Summary:

- Microsoft’s acquisition of Activision Blizzard faces regulatory hurdles, with potential gains of ~12% if the deal goes through.

- If the deal falls through, Activision’s share price will drop, offering an attractive entry point for investors who believe in its growth potential.

- ATVI stock, at best, is a hold right now.

Rich Polk

I’ve discussed Activision Blizzard (NASDAQ:ATVI) several times in the past, and today I’d like to revisit it once more to explore the potential outcomes of the Microsoft (MSFT) deal.

I’m not an anti-trust expert, far from it. However, I do follow Activision closely and believe that the remaining potential gains simply aren’t worth the effort.

Where we stand today

We should begin with the acquisition, its current status, and what investors stand to gain.

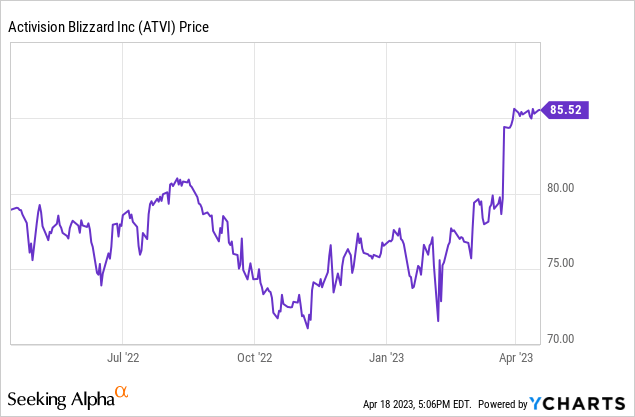

At the time of writing, Activision is trading around $85 per share. Microsoft has agreed to buy the company in an all-cash deal for $95 per share, representing ~12% upside from today’s price.

This deal was announced over a year ago and has undergone scrutiny from various government entities. Throughout this process, a patient believer in the acquisition could have purchased shares for around $70-75, possibly locking in a 30%+ gain if the deal ultimately goes through.

The deal has already received support from Chile, Brazil, Saudi Arabia, and Serbia, but we’re waiting on key players to finalize their decisions.

The UK’s Competition and Markets Authority (CMA), the U.S. Federal Trade Commission (FTC) are the two entities most likely to halt the deal. It is also not in the clear with the European Commission or the regulatory bodies of Australia, Japan, and New Zealand, which are all expected to weigh in on the deal.

The most recent regulatory updates have come from the CMA. In a recent statement, the organization said:

Having considered the additional evidence provided, we have now provisionally concluded that the merger will not result in a substantial lessening of competition in console gaming services because the cost to Microsoft of withholding Call of Duty from PlayStation would outweigh any gains from taking such action.

This is, and was seen by the markets as, a significant win for those hoping to see the deal close. However, the CMA has yet to announce a final decision, while the FTC continues to investigate the deal.

The FTC side of things is where the situation gets complicated, and where one might consider the 12% arbitrage no longer worth the wait.

The most recent update from the FTC is that a hearing has been set for August 2nd, 2023. The complexity arises when considering that Microsoft could close the deal before then, provided it has the global approvals it believes it needs.

If the deal closes, Activision shareholders receive the cash. However, Microsoft could be forced to unwind the deal or spin off its newly acquired assets in 2024 if the FTC rules against the legality of the deal. One would assume Microsoft would only close the deal if they were certain the FTC would rule in their favor.

What if the deal falls through?

If the deal fails to close, Microsoft will be required to pay Activision a $3 billion break-up fee, significantly easing the impact. Should the deal fall through, I would likely consider buying Activision shares on day one.

Why? Because we would certainly see Activision’s share price drop to the $60-70 range, presenting an excellent opportunity for those who believe in the brand and its offerings.

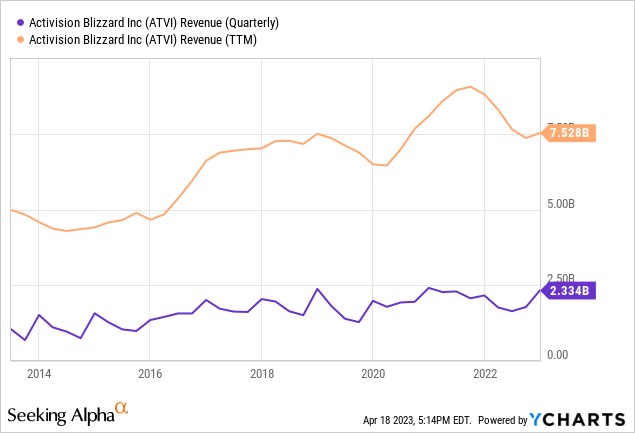

Currently, though, Activision is a company experiencing declining revenues year over year. The company reported $7.5B in revenue for 2022, a nearly 15% drop from 2021’s $8.8B. On a positive note, the FCF margin increased from 23.3% to 31.8% due to cost-cutting measures.

For the purposes of valuing the company today, let’s assume Activision Blizzard can grow its top line at a reasonable 8% over the next five years, reaching $11B in revenue by 2028. 8% is what we’d expect to see from an organic growth standpoint out of a large publisher in the space.

