Summary:

- Management rarely uses stock buybacks intelligently. Usually, there is never a consideration of valuation at all, and the process is automated.

- But sometimes, buybacks make less sense than others. In these cases, investors would be better served by receiving increased dividends or reducing debt.

- Western Union and 3M are examples of when poor capital allocation decisions regarding buybacks should have kept investors away.

phototechno/iStock via Getty Images

Introduction

Every business has a shelf life. They start out small, and, if successful, eventually grow to fill their addressable market until a competitor disrupts their business or changing consumer tastes diminish it. Pennsylvania Railroad, for example, was founded in 1846, and over the course of 36 years grew to become the largest railroad in the world by 1882. It successfully paid dividends to its investors for 100 years without a cut. But, eventually, in the 1970s, it went bankrupt.

So it goes.

It is important for investors to understand there is nothing wrong with this process. It is this very creative destruction that makes capitalism forever dynamic. In Warren Buffett’s early days, he would often buy businesses in their twilight hours. Those without much future, but already priced for total destruction by the market. These types of stocks were termed “cigar butts”. Businesses with one last puff left in them. Most of these were asset plays because back then most businesses were asset-heavy, and few people wanted the stocks if the businesses were shrinking. Nowadays, true cigar butt investments are rare. Plenty of professional investors are looking for them, so it’s uncommon for the prices to get low enough to be attractive. That’s one reason why Buffett doesn’t really use that strategy anymore. (Another being an investor keeps needing to find new such opportunities to reinvest their capital, and the larger the amount of capital one has to invest, the more difficult this becomes.)

Personally, I don’t buy cigar butt investments. There are several reasons for this, but the main one is that I view the biggest appeal of a stock investment is that it is a financial instrument that can organically grow earnings faster than inflation. Cigar butts, by definition, aren’t those types of investments. Additionally, I find it very difficult to judge at what point a business will call it quits and go bankrupt. Usually, by the time that happens, high-yield and distressed debt investors already have the upper hand, and that seems like a better way to go after true cigar butt or zombie investments rather than buying equities. So, I stick to businesses that can grow earnings over time.

This leads us to the category of stocks this article is about. These are the stocks of businesses that are no-growth, or slow-growth businesses, in which earnings growth is flat or growing no faster than inflation for a period of more than three years when we aren’t in a recession. Wall Street is generally of the opinion these types of businesses are necessarily bad (typically because some type of earnings growth is usually priced into the stock price). Management is typically in this camp as well. Probably because they usually receive a lot of stock-based compensation, and very often (unfortunately) their job security can be tied to the stock price. So, there are incentives to make it appear to investors that earnings are always growing at a fast rate, even if they aren’t.

In a rational world, if a business has fully saturated its market and doesn’t have too many clear growth prospects, it could simply return its profits to shareholders via dividends. Investors could then price the stock similar to a bond based on the dividend yield. If one looks at tobacco stocks the past several years, this is how they have been priced by the market.

Typically, I assume long-term inflation will run about 3% in the US as it has historically. I like to get better than market average returns, so I would expect a business with earnings growth between 0% and 3% to have a dividend yield around 8% before I would get interested in buying it. There is the risk that the business will deteriorate, and also some upside reward potential if they have a better-than-expected year or two, so when we put those two possibilities together, getting a 5% real return per year from the dividend is at least reasonable to me. But of course, each investor will have to decide what yield is reasonable for them.

What does not seem reasonable to me in this situation of slow earnings growth is for the company to spend its money on stock buybacks. With no real earnings growth, it is highly unlikely that buybacks will be a good long-term investment. And it is even more unlikely that it makes sense to take on additional debt to fund buybacks in this situation. Because these actions make no sense, investors and potential investors should have their eyes out for managements that do this, and investors would be wise to avoid or sell the stocks of managements that do.

3M & Western Union

Let’s start with 3M (NYSE:MMM) since I wrote several articles near their peak in 2018 (and also on the way down) about selling the stock or avoiding buying it. As 3M’s stock price fell, I continued to revisit the stock for a potential purchase, but the main reason I never bought it was their capital allocation with regard to buybacks. MMM eventually sort of served as a guide for what would more or less become a rule for me: If earnings growth is slow, I don’t want to see large amounts of buybacks.

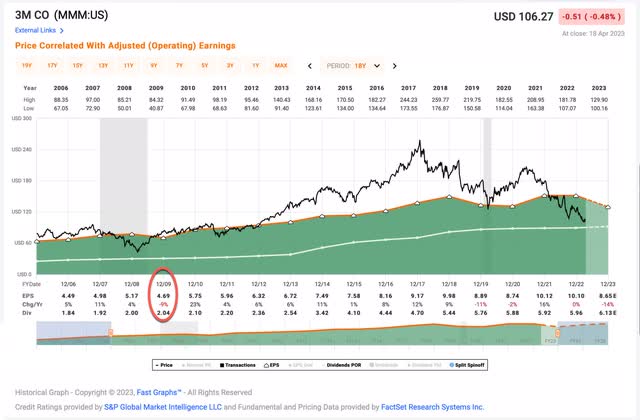

Let’s start by looking at 3M’s EPS history.

