Summary:

- The market has been overly critical of AT&T, and the stock remains highly undervalued.

- While AT&T is not a growth company, it could produce higher revenues and more profitability than consensus analysts anticipate.

- AT&T is trading at around six times 2025’s higher-end EPS estimates, and the stock provides a dividend close to 6%.

- AT&T has substantial potential to continue expanding its secondary businesses while focusing on improving efficiency in its core unit.

- AT&T’s stock is incredibly cheap, and as the company increases revenues and improves profitability, its share price should rise due to multiple expansion.

jetcityimage

When did AT&T (NYSE:T) become so dull? Was it before or after the botched TimeWarner deal? No, I know, it’s probably because of the five or 10 years of poor stock performance. Please, look at the stock’s returns in recent years as they have been flat to nothing at best with AT&T. So, with a stock having such a questionable track record, why would you want to own shares?

AT&T is transitioning into a company capable of producing mild growth while increasing efficiency and improving profitability simultaneously. Furthermore, due to the years of underperformance, the market has temporarily blacklisted AT&T, slapping the company with a meager 6-7 forward P/E multiple.

However, it’s like Be Graham said – “The market is a voting machine in the short term, but in the long term, it’s a weighing machine.” Therefore, as the market weighs AT&T’s stock, it should reprice its shares to a higher level due to multiple expansion and other constructive factors in the coming years. I’m keeping my AT&T year-end price target at $25, roughly a 25% upside from here.

Technically Speaking – Near-Term Downside?

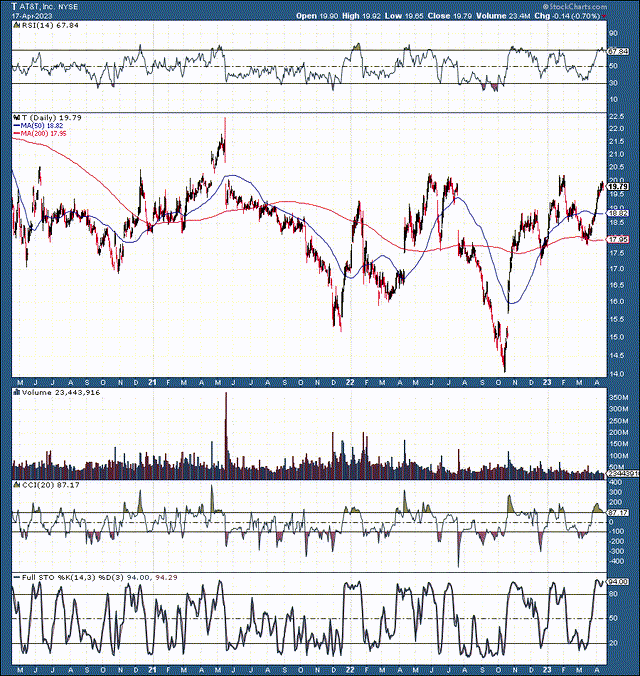

AT&T: 3-year chart

T (StockCharts.com)

While AT&T has appreciated by roughly 50% from its mid-October bottom, its shares have been flat over the last three years. Also, despite being overbought in the near term, AT&T’s stock is forming a bullish long-term reverse head and shoulders pattern, implying its shares could appreciate considerably longer term. Nevertheless, downside risk persists in the near term.

If AT&T doesn’t break out above the critical $20-20.50 resistance level soon, the stock could trade back toward the bottom end of its near-term range. Also, if volatility increases, AT&T could test the $18 support level soon. However, a move to this level would create a substantial buying opportunity, making the $18 point my initial add/buy target.

AT&T – Blacklisted

AT&T is going through a similar transitory slowdown as most companies during this challenging phase. However, AT&T has held up relatively well, and EPS is projected to dip by just 5% YoY. Moreover, I expect AT&T can surpass the lowered and depressed consensus figures. Thus, we may not see an earnings decline and could see earnings growth in the years ahead.

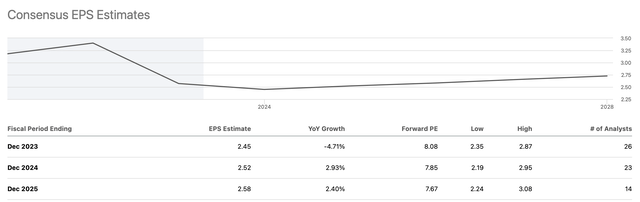

EPS – Could Outperform

EPS (SeekingAlpha.com )

Despite AT&T’s transitory earnings decline, it should grow EPS to approximately $3 in 2025. This dynamic implies that with AT&T’s price at $20, the stock is trading at a 6.33 forward P/E ratio, and if the stock revisits $18, it could be trading at just six times forward earnings expectations, and that’s remarkably cheap.

