opportunity for cash-rich companies like Apple.

- Flexibility: The deterioration of relations between the U.S. and China presents roadblocks for AAPL’s supply chain and manufacturing in the world’s second-leading economy. While Tim Cook has maintained ties with China, the cash on hand provides options and flexibility if relations between Washington and Beijing worsen, and if they improve, AAPL will be a big winner.

Like many technology companies, AAPL faces challenges in April 2023. AAPL’s share of personal computing devices fell 7.2% in Q1 2023, down 8.6% from the previous year. Unit sales of 4.1 million were 41% lower than the prior year, and AAPL experienced a more significant drop than Lenovo and HP.

While AAPL’s cash makes it a candidate for acquisitions, Tim Cook’s strategy will likely focus on intellectual property and talent. The bottom line is the failure of SVB has opened a new and attractive portfolio of emerging companies that could suit AAPL’s M&A appetite over the coming months.

AAPL shares are moving toward the record high

While personal computing devices are challenging, two expanding areas look likely to bolster earnings:

- India: Apple’s India sales grew by nearly 50% in the year through March 2023. Revenue in India was near $6 billion compared to $4.1 billion in the year through March 2022. India has tremendous potential as it is the world’s second most populous country. India could also offer AAPL an alternative to its Chinese manufacturing supply chain.

- Apple Banking: AAPL and Goldman Sachs launched their Apple Card savings account with a 4.15% annual percentage yield with no minimum deposit. According to the FDIC, the national average APY on savings accounts is only 0.35% making the Apple Card account very attractive.

The ghost of Steve Jobs remains throughout Apple Inc., and his successor, Tim Cook, has only enhanced the culture. AAPL is the world’s leading company, with lots of cash in a market experiencing significant challenges.

At nearly $165 per share, AAPL stock is closer to the record high than the early 2023 low. The trend is always your best friend in markets, and AAPL continues to be my favorite choice for my granddaughter’s financial future.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AAPL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The author always has positions in commodities markets in futures, options, ETF/ETN products, and commodity equities. These long and short positions tend to change on an intraday basis.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

The Hecht Commodity Report is one of the most comprehensive commodities reports available today from a top-ranked author in commodities, forex, and precious metals. My weekly report covers the market movements of over 29 different commodities and provides bullish, bearish, and neutral calls; directional trading recommendations, and actionable ideas for traders. I am offering a free trial and discount to new subscribers for a limited time.