Summary:

- Millions of people have used ChatGPT since it launched in November 2022.

- With cloud spend tightening, hyperscalers are developing generative AI to stay competitive by accelerating the roll out of AI processes for their own applications.

- Hyperscaler Microsoft has made a $10B investment into OpenAI for a reported 49% stake in the company at a $29B whole-company valuation.

- Chinese ChatGPT Concept Stocks are another potential investment source, as China’s A-Share Artificial Intelligence Index is up 79% in the past quarter.

David Becker

This article was originally sent to my subscribers of my Semiconductor Deep Dive Marketplace newsletter on April 8, 2023.

Subscribers have had 10 days to digest and decide their strategy based on my thesis in this article. But the catalyst for publishing it now on the free version of Seeking Alpha came from an April 17 note by Morgan Stanley analyst Keith Weiss who said that Microsoft (MSFT) is “best positioned to gain market share” among leading software companies that are pushing into the cloud and AI markets, thereby confirming my own thesis. My original article follows:

The Rise of Generative AI

Generative AI technologies are finding applications in marketing, advertising, drug development, legal contracts, video gaming, customer support and digital art.

Depending on how you look at it, Generative AI (commonly represented by ChatGPT) is either sucking out all the oxygen in the room (me), growing buzz surrounding the technology has reached a fervor the likes of which the VC market hasn’t seen in years (Pitchbook), a data privacy concern (Italian government), or a risk to the future of civilization (Elon Musk).

I already discussed Generative AI in my February 24, 2023 Seeking Alpha article entitled “TSMC Makes The Chips, But Nvidia Gets The Glory,” with the focus on Nvidia’s (NVDA) GPU chips and TSMC’s (TSM) foundry capabilities.

ChatGPT was invented by OpenAI, co-founded in 2015 by Elon Musk and Sam Altman. But in early 2018, Musk told Sam Altman that he believed the venture had fallen fatally behind Google. Musk proposed a possible solution: He would take control of OpenAI and run it himself.

Altman and OpenAI’s other founders rejected Musk’s proposal. Musk, in turn, walked away from the company — and reneged on a massive planned donation. The fallout from that conflict culminated in the announcement of Musk’s departure on Feb. 20, 2018.

In November 2022, OpenAI unveiled ChatGPT. Released in mid-March, OpenAI introduced a more powerful version of the ChatGPT system called GPT-4. ChatGPT4 extends the input content to text and images within 25,000 words, which can handle more complex and subtle problems than ChatGPT.

On the whole, the latest version of GPT-4 mainly improves the ability of language models on the basis of ChatGPT’s GPT-3.5, and adds multi-modal functions. The performance of different language scenarios and internal antagonistic authenticity evaluations is significantly better than GPT-3.5.

While OpenAI is currently not a publicly traded stock, there are many others that are traded in the U.S., as well as foreign stock exchanges. These companies are profiled in this article to provide data to investors.

Global Hyperscaler Companies

I project a deceleration in cloud capex spend in 2023 due to customers shying away from expensive cloud deals in a dour macroeconomic environment, according to The Information Network’s report entitled “Global Semiconductor Equipment: Markets, Market Shares and Market Forecasts.”

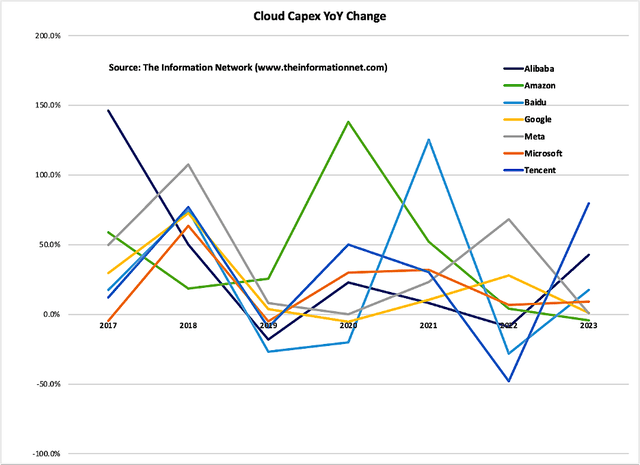

With cloud spend tightening (Chart 1), hyperscalers are looking to give their cloud divisions a shot in the arm with AI to stay competitive.

