Summary:

- This is a tough macro environment, but Airbnb is sustaining strong growth regardless.

- The company is profitable on a GAAP basis and maintains a net cash balance sheet.

- I expect the company to lean into share repurchases as it continues generating cash.

- I expect growth to decelerate meaningfully over the coming quarters as the company begins to lap tough comps.

AJ_Watt

Airbnb (NASDAQ:ABNB) is the rare tech company that is thriving in the current environment. The company is somehow continuing to deliver robust growth numbers even as it laps tough comparables. ABNB has coupled the fast revenue growth with enviable profit margins and has even begun rewarding shareholders with share repurchases. While there remains the nagging concern of eventual price competition, for now ABNB appears to be circling laps around the competition through its first-mover advantage. The stock might not look that cheap relative to tech peers, but remains buyable for those looking for a profitable tech play in the travel sector.

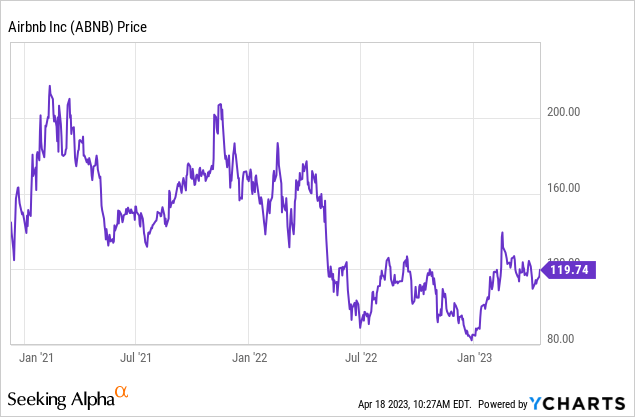

ABNB Stock Price

ABNB stock remains well below its highs, but the company is generating more profits than it ever has and is still growing rapidly.

I last covered ABNB in January where I rated the stock a buy on account of the high profit margins and secular growth. The stock has since returned 20%, as the company continues to defy expectations for tough comps to take hold. Meanwhile, the company is buying back stock and is projecting its strong profit margins to sustain in 2023.

ABNB Stock Key Metrics

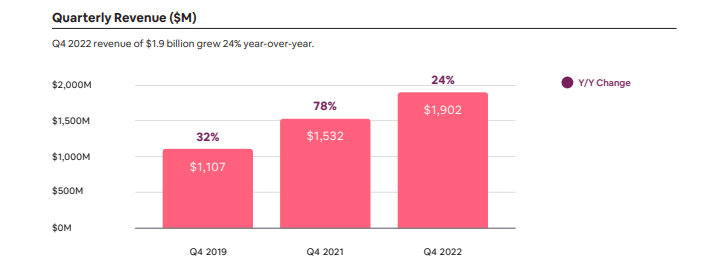

In its most recent quarter, ABNB delivered 24% YOY revenue growth. That represented a steep deceleration from the 78% growth rate posted in 2021, but that makes sense considering that 2021 was lapping a year of pandemic social distancing restrictions. It is curious that the 24% growth rate is not far from the 32% growth rate posted in the fourth quarter of 2019.

2022 Q4 Shareholder Letter

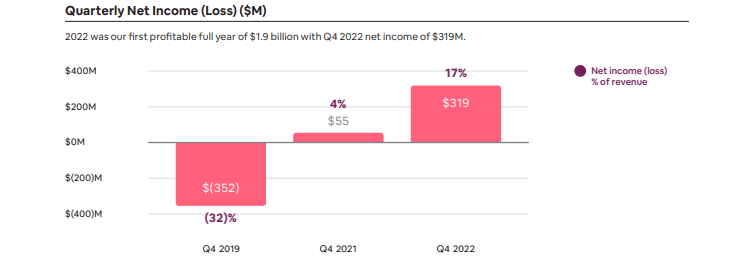

Meanwhile, ABNB generated $319 million in GAAP profits, good for a 17% net margin in the quarter. 2022 was the first year in which the company generated positive GAAP net income.

2022 Q4 Shareholder Letter

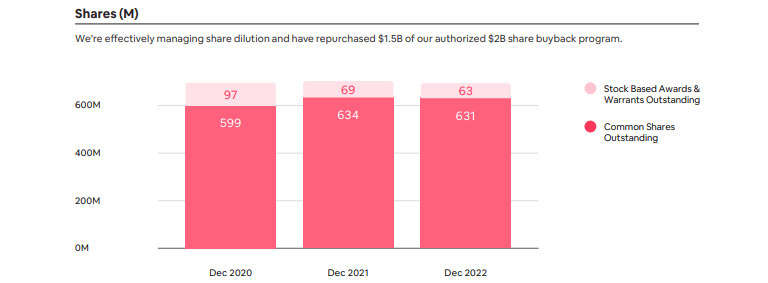

Unlike many tech companies which are still diluting their shareholders due to lack of profits, ABNB has actually seen its diluted shares outstanding decline YOY, as the company has already repurchased $1.5 billion of its authorized $2 billion share buyback program.

2022 Q4 Shareholder Letter

ABNB ended the quarter with $9.6 billion of cash versus $2 billion in debt and $1.2 billion of unearned fees. I note that I am not including the $4.8 billion in funds held on behalf of guests. Based on the strong balance sheet and high profit margins, I expect ABNB to continue its share repurchase program moving forward.

