Summary:

- Bank of America has one of the most secure and valuable deposit bases in the world.

- BAC’s credit profile is very low risk relative to peers, and the bank should remain profitable in just about any scenario.

- Net interest income is at record highs and should hover close to there in the near future, providing tremendous underlying earnings.

Brandon Bell

The hysteria we saw in March of 2023 pertaining to the banking sector was quite surreal. Naturally, I was on a quick 3-night vacation in Cabo San Lucas trying to relax with my wife and other friends, and all the sudden SVB Financial (OTC:SIVBQ) faced an existential bank run causing carnage in the sector, ultimately leading to the bank being taken over by the FDIC. It became normal for market pundits to juxtapose what the tangible book value would be of a given bank if most deposits leave and they have to sell everything at mark to market. Bank runs can doom any institution, which is why we have created safeguards that greatly negate the need or rationale for them, not the least of being the massive capital and liquidity requirements of banks, along with FDIC insurance. It is a profitable endeavor for newsletter writers to capitalize on investor panic and exaggerate problems, but it is not usually profitable for the actual investor as they end up selling quality stocks at deep discounts to intrinsic value, which is why we recommend making fundamentally based investment decisions. Bank of America (NYSE:BAC) is one of the strongest banks in the world, with immensely strong underlying earnings power, a vast and diversified deposit base, and very conservative loan underwriting that should do well in just about any credit environment. BAC stock is undervalued and offers a very compelling opportunity at current prices.

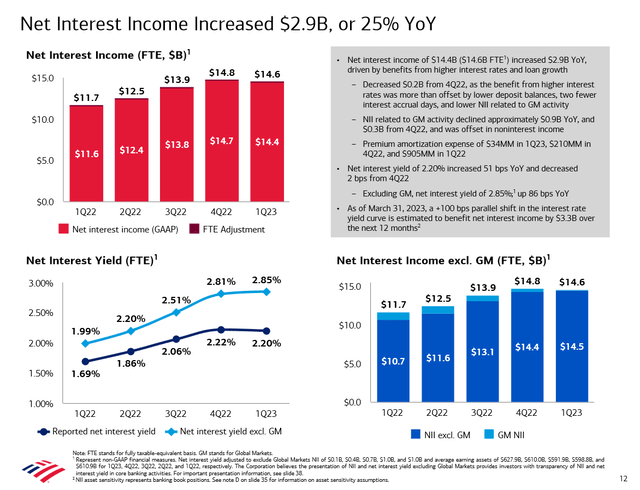

On April 18, Bank of America reported a very strong 1st quarter, generating $26.3B of revenue, and $.94 of diluted EPS, up 13% and 18% YoY, respectively. Net income was a very healthy $8.2B. This was good for an ROA of 1.07%, ROE of 12.5%, and an ROTCE of 17.4%, which puts it in the higher tier of banking performance. NII of $14.4B ($14.6B FTE) increased by $2.9B, or 25% due to higher rates and loan growth. Non-interest income of $11.8B increased by $154MM, or 1% on higher sales and trading revenue, which more than offset lower service charges and declines in asset management and investment banking fees.

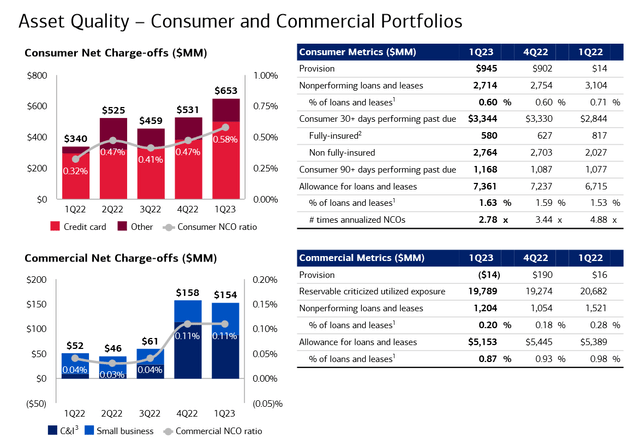

The provision for credit losses was $931MM, which included a net reserve build of $124MM, as opposed to a net reserve release of $362MM a year ago. Net charge-offs of $807MM were up YoY and QoQ, but are still below pre-pandemic level, which was a good credit environment on its own. The net charge-off ratio of 32bps, increased 16bps YoY, but was still below the pre-pandemic level of 39 bps. The credit card loss rate of 2.21% in Q1 23 was up from 1.71% in 4Q 22 but was still down from 3.03% in 4Q 19. BAC’s allowance for loans and lease losses stood at $12.5B, or 1.2% of total loans and leases, or $14B if you include the $1.4B reserved for unfunded commitments. Nonperforming loans increased by $.1B sequentially to $3.9B. 60% of Consumer NPLs are contractually current. Commercial reservable criticized utilized exposure of $19.8B increased $.5B from 4Q22. Noninterest expense of $16.2B increased by $.9B, or 6% YoY, which resulted in positive operating leverage for the 7th consecutive quarter. Pretax, pre-provision income of $10B was up 11 sequentially, and 27% YoY, which speaks to the enormous underlying earnings power of BAC, which is well-suited to dealing with challenges in the global economy.