Chart 1

There is a significant opportunity for hyperscalers like Amazon Web Services (AWS), Microsoft Azure, Google Cloud Platform and Meta, to accelerate the roll out of AI processes for their own applications, and over the long term, this will create competitive challenges for application software providers.

The five biggest tech firms have an estimated employment of 33,000 people working directly on AI research and development, with Amazon boasting the largest pool of AI-focused employees, at 10,113. Microsoft Corp. has 7,133 AI staff and Google has 4,970, according to Glass.ai.

Alibaba (BABA)

Alibaba Cloud unveiled the service, called Tongyi Qianwen, on April 7, 2023 through its official WeChat account, and has opened the chatbot to invite-only beta testing for corporate clients.

The landing page for Tongyi Qianwen’s website is sparse with no details about the functions of the service, which is described as a “productivity assistant and idea generator” that is “dedicated to responding to human commands” through the use of a large language model (LLM).

Alibaba is launching the “large-scale model” of its chatbot during the 2023 Cloud Summit in Beijing on April 11, 2023

Amazon (AMZN)

For more than a decade, virtual assistants had become indispensable. But they were hampered by clunky design and miscalculations, leaving room for chatbots to rise. Due to the startling success of OpenAI’s ChatGPT, A.I.-powered digital assistants such as Amazon’s Alexa, Apple’s Siri and Google’s Assistant are no longer enough to keep Amazon competitive in the technology industry.

Now that Alexa growth has stagnated, Amazon is working with smaller companies in the space. Amazon’s cloud unit is expanding a partnership with artificial intelligence startup Hugging Face. AWS already has more than 100,000 customers running AI applications in its cloud. These customers will now be able to access Hugging Face AI tools through Amazon’s SageMaker program. Additionally, Hugging Face’s software developers can use Amazon’s cloud computing power and its chips designed for artificial intelligence tasks.

Baidu (BIDU)

Chinese search engine giant Baidu has revealed its artificial intelligence-powered chatbot Ernie, the latest rival to OpenAI’s groundbreaking ChatGPT. More than 650 organizations in China have plans to use Ernie, including China CITIC Bank, the National Museum of China and the Global Times newspaper, according to Baidu.

Google (GOOGL) (GOOG)

Google announced in early April 2023 an upgrade for the company’s Bard AI, moving from the lightweight LaMDA model to the improved PaLM model, potentially closing the performance gap with OpenAI’s ChatGPT.

The migration is expected to enhance Bard’s math and coding capabilities and contribute to further improvements in AI capabilities in the upcoming months.

The big difference between ChatGPT and Bard is the data they use to generate answers. Bard extracts information straight from the internet, whereas ChatGPT is trained in datasets that end in 2021, which is why Bard answered the companies question posed to it about tech layoffs that took place in 2022 more accurately than ChatGPT.

Meta (META)

On February 23, 2023, Meta publicly released LLaMA (Large Language Model Meta AI), a foundational, 65-billion-parameter large language model.

Barely one-third of the size of GPT-3, the “smaller, more performant models such as LLaMA enable others in the research community who don’t have access to large amounts of infrastructure to study these models, further democratizing access in this important, fast-changing field.”

Interestingly, Meta noted in the press release:

“To maintain integrity and prevent misuse, we are releasing our model under a noncommercial license focused on research use cases. Access to the model will be granted on a case-by-case basis to academic researchers; those affiliated with organizations in government, civil society, and academia; and industry research laboratories around the world.”

However, LLaMa was leaked to the public through a 4chan article, where a member uploaded a torrent file just two weeks later. It is now free.

Microsoft (NASDAQ:MSFT)

Since 2019, Microsoft has invested at least US$3 billion in OpenAI. The company announced in mid-January that as part of the third phase of its partnership with OpenAI, it will make “a multiyear, multibillion dollar investment.”

