Summary:

- Tesla, Inc. reported Q1 results below market and analyst expectations.

- Revenue and deliveries growth remains robust, but margins suffered, with additional price cuts likely to increase this pressure.

- Tesla is still the automotive stock to own for the future, but prepare for near-term turbulence.

AdrianHancu

Tesla, Inc. (NASDAQ:TSLA) reported Q1 earnings after the close Wednesday, and the results were a mixed bag of continued growth at the cost of margins and cash flow. Shares are down modestly after the press release, around 4%, as investors weigh the numbers and what they could indicate about the near future.

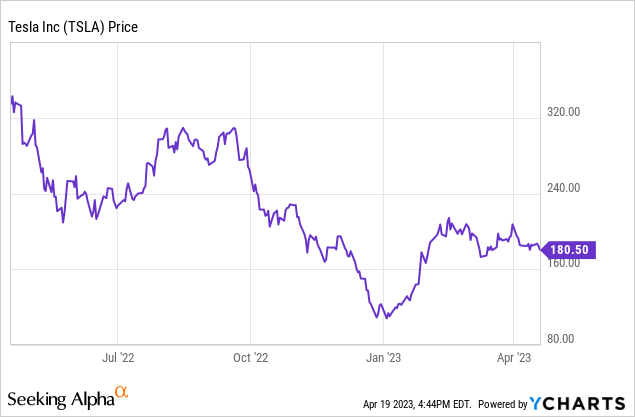

It has been a rollercoaster last 12 months for the company and the stock, with shares down around 50% over that timeframe. However, despite some of the more concerning metrics, I believe TSLA is still the automotive stock to own for the next decade.

Q1 Earnings Summary

Let’s start with a quick run-down of earnings to set the stage. Q1 revenue came in at $23.3 billion, up 24% YoY and about in line with analyst estimates, non-GAAP EPS was $0.85, down 21% YoY and also in line with analyst estimates. The company also delivered 422,875 vehicles in the quarter, up 36% YoY, of which 97.4% were Model 3 or Model Y vehicles.

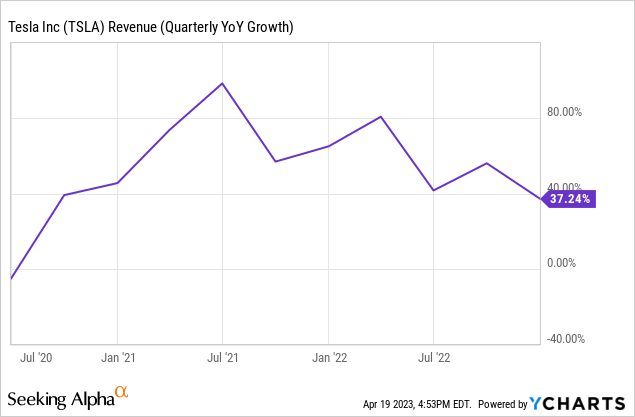

Starting with the good, revenue growth is still quite robust for a company with a revenue base as large as Tesla. Looking at previous quarterly YoY top-line growth rates, we can see that the current quarter’s 24% growth is a decline from the post-pandemic surge, but those were also born of easy comps.

Despite the moderate slowdown, Tesla is still well on its way toward a $100 billion annual revenue run rate.

Unfortunately, a few things are taken out of revenue before the amount can be considered usable dollars, so let’s talk about the report’s not-so-good elements.

The bear headline of this quarter will likely be the margin erosion that appears to have been greater than expected, and the trickle-down effect this had on cash flow. Specifically, operating margin fell from 19.2% in Q1 2022 to just 11.4% in Q1 2023, a significant drop over just one year of operation. Similarly, free cash flow for the quarter came in at a measly $441 million, an 80% decrease YoY. Tesla has plenty of cash to cover liabilities many times over, so this doesn’t pose any existential threat in the near term, but it certainly warrants further investigation.

For its part, Tesla blames higher input costs (commodities, logistics, raw materials) and lower average selling prices for the hit. In fact, in what I would consider an oddly-timed move, the company today cut the selling price of the Model Y by $3,000 and the Model 3 by $2,000, making this the sixth price decrease this year alone.

This appears to be part of a calculated strategy by the company to prioritize growth and increase market share over generating near-term profits. Tesla is trying to spur demand amid places like the U.S. making plans to reduce electric vehicle (“EV”) tax credits as the market becomes more entrenched and self-sufficient. While this might seem desperate, Tesla has operated this way from the very beginning.

I remember years ago, before the Model 3 was released, writing articles on Seeking Alpha discussing the merits of prioritizing market and mind share (i.e., sell as many cars as fast as possible, margins be damned) while bears cited cash burn and increasing SG&A expenses as evidence the stock would soon be toast. There are times to consolidate and amass cash and there are times to be aggressive and expand. In my opinion, the current EV market demands the latter approach.

The EPA in the U.S. is pushing for strict automotive regulations that would essentially require automakers to produce 60% EVs by 2030 and 67% by 2032, compared to just a 5.8% EV share in 2022. This is a massive opportunity for companies in the space, Tesla chief among them. While the company is already profitable and could probably earn $5-6 billion a quarter if it pumped the brakes on spending, that would not put the business in an advantageous position moving forward with traditional automakers making the EV switch breathing down Tesla’s neck for a piece of the pie.

Yes, things might get volatile for TSLA in the short-term as margins bounce around, capex runs hot, the market becomes more competitive, and tax credits subside, but the EV market still has substantial room to expand, and no company is better positioned from a production and mind share standpoint than Tesla. Now is the time to be aggressive, and if I’m a TSLA shareholder, I like this direction. Dominating such a crowded, lucrative space was never going to be easy or without obstacles, but Tesla is taking a long-term approach that will bear fruit in the future.

Thanks for reading!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.