Summary:

- Coca-Cola earned a TSR of over 70% across the last five years, compared to nearly 57% for the S&P 500.

- Executive compensation attempts to resolve the agent-principal problem.

- The company has a well-diversified and growing revenue base.

- The underlying business is profitable, but not attractively so.

- Coca-Cola does not present a margin of safety and is overvalued on a relative basis.

AlizadaStudios

The Coca-Cola Company (NYSE:KO) has established itself as a dividend king, with a track record of 61 consecutive annual increases. Nevertheless, the company has faced criticism over recent years, with suggestions that the business is in secular decline. However, this narrative ignores the structural changes that have, in part, driven revenue decline, and the long-term impact of management’s plan to shift the business toward more profitable avenues. That plan has succeeded, with revenues recovering, profitability improving, and returns in the last two years at their highest level in a decade. Nevertheless, recovering growth, despite profitable growth, supportable dividends, a decent incentive structure, Coca-Cola does not offer enough margin of safety to invest in. The market seems to have correctly assessed that Coca-Cola is back.

Strong TSR Performance

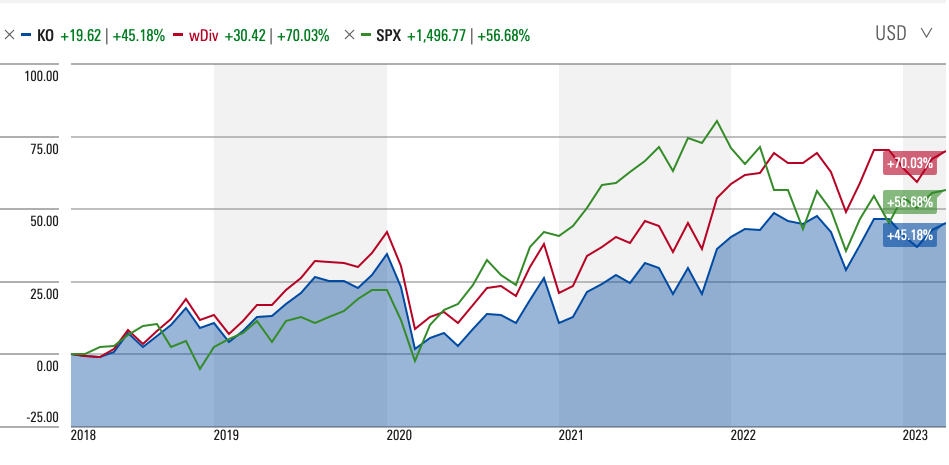

In the last five years, Coca-Cola’s share price has risen by just over 45% compared to a nearly 57% increase for the S&P 500 (SPX). However, management’s dividend policy ensured that total shareholder returns were over 70% for the period.