Microsoft is bringing generative artificial intelligence technologies such ChatGPT chatting app to its Microsoft 365 suite of business software.

Microsoft said in mid-March 2023 that the new AI features, dubbed Copilot, will be available in some of the company’s most popular business apps, including Word, PowerPoint and Excel.

Microsoft is pitching the Copilot features as being more powerful than simply being OpenAI’s ChatGPT embedded into Microsoft 365, and will be available in some of the company’s most popular business apps, including Word, PowerPoint and Excel.

China’s Strong Momentum

According to the data, as of April 4, China’s A-Share Artificial Intelligence Index is up by 2.73% in the past week, 21.51% in the past month, and 79.15% in the past quarter.

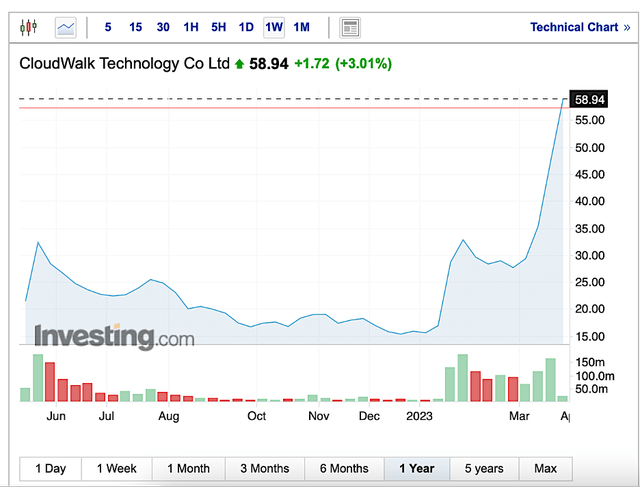

In terms of individual stocks, as of April 4, CloudWalk Technology (688327) doubled its stock price in just nearly 10 trading days, and the cumulative increase during the year is as high as 271%, as shown in Chart 2.

Chart 2

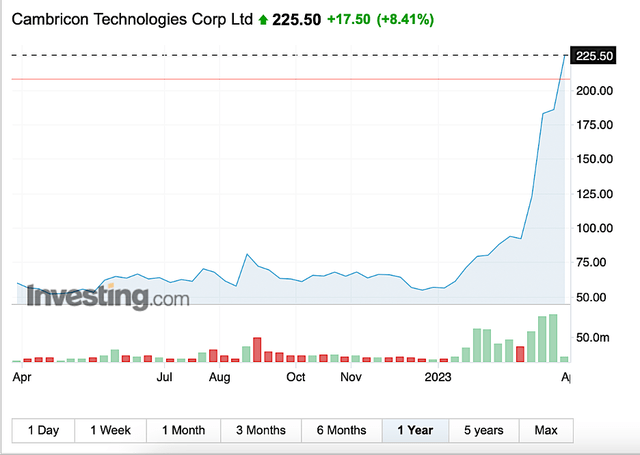

Cambricon Technologies (688256) has also increased in the year by more than 200%, as shown in Chart 3.

Chart 3

Kunlun Technology (300418) also soared by more than 251% during the year, as shown in Chart 4.

Chart 4

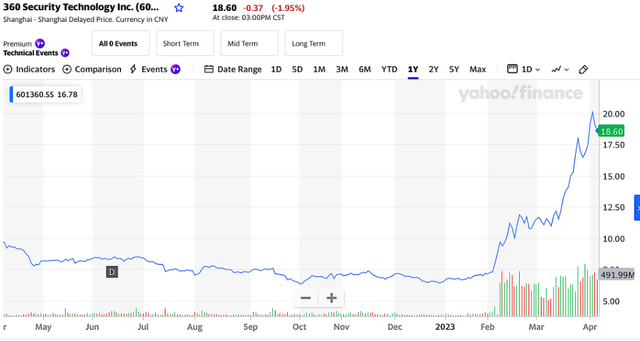

360 Security Technology (601360.SH) has also increased in the year by more than 200%, as shown in Chart 5.

Chart 5

Processor Chip Capabilities a Key Catalyst

Nvidia makes its A100 and H100 AI accelerator GPU chips. As I discussed it in the above referenced Seeking Alpha article, it won’t be further discussed here.