If we look at 3M’s historical EPS trend, which is represented by the dark green shaded area in the FAST Graph above, we can see that when I was most interested in MMM stock in 2018 and 2019, earnings per share had a very steady, but not particularly high EPS growth rate. While the stock was clearly too expensive near the peak in early 2018, by late 2018, after the price had come down, it was looking interesting, and in 2019, even more interesting, still. It was at this point looking at the buybacks became important.

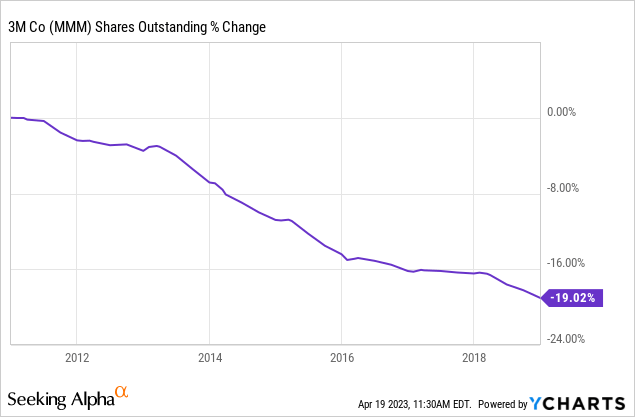

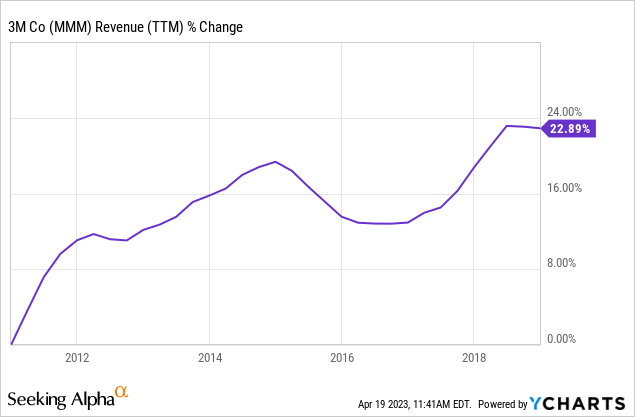

In the eight years from 2011 to 2019, MMM bought back nearly 1/5th of the company. If we measure EPS growth from point to point from 2011 to 2019 FAST Graphs has an EPS growth rate of +7.14%. That’s okay EPS growth, but it doesn’t take into effect the stock buybacks that were inflating EPS by reducing the share count. It’s difficult to quickly get an exact reading on the precise effect of buybacks on the business’s actual earnings per share because we don’t know the exact price for each share the company paid. Because of this, I simply take the amount the company bought back over this time period by measuring the amount of shares reduced, and taking it off the cumulative earnings per share growth they had. This probably produces more conservative earnings growth assumptions for businesses aggressively buying back shares, but I’ve found it’s a reasonably accurate way to quickly make buyback adjustments for earnings growth. When I make that adjustment for MMM over this period, I get a real earnings growth rate of about +4.30%, which is quite a bit slower than if we use earnings per share.

I find that often if I compare my adjusted earnings growth rate to revenue growth (which is harder for companies to manipulate, unless they are buying other new companies) I often get similar results. In this case, the revenue growth has a CAGR of about +2.62% over this time period, much closer to my earnings estimate of +4.30% than the unadjusted +7.14%. If I assume an inflation rate of 3% (it was actually a little slower during this time period) we can basically call MMM a slow-growth business.

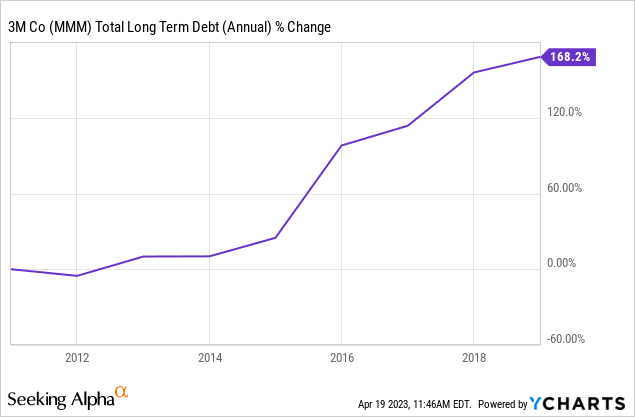

To make matters worse, 3M was borrowing money to buy back those shares in order to inflate the EPS (likely in hopes of propping up the stock price). Now we can look back and see that essentially all of the stock purchased during the past 10 years was purchased at a price higher than the price the stock trades today.

Instead of all this, 3M would have served investors better if they did not borrow money in order to buy back shares and instead increased the dividend. Investors could have then kept the dividend and allocated it as they wished instead of having 3M stock lose more than -50% of its value and having mountains of debt to pay back.