Source: Morningstar

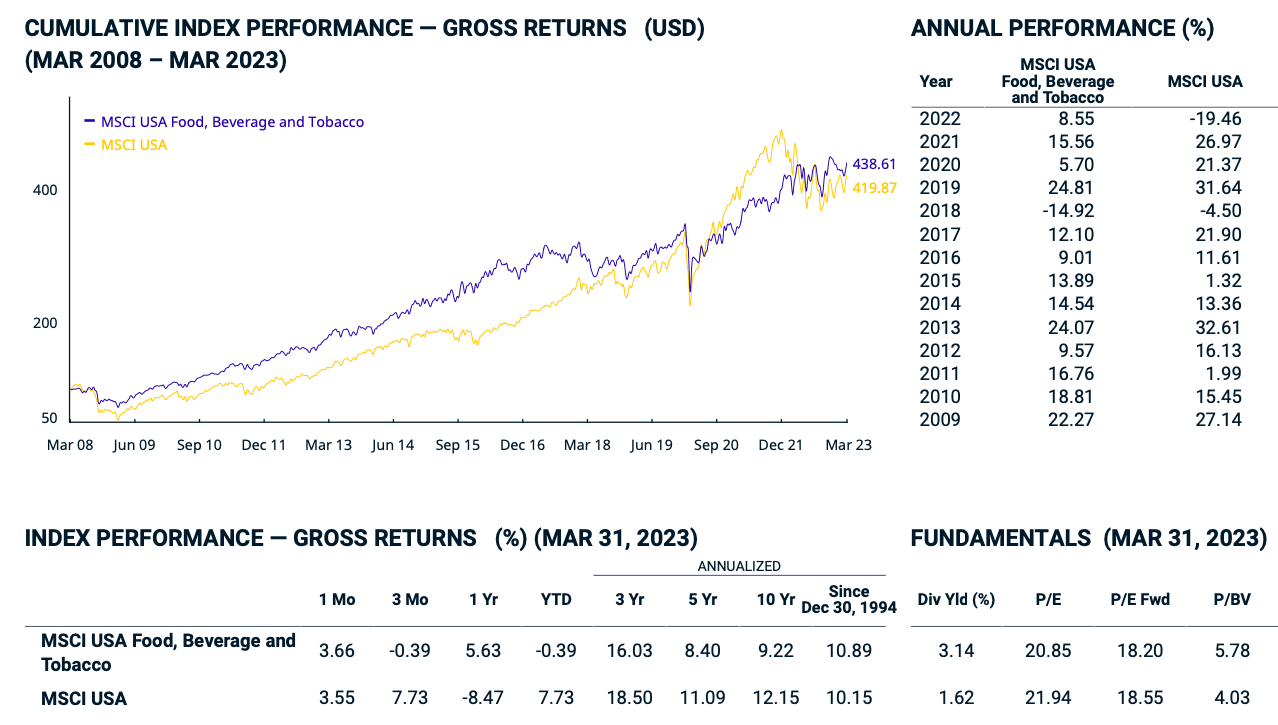

The results above reflect an underlying trend. The MSCI USA Food, Beverage and Tobacco index earned gross returns of 8.4% in that 5-year period, compared to an 11.09% increase for the MSCI USA.

Source: MSCI

This further emphasizes the importance of dividends in the sector for achieving superior TSR to the market.

Incentives Align Shareholder and Management Interests

Now, incentives are a frequently underappreciated factor in explaining and shaping behavior. No less an investor than Charlie Munger observed that,

“Well, I think I’ve been in the top 5% of my age cohort all my life in understanding the power of incentives, and all my life I’ve underestimated it.”

