Summary:

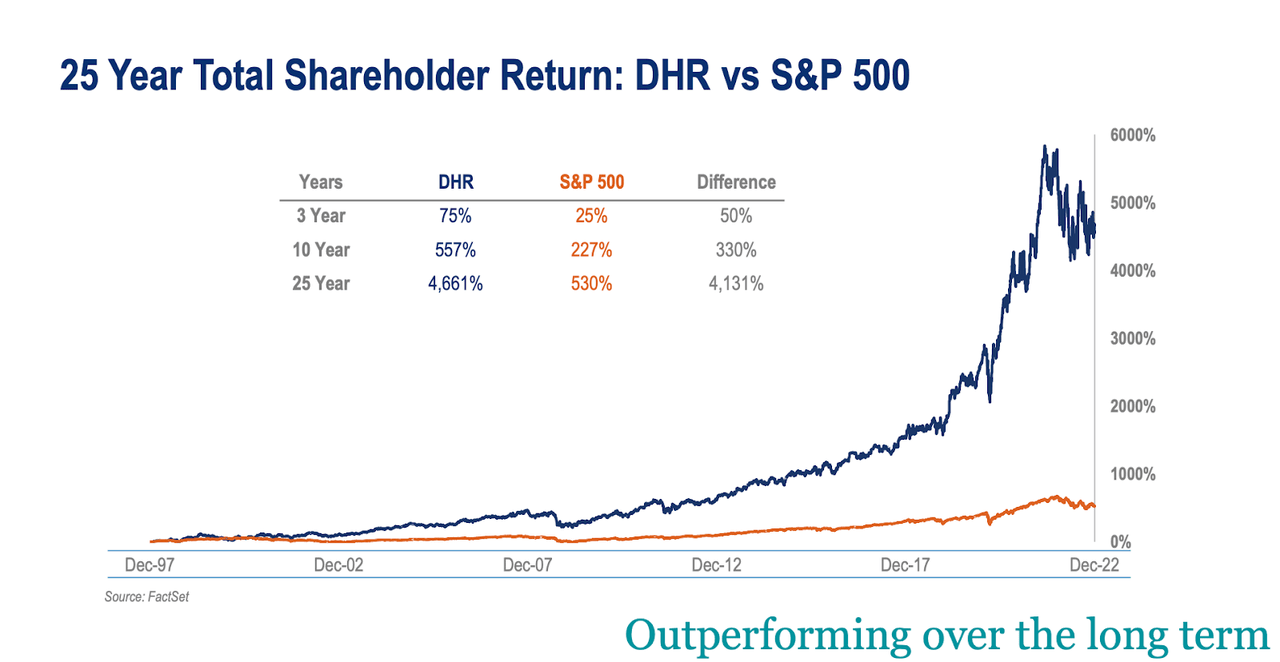

- Danaher has a long history of beating the market.

- Few companies in the world have compounded their earnings like DHR over the years.

- I believe DHR has double-digit dividend growth potential over the long term.

kynny

These days, my priority is to buy shares of the highest quality companies in the world.

With so many macro headwinds looming on the horizon, this is what allows me to sleep well at night with an overweight allocation towards equities (risk assets).

However, while I want to continually increase the quality of my portfolio overall, I’m not willing to overlook valuation.

Knowingly overpaying for stocks, no matter how great they are, is a sure-fire way to underperform over the long term.

When it comes to the bluest of blue chips, I don’t need to see wide margins of safety to comfortably buy shares.

I feel comfortable buying best-in-breed-type stocks when they’re trading at fair value.

Actually, I’d much rather do this than bottom fish, sacrificing quality for deep value.

And with all of that in mind, I wanted to write this piece highlighting a rare opportunity to buy one of the highest quality stocks in the entire market at fair value.

Danaher Overview

I’m talking about Danaher Corporation (NYSE:DHR).

