Summary:

- Bank of America Corporation just released its first quarter earnings.

- The release beat on revenue as well as on earnings per share.

- Bank of America’s release caps a series of strong releases from America’s big banks, which saw JPMorgan and Charles Schwab rally after beating estimates.

- In this article, I explain why I remain bullish on Bank of America after its stellar Q1 earnings release.

Drew Angerer

Bank of America Corporation (NYSE:BAC) just released its first quarter earnings, easily surpassing analyst estimates on revenue and earnings per share (“EPS”). The quarter delivered $0.94 in EPS, slightly ahead of the $0.93 consensus, and $26.3 billion in revenue, well ahead of the $25.28 billion consensus.

Heading into Bank of America’s earnings release, I was feeling optimistic. The Charles Schwab Corporation (SCHW) and JPMorgan Chase & Co. (JPM) both beat analysts’ estimates when they put out their releases. So, I felt like there was a good chance that Bank of America would beat as well. Indeed, it did, although the magnitude of the beat was not quite as large as what was observed with JPMorgan, which was a solid 20% ahead of EPS estimates.

Nevertheless, it was a pretty good release from Bank of America. Not only did revenue and earnings beat estimates, but net interest income rose 25%, and the 20% decline in investment banking fees was much less severe than the previous quarter’s 54% decline. If the trends continue at the present rate, we may even see investment banking flip back to positive growth by the end of the year! I never factored that possibility into my previous analyses of Bank of America: I just figured that the growth and margins would be good even with i-banking doing poorly. However, it is now looking like even investment banking could start making a real contribution to BAC’s growth in a few quarters.

In this article, I will explain why I am bullish on Bank of America stock after its strong first quarter earnings release. I will review the release, pointing out strengths and weaknesses. I’ll also go over “long term” factors that make the stock a worthy long-term hold. Finally, I’ll review risks and challenges to my bullish thesis, particularly those pertaining to Fed policy and interest rates.