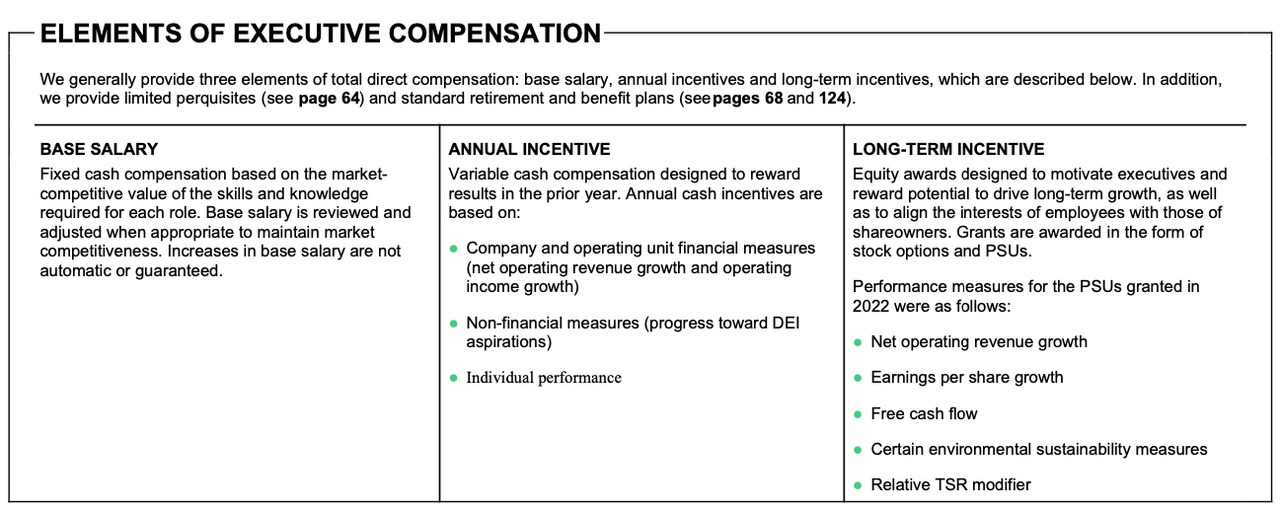

Ideally, to resolve the agent-principal problem that pits management interests against those of shareholders, executive compensation should be tied to return on invested capital (ROIC), or return on capital employed (ROIC), either of which is correlated with long-term corporate value and rewards management for capital allocation skill. Coca-Cola does not do this, they do the second best thing, which is to tie it to drivers of value. According to the 2023 Proxy Statement, long-term incentives are in the form of equity awards granted in the form of Performance Share Units (PSUs) and stock options. The PSUs for 2022 were weighted 30% for net operating revenue growth, 30% for earnings per share growth, 30% for free cash flow (FCF), and 10% for certain environmental sustainability measures.