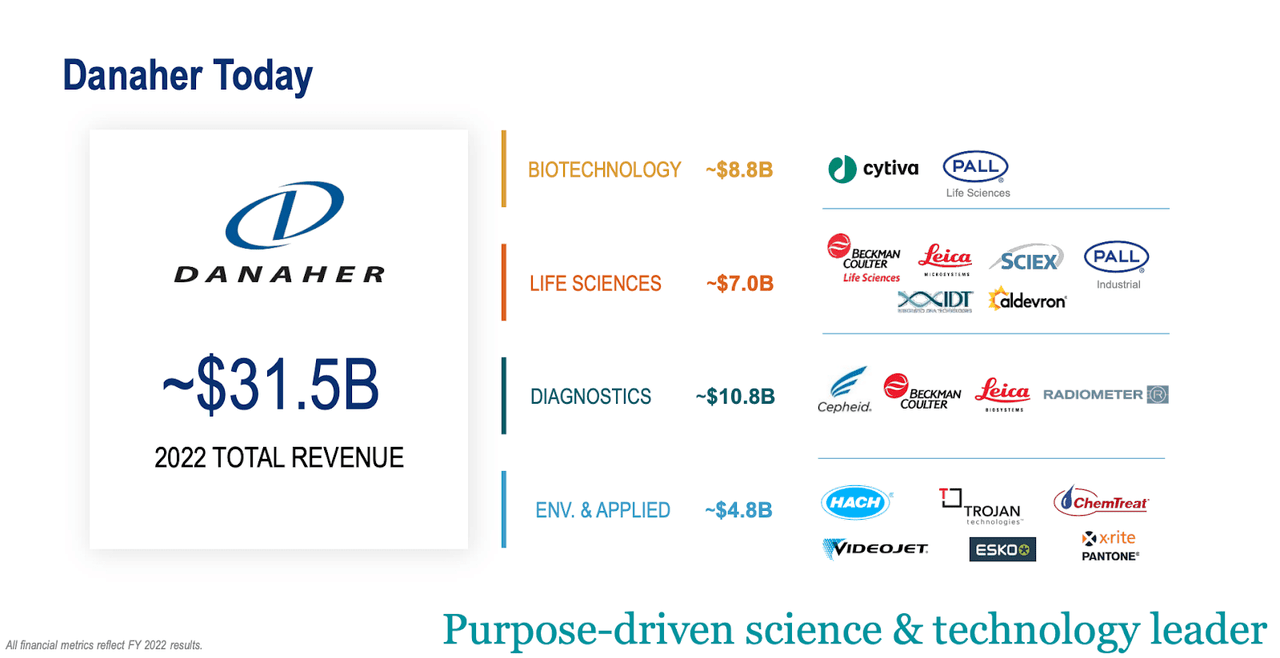

This is a diversified life-sciences tools/services company that operates 4 main segments: biotechnology (28% of 2022 sales), life sciences (22% of 2022 sales), diagnostics (35% of 2022 sales), and environmental & applied solutions (15% of 2022 sales).

Danaher data (Danaher Investor Relations )

This company does business in more than 60 countries worldwide and last year, roughly 58% of DHR’s sales came from international markets.

Unless you work in fields that specifically deal with this company’s products/services, then you likely haven’t heard of the brands that it owns/operates. However, DHR is a leader in all of the areas that it operates in, competing for best-in-class market share positions across a variety of industries, allowing the company to generate strong sales growth, maintain high margins, produce strong cash flows, and ultimately, generously reward shareholders with growing dividends.

Throughout its history, DHR has relied on acquisitions to boost growth and elevate its competitive position.

This management team has proven itself to be more than competent when it comes to making accretive acquisitions (as well as spinning off non-core assets to unlock value for shareholders).

What’s more, DHR has maintained a strong balance sheet throughout its constant M&A activity (this is an A- rated company).

DHR’s long-term debt currently sits at $19.0 billion, which looks relatively attractive when compared to its cash position of approximately $6 billion and annual cash flows in the $7.5 billion area).

Therefore, I expect to see this company remain active in the M&A markets, which should be exciting for shareholders, due to DHR’s prior success.

I should also note that this company is internally innovative as well; DHR spent $1.7 billion on R&D in 2022 alone.

As you’ll see below, DHR’s track record, with specific regard to generating reliable bottom-line growth, is top-notch.

Without a doubt, this is a SWAN stock (Sleep Well At Night), which is exactly why I’ve been taking advantage of DHR stock’s recent sell-off.

Danaher data (Danaher Investor Relations )

Near-term COVID-19 Headwinds

Why have shares sold off recently?

In short: tough year-over-year COVID-19 comparisons.

Like so many big healthcare names, DHR faces y/y COVID-19 related comp issues now that the pandemic is winding down.