Western Union

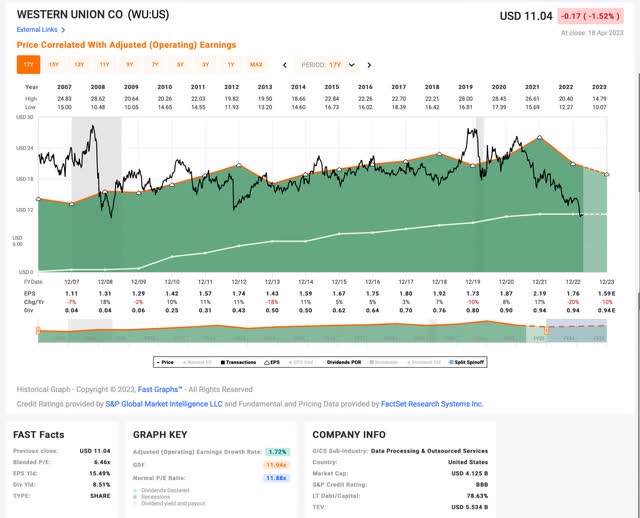

I have never written about Western Union (NYSE:WU) stock before, but we have a similar situation as 3M.

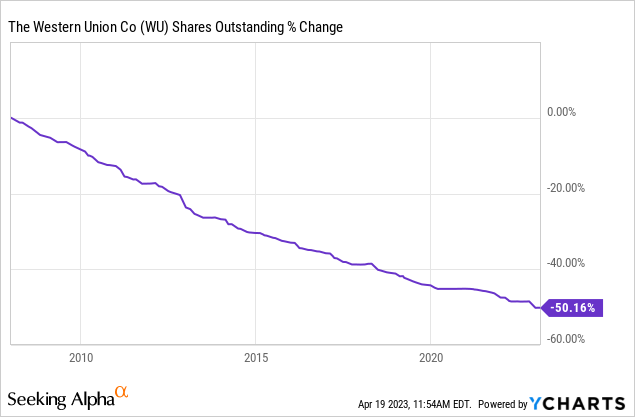

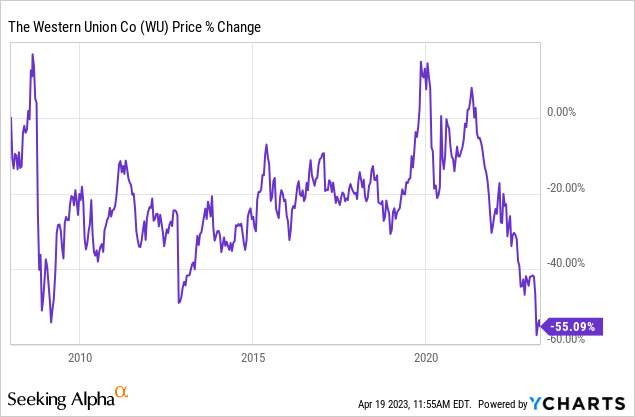

Since January 2008 they have bought back 1/2 of the business. How do you suppose the stock price has performed over this time period?

Overall, nearly every one of those stock purchases is worth less now than when they were made.

If you look at Western Union’s EPS growth history, it is pretty slow no matter what time frame one picks, yet they are still buying back stock. I track this stock for my investing group, The Cyclical Investor’s Club, because I occasionally get questions about it, and it was after a recent update of their numbers I decided to write this article. My earnings growth estimate from 2015 to 2023’s expected earnings is a -3.14% CAGR. And it was very slow even before the recent decline. Yet these guys have kept buying back more and more stock!

Only now, with a dividend yield above 8%, might this stock be considered a decent cigar butt. But investors will have to count on the current downward trend in revenues and earnings stabilizing and not falling further. I’m not good at predicting trends like that, so I don’t buy the stocks of shrinking businesses. (I don’t think Western Union should either.)

Conclusion

Businesses do not last forever. As they stop growing, they should naturally return money to shareholders via the dividend, and if the business can hold on long enough like that, and the dividend is high enough, investors could still do fairly well. The same cannot be said for buying back lots of shares of a shrinking business, which will almost always result in a falling stock price and lost capital forever.

My basic rule of thumb is for a business growing earnings in the 3% to 6% range (adjusted for buybacks), I want a dividend in the 5% to 7% range to get me interested, and a small amount of buybacks might be tolerable. If earnings growth is in the 0% to 3% range, I want to see a dividend of 8% or more to interest me and I prefer almost no buybacks. If earnings growth is negative when we aren’t in a recession, I avoid the stock. I’ve found that these basic guidelines will save medium and long-term investors a lot of money on average. They have certainly helped me avoid a lot of duds the past few years.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you have found my strategies interesting, useful, or profitable, consider supporting my continued research by joining the Cyclical Investor’s Club. It’s only $30/month, and it’s where I share my latest research and exclusive small-and-midcap ideas. Two-week trials are free.