Looking ahead, management has guided for up to $1.82 billion in revenue in the first quarter, representing up to 21% YOY growth (23% constant currency). I should note that investors should be factoring in inevitable deceleration in growth rates, as ABNB will soon be lapping tough comps. This is not too dissimilar to the deceleration seen at e-commerce companies over the past year. On the conference call, management noted that the first quarter of 2022 was “significantly impacted by the Omicron strain of COVID-19 in January and to a lesser extent the war in Ukraine during February,” helping to explain why ABNB will still generate strong growth in this upcoming quarter.

Even as they expect decelerating growth in the later part of 2023, management still expects to maintain 34.6% adjusted EBITDA margin generated in 2022. The assumption is that ABNB will be able to offset lower ADR with cost efficiencies.

Regarding that last point, it is interesting to note that ABNB is one of the few tech companies which are not doing layoffs in the current environment (at least in its tech division, the company recently laid off some of its recruiting staff). This is in large part due to the fact that ABNB already underwent dramatic cost rationalization during the height of the pandemic, when its business came to a virtual standstill. The company has since maintained that cost discipline and it is showing in the company’s strong profit margins.

Management noted that they are “actually stepping on the gas,” staying “focused on just really hiring in key positions.” Amidst a period in which both the consumer and travel competitors are being hurt by the rising interest rate environment, ABNB is in a position of strength to take advantage and aggressively take further market share.

Is ABNB Stock A Buy, Sell, or Hold?

ABNB remains a rare secular growth story in travel. While the growth stories of the likes of Expedia (EXPE) and Booking (BKNG) have been impaired due to Alphabet (GOOGL), ABNB is still benefiting from secular growth tailwinds as more and more consumers become more comfortable with the idea of the “gig economy” for housing. Being a first-mover in this attractive market, ABNB has benefitted from having the largest (and growing) network of supply and demand, helping it to outpace its competitors.

Unlike many of its competitors which have seemingly given up on innovation and have focused primarily on near term profits, ABNB continues to deliver innovative improvements. For example, ABNB has seen great success with “Airbnb Setup,” which connects new prospective hosts with so-called Superhosts to help complete their first reservation. This has helped ABNB continue to rapidly bring on new hosts even as it is already very large in size.

2022 Q4 Shareholder Letter

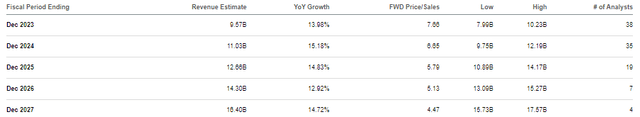

ABNB’s strong results are being reflected in the stock price. Even though the stock remains well off its highs, the stock is still trading at around 7.7x sales, a relatively rich multiple considering that growth is expected to decelerate meaningfully to the low double-digits over the coming years.

Seeking Alpha

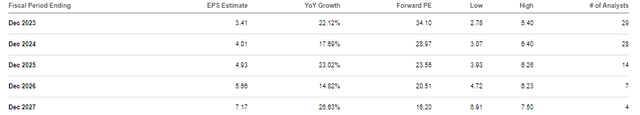

But that multiple looks more reasonable when considering the high profit margins, as ABNB is trading at around 34x forward earnings.

Seeking Alpha

Sure, ABNB is not dirt-cheap, especially as compared to EXPE, which is trading at around 10x earnings. But even if we assume multiple compression to around 15x earnings by 2030, ABNB is offering 9% potential annualized upside over the next eight years (inclusive of annual earnings). One can still make the argument that this return is insufficient in the current environment, ABNB may surprise to the upside if it is able to show operating leverage (the above estimates assume just 31% net margins by 2030).

What are the key risks? I view the risk assessment as being straightforward: competition. There is no reason why hosts cannot also list their properties on competitor websites – competitors may be able to win over hosts through promotions and lower fees. This may in turn lead to lower sales volume at ABNB, which might in turn lead to lower unit-level margins and higher advertising spend. These all may negatively impact the bottom-line, preventing operating leverage for the company. Such a scenario would undoubtedly lead to multiple compression – ABNB would see considerable downside if its stock sold off to trade in-line with EXPE or BKNG. There is also the risk that its network advantage has diminishing returns, as consumers might not benefit from having even more selection. It is also possible that consensus estimates are too optimistic, as the company may see growth decelerate even faster than expected. That was the case with e-commerce stocks and this scenario should not be underestimated considering the tough macro environment. Thus while I still find ABNB buyable, I must caution that the current valuation might not be enough relative to more beaten-down tech peers.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of GOOGL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I am long all positions in the Best of Breed Growth Stocks Portfolio.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Sign Up For My Premium Service “Best of Breed Growth Stocks”

After a historic valuation reset, the growth investing landscape has changed. Get my best research at your fingertips today.

Get access to Best of Breed Growth Stocks:

- My portfolio of the highest quality growth stocks.

- My best 10 investment reports monthly.

- My top picks in the beaten down tech sector.

- My investing strategy for the current market.

- and much more

Subscribe to Best of Breed Growth Stocks Today!