Source: The Coca-Cola Company 2023 Proxy Statement

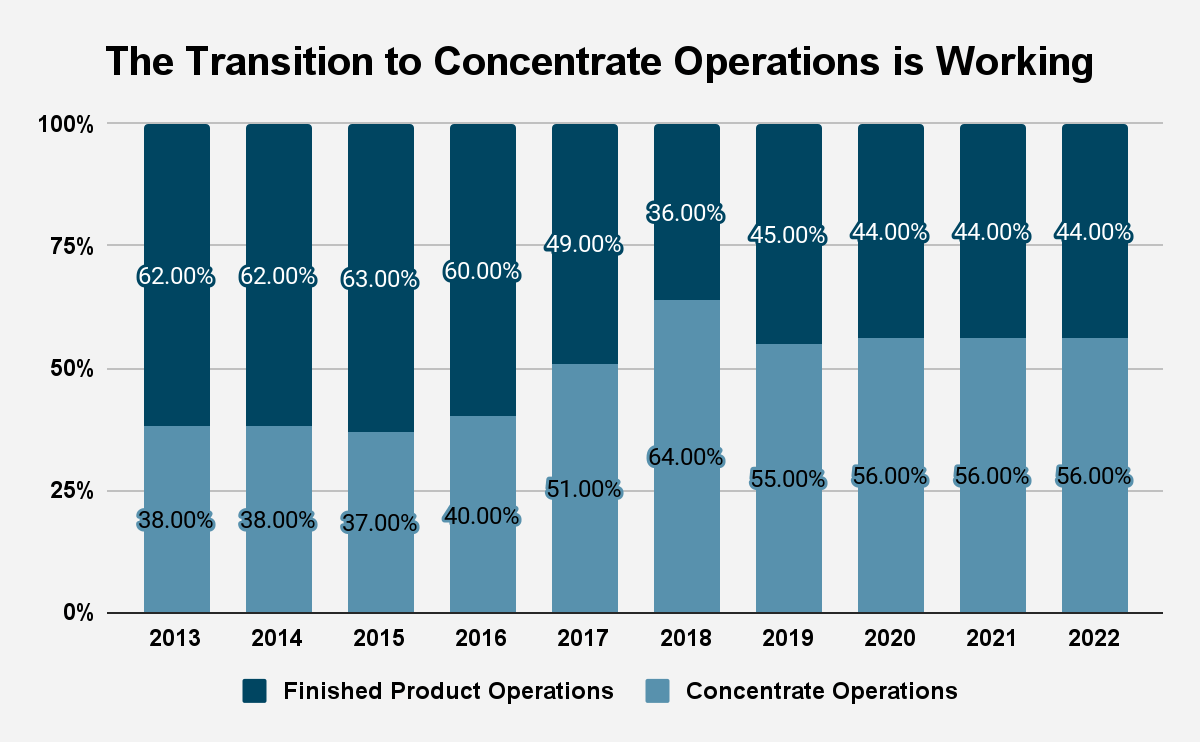

Coca-Cola Has Entered a New Era of Growth

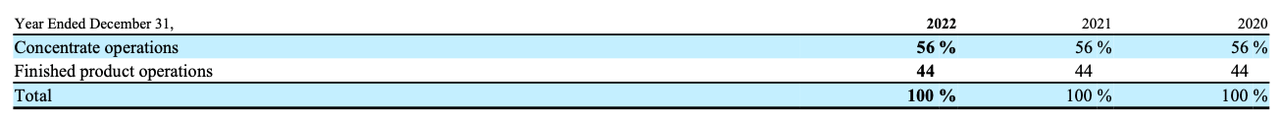

Coca-Cola is a truly global enterprise, and this is reflected in its operating segments, which consists of geographic operating segments covering the entire planet: Europe, Middle East and Africa (EMEA); Latin America; North America; and Asia Pacific; as well as Global Ventures; and Bottling Ventures. The firm is largely engaged in selling non-alcoholic beverages, with the geographic operating segments deriving a majority of their revenues from making and selling beverage concentrates and syrups, or even finished beverages. The Global Ventures segment consists of the business’ Costa, innocent, and Doğadan businesses, along with fees earned due to distribution coordination agreements between the company and Monster. The Bottling Investments segment is involved in bottling, regardless of the geographic location of the bottler. It also receives most of the firm’s equity method investees’ income. Most of the segment’s revenues come from making and selling finished beverages. Finished product operations produce higher revenues at low gross margins. In 2022, concentrate operations made up 56% of revenues, while finished product operations were responsible for 44%.

Source: The Coca-Cola Company 2022 Annual Report

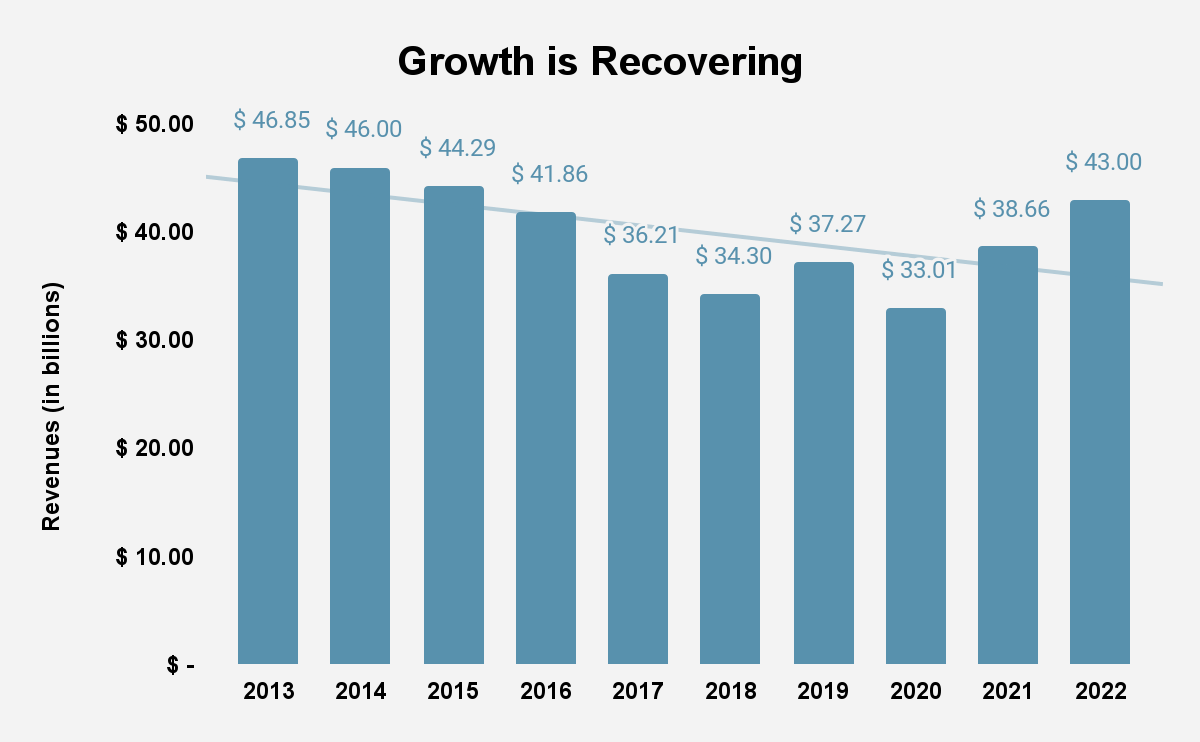

In the last five years, revenue has grown from $31.86 billion in 2018 to $43 billion in 2022, compounding at 6.19% a year. In the 1950-2015 period, 24.2% of firms achieved a 5-year sales compound annual growth rate (CAGR) of between 5% and 10%. In that time, according to Credit Suisse’s “The Base Rate Book”, the mean and median 5-year sales CAGR were 6.9% and 5.2% respectively.

