Summary:

- The management team at Facebook parent Meta Platforms is expected to announce financial results covering the first quarter of the company’s 2023 fiscal year.

- Analysts currently anticipate both sales and profits weakening, though they are more bullish on revenue than management.

- The firm is in solid condition and shares look cheap enough to justify upside, even after the stock more than doubled since late last year.

Justin Sullivan

When I buy shares in a company, my goal is to hold it for a year or longer. I have no reservations when it comes to owning stock for five years or more even. But this doesn’t mean that I am guaranteed to hold a stock for the long haul. If shares of a company that I purchased skyrocket in a short window of time and are no longer as attractive as other opportunities that are out there, I will divest of those holdings and look elsewhere for opportunities. Over the past year or so, this only occurred with one of my holdings. That holding in question was Facebook parent Meta Platforms (NASDAQ:META). After initially buying my first shares in the business in late October of last year, and building up that position, I eventually sold out, with my first sales occurring 98 days later and the last occurring 134 days later.

The upside I experienced during that time was significant, with a near doubling in the money that I put in. In retrospect, however, I do regret selling out so soon and I need to make clear that just because I sold does not mean that I believe the company is anything less than a solid prospect. However, it is clear by now that the easy money has been made. But since I sold out my shares, the stock has continued to rise, with shares up 18.8% compared to the price I last sold them at. Of course, it’s important to keep in mind that this picture could change. And what more likely time for there to be a change, either for better or for worse, than during an earnings release? It just so happens that, later this month, management will be reporting financial results covering the first quarter of the company’s 2023 fiscal year. Leading up to that point, investors would be wise to keep a close eye on a few key things. After all, the items in question would likely play a big role in determining whether additional upside can be achieved by investors, or whether the stock is destined to pull back.

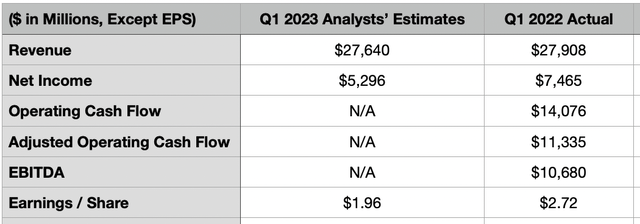

A look at headline expectations

After the market closes on April 26th, the management team at Meta Platforms will announce financial results covering the first quarter of the company’s 2023 fiscal year. The very first thing that investors will likely focus on will be what I call the headline news. This largely revolves around revenue and profits. On the revenue side of things, analysts are currently anticipating sales of $27.64 billion. To put this in perspective, that would translate to a 1% decline compared to the $27.91 billion the company reported only one year earlier. Interestingly, management has been pretty detailed on this front. During their fourth quarter earnings release, for instance, they said that revenue would be between $26 billion and $28.5 billion. The midpoint there would be $27.25 billion for a year-over-year decline of 2.4%.

It’s rare, in my experience, for analysts to be more bullish than management is, particularly by the amounts that we are talking. It’s frankly unclear why they might be. We do know that management’s forecast was based on a 2% hit stemming from foreign currency fluctuations. I also know that the dollar has grown weaker so far this year. So it is possible that the optimism is coming from that. Of course, it could also relate to expectations regarding the company’s core business. This is centered around what management calls the Family of Apps. And the overwhelming majority of the revenue associated with it comes from advertising.