In 2022, DHR’s COVID-19 related sales were approximately $800 million and during its most recent earnings conference call, management highlighted a $150 million target for 2023 (much lower than its initial expectations of approximately $500 million or so).

Thankfully, the rest of DHR’s business continues to grow nicely.

After lowering its 2023 COVID-19 related guidance, DHR’s CEO, Rainer Blair, was quick to note that the non-COVID-19 related bioprocessing continues to grow at a rapid clip, stating:

“Our non-COVID business has averaged more than 20% growth over the past two years. Given these elevated growth rates, we spent the past several weeks speaking with our customers to better understand their planning assumptions for 2023. And based on these discussions, we anticipate non-COVID bioprocessing core growth will be high single digits for the full year 2023.”

This trend is being seen throughout Danaher’s business, with its “core” business posting the reliable growth that investors have come to expect over the years, while the “total” business, which includes dwindling COVID-19 related sales/earnings, is posting negative y/y growth figures.

Looking at overall 2023 guidance during the Q4 earnings call, Blair said,

“Now for the full year 2023. We expect high single-digit core growth in our base business. And we also expect total core revenue growth to decline mid-single digits for the year as a result of lower demand for COVID-19 testing, vaccines and therapeutics. Additionally, we expect the full year adjusted operating profit margin of approximately 31%.”

Obviously, seeing guidance for negative mid-single digit growth here isn’t great.

Analysts have baked this into their full-year 2023 earnings-per-share growth expectations as well.

Currently, the consensus EPS total for Danaher in 2023 is $10.03.

Assuming that figure is correct, it would represent -8.4% y/y growth compared to 2022’s full-year EPS total of $10.95.

It appears that these short-term sales/earnings headwinds (largely created by unsustainable COVID-19 comps) have shrouded DHR shares with poor sentiment.

But, I believe that this short-term driven weakness is creating an opportunity for long-term investors to finally begin to accumulate shares of this wonderful company at a fair price.

History Shows That DHR’s 2023 May Not Be As Bad As Wall Street Expects

At this point in time, that Buffett phrase has become a cliche; however, that doesn’t mean that investors should ignore it.

I continue to believe that long-term investors should prioritize quality when making stock selections.

Blue chip companies tend to outperform over the long-term, especially when they’re purchased with an acceptable margin of safety.

Due to Danaher’s exceptional track record (more on this in a moment), I think the appropriate margin of safety is 0%.

In other words, anytime that these shares fall to fair value, I’m willing to buy them.

I don’t think investors need to benefit from multiple expansion via mean reversion for DHR shares to produce market-beating returns over the long-term.

I believe that the stock’s fundamental growth outlook takes care of this on its own and therefore, any discount that forms, relative to fair value, is a cherry on top of this investment thesis, in my opinion.

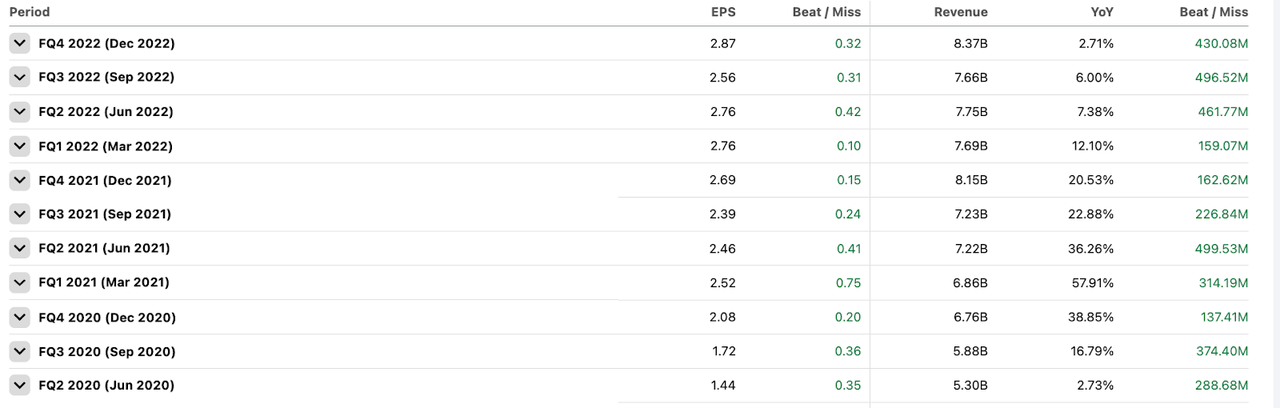

With regard to fundamental growth, I think it’s important to note that Danaher has beaten Wall Street’s estimates on the bottom-line during every single quarter since Q1 2018 (and frankly, that streak could be much longer; Seeking Alpha’s historical earnings tracker only goes back 5 years, so I didn’t have access to the beat/miss data prior to 2018).

