Summary:

- Google will report earnings for 1Q-23 at the end of the month.

- I think Google is massively underrated right now. Profit estimates appear low.

- Google’s stock is, from a chart perspective, at an inflection point.

400tmax

I am very optimistic about the upcoming earnings of Alphabet Inc. (NASDAQ:GOOG) (NASDAQ:GOOGL). Google will report earnings for its first quarter on April 25, 2023, and I believe the technology company provides investors with an appealing pre-earnings investment case. Investors have recently expressed concern about Google’s slowing growth, but in my opinion, these concerns are unfounded.

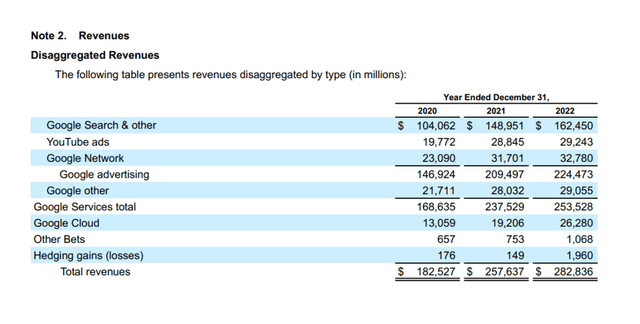

Google increased its sales by approximately $100 billion between 2020 and 2022, and the company remains the most successful online search engine, giving Google strong pricing power in online ad placements.

Furthermore, Google’s market valuation has suffered a significant and unjustified drop as a result of the botched release of its AI chatbot.

With that said, I believe Google will beat earnings expectations later this month, and I believe the earnings release will serve as a catalyst for a major breakout in Google’s stock.

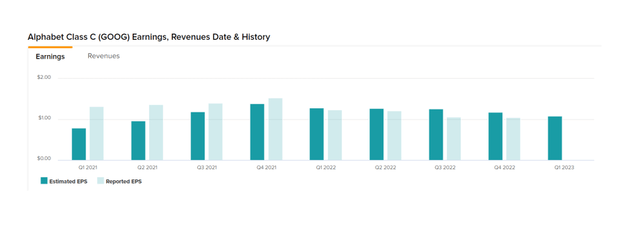

Google 1Q-23: Low Expectations

In the last year, Google has suffered from a downturn in the advertising market, which has, in my opinion, been more than reflected in profit estimates.

The market currently forecasts only $1.08 per share in profits for Google’s first quarter, representing a 12% YoY decline. Google was expected to earn $1.28 per share in profits in the first quarter of last year, but instead earned $1.23 per share. I believe that the advertising recession has been relatively mild thus far, and that strong cloud growth could offset some of Google’s weakness in the core business.

Personally, I expect a profit of around $1.14 per share, which represents the average quarterly profit figure for 2022.

The cloud segment, which I believe is a hidden gem within Google, will be the one to watch on April 25, 2023. Cloud sales more than doubled between 2020 and 2022, and it is the segment with the greatest potential for growth for Google.

The segment is not profitable, with cloud posting a $3 billion operating loss in 2022, but the business is on a good trajectory, with new customers signing on and sales increasing 37% in 2022 alone.

If Google beats expectations in 1Q-23, it will most likely be due to the expansion of Google’s cloud services.

Google Cloud Services Revenue (Alphabet Inc)

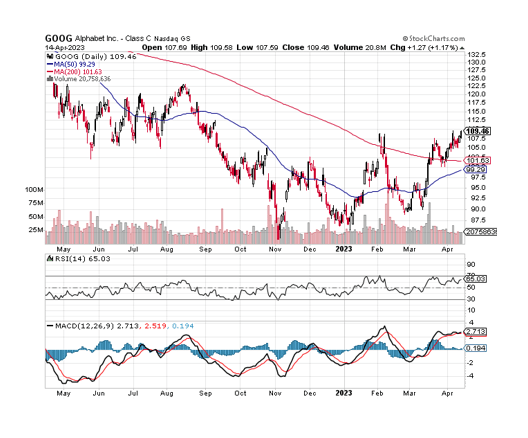

Set For A Breakout (Technical Analysis)

Google stock appears to be on the verge of a breakout: Google has fully recovered from the botched presentation of its Bard AI chatbot, and the stock is now back to where it was before Google announced 4Q-22 results.

Sentiment has clearly improved, as the stock has gained nearly 25% since its February low, revealing a bit of a disconnect in my opinion. The stock price has risen significantly, but profit estimates remain low in comparison to the 2022 quarterly average. This could indicate that expectations are unrealistically low. Google stock recently broke through the 200-day moving average, another bullish technical sign.

Moving Averages (Stockcharts.com)

Google Was, Is And Will Be A Steal Before Earnings

Google’s entire business, which includes cloud, search, AI, and other segments, is valued at 18.1x earnings prior to the company’s earnings release. As I previously stated, when valuing Google, investors must keep in mind that the company has a significant amount of cash on its balance sheet, which distorts the P/E metric.

Google had approximately $114 billion in cash at the end of 2022, or approximately $9 per share. When adjusted for this cash, Google trades at 16.6x ex-cash, which remains a compelling earnings multiple given the stock’s recent 25% gain.

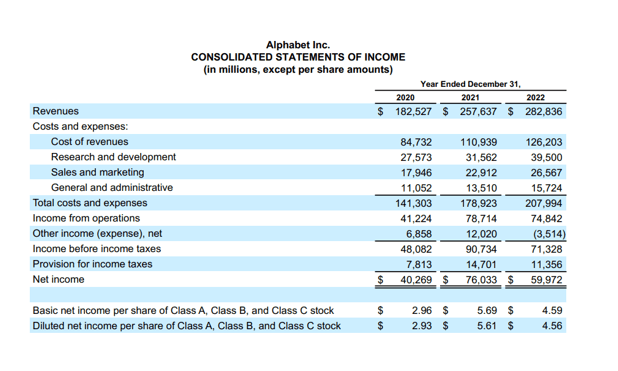

Furthermore, Google’s sales base has expanded enormously in the last two years, something that I think the company is not getting enough credit for. Google increased its sales by $100 billion and profits by $20 billion between 2020 and 2022, representing 55% and 49% growth rates, respectively. With this kind of raw sales and profit power, I’m not worried about Google’s competitive position or growth prospects.

Consolidated Statements Of Income (Alphabet Inc)

Why Google Might See A Lower/Higher Valuation

I believe Google’s valuation could fall under two conditions.

First, the advertising market may remain in a slump for a longer period of time, which I believe will have little impact on Google given the company’s competitive strength in search and online advertising.

Second, if Google fails to demonstrate that it can continue to grow profits (and achieve profitability in cloud computing), investors may lose faith in the stock. Failure to do so would almost certainly result in a lower earnings multiple.

My Conclusion

I think the odds are in favor of an earnings beat for Google’s upcoming first quarter report at the end of the month. Profit estimates are low, and the market does not expect much from Google, which could be a positive sign.

The bar for Google’s earnings is so low that it would be easy for the company to clear it, especially if cloud continued to grow rapidly in 1Q-23.

I also believe Google’s raw sales and earnings power are undervalued, with the stock trading at only 16.6x cash-adjusted forward earnings.

Despite a 25% increase since the February low, Google is dirt cheap, and the stock’s chart picture is becoming increasingly bullish ahead of earnings.

Buy with confidence.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of GOOG either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.