Earnings Summary

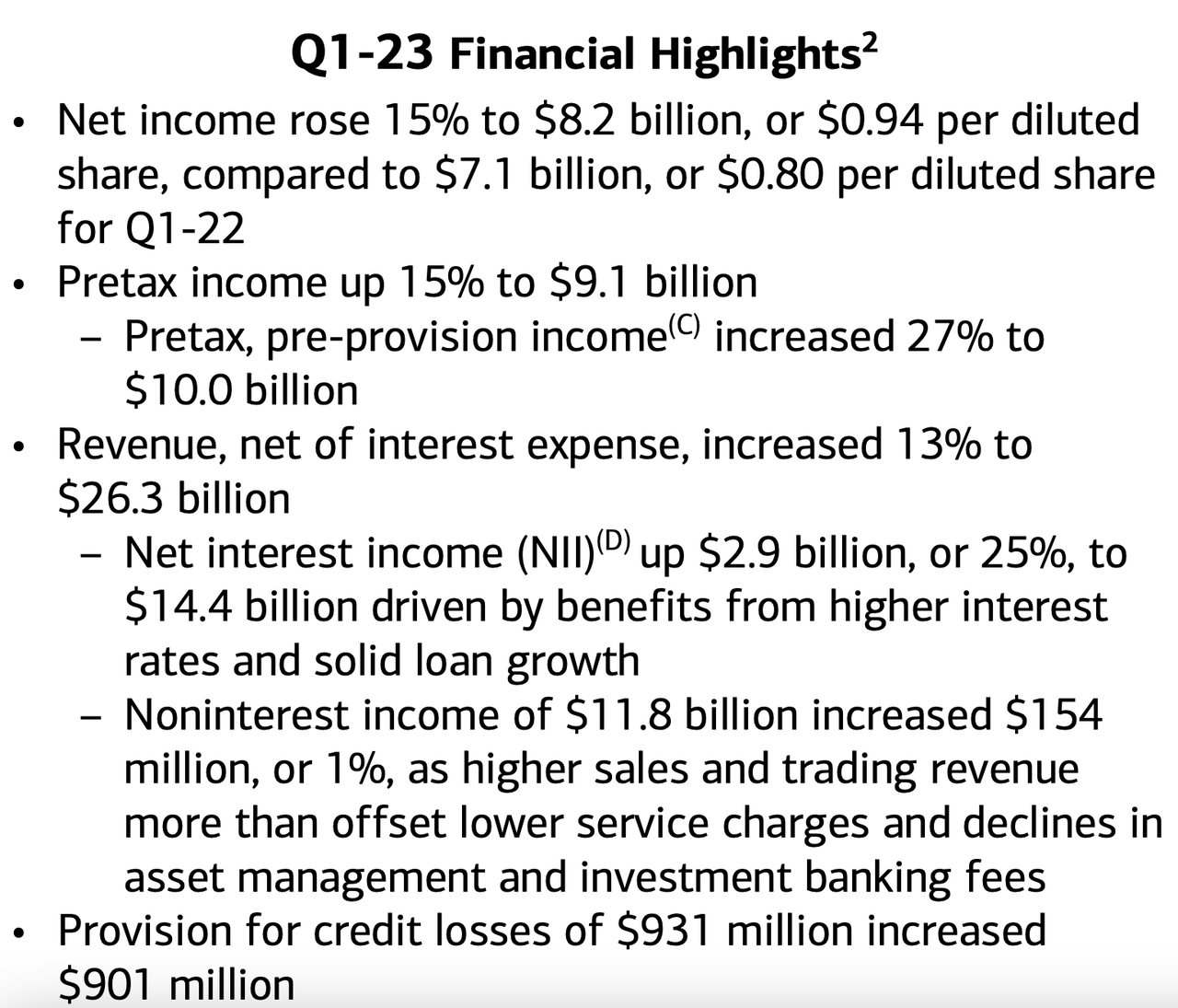

In its most recent quarter, Bank of America delivered:

-

$26.3 billion in total revenue, up 13%, a beat.

-

$0.94 in diluted EPS, up 15%, a beat.

-

$2.9 billion in net interest income, up 25%.

-

$931 million in provisions for credit losses (“PCLs”), increased by $900 million.

-

$807 million in charge-offs, which was below pre-pandemic levels.

-

$10 billion in pre-tax, pre-provision income, up 27%.

-

$1.2 billion in investment banking fees, down 20%.

BAC earnings summary (Bank of America)

Overall, it was a pretty strong showing. The large increase in PCLs was not a positive, but it is very encouraging earnings increased even with that big reserve build. It implies that an even larger earnings increase could occur later in the year if risks abate and BAC can reduce its PCLs. The 27% increase in pre-tax, pre-provision income might portend the increase in net income that could be observed later in the year, assuming that risks do wind down.

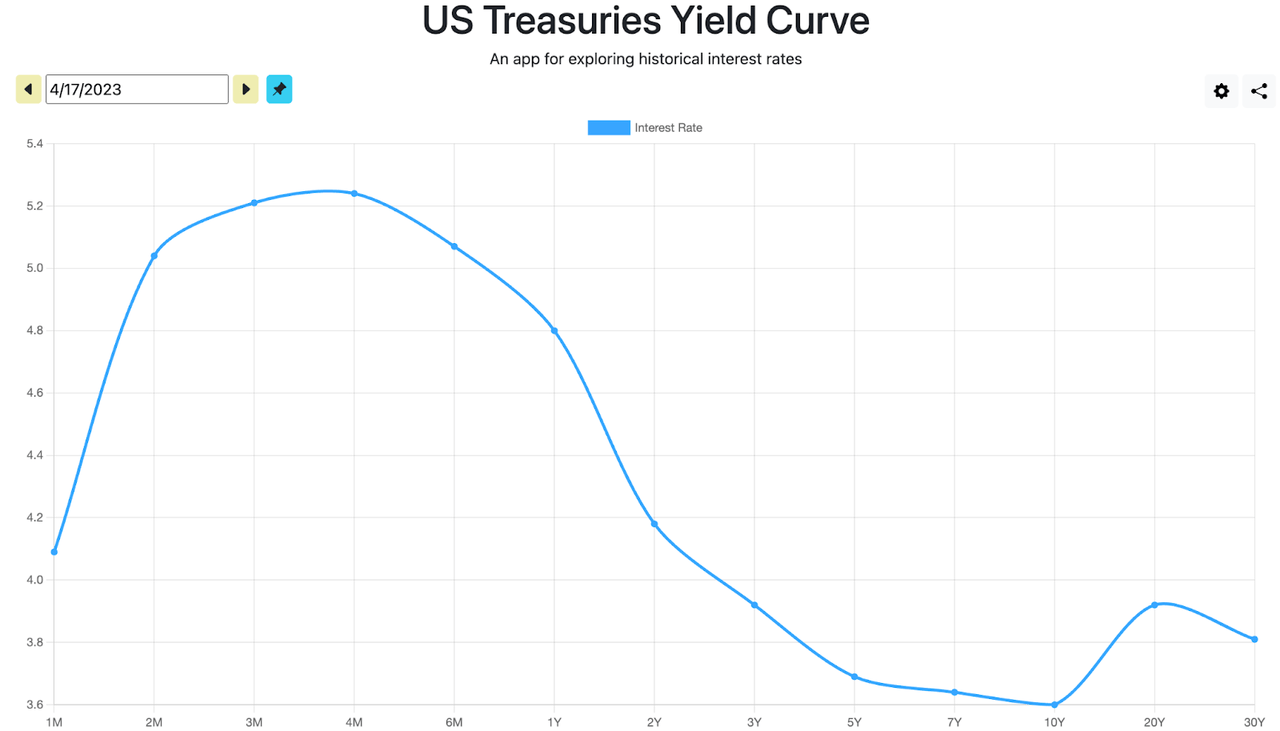

That is not an assumption I would just run with, though. The U.S. yield curve is still inverted, and inverted curves tend to predict future recessions. It would be prudent to assume that there will be a recession, and that BAC’s PCLs will either stay flat or go up, rather than go down. Nevertheless, BAC’s Q1 release showed that the company can easily produce earnings growth well into the double digits even with reserves rising dramatically. So, there is a case to be made for investing here.