Intel’s (INTC) Xeon CPU is used in generative AI with Nvidia’s H100 GPUs to power virtual machines accelerating generative AI models in Azure, including ChatGPT. The linked article specially mentioned the 4th Gen Xeon as the head-node to run alongside the H100s. Intel’s 4th Gen Xeon, already shipping, is now being deployed by the top 10 global cloud service providers.

When combined with Nvidia H100 Tensor Core GPUs, these systems can deliver dramatically higher performance, greater scale and higher efficiency than the prior generation, providing more computation and problem-solving per watt.

The new Intel CPUs will be used in Nvidia DGX H100 systems, as well as in more than 60 servers featuring H100 GPUs from Nvidia partners around the world.

Google said its fourth-generation Tensor Processing Units, or TPUs, that train its artificial intelligence models are between 1.2 and 1.7 times faster and up to 1.9 times more power efficient than Nvidia’s A100 chips.

Google did not compare its TPUs to Nvidia’s H100 chips because those came to market after Google’s chips and use newer technology.

Investor Takeaway

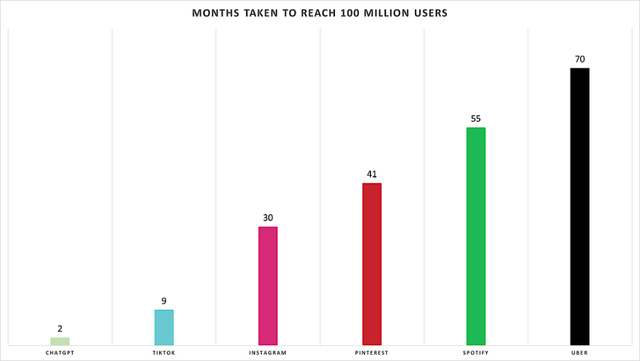

As the biggest sensation in the recent market, Chart 6 shows the rapid acceptance of ChatGPT, reaching 100 million users in just 2 months as compared to other growth areas.

Chart 6

The concept of ChatGPT covers communication, computers, software and other industries. The breadth and depth are expected enough. As the money-making effect continues, it will stimulate and attract more off-site funds to flow into and thus promote the continuation of the ChatGPT concept.

However, ChatGPT is still in a very early stage in application scenarios and commercial exploration. As a kind of generative AI, the performance of ChatGPT undoubtedly brings a lot of imagination to the industry in application practice. In the near- to medium-term, the winners will likely be the owners of the foundational AI models such as OpenAI and Microsoft, who can charge others to use them for experiments and new applications.

Microsoft The Greatest Beneficiary of ChatGPT Concept

If successful, Microsoft will be among the biggest winners. As noted above, since 2019, Microsoft has invested at least US$10 billion in OpenAI. As part of its dealings, for example, Microsoft is getting broad rights to commercialize OpenAI’s technologies as well as the ability to bundle and resell them as part of its broader Azure cloud. Details of its January 23, 2023 updated collaboration are reported here.

Microsoft’s multi-billion dollar investment will help finance the immense cloud infrastructure needs of OpenAI to train and run its various models on the Microsoft Azure cloud platform.

OpenAI and ChatGPT use Microsoft Azure’s cloud infrastructure to deliver the performance and scale necessary to run their artificial intelligence (“AI”) training and inference workloads. High-performance computing (HPC), data storage, and global availability are foundational to ChatGPT’s systems.

Bing, Microsoft’s search engine, will become the first beneficiary of the technology. This alone has the potential to re-make Microsoft one of the leading search engines in the world. Internet Explorer was the default browser for many and Windows was installed in most machines in the early days of the internet. Then Google changed everything with their search engine.