Taking a longer view, revenue has declined from $46.85 billion in 2013 to $43 billion last year, decaying at a rate of -0.85% per year.

Source: The Coca-Cola Company Filings

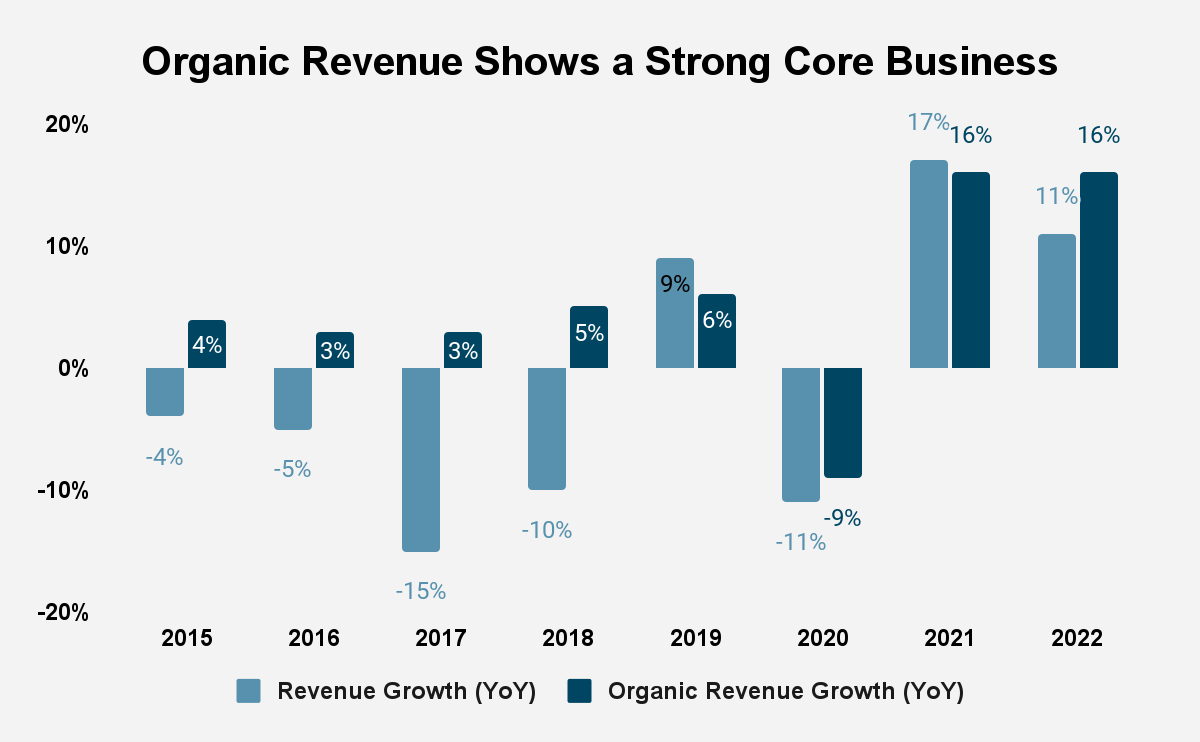

Investors have taken the above results as a signal that the business is in secular decline. However, this view has always been wrong. Management has executed a transition strategy that has shifted the revenue mix away from finished products toward concentrate operations, which offer higher margins, and in terms of regions, has involved refranchising bottling operations in North America and China, and structural changes in Europe and Africa. This was in recognition of the decline in demand for carbonated drinks.

Source: The Coca-Cola Company Filings

While net operating revenues have suffered as a result of structural factors, organic revenue, which the firm has reported since 2015, has grown every year since, except 2020, when it suffered due to the pandemic. The recovery post-pandemic should be seen as the result of a successfully executed plan. Management expects organic revenue to grow 7% to 8%, which seems achievable, given historic trends.