Obviously the past doesn’t predict the future perfectly, but with DHR’s perfect 5-year track record in mind (in terms of exceeding expectations), I wouldn’t be surprised in the least if DHR’s full-year EPS came in well above the current $10.03/share consensus estimate, meaning that the near-term growth outlook likely isn’t as bad as the market currently fears. For reference, DHR has beaten Wall Street’s quarterly EPS estimate by at least $0.10/share during every quarter since Q2 2020…

Danaher data (Seeking Alpha )

Over the last 11 quarters, DHR has beaten by an average of $0.30/share.

If that trend continues, we’ll be looking at EPS north of $11.00/share this year.

At this point, I’m happy to take management at its word (regarding mid-single digit EPS headwinds this year).

Sure, they could be sandbagging things a bit here. It’s definitely better to under-promise and over-deliver. But, right now, my full-year EPS expectations are in the $10.50 area, which would imply y/y growth of -4% or so.

And being that the core business continues to grow nicely, setting DHR up for renewed double digit bottom-line growth results moving forward once COVID-19 comps are in the rear view, I believe that recent share price weakness has positioned DHR shares for strong returns over the medium to long term.

Fair Value: A Rare Opportunity Arises

DHR is down by 3.5% on a year-to-date basis.

This means that shares have underperformed the broader market by a wide margin (thus far during 2023, the S&P 500 is up by nearly 8.4%).

During a trailing 12 month basis, DHR’s sell-off is worse.

Danaher shares have fallen by 7.40% during the last year.

What’s more, DHR is down by approximately 24% from the all-time highs in the $333 area that shares hit in late-2021.