OpenAI’s models can be used to improve the Bing search engine’s natural language processing (“NLP”) to better understand search intent, generate more informative search snippets for Bing’s results page, and produce more relevant autocomplete predictions for Bing search queries

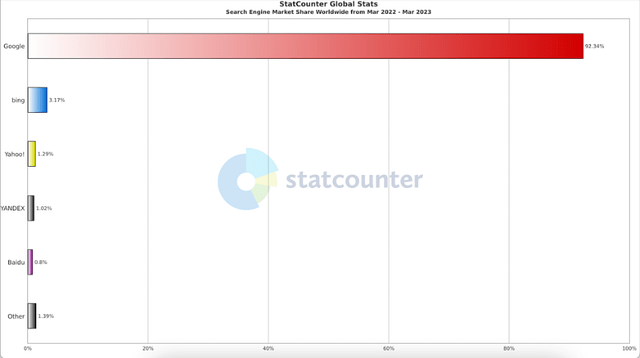

I expect a comeback to Microsoft via Bing. This has serious implications for Google and industries that were built around Search Engine Optimization. Chart 7 shows the market share of search engines worldwide from Mar 2022 – Mar 2023. Google has 93.17%, Bing has 2.88% and Yahoo! has 1.12%.

Chart 7

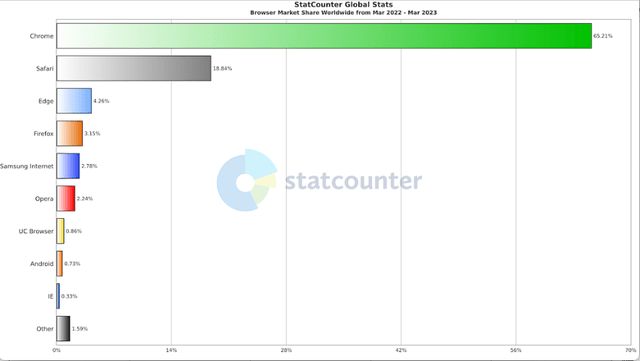

A web browser is a software application that enables users to access and interact with web pages on the internet. Google Chrome is the leading browser in terms of browser market share with 61.80% of all users preferring it. Safari follows with 24.36%, with Edge, Firefox, and other browsers making up the remainder of the list, as shown in Chart 8.

Chart 8

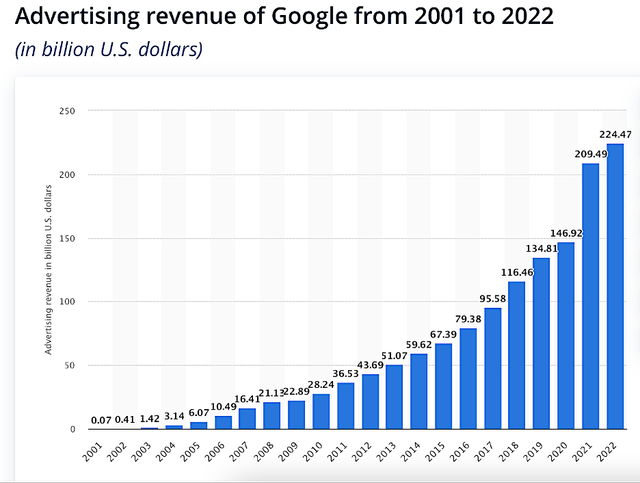

In the most recently reported fiscal year, Google’s revenue amounted to $279.8 billion. Google’s revenue is largely made up by advertising revenue, which amounted to $224.47 billion in 2022, as shown in Chart 9. There are three components of Google business model that aid Google to help advertise: AdWords, AdSense and AdMob, and I refer readers to Google’s website for full details.

Chart 9

Microsoft also announced large price hikes for outside developers to plug their programs into Bing via its API. For example, Bing Web Search fees for 250 transactions per second will increase from $7 to $25 per 1,000 transactions.

Microsoft’s multi-year, $10 billion investment into OpenAI, in exchange for a reported 49% stake in the company at a $29 billion whole-company valuation, will help finance the immense cloud infrastructure needs of OpenAI to train and run its various models on the Microsoft Azure cloud platform.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

This free article presents my analysis of this semiconductor sector. A more detailed analysis is available on my Marketplace newsletter site Semiconductor Deep Dive. You can learn more about it here.