Source: The Coca-Cola 2015-2022 Earnings Reports

A Profitable Business Model

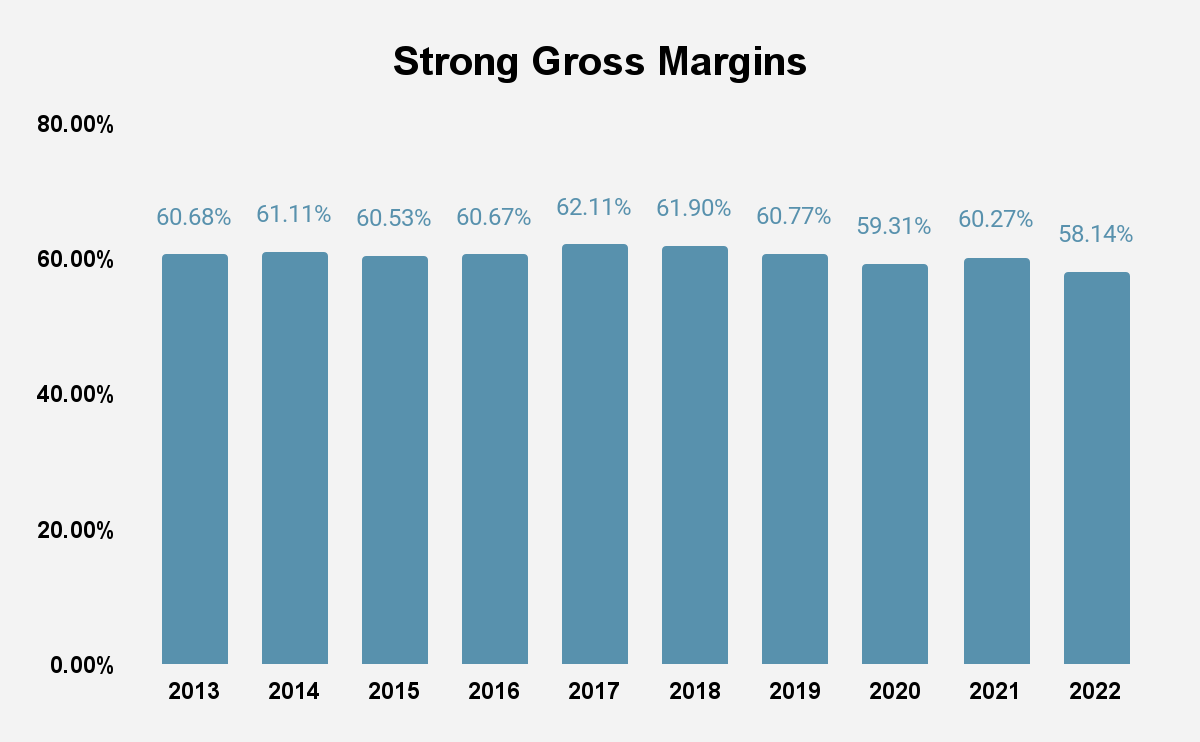

Gross profits grew from $20.09 billion in 2018 to $25 billion in 2022, compounding at 4.8%. In that time, gross margins declined from 61.9% to 58.14%. However, the bigger picture shows that gross margins have stayed very strong right through the structural changes that management has implemented. As the impact is felt, gross margins will improve. As the transition to concentrate operations continues, we should expect gross margins to recover as well.

Source: The Coca-Cola Company Filings

Gross profitability, meanwhile, grew from 0.24 in 2018 to 0.27 in 2022. Although an improvement, it is still short of the 0.33 threshold that Robert Novy-Marx’s research shows marks out a stock as attractive. Gross profitability is likely to continue to improve as the business moves away from capital-intensive finished products, which means a slower asset growth.

Operating income rose from $8.7 billion in 2018 to $10.91 billion in 2022, compounding at 4.63% per year. Operating margin, in turn, declined from 27.31% in 2018 to 25.37% in 2022. This is much higher than the mean and median operating margins in the consumer staples sector in our reference period, which were 8.3% and 8% respectively. The firm’s margins place it in the top tier in the industry. This reflects the success of the differentiation strategy that the company is pursuing. The brand itself is worth $35.4 billion and is the 44th most valuable in the world and the 4th most valuable in the food and beverage industry.

