Summary:

- Tesla reported weak Q1 results.

- Margins, profits, and cash flows are moving in the wrong direction.

- Q2 could be worse due to further price cuts.

- The valuation remains high.

Xiaolu Chu

Article Thesis

Tesla (NASDAQ:TSLA) has reported quarterly results that are mostly seen as negative, as margins and earnings dropped considerably, while free cash generation was weak as well due to inventory piling up.

But things could get worse over the coming quarters as further price reductions for Tesla’s vehicles make it likely that margins will be even weaker during the second quarter, and possibly beyond. At the same time, TSLA trades at a pretty high valuation, which is why it’s not surprising that shares are under pressure.

What Happened?

Tesla reported quarterly results that missed estimates, as we can see in the following screencap from Seeking Alpha:

Seeking Alpha

While the non-GAAP, or adjusted, earnings per share were in line with estimates, revenues missed the analyst consensus estimate. Compared to past results, when Tesla did beat estimates more or less regularly, that was a pretty bad result. Shares are down 4% in after-hours trading at the time of writing, following a price decline during regular trading hours. But when we delve into the details, things look even worse, I believe.

Many Things Are Moving In The Wrong Direction

Tesla is one of the most expensive automobile companies based on traditional valuation metrics such as price to earnings, price to sales, or price to book value. In the past, this was justified by Tesla’s strong performance when it comes to revenue growth, expanding margins, growing free cash generation, and exploding profits. One could argue that even those facts do not justify a 50x earnings multiple, but these advantages definitely warranted a valuation premium versus traditional (legacy) automobile companies such as Ford (F), General Motors (GM), or Volkswagen (OTCPK:VWAGY), which oftentimes trade at 5x to 10x net profits.

During the pandemic, when consumers were flush with cash and when ultra-low interest rates made financing a vehicle easy, Tesla saw explosive growth and benefited from rising sales prices that lifted its margins. But from what we have seen in the more recent past, and especially in the just-released earnings report, it looks like the good times have come to an end for Tesla, as many metrics are moving in the wrong direction right now.

Tesla generated deliveries growth of 36% during the first quarter, compared to one year earlier, as the company delivered 423,000 vehicles. While the 36% growth alone is significantly below the company’s long-term target of growing its volumes by 50% per year on average, that’s by far not the worst number in the first quarter. Instead, Tesla’s performance based on many other metrics looked worse.

The company grew its revenue by 24% year over year, which was way below the deliveries growth rate. The reason for that is that Tesla saw its average sales price compress considerably during the period, more than what the analyst community had forecasted. This is the total company-wide revenue growth rate, which includes Tesla’s non-automobile businesses (e.g. energy). The non-auto businesses are not profitable yet, but bulls still see a lot of value in them due to their high relative growth. And it’s true that growth in the non-auto business was way higher than in the auto business, as energy generation and storage revenue rose by 148% year over year, while services revenue rose by 44%. With those two units growing faster than the company-wide revenue growth rate, it is, of course, not surprising that Tesla’s auto revenues grew less than 24% – the franchise generated revenue growth of 18% year over year. Growing deliveries by 36% while growing the revenue generated from these deliveries by just half that amount is pretty bad, of course – ideally, investors want to see revenue growth that is higher than volume growth (and not way lower), as this helps combat headwinds from inflation.

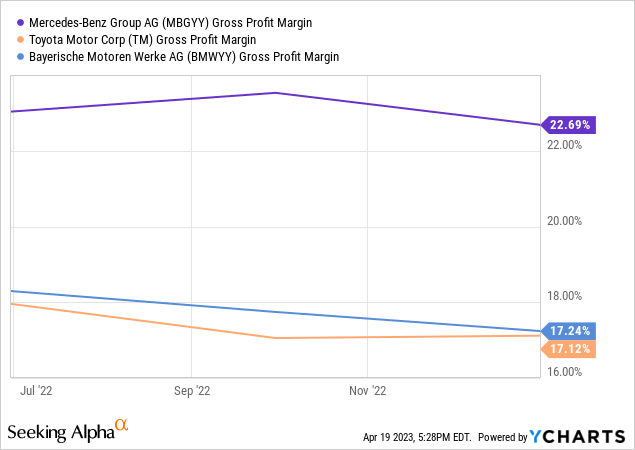

With dropping sales prices, Tesla wasn’t able to withstand headwinds from inflation, which is why its margins took a big hit. Tesla’s gross margin came in at 19% for the quarter, down by a massive 1,000 base points from 29% one year earlier. When a company’s size grows, investors generally want to see expanding margins, and many companies achieve this goal via operating leverage, fixed-cost digression, and so on. But in Tesla’s case, that has absolutely not been the case, at least during the first quarter, as Tesla’s margins slumped. This is an issue for an important part of the bull thesis – many bulls have stated that Tesla is deserving of a premium valuation due to its high and growing margins. And for some time, its margins did indeed expand, and a year ago they undoubtedly were high for an automobile company. But this trend is no longer playing out, as margins have now been dropping for some time, and margins also aren’t especially high any longer:

Toyota (TM) and BMW (OTCPK:BMWYY) have gross margins of 17%, and Mercedes (OTCPK:MBGYY) has a gross margin of 23% – Tesla is in the middle of that. Being in the middle of its peer group margin-wise is not a bad result, but not a great result, either – and it’s not supportive of a “Tesla will always be the margin leader” narrative.