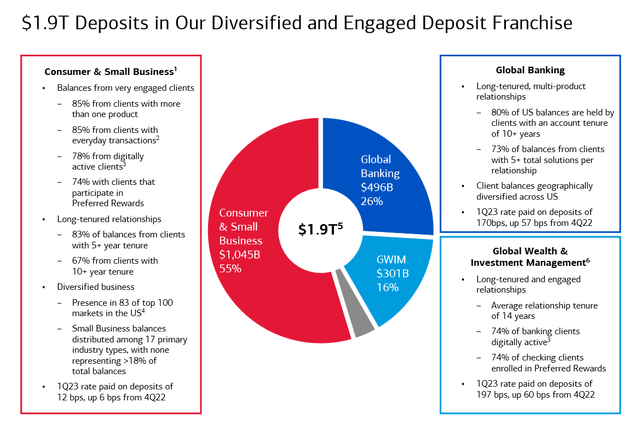

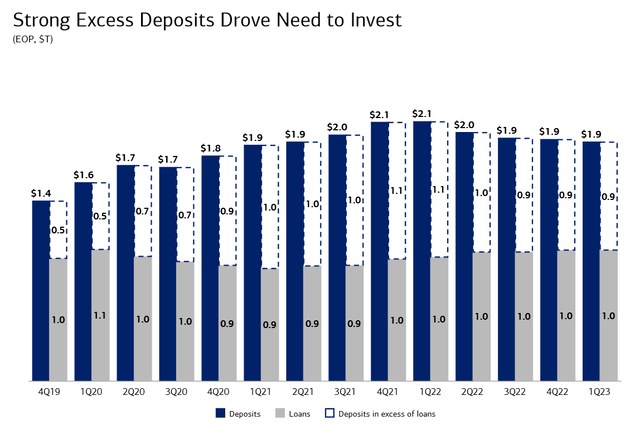

BAC’s Q1 2023 Investor Presentation

Average loans and leases grew by $2B QoQ, while average deposits decreased by $32B QoQ. Total loans and leases are up 7% YoY, despite a 35% decline in residential mortgage and home equity. $588B of loans were Commercial and $453B were Consumer related. Interest-bearing deposits grew by 2% sequentially and are up 26% since the 4th quarter of 2019. Noninterest-bearing deposits declined by 7% sequentially but are up a staggering 54% since the 4th quarter of 2019. In all the manufactured hysteria relating to deposits, it is being left unsaid that this is following a period of massive growth in banking deposits due to fiscal stimulus and savings, which of course was going to get reversed at some point. Deposits of $1.91 trillion at the end of Q1 are still 34% above where they were prior to the pandemic. As the Federal Reserve nears the completion of its rate hikes, I’d expect deposits to stabilize towards the end of this year.

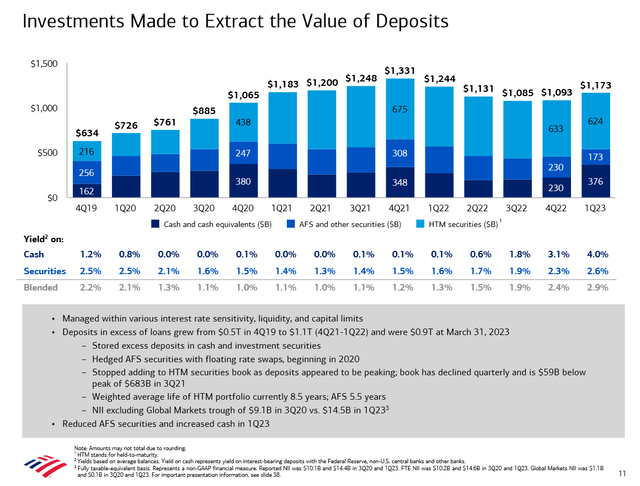

BAC’s Q1 2023 Investor Presentation BAC’s Q1 2023 Investor Presentation BAC’s Q1 2023 Investor Presentation

While there has been a lot of hysteria about HTM and AFS mark to market losses, there hasn’t been much discussion about the offsetting increases in profitability in net interest income. BAC’s deposits in excess of loans grew from $.5T in Q4 2019 to $1.1T in 4Q21, so some of these excess deposits were invested into cash and securities. BAC at least hedged the AFS securities with floating rate swaps beginning in 2020, very much unlike SVB. The HTM securities book stopped growing when deposits peaked and has now declined by $59B from its peak of $683B. BAC still has $900B more deposits than loans. The HTM portfolio will continue to amortize, and BAC emphasized that it is still earning a spread based on the 290-basis point income yield from these investments, and the 92-basis point cost of the deposits funding them. BAC’s rate paid on its roughly 1 trillion dollars of Consumer deposits grew to 12 basis points from 6 basis points in the 4th quarter, because 52% of the deposit mix is checking accounts, which pay very little. Not every deposit base is equal, and BAC’s is as good as any. Rate movements are concentrated in the small CDs and consumer investment deposits, which together represent about 5% of the deposits. Net interest income bottomed in Q3 of 2020 at $9.1B and is now $5.4B higher on a quarterly basis at $14.5B in Q1 of 23, so the value of the deposit base has increased dramatically, although this is often left out of the bear-case analyses sold in newsletters.

