Summary:

- Microsoft reports earnings next Tuesday after the bell.

- Microsoft stock is trading near all time highs, a rarity in the tech sector.

- The macro environment remains difficult but Wall Street is likely to focus on management commentary on the future for Bing.

- I discuss the upside and risks of MSFT stock from today’s prices.

Ethan Miller/Getty Images News

Microsoft (NASDAQ:MSFT) is set to report earnings on Tuesday, April 25th after the bell. The stock has surged this year largely due to its push into artificial intelligence and renewed confidence in its Bing search engine. The macro environment has not necessarily improved, raising the risk that MSFT disappoints on some of its growth and margin metrics, especially from the company’s PC businesses. Yet I expect the enterprise tech and cloud computing revenues to show resilient growth rates and more importantly, for management to give a roadmap for their long-term ambitions in search. I expect Wall Street to forgive any near term misses on the numbers as they suddenly can dream about the potential for MSFT to take market share in search.

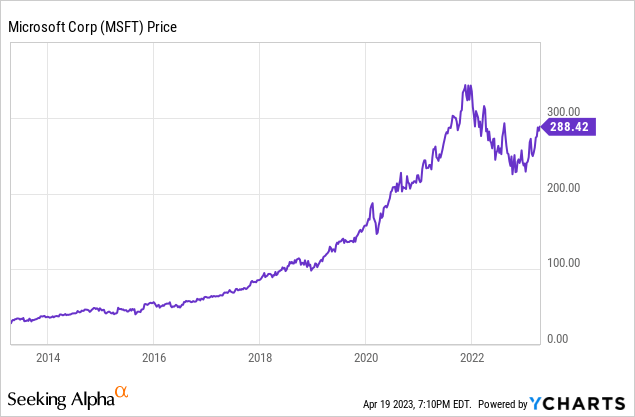

MSFT Stock Price

MSFT is one of the few tech stocks that did not dip so hard amidst the tech sector crash and continues to trade near all time highs.

I last covered MSFT in March where I rated the stock a buy due to the company showing resilient growth rates amidst a tough macro backdrop. That thesis remains in place but search is becoming a more and more important piece of the narrative.

MSFT Stock Key Metrics

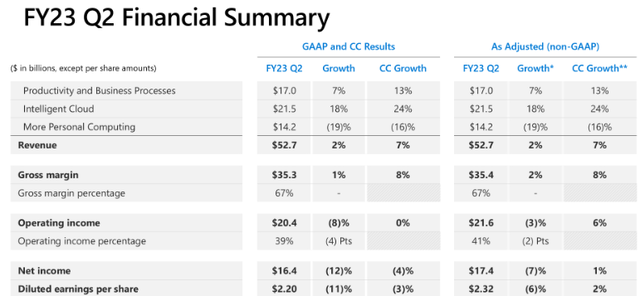

In the most recent quarter, MSFT had generated 7% overall revenue growth, but that was largely impacted by a 16% decline in the PC business. MSFT continued to show double-digit growth in its more crucial enterprise tech and cloud computing business segments while generating a strong 31% net margin.

FY23 Q2 Presentation

The fact that MSFT continues to trade at around 30x earnings indicates that Wall Street is focusing less on the decelerating revenue growth and focusing more on the company’s ability to sustain strong profit margins in spite of the tough macro environment – other tech stocks appear to be benefitting from similar sentiment. On the conference call, management stated the possibility that they may miss on their prior mid-teens revenue growth guidance but expect to maintain operating margins.

Microsoft Cloud Slowdown

As usual, I expect investors to focus on growth rates for Azure, their cloud computing jewel. Management had noted that the growth rate would be around 30% for this upcoming quarter but again, this tough macro environment makes forecasting more difficult than in prior years. Some analysts have suggested that cloud growth may be “better than feared,” but some disappointment on this front is not out of the question. More importantly, even if MSFT meets or even beats on that 30% guidance, it is highly likely that this would be insufficient to move the needle as analysts may continue to worry about eventual weakness in upcoming quarters.

Focus On Bing

Yet I find it very likely that no matter what kind of numbers MSFT shows, most attention will be placed on its Bing search engine. MSFT has already made a multi-billion dollar investment in OpenAI, the company behind ChatGPT. Investors have shown great enthusiasm for how generative AI can improve the growth prospects for Bing search, even before any impact has shown up in the financial results. News reports have surfaced suggesting that Alphabet (GOOGL) may be displaced by Bing as the default search engine for Samsung phones. I expect management to speak very highly about the long term growth opportunity for Bing while identifying it as a high priority growth venture. Such a move would also make financial sense considering that growth rates have been decelerating and enthusiasm for Bing may help the stock sustain its premium valuation, in spite of any choppiness in its financials. Bing would help further the image that MSFT is a dominant and highly profitable mega-cap tech titan with significant investment in long term innovation.

Is MSFT Stock A Buy, Sell, or Hold?

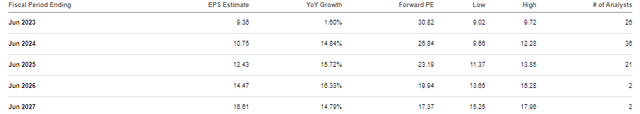

As of recent prices, MSFT was trading at just around 30x earnings. Consensus estimates call for double-digit earnings growth over the coming years, largely from operating leverage.

Seeking Alpha

While 30x earnings is not a demanding multiple considering the company’s track record and resilient revenue base, it represents a sizable premium to the roughly 20x earnings multiple of GOOGL (and I note that GOOGL is arguably even cheaper than that when viewed on a sum-of-the-parts basis). Investors appear to be viewing the competition in search as one in which MSFT has everything to gain and GOOGL has everything to lose. That view makes the valuation discrepancy quite easy to understand, even though it may not be so easy for MSFT to displace GOOGL’s dominance in both search and online advertising. I continue to find MSFT buyable though the high relative valuation may make the stock ironically more risky than cheaper tech peers. I am of the view that Wall Street may be overestimating the disruptive potential of MSFT and underestimating its risk of being disrupted – in particular I have a conflicting view with consensus regarding MSFT’s positioning in video conferencing and cybersecurity. It is also possible that my prediction for positive sentiment ahead proves incorrect, and that the stock may trade lower upon deteriorating enthusiasm in AI and search. I rate the stock a buy, but emphasize my preference for cheaper alternatives in the tech sector. In spite of the premium valuation, investors may still be underestimating the upward pressure that Bing and artificial intelligence may have on the stock price.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of GOOGL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I am long all positions in the Best of Breed Growth Stocks Portfolio.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Sign Up For My Premium Service “Best of Breed Growth Stocks”

After a historic valuation reset, the growth investing landscape has changed. Get my best research at your fingertips today.

Get access to Best of Breed Growth Stocks:

- My portfolio of the highest quality growth stocks.

- My best 10 investment reports monthly.

- My top picks in the beaten down tech sector.

- My investing strategy for the current market.

- and much more

Subscribe to Best of Breed Growth Stocks Today!