Why is AT&T’s stock this cheap? Has the market lost its mind? I believe it has when it comes to AT&T. The market saw a lackluster stock performance over the years, accompanied by a botched merger with Time Warner. Therefore, the market is overly negative on AT&T with this ultra-low P/E ratio. After all, AT&T is a global telecom leader, continuously searching for ways to innovate and increase profits.

AT&T – Better Without HBO

Perhaps now that Warner Bros. is out of the way, AT&T can focus on expanding and optimizing its core businesses. Also, the company can focus on increasing growth prospects in its secondary businesses. This phenomenon should enable AT&T to provide modest revenue growth while simultaneously improving productivity and increasing profitability. Consensus revenues are for about $123 billion this year, but AT&T can achieve revenues of approximately $128-130 billion in 2025. This dynamic should provide around 5% revenue growth over the 2024 and 2025 year periods.

However, if AT&T concentrates on expanding its various revenue streams, its growth could surprise to the upside. AT&T continues expanding its sprawling fiber and 5G empire. The 5G network now reaches most Americans (roughly 290 million) in more than 24,000 towns and cities across the U.S.

Also, AT&T recently introduced a medical radar device designed to monitor people through walls. Moreover, AT&T is involved in various segments that may potentially provide substantial growth for the company as AT&T moves forward. AT&T may not have the best management, but the company produces enormous cash flows and could provide better-than-expected growth in the coming years.

Management Change – Leads to Real Innovation

Not all of AT&T’s top management deserves to “go.” However, some of the good old boys at the helm of AT&T have let shareholders down. Unfortunately, such a highly profitable cash cow like AT&T needs to be improved by better management. The TimeWarner deal was a disaster, as AT&T’s management brought one of the best film studios and entertainment companies to its knees. AT&T bought TimeWarner for more than $80 billion, then after destroying substantial value, they spun it off for about 50% less.

Therefore, I have a big problem with a management structure that’s too bureaucratic and needs to be more innovative. AT&T needs to unlock some growth to expand its multiple and get its stock price moving and a perfect catalyst could be a management shakeup toward the top. Once a management shakeup occurs, we can expect increased productivity and improved efficiency leading to higher margins and more profitability. Thus, a management shakeup could be an ideal catalyst to boost AT&T’s performance and stock.

Here’s where AT&T’s stock price could be in future years:

| Year | 2023 | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 |

| Revenue Bs | $123 | $126 | $130 | $134 | $137 | $140 | $143 | $147 |

| Revenue growth | 1.9% | 2.4% | 3.2% | 2.9% | 2.5% | 2.2% | 2.1% | 2.6% |

| EPS | $2.75 | $2.90 | $3.15 | $3.37 | $3.57 | $3.78 | $4 | $4.30 |

| EPS growth | 7% | 5.5% | 9% | 7% | 6% | 6% | 7% | 6% |

| Forward P/E | 6.7 | 7.9 | 8.7 | 9 | 9.4 | 9.8 | 9.5 | 9.6 |

| Stock price | $20 | $25 | $29 | $32 | $36 | $40 | $43 | $48 |

Source: The Financial Prophet

I use relatively modest revenue, earnings growth, and multiple expansion projections. Still, we see a high probability that AT&T’s stock will move significantly higher in the coming years. Of course, AT&T is not a “multi-bagger” in a few years, but the stock has significant value and underestimated growth potential. Moreover, AT&T pays a dividend of nearly 6%, and we can implement the covered call strategy to increase yield if the market remains sideways. Furthermore, due to the nature of AT&T’s business, AT&T has limited downside, even if the economic landscape weakens from here. Thus, AT&T is an appropriate “recession-proof” stock. Also, I’m sticking with my year-end price target of $25 and will consider adding to my position if AT&T’s stock corrects to the $18 range.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of T either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I am long a diversified portfolio with hedges.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Are You Getting The Returns You Want?

- Invest alongside the Financial Prophet’s All-Weather Portfolio (2022 17% return), and achieve optimal results in any market.

- Our Daily Prophet Report provides crucial information before the opening bell rings each morning.

- Implement our Covered Call Dividend Plan and earn an extra 40-60% on some of your investments.

All-Weather Portfolio vs. The S&P 500

Don’t Wait! Unlock Your Own Financial Prophet!

Take advantage of the 2-week free trial and receive this limited-time 20% discount with your subscription. Sign up now, and start beating the market for less than $1 a day!