The combination of weaker-than-expected revenue growth and a massive hit to its margins has made Tesla’s profits decline by 24% year over year, which is far from good for a growth stock trading at a premium valuation.

Declining profits, in combination with growing inventory levels (which isn’t great either), has made Tesla’s free cash flow slump by around 80%, to just $400 million for the quarter. While Tesla still has a strong cash position, which is good, of course, that cash pile isn’t growing very fast any longer, unlike in the past, when Tesla oftentimes added more than $1 billion to its cash pile in a three-month period. And yet, despite these weak results for Tesla’s Q1, things could get worse going forward.

The Outlook Is Far From Great

As we have seen above, the biggest problems for Tesla are its declining sales prices, as those cause several issues: Revenues are growing way slower than deliveries, and margins are being compressed, which, in turn, causes profits and cash flows to decline.

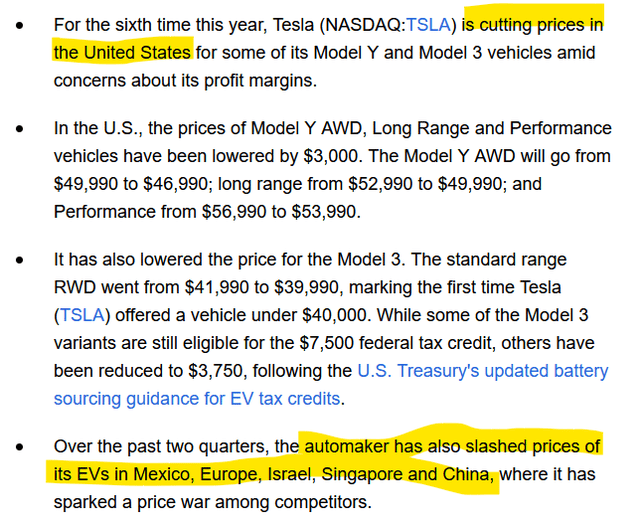

And based on the news we have seen today, we can assume that this trend will continue during the current quarter. Seeking Alpha reports:

Seeking Alpha

These price cuts are not reflected in the just-reported numbers yet, but they will surely have an impact on Tesla’s Q2 results. Price decreases vary from model to model, but are mostly in the 5% range. In other words, average sales prices could decline at a mid-single-digit rate due to these price declines alone, and those aren’t the only ones we have seen in the recent past – this is the sixth time Tesla has cut its US prices this year. Price cuts have also occurred in other important markets, primarily China, thus it seems unlikely that Tesla’s international business will be a booster for its ASPs going forward.

The expected hit to Tesla’s revenues is not the most problematic issue, however. Instead, the margin hit will likely hurt even more. It’s possible that Tesla finds a way to mitigate the margin headwind stemming from these price reductions, e.g. via more efficient ways of production, but so far, that has clearly not been the case, as margins took a huge hit during the most recent quarter. Unless something changes, margins will take another hit from the just-announced price decreases as well. If Tesla’s gross margins during Q2 fully reflect an estimated 5% ASP decline, gross margins could drop from 19% to 14%, which would make for a 26% gross profit decline per car. That will be partially offset by higher deliveries, as long as Tesla manages to sell more vehicles during this year’s Q2 vs. last year’s Q2. I believe that it’s likely that deliveries will increase, but it could still be quite difficult to battle a 25%-plus decline in Tesla’s gross profit per car number.

I thus believe that the near-term outlook for Tesla is far from exciting, as the weak results for Q1 and the price declines we have seen since then suggest that margins will remain weak (compared to the margins Tesla has generated in the past), and they could very well decline further during the current quarter. This, of course, could also result in further headwinds for profits and cash flows.

Final Thoughts

Tesla is not a bad company at all. But when an automobile company trades at around 50x net profits, while many legacy peers trade at 5x to 10x net profits, then business execution has to be excellent. And that’s not the case here any longer.

While deliveries are still growing at a sizable pace and while the balance sheet is strong, ASPs, margins, profits, and cash flows are moving in the wrong direction. And since Tesla keeps lowering its prices, which suggests demand issues, margins and profits could be even worse during the current quarter, and, potentially, beyond.

The automobile industry is cyclical, capital-intense, very competitive, and famous for its low margins – and TSLA more and more looks like a traditional auto company when it comes to these issues. Its margins are now neither better nor worse than those of major legacy peers, which is why I do not believe that the current valuation is justified. Should TSLA be successful with its robotaxi efforts that could change, of course, but I wouldn’t want to bet on that.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Is This an Income Stream Which Induces Fear?

The primary goal of the Cash Flow Kingdom Income Portfolio is to produce an overall yield in the 7% – 10% range. We accomplish this by combining several different income streams to form an attractive, steady portfolio payout. The portfolio’s price can fluctuate, but the income stream remains consistent. Start your free two-week trial today!

The primary goal of the Cash Flow Kingdom Income Portfolio is to produce an overall yield in the 7% – 10% range. We accomplish this by combining several different income streams to form an attractive, steady portfolio payout. The portfolio’s price can fluctuate, but the income stream remains consistent. Start your free two-week trial today!