With $11B in revenues, at a 26.8% FCF margin (consistent with what Activision typically achieves) and a 3% terminal growth rate, the organization’s valuation would be $43.9B.

Activision has a significant cash reserve, and the $3B break-up fee would increase net debt to -$11B, resulting in a total valuation of $55B.

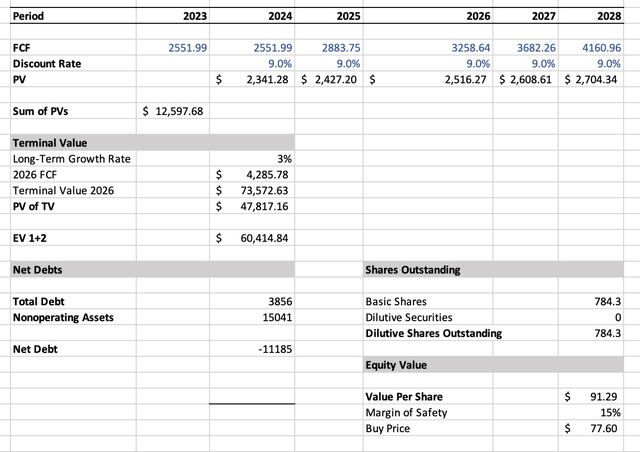

Activision valuation with lofty expectations (Author)

With lofty expectations of 13% top line growth through 2028 (the market predicts 13.4% annual growth for video game software), and a more generous 30% FCF yield, for the business to be worth $72B ($91/share), which would make a purchase today viable, but still risky.

Why Buy Activision Here?

To purchase Activision shares at the current price, you either have to:

A) Assume the deal goes through, securing an easy 12% return in (hopefully) six months, or; B) Believe that Activision can grow significantly after the deal.

Option “A” is straightforward: the company is either acquired, or it’s not. Option “B” is more complex; if you genuinely believe in Option “B,” you might consider selling Activision now and waiting for the market to oversell on the news of the deal’s termination.

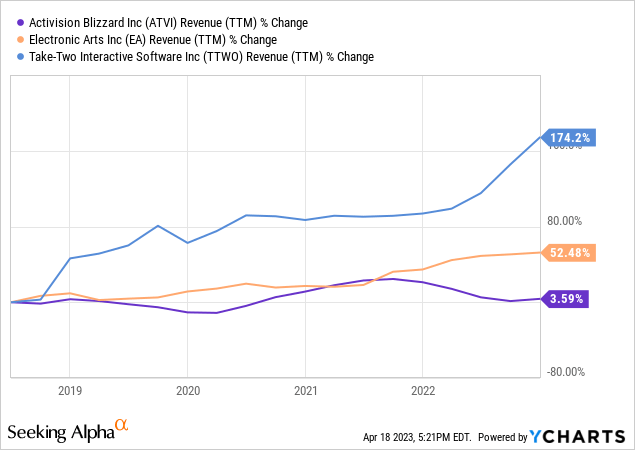

Chart: Revenue growth over last 5yr of ATVI and peers

Option “B” is only a viable choice if you assume Activision can keep up with the broader industry’s growth, which is far from guaranteed based on recent trends.

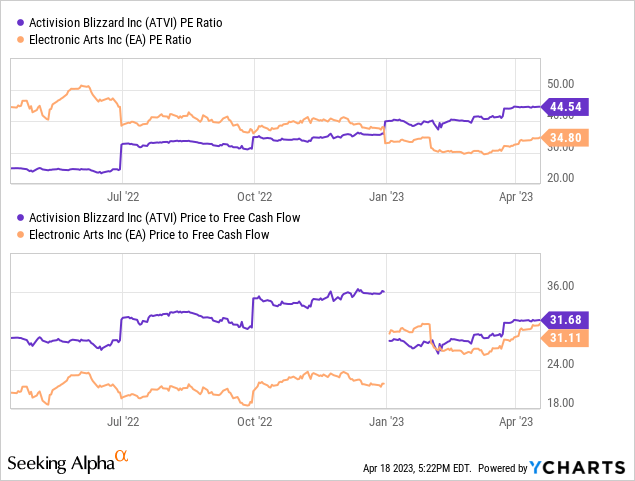

Chart: ATVI and EA price ratios compared

Additionally, it’s worth noting that Activision is slightly more expensive than its closest peer, EA, on a cash flow basis and significantly more expensive on a PE basis, despite shrinking revenues (compared to EA’s recent growth).

Final thoughts

Your stance on Activision Blizzard ultimately depends on your investment goals and expectations.

If you believe that global governments won’t “rock the boat” and block this acquisition, you could potentially secure a ~12% gain with minimal risk. However, this might still take 9-18 months, depending on the outcome and associated risks that will be determined in the FTC trial.

On the other hand, if you think the deal will fall through and Activision has a promising future, it might be more prudent to sell now and re-enter the market during the inevitable significant drop following the announcement of such news.

In summary, Activision Blizzard is best considered a hold at its current price. The potential gains from the acquisition arbitrage may not be substantial enough to warrant an investment today, particularly given the regulatory uncertainty and the time it may take for the acquisition to conclude. Investors who believe in the company’s long-term growth potential without the acquisition will find it more prudent to wait for a share price drop following the deal’s termination, presenting a more attractive entry point.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MSFT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.