Summary:

- We expect Meta Platform to be a significant contributor to our performance over the next several years.

- META stock hit the lows of $88 per share in November of 2022, as the stock dropped a staggering 75% from its highs.

- How has Mr. Market’s perception of Meta’s future prospects changed so much in just a few months?

Kelly Sullivan

fuThe following segment was excerpted from this fund letter.

Meta Platforms (NASDAQ:META)

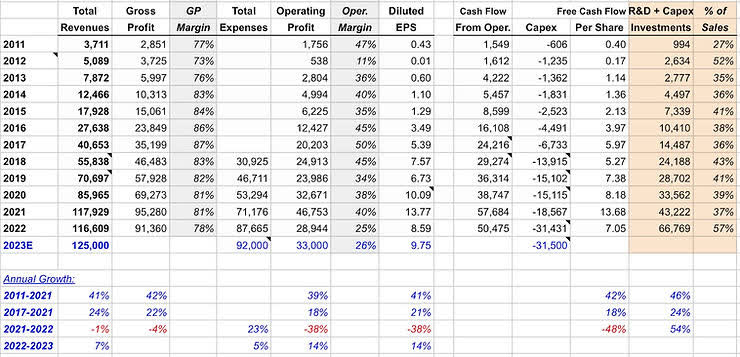

META stock hit the lows of $88 per share in November of 2022, as the stock dropped a staggering 75% from its highs, while revenues only declined by 1% in 2022, gross margins dropped 4% and EPS declined 38% (please see the figures we included below). At the time we published a note: “Does a $750 billion decline in Meta’s market cap make sense?“

Source: Rowan Street Capital, LLC

Since those lows, Meta’s stock has increased +131% compared to the S&P 500 rise of +7% for the same time period. So how has Mr. Market’s perception of Meta’s future prospects change so much in just a few months?

As it usually happens after a huge rise in the stock price, analysts are now turning bullish on the stock and upgrading their price targets (akin to shooting an arrow first, seeing where it lands and putting a bulls eye over it). Their bullishness is largely based on the new discipline around expenses and capital spending.

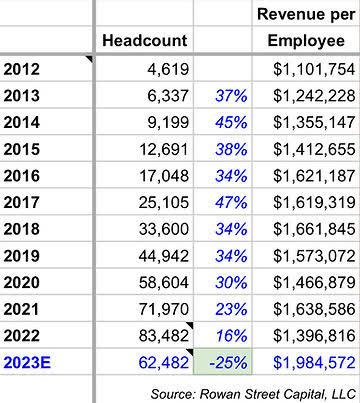

On the latest Feb.1 quarterly call, Mark Zuckerberg discussed his management theme for 2023 as the “Year of Efficiency”. For most of Facebook’s history, they saw rapid revenue growth year after year and had resources to invest in many new products. But 2022 was a humbling wake up call for Zuck. The world economy changed, competitive pressures grew, and the company’s growth slowed considerably. They responded by scaling back budgets, shrinking their real estate footprint, and made a difficult decision to lay off 13% of workforce (note that in March ’23 they announced plans to cut another 10,000 jobs and close 5,000 open roles – that is after an 11,000-job layoff in November). Below, we jotted down Meta’s hiring progression since their IPO in 2012:

Over this 10-year time period, they have increased their headcount at a staggering speed of 34% per year from 4,619 to 83,482 employees (note that this includes the ~11,000 employees impacted by previously announced layoffs who remained on payroll as of 12/31/22 due to legal requirements). In the same time period, their revenues have grown at a rate of 37% per year, so we can say that the headcount increase was justified for this ‘high growth era’.

If we look at the past 3 years (since COVID started), Meta has grown their headcount by 23% per year, while their revenues grew at a rate of only 18% per year, coming to a complete halt in 2022 (-1% revenue decline). So we can argue that Zuck is pivoting quickly and re-adjusting the company’s cost structure to the new world as well as his new expectations for growth ahead.

We estimate, based on the layoff figures that the company has provided, that Meta will finish 2023 with 62,482 employees – a dramatic 25% reduction from 2022. At the same time, Meta’s revenues are estimated to increase 6% in 2023 to $124 billion. Thus, we estimate that 2023 will be the highest ‘Revenue per Employee’ year in company’s history, coming close to $2 million per employee (please refer to the figures above).

More importantly, Zuck is not only focused on reducing heads, but on developing a flatter organizational structure that is conducive to faster decision-making. Here is what he said in his recent note to employees:

“It’s well-understood that every layer of a hierarchy adds latency and risk aversion in information flow and decision-making. Every manager typically reviews work and polishes off some rough edges before sending it further up the chain.

In our Year of Efficiency, we will make our organization flatter by removing multiple layers of management. As part of this, we will ask many managers to become individual contributors. We’ll also have individual contributors report into almost every level – not just the bottom – so information flow between people doing the work and management will be faster.

Of course, there are tradeoffs. We still believe managing each person is very important, so in general we don’t want managers to have more than 10 direct reports. Today many of our managers have only a few direct reports. That made sense to optimize for ramping up new managers and maintaining buffer capacity when we were growing our organization faster, but now that we don’t expect to grow headcount as quickly, it makes more sense to fully utilize each manager’s capacity and defragment layers as much as possible.”

Naturally, the ‘Year of Efficiency’ and the focus on building the critical muscle for financial discipline going forward was music to Wall Street’s ears, and was almost entirely responsible for the stock more than doubling from November. We are huge supporters of this renewed focus as well. At the same time, Meta is an innovative technology company, and as long-term investors, we really liked hearing that Meta will still continue to invest heavily into its long-term vision despite the renewed focus on efficiency. They are not just playing defense and trying to survive, they are playing to win! Zuck emphasized this in his recent note to employees:

“In the face of this new reality, most companies will scale back their long term vision and investments. But we have the opportunity to be bolder and make decisions that other companies can’t. So we put together a financial plan that enables us to invest heavily in the future while also delivering sustainable results as long as we run every team more efficiently. The changes we’re making will enable us to meet this financial plan.

I believe that we are working on some of the most transformative technology our industry has ever seen. Our single largest investment is in advancing AI and building it into every one of our products. We have the infrastructure to do this at unprecedented scale and I think the experiences it enables will be amazing. Our leading work building the metaverse and shaping the next generation of computing platforms also remains central to defining the future of social connection. And our apps are growing and continuing to connect almost half of the world’s population in new ways. This work is incredibly important and the stakes are high. The financial plan we’ve set out puts us in position to deliver it.”

In summary, despite the stock more than doubling from November, we believe our investment in Meta still has meaningful upside in the years ahead driven by continued innovation, accelerating revenue growth, newly emphasized cultural principles that are guiding operational and cost efficiencies, and still attractive valuation.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.