Summary:

- Google has continued getting pummeled in the news cycle, although threats have yet to actually materialize for its business.

- The Samsung contract has not been cancelled, and Google’s search engine is still getting similar levels of usage.

- The real threat here is Google’s executives overreacting and messing with the golden goose: Google.com.

- However, given the Google founders’ ongoing involvement with and control over the firm, I don’t foresee that happening.

- Considering all of this together, I still think Google is a buy.

Nuthawut Somsuk

Overview

Google/Alphabet (NASDAQ:GOOG) (NASDAQ:GOOGL) has continually been in the news cycle for the supposed threats that it is facing to its core Search business from Microsoft (MSFT). Yesterday saw the latest salvo in this ongoing conflict, with the New York Times posting a searing headline that shows just how serious this situation has become:

New York Times

Google is now ‘sprinting to protect its core business’. Undoubtedly, the company is on its back foot, at least in terms of media perception. The situation detailed in the Times is simple yet serious. This article will cover this news item in passing while outlining how Google’s business has been holding up throughout the ongoing. I’ll also expand the scope of analysis later in the article to consider Google’s product and positioning within the changing AI-enabled search landscape.

The Samsung Situation

While many investors may already be aware of what’s going on, I’ll run through a quick summary of the Samsung situation here. The news is that Samsung is considering switching to Bing as the default search engine on its devices, which puts on the line a contract worth $3B yearly in revenue to Google. This news came as a ‘shock’ to Google’s employees and is being attributed to the AI features baked into Microsoft’s new offering. The contract negotiations are ongoing.

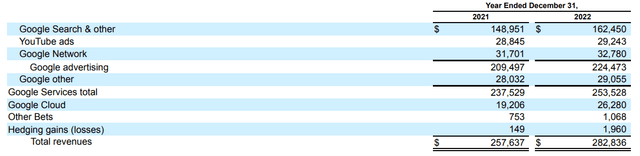

Even more significantly, a similar contract that Google has with Apple is also up for renegotiation this year; that contract is worth $20B. Taken together these 2 contracts composed a 14.2% of Google’s entire Search business last year – a fairly significant number.

Alphabet 2022 10-K

This is definitely news. Google has been so dominant in search for so long that even the prospect of one of its enterprise customers switching to another provider is rightfully shocking to its employees.

Impact on Google

I think there is more bark than bite with this news article. Google’s relationship with Samsung is over a decade old, and we must remember that Samsung runs Google’s mobile operating system, Android, on all of its devices. It doesn’t seem rational for a company to switch away from a search provider that literally owns the operating systems that its phones rely on. Samsung would be damaging a relationship that is central to its business if they were to switch away from Google.

I also think the same goes for Apple’s contract with Google. Apple as a tech company is intimately aware of user preferences. This has been part of its DNA for a long time running and is a central differentiator to their business. Some of Apple’s largest initiatives over the last decade, such as the privacy changes around app tracking, were undergirded by its user-centric culture. As such, I don’t think Apple will move away from Google’s search engine as that is still the preeminent solution amongst consumers.

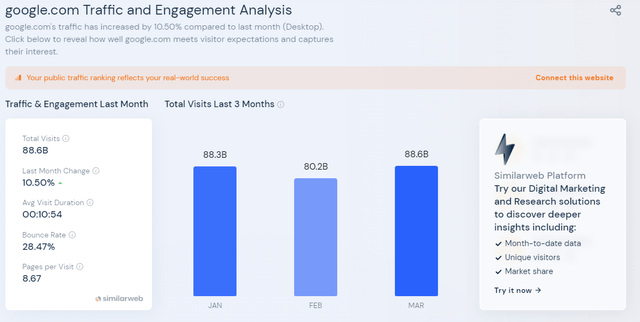

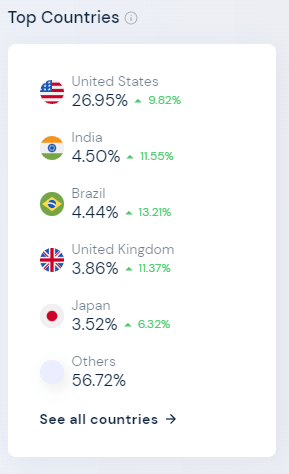

To prove this ongoing consumer preference for Google over Bing, we can take a look at the evolving metrics for both websites. Here we can see that things are still going just fine for Google.com:

