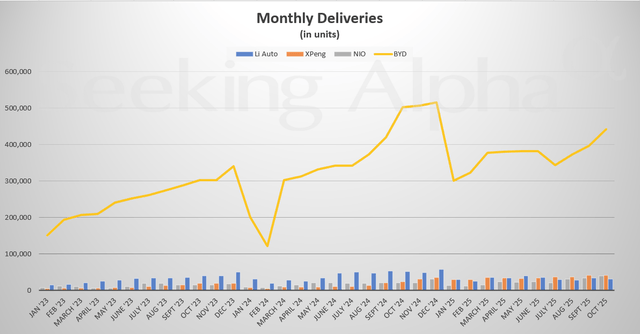

China’s EV market showed a clearer competitive split in October. NIO and XPeng continued to scale delivery momentum, each posting some of their strongest monthly volumes of the year. Meanwhile, Li Auto’s delivery downturn persisted, signaling deeper demand challenges as the market shifts more decisively toward fully electric platforms. BYD saw a healthy rebound sequentially, retaining its high-volume leadership even as Y/Y comps remain pressured by last year’s peak base. The month underscores a reshaping dynamic: software-driven EV makers are gaining ground, while hybrid-led strategies appear to be losing their edge.

China’s EV market showed a clearer competitive split in October. NIO and XPeng continued to scale delivery momentum, each posting some of their strongest monthly volumes of the year. Meanwhile, Li Auto’s delivery downturn persisted, signaling deeper demand challenges as the market shifts more decisively toward fully electric platforms. BYD saw a healthy rebound sequentially, retaining its high-volume leadership even as Y/Y comps remain pressured by last year’s peak base. The month underscores a reshaping dynamic: software-driven EV makers are gaining ground, while hybrid-led strategies appear to be losing their edge.

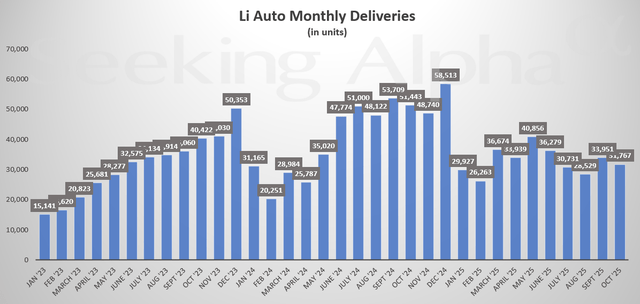

Li Auto (LI)

Deliveries: 31,767 M/M Change: -6.4% Y/Y Change: -38.2%

Li Auto’s deliveries declined again in October, extending its multi-month slide. The 6% M/M dip reflects ongoing pressure from both rising competitive intensity and slower traction in its newer models. The Y/Y decline remains steep at ~38%, signaling that the brand’s earlier dominance in the extended-range hybrid segment continues to erode as consumers increasingly gravitate toward fully electric offerings and refreshed premium EV portfolios from peers.

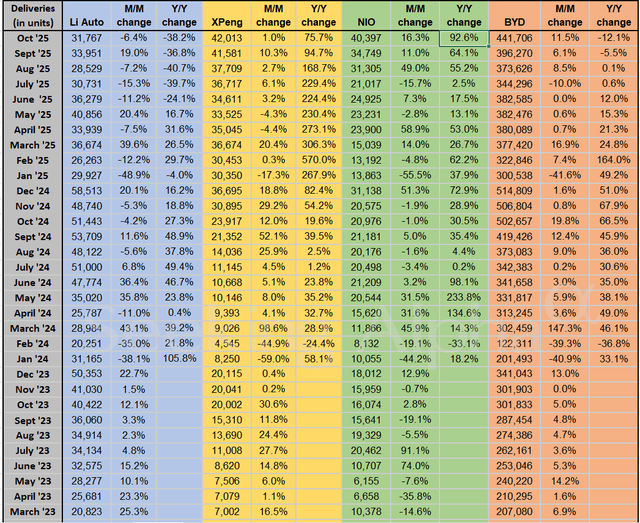

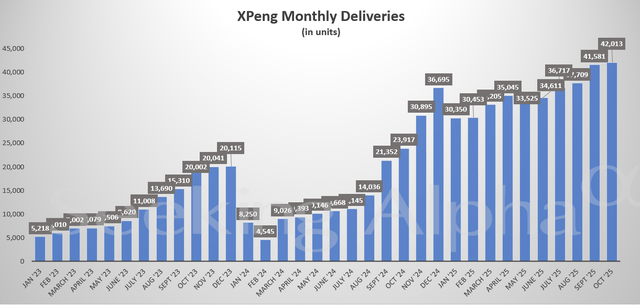

XPeng (XPEV)

Deliveries: 42,013 M/M Change: +1.0% Y/Y Change: +75.7%

XPeng maintained stable momentum in October, with deliveries inching up 1% M/M while still delivering a strong 76% Y/Y increase. The company continues to benefit from sustained demand for the X9 and G6 platforms, supported by broader software innovation and its intelligent driving technology positioning. While growth has moderated compared to earlier surges, XPeng remains on a solid upward trend relative to last year’s volumes.

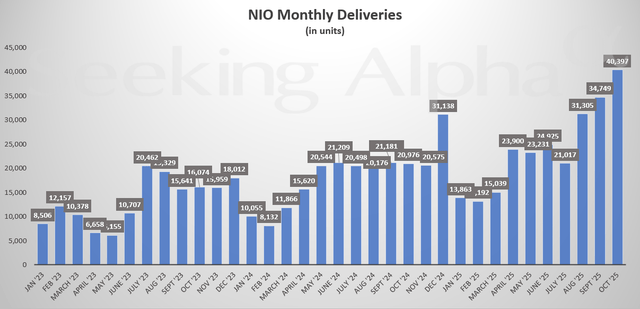

NIO (NIO)

Deliveries: 40,397 M/M Change: +16.3% Y/Y Change: +92.6%

NIO posted another strong month, with deliveries rising 16% sequentially, marking one of its highest-volume months in over a year. The nearly 93% Y/Y surge reflects recovery momentum driven by refreshed models, improved cost efficiencies, and strong reception for its latest NT 3.0 platform lineup. NIO’s delivery trajectory in recent months suggests that earlier demand softness may be reversing, with product upgrades playing a key role in re-acceleration.

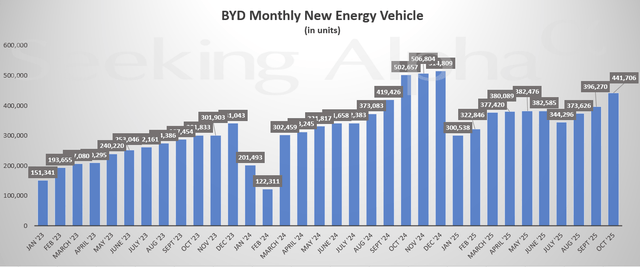

BYD (OTCPK:BYDDF) (OTCPK:BYDDY)

Deliveries: 441,706 M/M Change: +11.5% Y/Y Change: -12.1%

BYD showed a solid 12% sequential rebound in October following seasonal and pricing-driven slowdowns earlier in the quarter. However, deliveries remain down Y/Y, highlighting the impact of intensified domestic price competition and market normalization from last year’s elevated base. Even so, BYD continues to dominate China’s EV landscape by volume, with scale, model variety, and cost leadership remaining its strongest strategic advantages.