Net income has risen from $6.43 billion in 2018 to $9.57 billion in 2022, compounding at 8.23% per year. In our reference period, 34.1% of firms earned a 5-year earnings CAGR of between 0% and 10%. The mean and median 5-year earnings CAGR for the period were 7.3% and 5.9%. Management expects currency neutral earnings to rise by 7% to 9% in 2023.

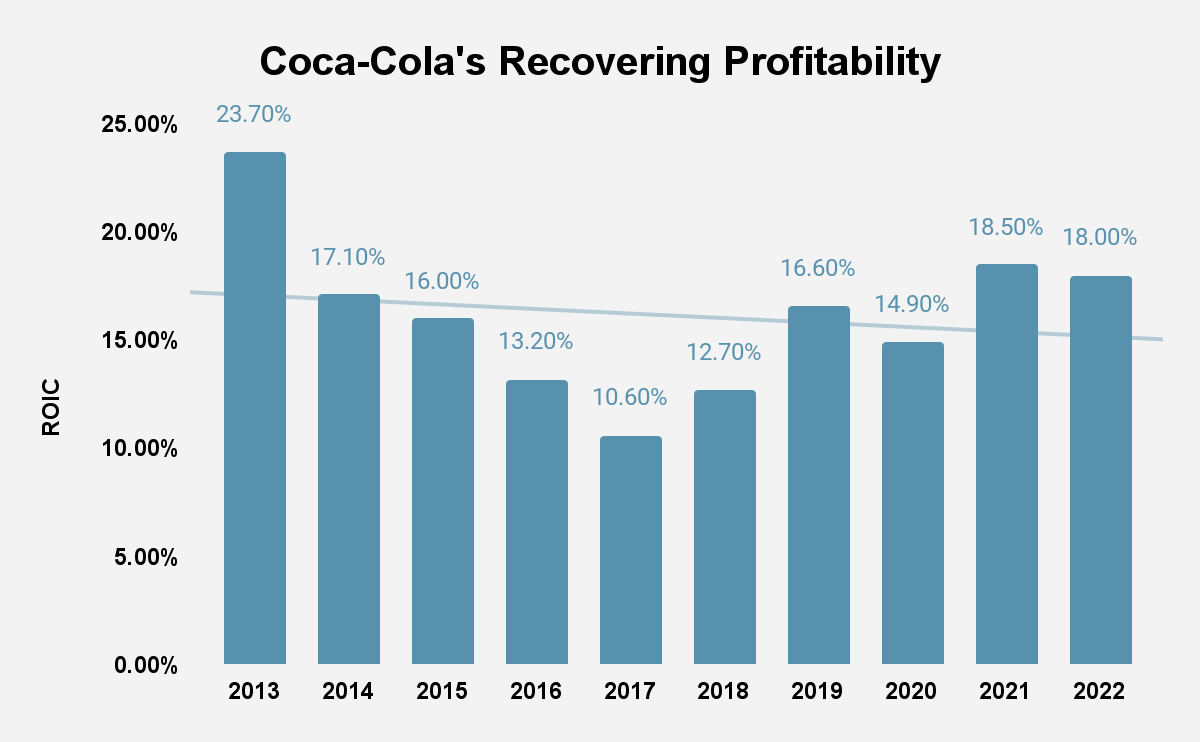

Coca-Cola’s profitability is underlined by its ROIC, which has grown from 12.7% in 2018 to 18% in 2022. The long view shows that profitability has improved since the 2017 bottom. Given that ROIC is correlated with corporate valuation, rising ROIC has occurred with a better market performance.