Similarweb

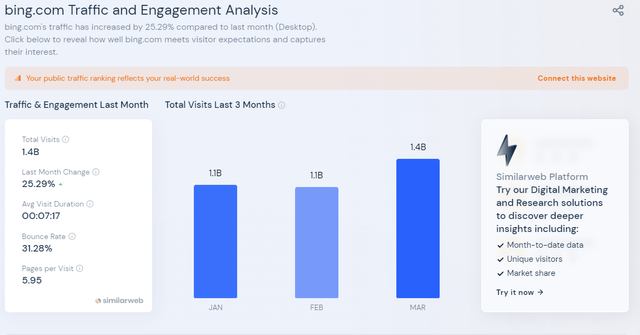

Similarweb

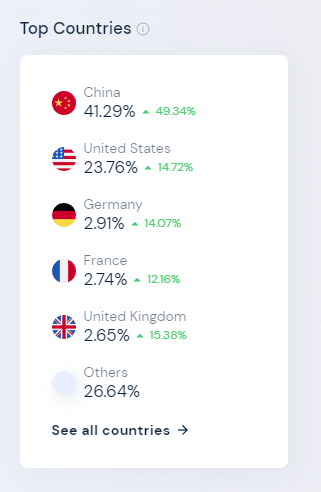

The new Bing launched in February this year. While Bing has seen an uptick in usage in March, it still pulled in only 1.4B hits versus Google’s 88.6B; not exactly game-changing. I also think a lot of this new activity is due to fascination rather than shifting consumer preferences. A closer look at the data also shows that most of Bing’s growth was in China, a significantly less lucrative (per-click) digital advertising market than the United States. Across the US, the monthly growth for Bing was 14.72% while it was 9.82% month-over-month for Google.com. These are not numbers that indicate a sea shift as to search preference.

Similarweb Bing.com

Similarweb Google.com

Considering all of that, I think the direct risks here are overstated. I think the real risk is Google damaging itself by changing things too much. I’ll detail that briefly in the next section.

Don’t Mess With The Golden Goose

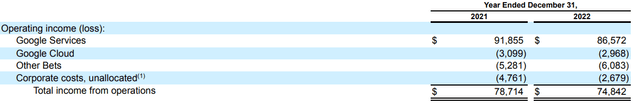

Google.com is Google’s golden goose. It earns all of the company’s profits. Google Cloud and ‘Other Bets’ (formerly known as ‘Google X’) aren’t even profitable as of yet. As such, it’s no wonder that Google executives flew into a panic the second that it seemed that it was under threat.

Alphabet 2022 10-K

This panicked response is more worrisome to me than the actual competition Google faces, which frankly hasn’t materialized in any tangible form as of yet. Simply put, Google executives could make decisions that are more reactive to competition rather than proactive as to their business. This could result in them making changes to their core product that users don’t actually like or want. In turn, this may result in them damaging the golden goose and negatively impacting their business. As Jeff Bezos likes to say, you need to obsess over your customers – not your competitors.

To that end I think it will be critical to watch how Google’s core search product evolves. If it changes too significantly then I am going to get concerned.

Conclusion

Considering all of this together, I am still optimistic for Google. While the news cycle has continued to ring the alarm, there has not been a drop-off in Google.com’s userbase or cancellations around any of their enterprise contracts. I’ll reiterate that the concern that I have here is Google executives messing with the golden goose.

However, I think Google’s corporate structure is a hedge against reactionary thinking and what would be concomitant large changes to its core product. Observers of Google know that co-founders Larry Page and Sergey Brin own over 80% of Class B shares, each of which has 10x the votes of Class A shares while also not trading on any exchange. This gives the founders over 50% of overall votes and veto power on any overly significant changes to Google. It’s my estimation that they will be quite cautious as to making too fundamental a change to the elegant and simple Google.com that has brought them their billions.

To that end, I foresee Google’s innovation in this regard being more marginal and iterative, which is the way that it needs to be. The market should become aware of this in due time and Google is still a buy in my book.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in GOOG over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.