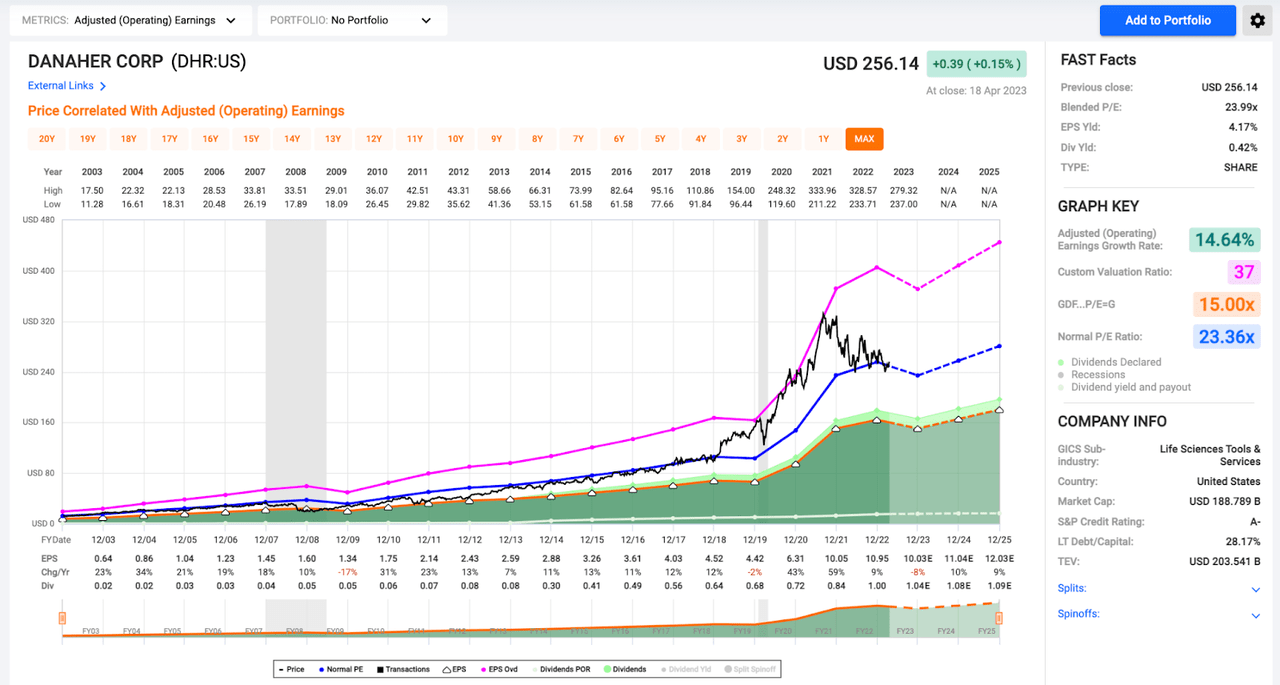

As you can see below, DHR was trading with a historically high premium when it hit those all-time highs in 2021.

F.A.S.T. Graphs (F.A.S.T. Graphs)

Shares were trading for 37x blended earnings at the time.

That premium was well above historical multiples and implied overvaluation.

The pink line of the chart above represents that 37x area where the stock was trading throughout the COVID-19 rally. While it’s true that DHR shares maintained that valuation level for a couple of years as COVID-19 sales boomed, the fact is, the stock hasn’t traded with that sort of premium attached to shares during any other time during the last 20 years.

Looking backwards, DHR’s average P/E ratios during the last 5, 10, 15, and 20-year periods are 28.7x, 25.1x, 23.2x, and 23.4x, respectively.

No matter how you slice it, those 35x+ multiples that investors placed on DHR during its bull run in 2021 didn’t make sense.

Yes, the company was experiencing enormous growth during that period of time.

During 2020 DHR’s EPS rose by 43%.

The company followed that up with a 59% EPS growth year in 2021.

This means that from 2019 to 2021, Danaher’s EPS more than doubled from $4.42 to $10.05.

That represents a tremendous performance. But, that sort of growth obviously wasn’t sustainable for a mature company like DHR and therefore, I never bought into the hype.

Yes, DHR’s share price was skyrocketing and investors who bought shares early in the COVID-19 crisis have generated amazing returns.

Kudos to investors who predicted this trend and were brave enough to pay such high premiums. But, as a relatively conservative, value oriented investor, the risk/reward attached to those premiums didn’t make sense to me and for a couple of years, I’ve been content to sit on the sidelines, waiting for a better opportunity.

Well, with shares hovering in the $250 area, I think that opportunity has arrived.

Now that the COVID-19 greed has worn off a bit, I think now’s the time to begin building a DHR position.

And that’s exactly what I’ve done recently… because opportunities to buy shares of blue chips like this at a discount to fair value don’t often last.

The COVID-19 premium has distorted the 5 and 10-year averages higher and therefore, when looking at the stock’s history in an attempt to identify a historical fair value multiple, I think those longer-term ~23x multiples make more sense.

Throughout this 20-year period, DHR has produced fundamental growth that is nearly unrivaled throughout the entire stock market.

From 2002-2022, DHR produced negative y/y EPS growth just twice.

During this 20-year period, DHR’s average annual EPS growth rate was 17.50%.

No matter what sector/industry you’re looking at, it doesn’t get much better than that.

And with those amazing results in mind, DHR clearly deserves an above-market multiple.

Honestly, I’d be happy to pay 25x for a company likely to grow EPS at a 15%+ clip; however, moving forward, DHR’s growth prospects aren’t quite that high.

Looking at management guidance, peer performance across the industry, and analyst estimates, I think growth in the 10-12% range throughout the next 5 years or so is more likely.

And therefore, I want to place a discounted multiple on that 25x target…and being that the long-term average of 23x matches up with that desire, I’m content to side with the averages and place a 23x multiple on forward earnings expectations here to arrive at my personal fair value estimate.

With that being said, I believe that DHR shares are worth approximately $250.00/share.

In recent months I’ve bought shares a couple of times when they dipped below that level.

On March 2, 2023 I initiated my DHR stake at $244.71.

Then on April 3, 2023 I added to my position at $248.33.

(Both of these trades were discussed in real-time with Dividend Kings subscribers)

I hope to continue to build out this position over time as savings/dividends roll in and therefore, don’t be surprised to hear about more DHR purchases at or below this $250 level.

Added Benefit: An Upcoming Spin-off

I want to note that this bullish thesis isn’t just about long-term capital gains potential.