More than 80% of BAC’s deposits have been with the bank for more than five years, and more than two-thirds of consumer deposits are balances with customers who have had relationships with the bank for more than 10 years. Bank of America provides a lot of services for these customers other than just strictly rate. It might be ease of access, technology, ancillary products connected to the accounts, etc., but the sole focus on rates is misleading. In GWIM, the average relationship for clients is around 14 years, while in Global Banking, 80% of deposit balances are held by clients who have had an account with BAC for at least 10 years. 73% of balances are held by clients that have at least five products with the company.

BAC’s Q1 2023 Investor Presentation

The company added 130K net new Consumer checking accounts for the 17th consecutive quarter of growth, and 14.5K net new GWIM relationships. Since Q1 22, BAC has added a record 3.6MM investment accounts, with $37B of net client flows. Digital sales grew 4% YoY to 1.8MM, and now represent 51% of total sales. GWIM sent over 40,000 referrals to other lines of business, including opening a record 35,000 bank accounts, up 18% YoY. Global banking grew loans and leases by 6% YoY to $381B and posted its 2nd best revenue quarter at $6.2B, up 19% YoY. Global Transaction Services revenue of $3.1B, was up 47% YoY. BAC was #3 in Investment Banking fees, albeit in a very weak environment. Global Markets grew sales and trading revenue to $5.1B, which was the second highest quarterly sales and trading revenue in a decade. FICC posted stellar results with the highest quarterly revenue in a decade up 27% YoY. Average loans in Global Markets were $125B, up 15% YoY.

BAC ended Q1 with a CET1 ratio of 11.4%, which was up 14bps sequentially. BAC is in extraordinary financial condition with average global liquidity sources of $854B and ending global liquidity sources of $904B. BAC’s Supplementary Leverage Ratio stood at 6% at the end of Q1, from 5.9% in Q4, and 5.4% a year ago. The company paid $1.8B in common dividends and repurchased $2.2B in common stock, including repurchases to offset shares awarded under equity-based compensation plans, which is always an issue in Q1 for BAC. Book and tangible book value per share ended the quarter at $31.58 and $22.78, respectively, up 3 and 4% sequentially. Shareholders’ equity increased by $7B in the quarter, as earnings were only partially offset by capital distributed to shareholders, and BAC saw an improvement in AOCI of $3B, due to lower long-term rates.

Management guided that based on everything they know regarding interest rates and customer behavior, the company expects 2nd quarter NII on an FTE basis to be around 2% lowered than the exceptional Q1, so about $14.3B plus or minus. Every business segment for BAC grew customers and accounts organically in Q1, speaking to the underlying momentum of the enterprise. That is still a pretty good environment for bank profitability given the lingering strength in credit, where credit reserves have already been heavily frontloaded due to CECL accounting, which still far too many analysts seem to fully appreciate. Loan growth is expected to be modest, mostly driven by credit cards, and to a smaller extent, commercial. There has been a lot of hysteria over commercial real estate, which I think is vastly overblown in relation to the big banks. In Q1, BAC took $15MM of losses on office loans. The company has around $73B of commercial real estate loans, which is less than 7% of the total loan book, which of course is highly diversified across the nation. Offices represent 2% of the book, or $19B, with 75% Class A. These loans typically originated at a 55% loan-to-value, so despite significant prices declines, these loans are mostly still extremely well secured. Only $3.6B is classified as reservable criticized and even after recent refreshes on the most challenging loans, the LTVs are still 75%. $4B of office loans mature this year, while another $6B mature next year. BAC is a very conservative bank, reminiscent of Wells Fargo going into the Financial Crisis. Those expecting huge loan losses are looking at the wrong bank.

At T&T Capital Management, we believe that BAC is worth in excess of $40 per share, given its underlying earnings power. At a recent price of $30.55, the stock trades at just 9.6x forward earnings, which is too cheap for a company that can consistently generate mid to high teens returns on tangible equity. The stock offers a compelling dividend of 2.88% and will be buying back stock at accretive prices in bulk, due to their excess capital position. Bank of America has gotten way too cheap, and the bearish narrative simply doesn’t align with the fundamentals.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of BAC either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.