Source: The Coca-Cola Company Filings and Author Calculations

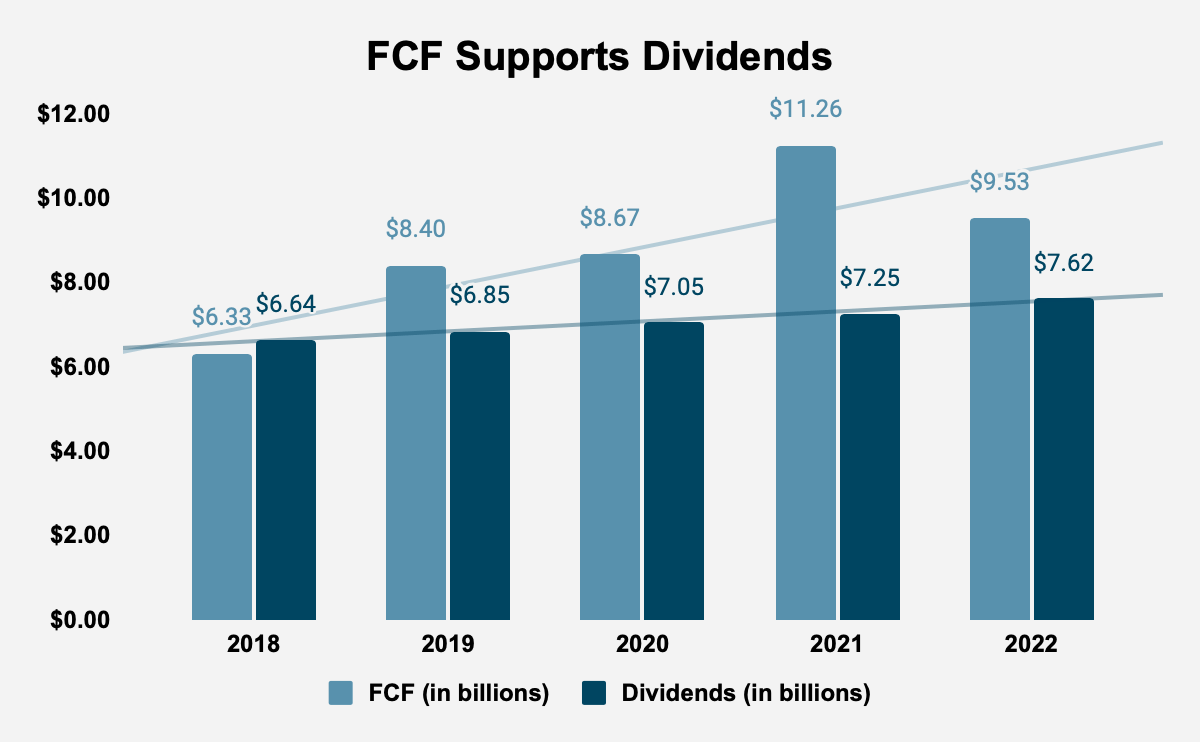

FCF Supports Dividends

FCF has grown from $6.33 billion in 2018 to $9.53 billion in 2022, compounding at 8.53% a year. Cumulatively, the firm has generated 44.19 billion in FCF in that time or 16.2% of its market cap. In that time, the firm has grown dividends from $6.64 billion in 2018 to $7.62 billion in 2022, compounding at 2.79% a year. Cumulatively, the firm has paid out $35.4 billion in dividends over the last five years. In February this year, management announced a 4.5% increase in the dividend per share, which is the 61st consecutive annual increase. Management expects to earn $9.5 billion in FCF in 2023, which is roughly in line with 2022.

Source: The Coca-Cola Company Filings

Valuation

Coca-Cola has a price-earnings (P/E) multiple of 28.79 compared to 20.85 for the MSCI USA Food, Beverage and Tobacco Index, 21.94 for the MSCI USA and 22.19 for the S&P 500. Secondly, with a gross profitability of 0.27 in 2022, its profitability is below the 0.33 threshold. With $9.53 billion in FCF in 2022 and an enterprise value of $300.29 billion, Coca-Cola has an FCF yield of 3.17% compared to 2.7% for the 2,000 largest firms in the United States, as calculated by New Constructs. This suggests that the business is overvalued and that its FCF is not trading with a sufficiently wide margin of safety. These factors do not warrant going further with an investment. They do suggest, however, that current shareholders can look forward to beating the market, given the superior FCF yield.

Conclusion

There is much to love in Coca-Cola’s business model, with diversified revenue that continues to grow at above average rates, and a profitable business model. Further, management’s transition plan has worked, and is likely to ensure long-term growth and rising profitability. In turn, growing FCFs will ensure that Coca-Cola will be able to continue to be a dividend king. Although executive compensation could be improved, there is some attempt at aligning management and shareholder interests. The company’s chief weapon in the TSR wars is its dividend policy, which, as we have seen, is firmly supported by its FCF growth. However, the market seems to have taken these factors into account, leaving investors without an opening. Current investors should stay invested, though.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.