I think the company’s propensity for double-digit growth speaks for itself and will result in much higher share prices in 5-10 years and we’re seeing today.

But, there are a couple of other points that I want to make before I end this report.

First of all, DHR has plans to separate its Environmental & Applied Solutions segment from the parent company, creating a pure play water management company.

The company believes this move will unlock significant value for shareholders…and I agree.

Historically, Danaher has created a lot of value for its shareholders by spin-offing off non-core assets.

For instance, in 2016 DHR spun off Fortive (FTV) and since then FTV shares have risen from the $42.00 area to the $66.00 area.

Not to mention, Fortive is paying a rising dividend, which has the potential to continue to compound moving forward.

In 2019 DHR spun-off Envista (NVST) and since then NVST shares have risen from the $29.00 area to the $38.00 area.

I really like the water treatment/management industry and I’m looking forward to owning shares of this company in the event of a spin-off (which is expected to occur during Q4 of 2023).

The companies that I follow in this industry all trade with very high multiples due to secular tailwinds in that space.

For instance, Xylem (XYL), which is a name that I’ve had on my watchlist for years now, trades for 35x earnings right now.

XYL is a wonderful company, but I can’t stomach paying that sort of premium.

This is an area of the market that I wish I had more exposure to, however.

Unfortunately, high valuations have prohibited me from buying into several of my favorite stocks in the industry. But, it looks like Danaher’s upcoming spin-off will give me some pure-play exposure.

Danaher notes that its Environmental & Applied Solutions spin-off generates roughly 55% of its sales via recurring revenue contracts and is expected to generate a ~25% EBITDA margin.

To me, that sounds like a very high quality business and I suspect that it will generate solid returns, similar to DHR’s other recent spin-offs.

Danaher: A Dividend Growth Powerhouse

Lastly, and most importantly, I want to put a spotlight on the fact that Danaher isn’t just providing investors with added shares via ongoing spin-offs…but also, a rapidly growing passive income stream via its reliably growing dividend.

Many investors probably look at DHR’s 0.42% dividend yield and immediately move on. I get it…in today’s high interest rate environment, that’s not an attractive yield.

But, this isn’t a story about the present. This is a dividend growth story about the future.

DHR is currently on a 10-year dividend growth streak (the company froze its dividend for a year coming out of the Great Recession).

Since 2009, DHR’s dividend has compounded from $0.05/share to $1.08/share.

The company’s 5-year dividend growth rate is 11.95%.

And, after all of this growth, DHR’s EPS payout ratio is just 9.8%.

In February of 2023 DHR announced its most recent dividend raise: 8%.

However, I suspect this accounts for the poor COVID-19 comps in the near-term.

Given the stock’s extremely low payout ratio and my expectations for double-digit bottom-line growth over the next 5-10 years (on average), I believe that DHR can continue to compound its dividend at a double-digit clip moving forward.

With that in mind, I wouldn’t be surprised to see DHR’s annual dividend roughly twice as high as it is today in 5-6 years’ time.

In 10 years, I think it’s realistic that DHR’s annual dividend could be roughly 4x the size that it is today.

This would imply a yield on cost of nearly 2%.

In 15 years, I think it’s possible for DHR’s dividend to be approximately 8x the size that it is today.

This would imply a yield on cost of roughly 3.5%.

These theoretical scenarios become more and more attractive the longer down the road you’re willing to look.

For instance, someone who bought DHR shares 20 years ago is sitting on a yield on cost of approximately 8% today.

Over the next 20 years, I wouldn’t be surprised to see similar dividend growth performance play out.

I understand that it’s hard to look 10-15 years down the road for most investors; however, if you’re someone with a long-term investing time horizon, then the power of compound interest when we’re talking about double digit dividend growth prospects shouldn’t be ignored.

And while I admit that it’s impossible to peer out that far into the future clearly, I think that Danaher’s well diversified wide moat business which benefits from secular tailwinds is about as safe as they come when it comes to picking long-term winners.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of DHR either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Dividend Kings helps you determine the best safe dividend stocks to buy via our Master List. Membership also includes

Dividend Kings helps you determine the best safe dividend stocks to buy via our Master List. Membership also includes

- Access to our model portfolios

- real-time chatroom support

- Our “Learn How To Invest Better” Library

Click here for a two-week free trial so we can help you achieve better long-term total returns and your financial dreams.