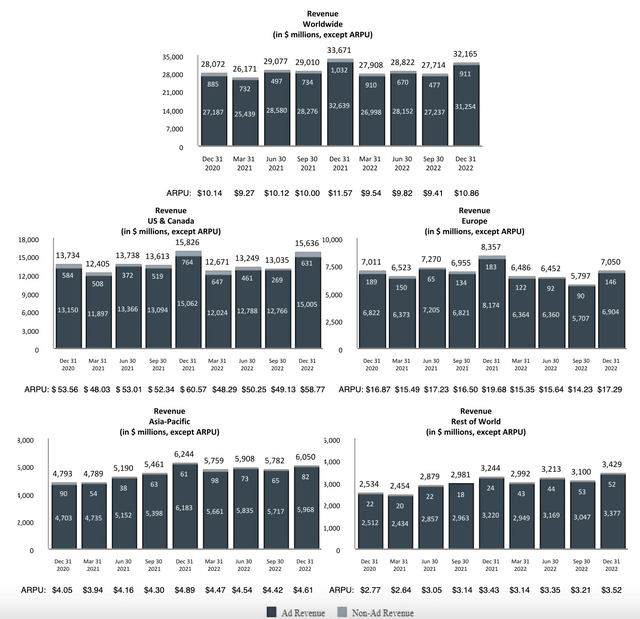

Globally, it’s estimated that digital ad spending will grow to about $422.8 billion this year. That’s 7.2% higher than what was seen in 2022. However, it also marks a meaningful slowdown in growth compared to the 13.7% growth experienced from 2021 to 2022. At the end of the day, Meta Platforms should benefit from a growth in users. Globally, the company reported 2.963 billion monthly active users at the end of 2022. That was up from 2.958 billion one quarter earlier and it translated to a year-over-year increase of nearly 1.8%. However, ARPU generated by the company has been weakening. In the final quarter of 2021, it came out to $11.57 per user. One year later, it fell to $10.86. Although some might chalk this up to the fact that the international growth the company has seen will translate to lower revenue on a per-user basis, it’s also the case that the company saw weakness in even its developed markets. In the US and Canada, for instance, revenue was down 3% per user, while in Europe it was down 12.1%.

On the bottom line, the expectation is for earnings per share of $1.96, with adjusted earnings per share of $1.92. To put this in perspective, earnings per share in the first quarter of 2022 totaled $2.72, which translated to net income of $7.47 billion. If analysts are correct, then actual net income will be around $5.30 billion, while adjusted income will be $5.19 billion. A drop in revenue will certainly contribute to this. But the primary driver will be an increased operating structure. In his most recent guidance, management said that total operating expenses for 2023 will be between $89 billion and $95 billion. That’s down from the $94 billion to $100 billion previously anticipated. Even so, restructuring costs, continued expansion at its data centers, and continued significant investment in Reality Labs, which focuses on the company’s metaverse operations, will all be weighing on its bottom line. Analysts have not provided guidance when it came to other profitability metrics. But for context, operating cash flow in the first quarter of 2022 was $14.08 billion, while the adjusted figure for this was $11.34 billion. Meanwhile, EBITDA for the business was $10.68 billion.

One thing that could definitely impact bottom line results, at least from a per-share perspective, will be any share buybacks management engaged in. At the same time that the company has decided to slash several thousand jobs, it initiated a new $40 billion share buyback program last year. After purchasing 161 million shares for $27.93 billion last year, the company already had $10.87 billion worth of authorization under its prior plan. That gives us $50.87 billion in all to work with. And with cash in excess of debt totaling $30.82 billion at the end of last year, it wouldn’t be surprising to see additional buybacks in the first quarter.

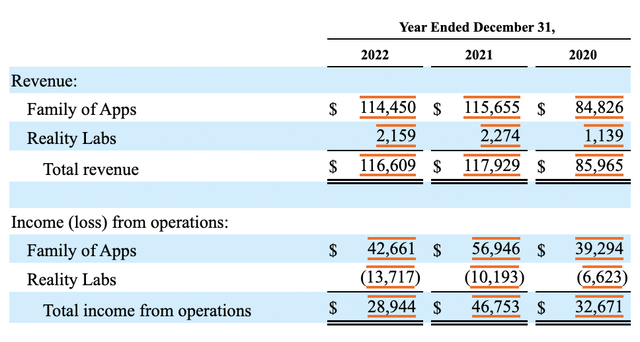

A look into the metaverse

When I bought shares of Meta Platforms, I did so because I recognized that the company does not need its metaverse operations in order to survive. Advertising spending is a bit weak right now, but it’s also within the historical range of what the company has achieved in prior years. Add on top of this the fact that it continues to grow in all of its markets, with the exception of Europe where it has contracted some, and my view on the metaverse centered around two different scenarios. The first scenario is that management would eventually achieve something amazing that would generate tremendous upside. So far, that looks unlikely. And in that unlikely scenario, the company would eventually cut its losses and see cash flows rise materially compared to what they have been. In both scenarios, the company would be incredibly healthy and would be trading at rather low multiples.