U.S. yield curve (ustreasuryyieldcurve.com)

Valuation

Having looked at Bank of America’s quarterly earnings, we can now turn to its valuation.

According to Seeking Alpha Quant, BAC trades at:

-

9.5 times earnings.

-

2.45 times sales.

-

0.99 times book value.

-

0.92 times estimated future book value.

BAC scores a “C” on valuation in Seeking Alpha’s quant system, indicating that it’s valued about average for its sector. It is cheap by the standards of the S&P 500 (SP500), though, as the index currently has a 22 P/E ratio.

A few of the multiples above are affected by BAC’s earnings release. For example, the 9.5 P/E ratio has fallen to 9.27 due to higher TTM earnings. Overall, though, Seeking Alpha Quant’s multiples are in the right ballpark, as book value and sales have not grown very much since Q4.

In addition to multiples, we could use a discounted cash flow model to value Bank of America stock. A full discounted cash flow (“DCF”) model, which usually includes several Excel spreadsheets full of forecasted income and cash flow statements, would be beyond the scope of this article. However I can do a modified DCF analysis that simply assumes that BAC grows its earnings at 0%. Reality is unlikely to resemble that, as BAC has guided for further growth, but by estimating 0% growth we use conservative assumptions, which helps to avoid overpaying.

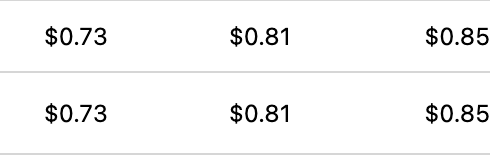

According to Seeking Alpha Quant, BAC had $2.39 in EPS over the three quarters before the most recent one. Last quarter, of course, saw $0.84 in EPS. So we have $3.23 in trailing 12 month EPS. Discount that at the current 10 year treasury yield, and you get a $90 price target. Throw in a 6.5% risk premium, which brings the discount rate to 10%, and you get a $32.3 price target. So, there is upside for BAC even under the assumption of 0% growth and a very high risk premium!

Three months of BAC eps (Seeking Alpha Quant)

Risks and Challenges

As we’ve seen, Bank of America stock is very cheap, is growing quickly, and has upside even under very conservative growth assumptions. It looks like an enticing package, and indeed it’s enticing enough for me to have bought it during its recent dip, as well as before that. However, there are many serious risks facing Bank of America investors, and they deserve to be mentioned. In no particular order, these risks include:

-

Unrealized securities losses. Bank of America’s “real” book value is significantly lower than the book value it reports to investors, because it has a large amount of unrealized losses on treasury securities. They were reported at $109 billion at the end of 2022, by Q1 they had shrunk to $99 billion. The decline in the treasury yield observed in the first quarter logically implies that treasury prices were rising–that’s good for BAC. However, the bank still has $99 billion less in book value than what it reports on its balance sheet. HTM securities are reported at amortized cost, not fair value, so their economic value is not on the balance sheet. This has some bearing on valuation. For example, I wrote earlier that BAC has a 0.99 price to book ratio, which certainly looks cheap, but it’s not nearly as cheap if you swap out amortized cost securities for fair value in the balance sheet calculation.

-

The inverted yield curve. The U.S. treasury yield curve is currently inverted. Banks borrow money on the short end of the yield curve, and lend on the long end. This theoretically implies that their net interest income (“NII”) should fall when the yield curve is inverted. So far, we aren’t seeing that: NII is still rising dramatically at BAC and other banks. However, it could occur later, if the inversion gets even worse, so this is a situation that investors will want to keep their eyes on.

-

Competition for deposits. Related to the previous point is the point about competition for deposits. Banks need deposits, and the cash that comes with them, in order to maintain their CET1 ratios. If their cash levels fall too low, then they have to sell securities in order to maintain their capital ratios–this is where the “unrealized losses” problem comes into effect. If you have to sell securities at losses, then your investments were unprofitable, and you may also suffer liquidity issues. Currently, Apple Inc. (AAPL), in partnership with Goldman Sachs (GS), is offering a 4.5% yield on a savings account. This kind of yield tends to inspire competition among banks, especially those whose yields are lower, and Apple’s 4.5% APY was well publicized, so many depositors will know about it. This could lead clients to withdraw from their Bank of America accounts, diminishing the bank’s capital position and liquidity.

The Bottom Line

Having looked at earnings, valuation, and growth prospects, Bank of America Corporation looks like a pretty good buy at today’s prices. The company doesn’t even need any growth to have a fair value estimate that is higher than its current stock price, and it is still trading below reported book value. To be sure, there are risk factors to think about, such as unrealized losses and competition for deposits. But on the whole, Bank of America Corporation is a compelling investment.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of BAC, AAPL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.