For those who still own shares of Meta Platforms, it will be vital to see exactly what transpired on the metaphor side of things. Last year, that business generated $2.16 billion in revenue. But on that revenue, it saw operating losses of $13.72 billion. Even though the company has been tightening its belt in order to cut costs, there has been no indication as of yet that they are willing to significantly reduce spending on metaverse activities. In the event that management reports something amazing or if they announce that they are indeed cutting costs materially, I would expect the implied savings to translate to significant upside for shareholders in the form of share price appreciation.

Shares still look cheap

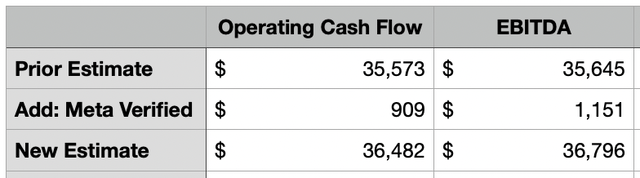

Although I have since divested my shares of the company, I do believe that the stock is still undervalued to some degree right now. In one of my prior articles, I calculated out a good approximation of what both operating cash flow and EBITDA should be for the company this fiscal year. In a subsequent article, I provided an assessment of how Meta Verified might play out from a financial perspective. One estimate provided by a third party was that, by early next year, Meta Verified might have 12 million subscribers or more.

* $ in Millions

If we assume that this will be correct, and we assume that this number will increase throughout the year as opposed to occurring right away, then perhaps we would estimate a weighted average number of subscribers of eight million. With the higher price of the two to reflect the app subscription instead of the web version, we would get revenue of about $1.44 billion. Stripping out expenses and interest expense, I asked estimated that this kind of revenue would translate to profits of nearly $910 million for this year. Add that on to my aforementioned calculations, and we would end up with adjusted operating cash flow of $35.57 billion and EBITDA of roughly $35.65 billion for this year.

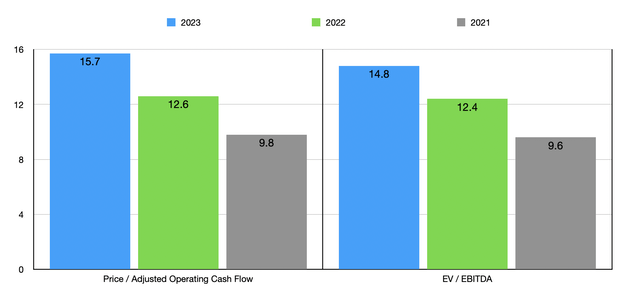

Using these figures, I calculated that the company is trading at a forward price to adjusted operating cash flow multiple of 15.7 and at a forward EV to EBITDA multiple of 14.8. But again, a lot of its pain has been self-inflicted. If we see this picture change and financial performance revert back to what it was in 2022 or even 2021, shares would look even cheaper. Considering that we are dealing with a truly global enterprise that is quite healthy, I would consider these multiples to be in a range that’s indicative of an undervalued firm.

Takeaway

Based on the data provided, I must say that I remain impressed by the meteoric rise of shares of Meta Platforms in recent months. Truth be told, I regret selling out when I did. However, that tends to happen with value investors, since our continuous search for the cheapest companies leads to us leaving some money on the table. Even after shares have risen in recent months, I would make the case that further upside is perhaps warranted from here. Naturally, though, investors would be wise to see exactly what the firm reports in the coming days, since that could set the tone for the rest of the year. But in the meantime, I do still think the company warrants a solid ‘buy’ rating at this time.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Crude Value Insights offers you an investing service and community focused on oil and natural gas. We focus on cash flow and the companies that generate it, leading to value and growth prospects with real potential.

Subscribers get to use a 50+ stock model account, in-depth cash flow analyses of E&P firms, and live chat discussion of the sector.

Sign up today for your two-week free trial and get a new lease on oil & gas!